What I'm looking at - standard deviations, tech breadth, relative strength, USD

Here’s what I’m looking at:

Bollinger Bands and momentum

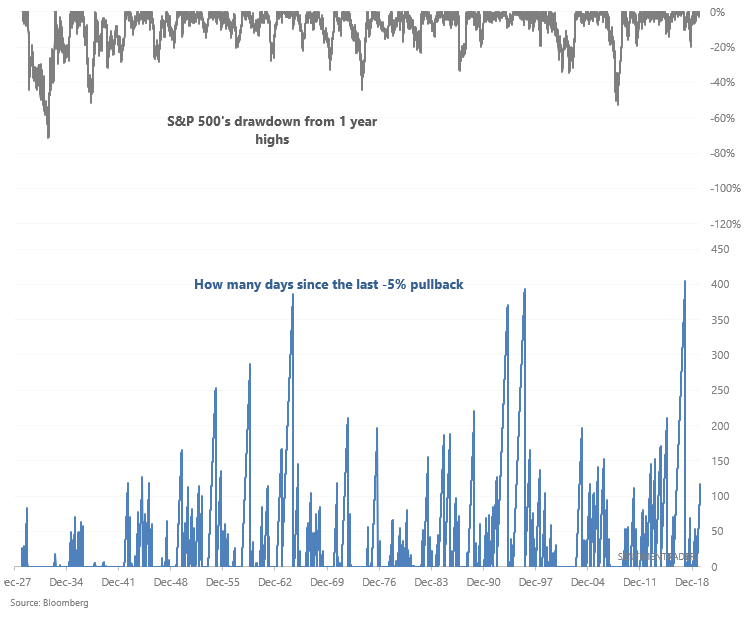

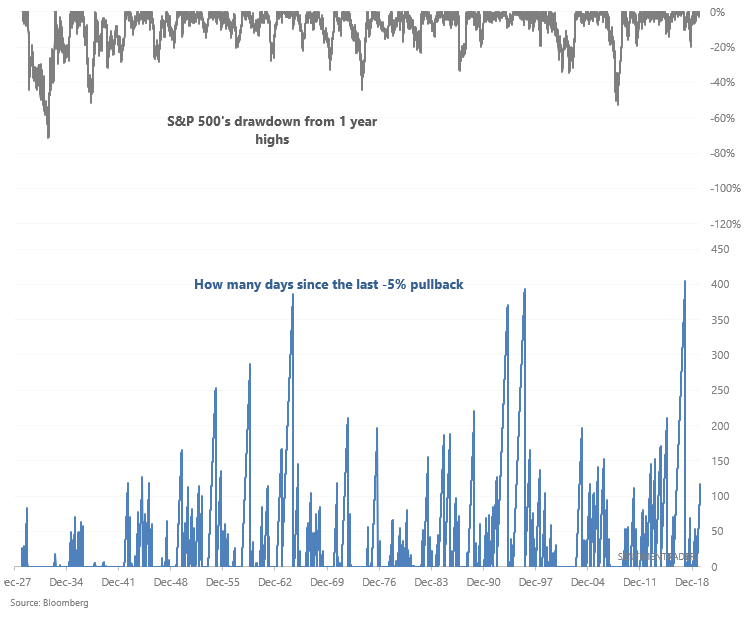

As Seth Golden noted, the S&P has gone many days without a -5% pullback and is currently more than 2 standard deviations above its 200 day average.

While it could be assumed that this is bearish for stocks, that hasn't always been the case. There's 2 sides to the "market has rallied too much" coin:

- Market has rallied too much, so it'll pullback. Or...

- Market's momentum is very strong, it'll "eventually" pullback and then rally even further after that.

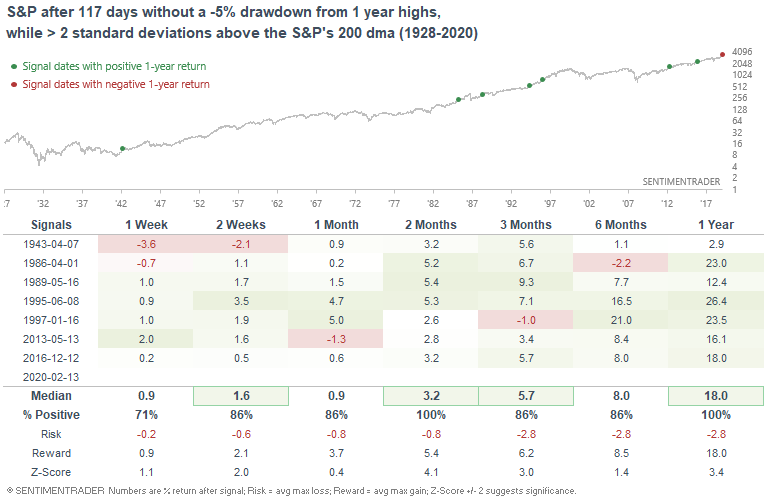

When the S&P went 117 days without a -5% drawdown from 1 year highs while it was more than 2 standard deviations above its 200 dma, the S&P's forward returns on nearly every time frame were more bullish than random.

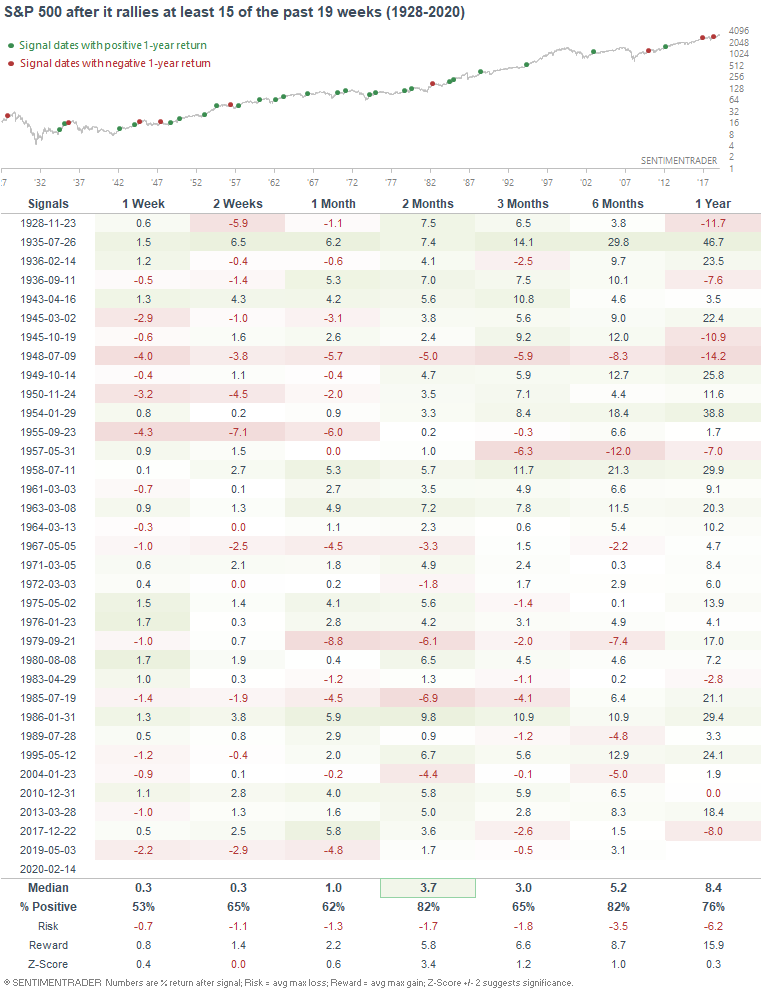

In the meantime, the S&P is now on the verge of having gone up 15 of the past 19 weeks. Once again, this led to more bullish than average returns over the next 2 months:

Tech breadth

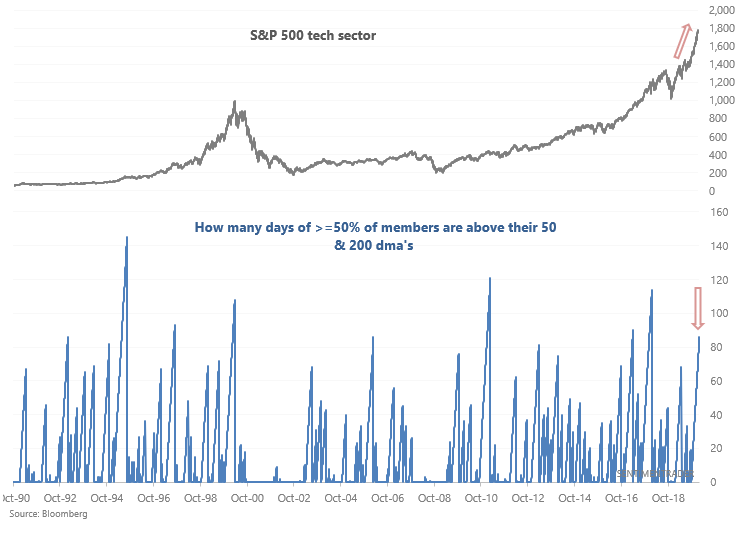

Tech stocks continue to lead the broad U.S. stock market's rally. At least 50% of the S&P 500 tech sector's members have been above their 50 and 200 dma's for 4 months, which is an extremely long time:

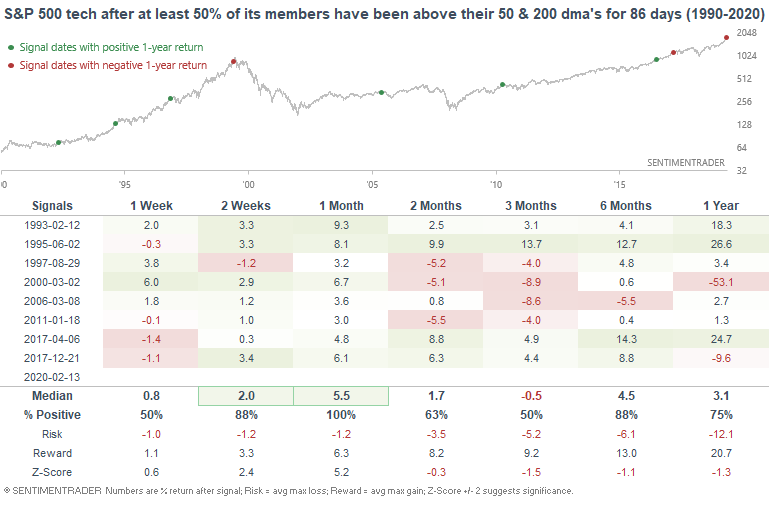

When the S&P 500 tech sector's breadth had been this strong for this long, it often faced weakness over the next 2-3 months:

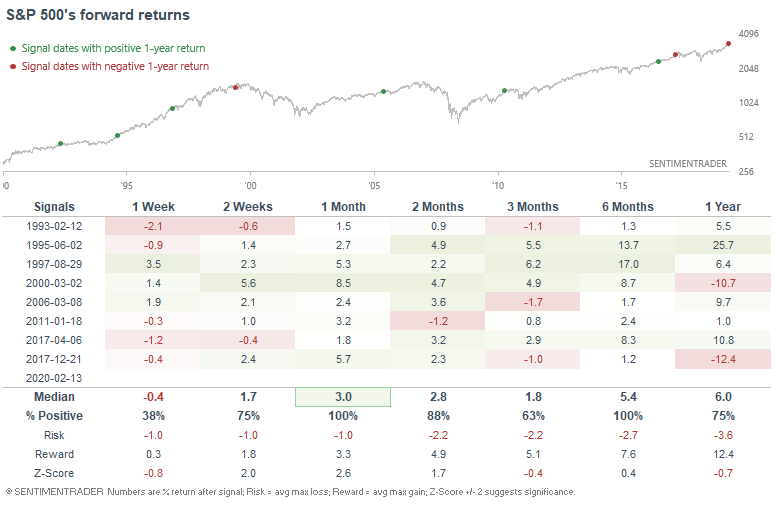

Here's what the S&P 500 did next:

Relative strength

2 of our best trading models rely on the relative strength between the NASDAQ Composite and S&P 500 (here and here). In general, it is far better to go long the NASDAQ when the NASDAQ is outperforming, and it's far better to go long the S&P 500 when the S&P 500 is outperforming. In other words, it's usually better to be a trend follower than a contrarian when it comes to the NASDAQ:S&P ratio.

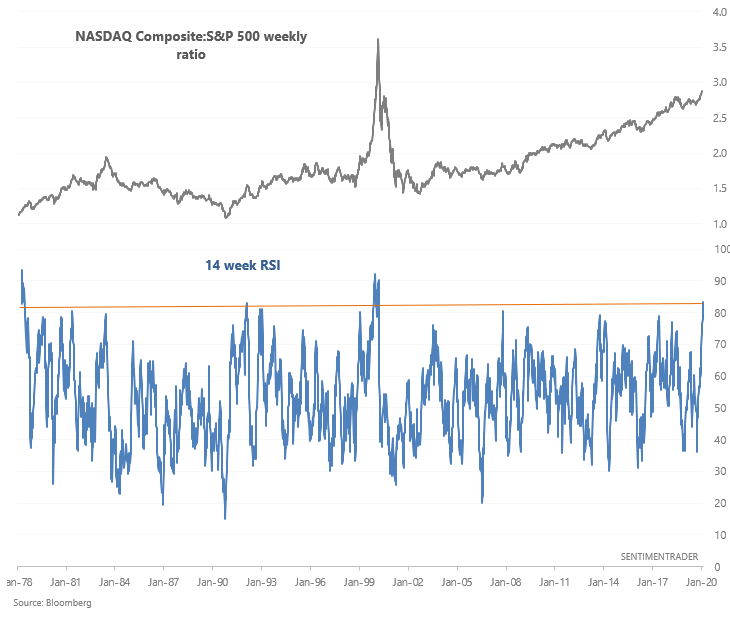

However, the NASDAQ:S&P ratio has increased so much that its 14 week RSI is now above 83:

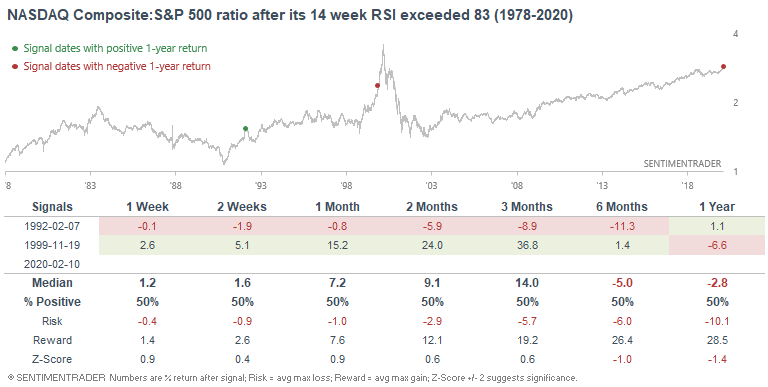

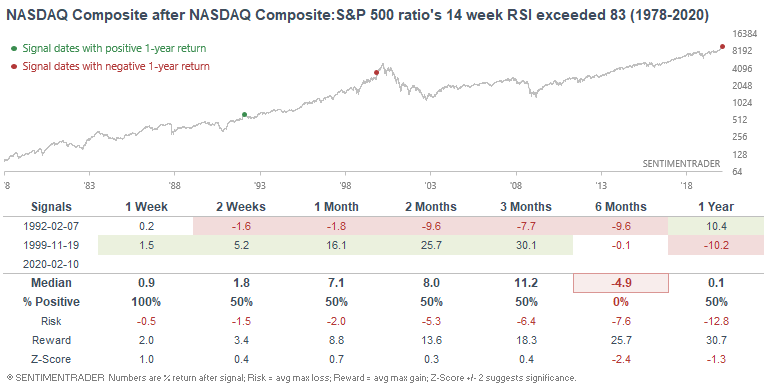

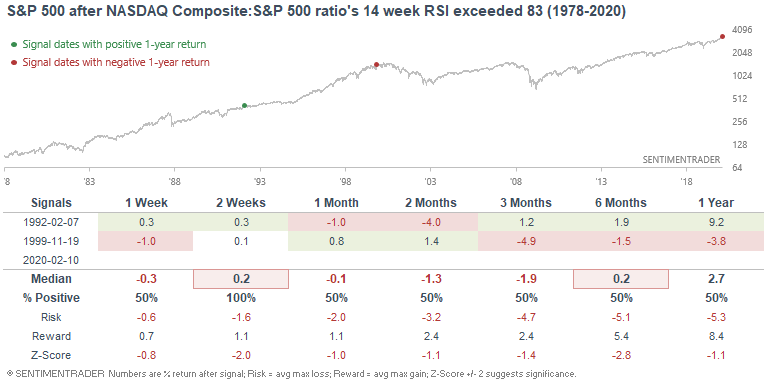

Aside from the initial case in 1978, there were only 2 other times when this happened. In general, this wasn't great for the NASDAQ:S&P ratio or for the NASDAQ and S&P:

However, a sample size of 2 isn't big. So I wouldn't consider this to be a major short term bearish factor for stocks.

Dollar

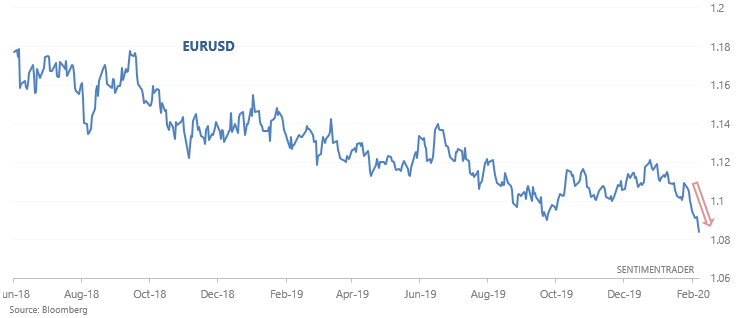

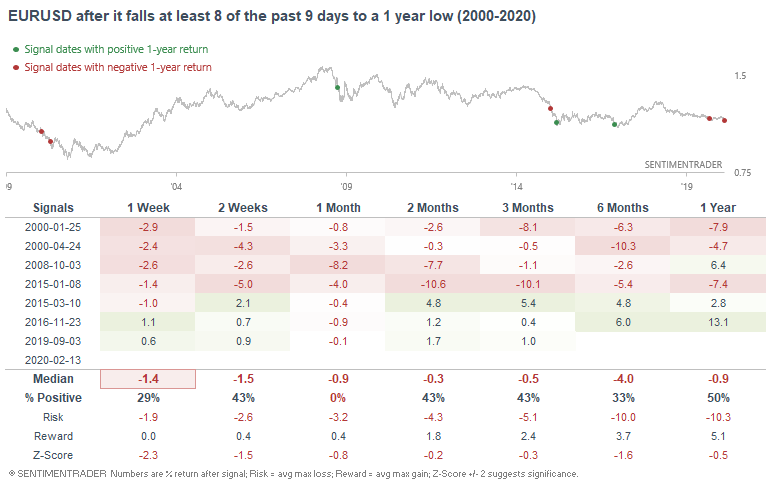

And finally, the USD continues to rally while other currencies continue to sink against the USD.

EURUSD has fallen 8 of the past 9 days to a multi-year low. When this happened in the past, its returns over the next month were weak:

My trading portfolio

My trading portfolio is allocated 50% in the Macro Index Model and 50% in the Simple Trading Model With Fundamentals. At the moment I have instituted a discretionary override and gone 100% long bonds (instead of long stocks) due to the extreme nature of many of our core indicators, even though some of these core indicators aren't in the models.

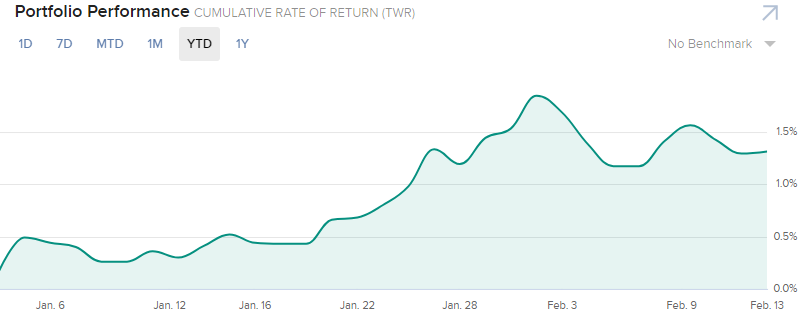

Performance YTD 2020:

My trading account is up 1.31%

Currently 100% in bonds