What I'm looking at - healthcare, France, GDP growth, MSCI World Index, breadth

Here's what I'm looking at:

Healthcare

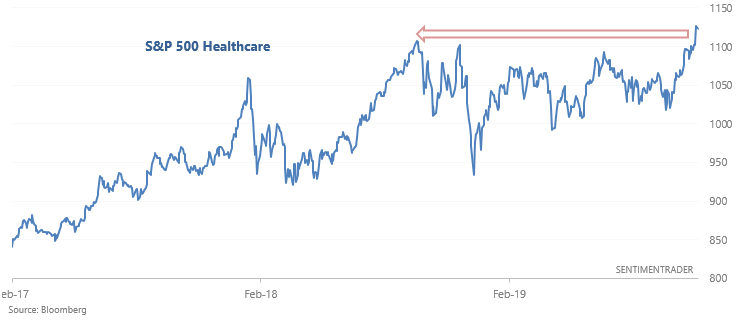

With stock markets around the world trending higher, various sectors of the S&P 500 continue to breakout. For example, the S&P 500 Healthcare sector exceeded its October 2018 high last Friday:

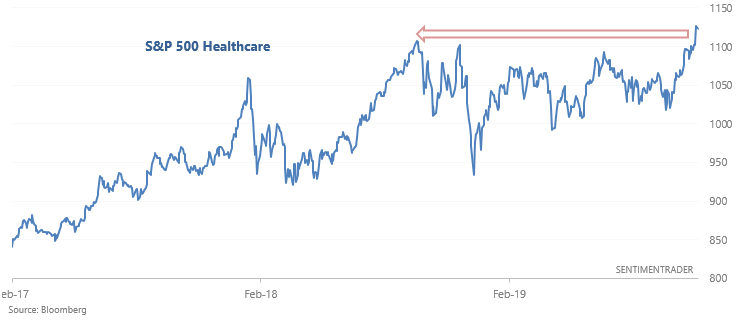

Over the past 30 years, such long term breakouts were rare but bullish for the S&P 500 Healthcare sector over the next 6 months.

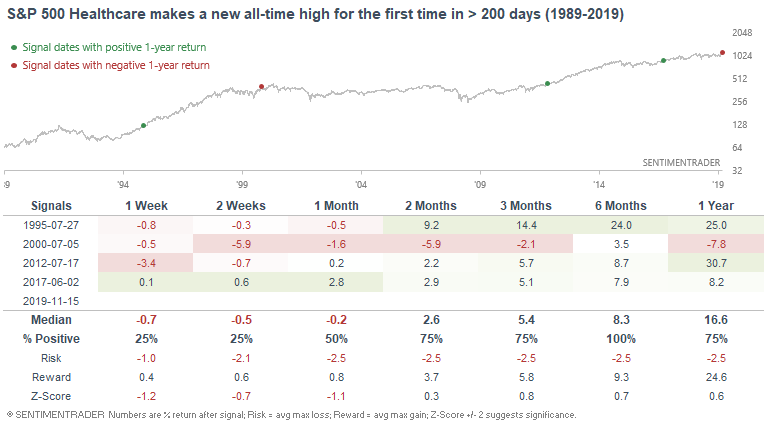

As for the S&P 500, this was still bullish over the next 2 months, despite one of the cases (July 2000) occurring just before a massive bear market began.

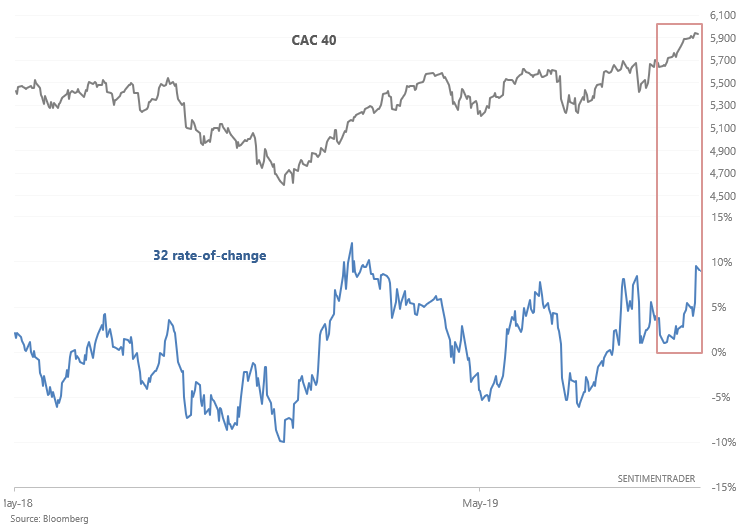

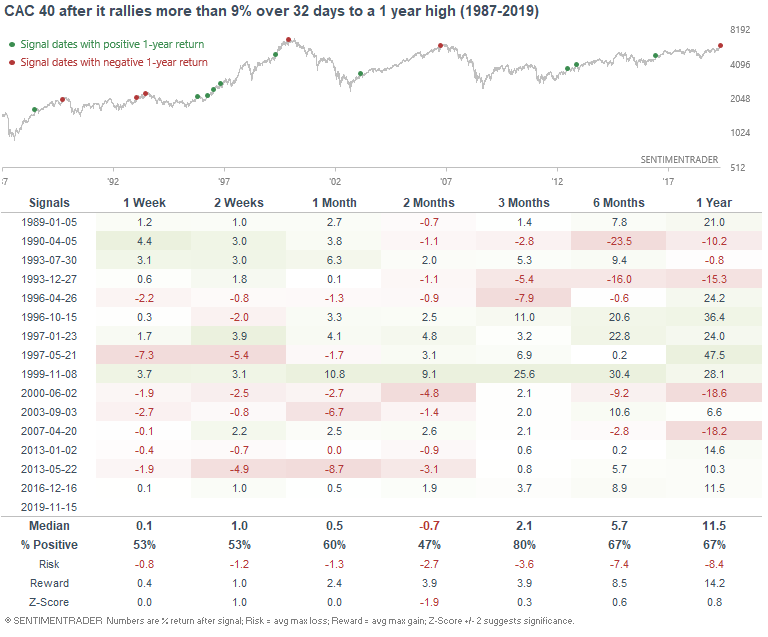

France

With global stocks still rallying higher, a short term breather is likely. For example, France's CAC 40 Index has rallied more than 9% since early-October to a multi-year high:

Such strong short term rallies typically run into trouble over the next 2 months, with a bearish risk:reward profile for the CAC 40.

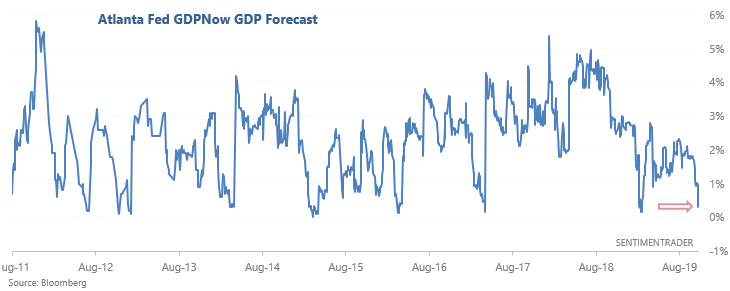

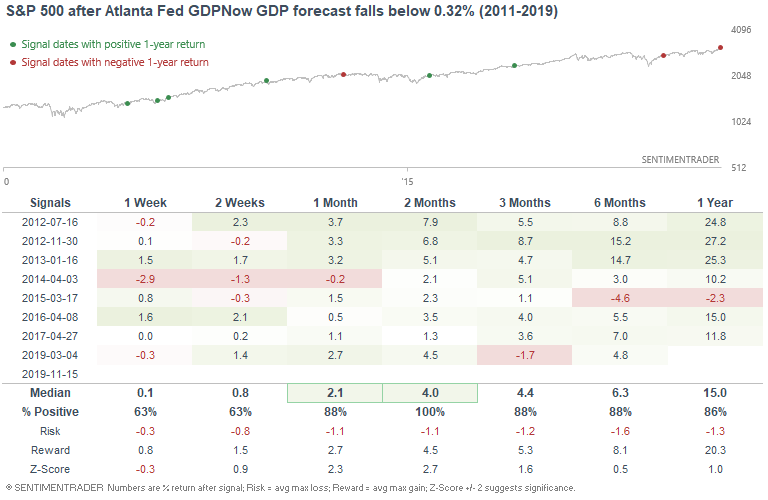

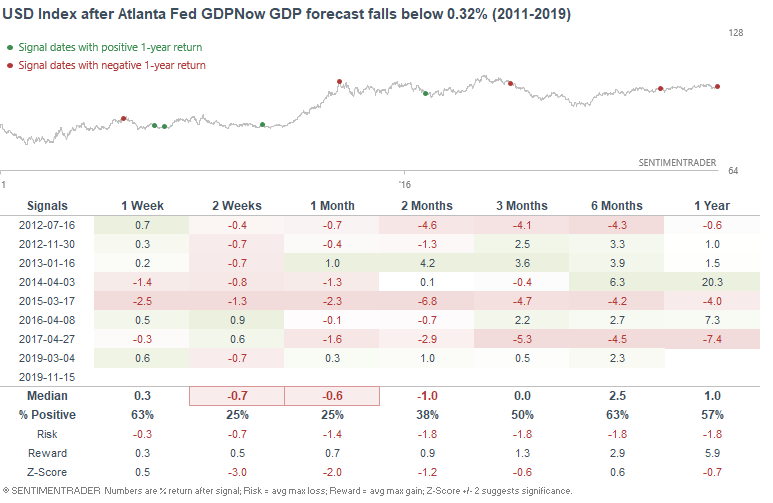

GDP growth

As Bloomberg TV demonstrated, the Atlanta Fed's GDPNow GDP Forecast (estimate for growth) is showing a sharp slowdown for Q4.

Such slowdowns in economic growth expectations have occurred multiple times in this bull market, and were all bullish for stocks over the next 2 months:

*Don't take the 6-12 month forward returns too seriously, since this data is limited to the current bull market. With that being said, if we only look at cases that were not followed by a recession (and a recession now is unlikely), this is bullish for stocks on almost all time frames.

Meanwhile, this was mostly bearish for the U.S. Dollar over the next few weeks:

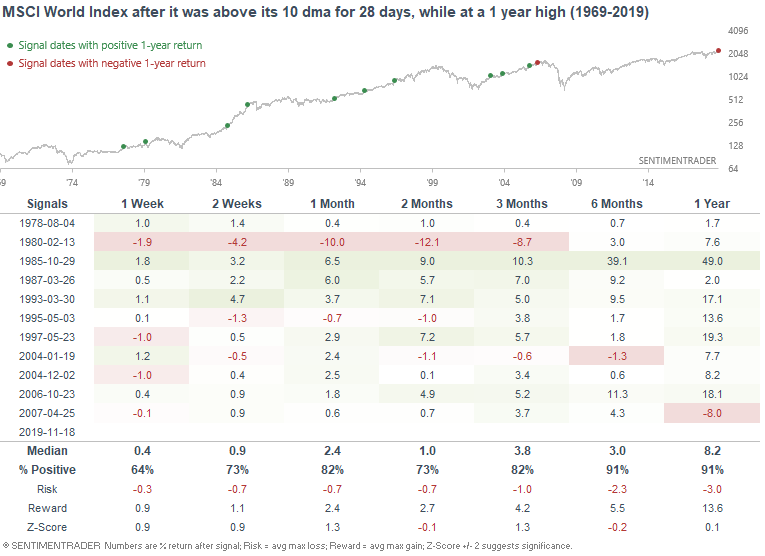

MSCI World Index

With stocks rallying a few points every day, the MSCI World Index continues to push towards new highs.

Similar to my weekend post, the MSCI World Index has spent 28 days above its 10 dma. When this happened while global stocks were at a 1 year high, the MSCI World Index almost always went up 6-12 months later. The one big exception was 2007, when this occurred just a few months before stocks topped.

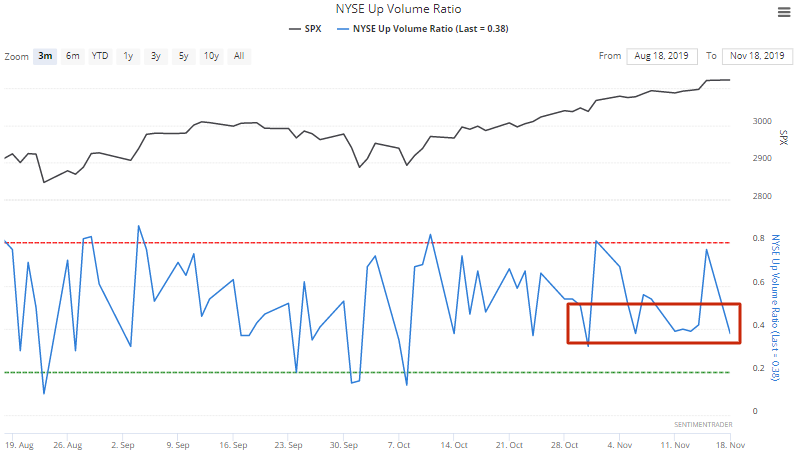

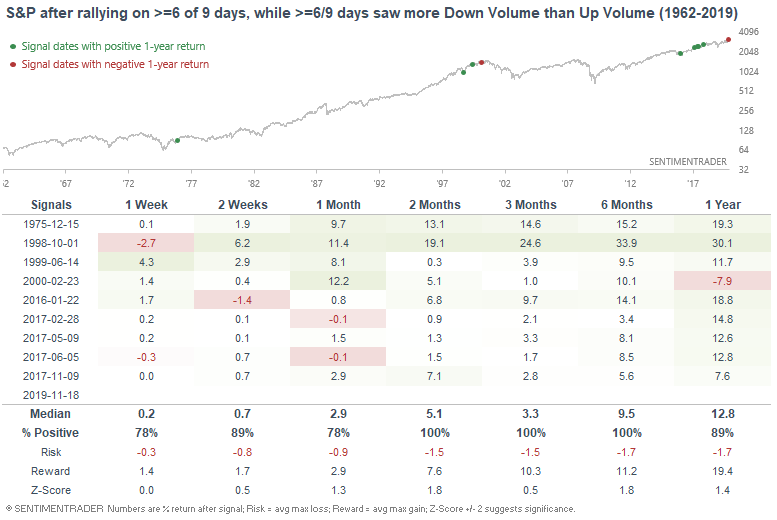

Breadth

Jason (here and here) and I have touched on breadth recently, usually with the conclusion that breadth is short term bearish for stocks right now. These problems remain. Similar to several of the past few days, the S&P managed to squeak out a gain while more volume flowed into falling issues than rising issues.

The S&P 500 has gone up on 8 of the past 9 days, while 6 of the past 9 days have seen more volume flowing into declining issues. Looking at the few times this happened in the past, the S&P went up every time over the next 2-6 months. This is mostly due to the fact that many of these signals occurred in 2017, a year in which stocks rallied relentless, regardless of warning signs from various indicators.

Despite this bullish stat, I would overall consider breadth to be a bearish factor for stocks right now.