What I'm looking at - emerging markets, utilities breadth, AAII, Taiwan

Here's what I'm looking at:

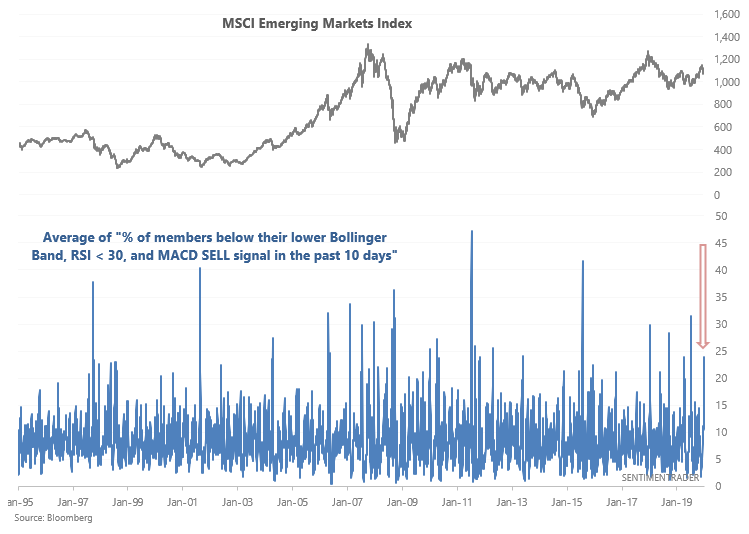

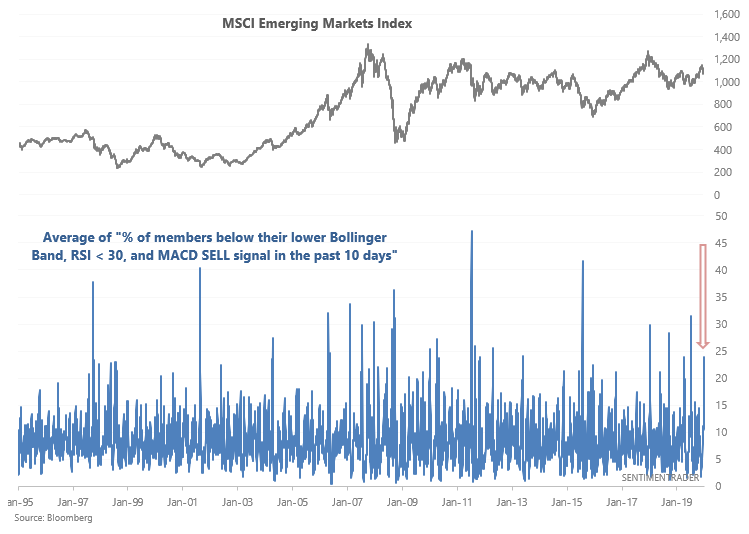

Emerging markets plunge & breadth aggregate

We've looked at various breadth stats recently, such as the "% of index members below their lower Bollinger Bands", "the % of index members with RSI < 30", and "the % of index members with MACD sell signals in the past 10 days". With Emerging Markets falling, we can create an aggregate for these 3 breadth indicators.

As you can see, breadth is quite weak for emerging markets. When this happened in the past, the MSCI Emerging Markets Index's returns were not significantly different from random. On the other hand, 3-12 month forward returns leaned bullish:

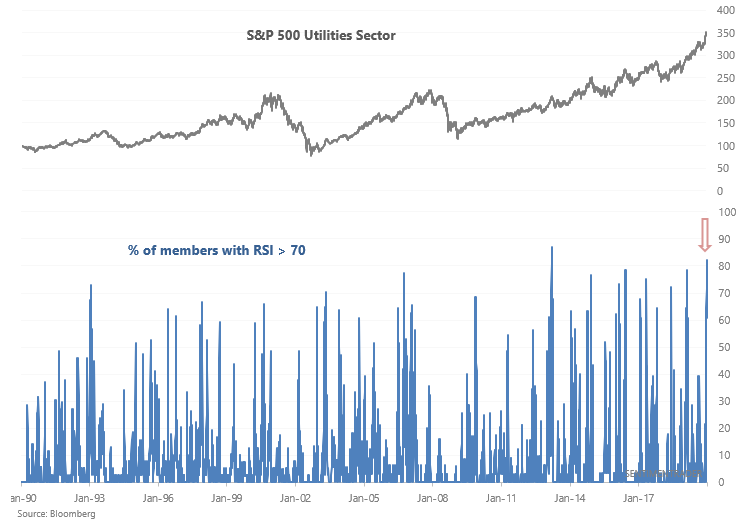

Utilities breadth

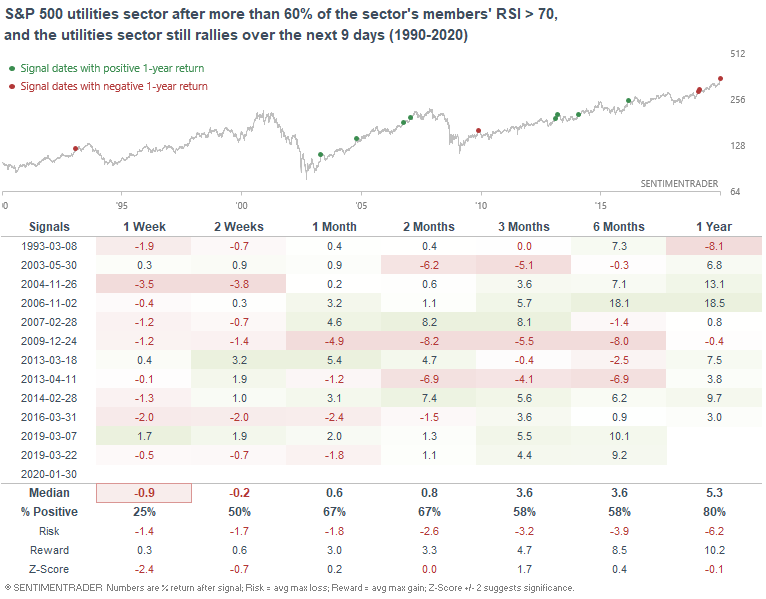

The phrase "extremes can become more extreme" is highly pertinent to utilities right now. After an extremely large number of the utilities sector's members saw RSI readings >70 (overbought), the utilities sector continues to rally:

When many of the utilities sectors' stocks were overbought, yet the utilities sector still rallied over the next 9 days, the utilities sector usually faced weakness over the next week:

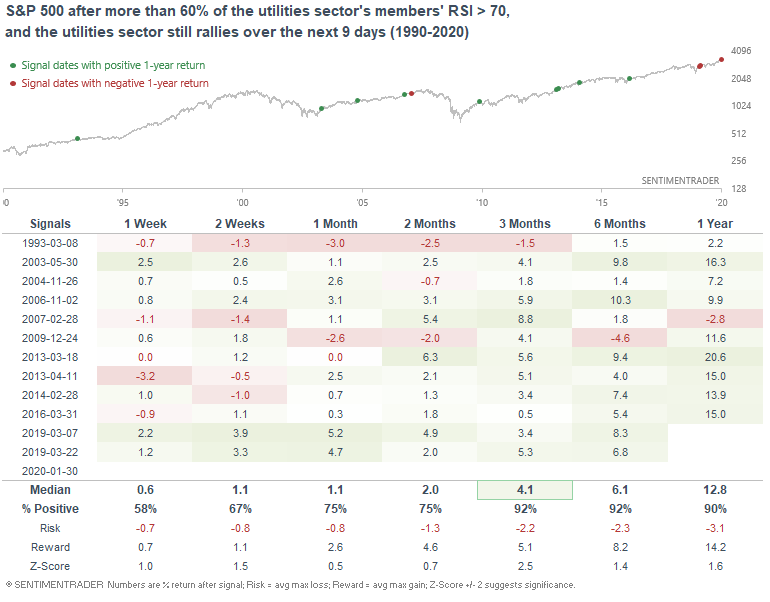

On the other hand, this was quite bullish for the broad S&P 500 over the next 3 months:

AAII

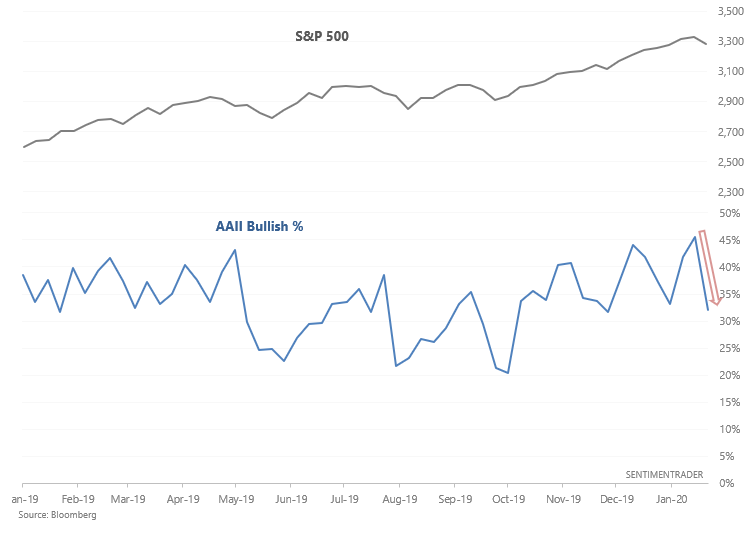

Last week saw the AAII Bullish % jump to a 1 year high. But as U.S. equities stalled this week, AAII Bullish % fell more than -13%, which is quite a strong one week slump:

When this happened in the past, the S&P sometimes faced continued short term weakness over the next 2-4 weeks. Granted, most of the bearish cases occurred before 2003, so perhaps this isn't a significant bearish factor for the stock market anymore.

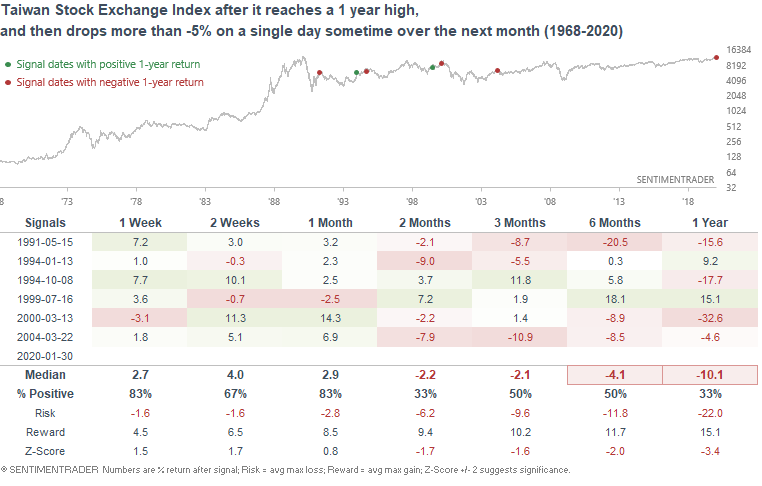

Taiwan

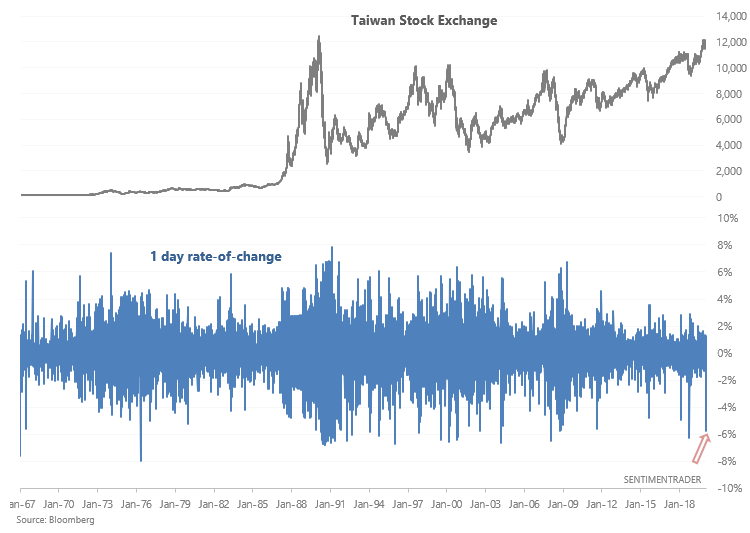

And lastly, Taiwan posted an extremely large 1 day drop on Thursday after recently reaching a multi-year high. Such large drops from all-time highs are rare:

When they occurred in the past, the Taiwan Stock Exchange Index often rallied over the next few weeks: