What I'm looking at - Chinese profits, Nikkei breadth, Germany breakout, VIX Put/Call, fund flows

With stocks still hovering near all-time highs, here's what I'm looking at:

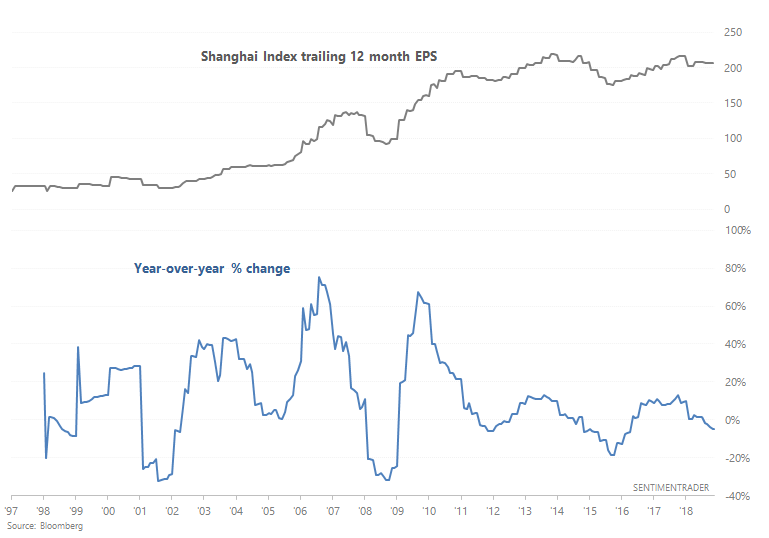

Chinese corporate profits

As Bloomberg noted, Chinese corporate earnings are weak. The following chart illustrates the year-over-year % change in the Shanghai Index's 12 month trailing earnings per share. As of September 2019, this figure stands at -4.7% (and for October 2019 is currently tracking -4.8%).

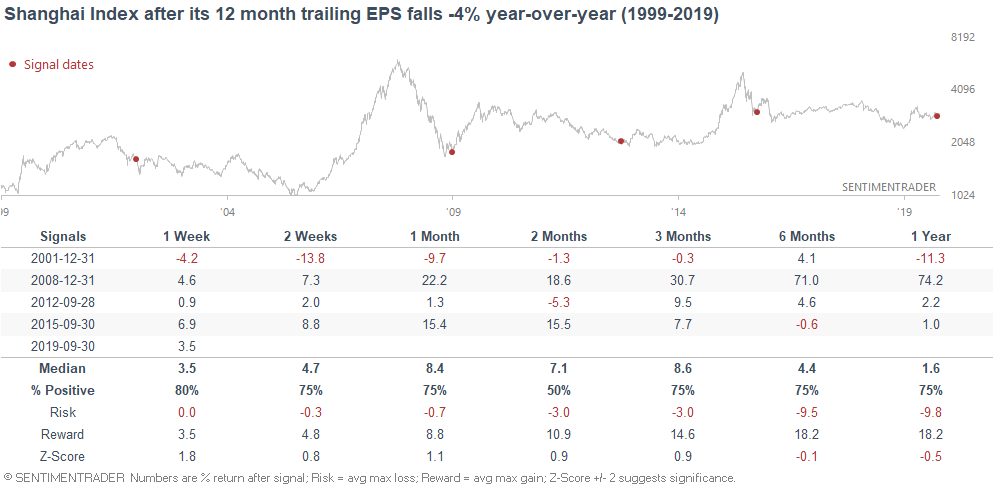

But when trailing EPS was down this much year-over-year, it wasn't clearly bearish for Chinese equities going forward:

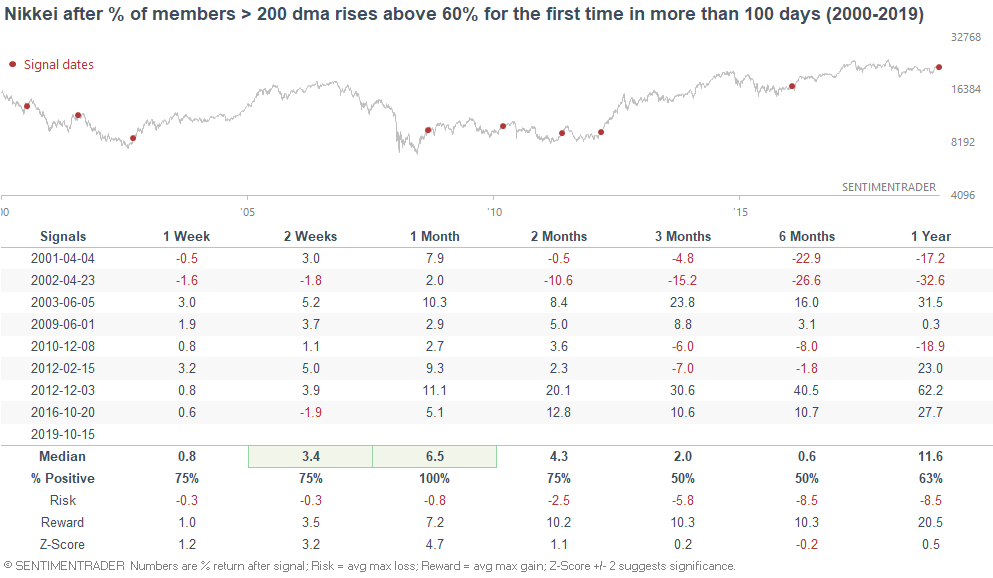

Nikkei

As Strategas noted, the % of Nikkei stocks above their 200 dma rose above 62% on Wednesday for the first time since October 2018:

This marks a resurgence in breadth after a long streak of weak breadth:

When breadth surged in the past, the Nikkei's returns over the next month were mostly pristine:

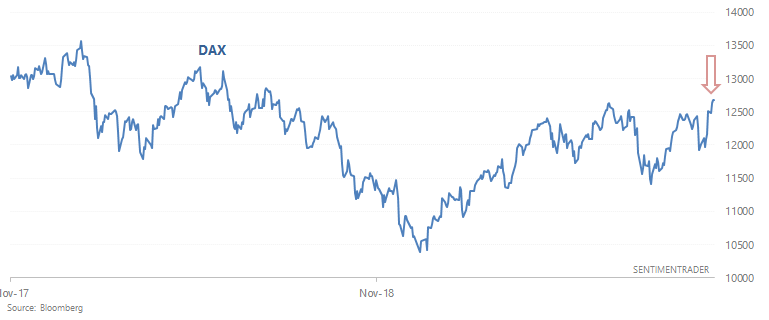

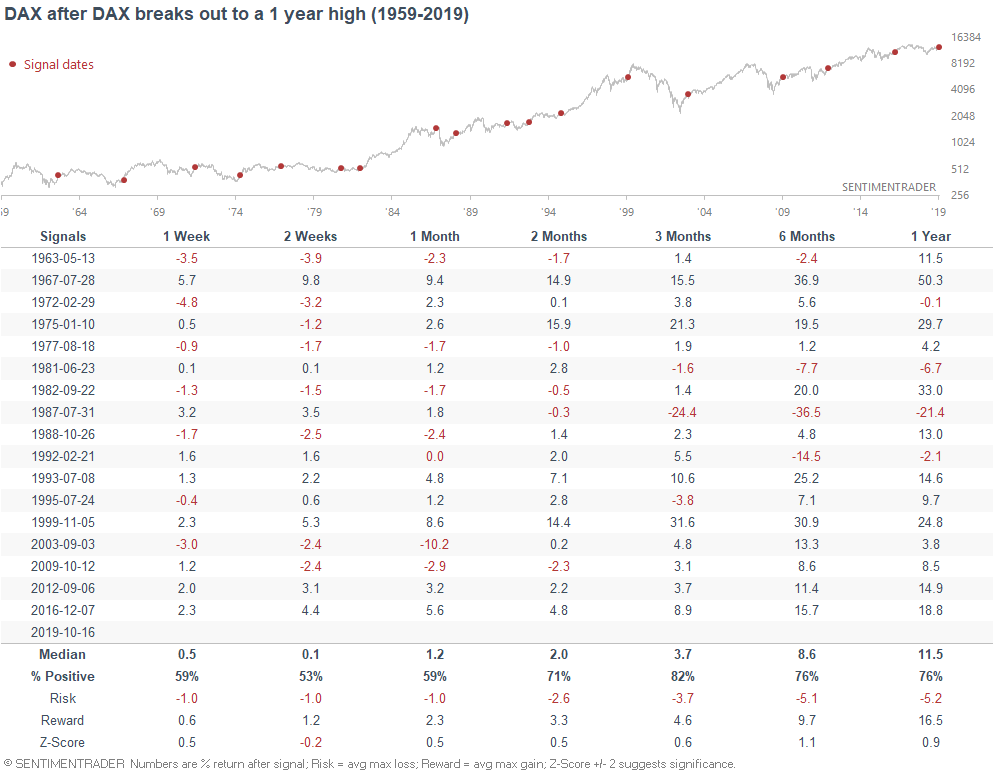

Germany

Similar to the Japanese Nikkei, the German DAX has broken out to a 1 year high:

When this happened in the past, the DAX usually went higher over the next 3 months:

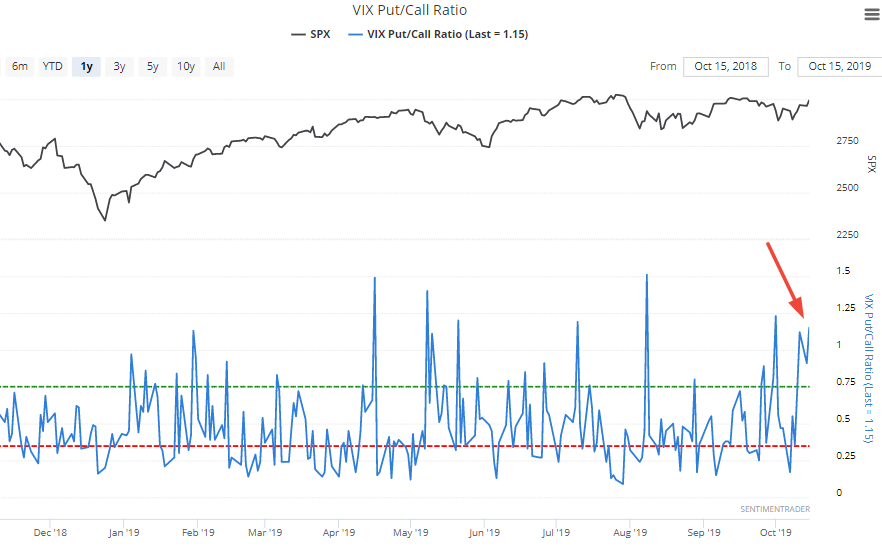

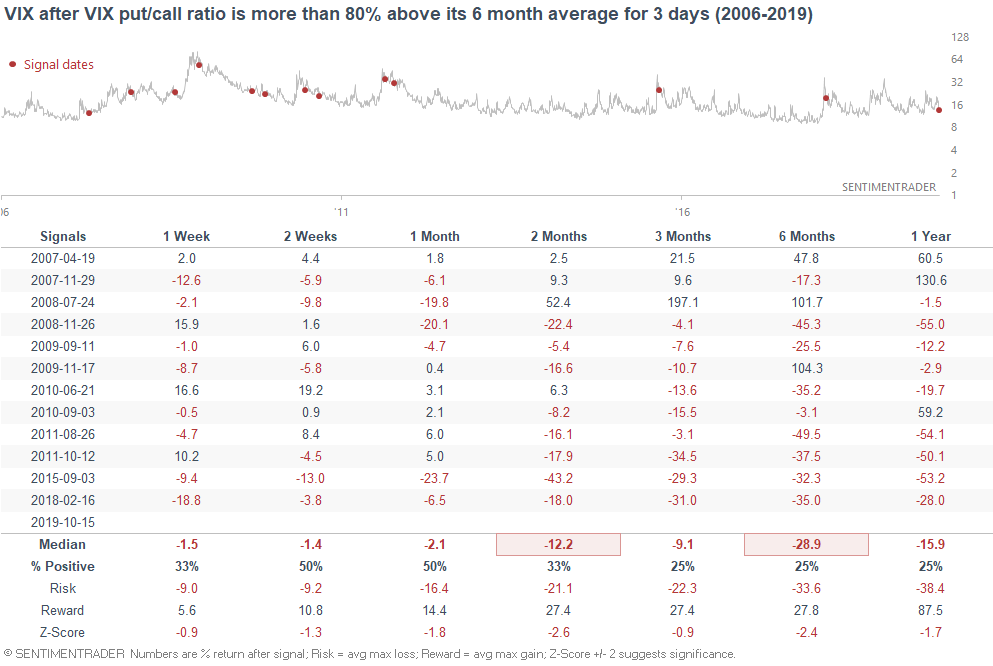

VIX Put/Call ratio

As of Tuesday, the VIX Put/Call ratio had been above its 6 month average by more than 80% for 3 consecutive days:

When the put/call ratio remains elevated in the past, VIX's returns over the next 2-6 months were more bearish than random:

*This was not consistently bullish or bearish for the S&P 500 on any time frame.

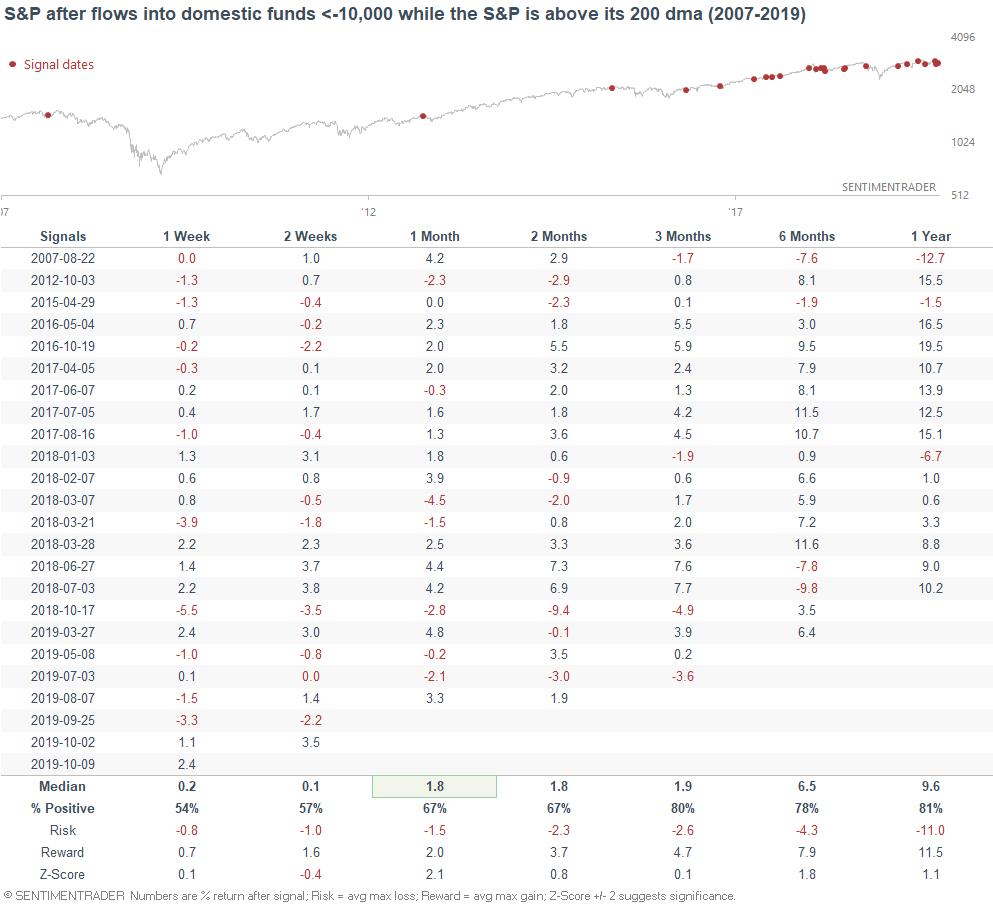

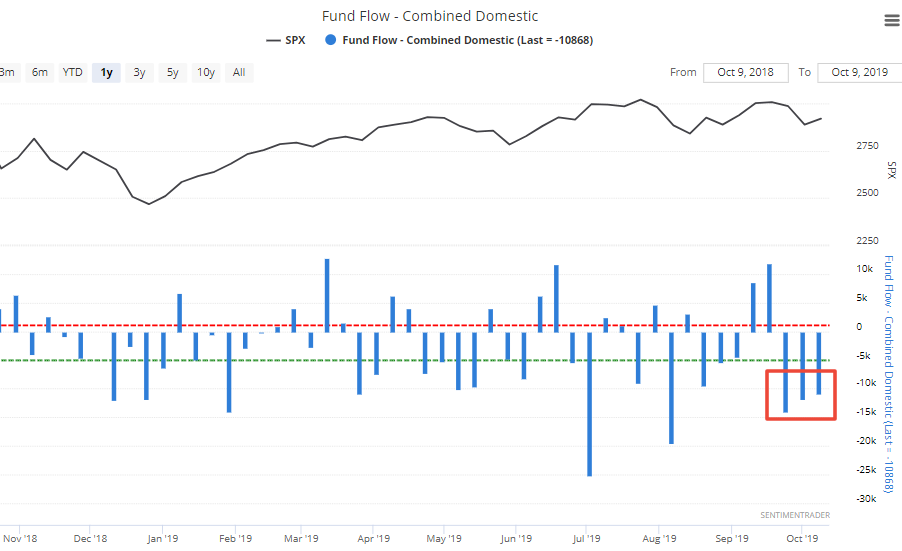

Fund flows

Equity mutual funds and ETFs continue to experience outflows, prompting our Domestic-only Fund Flow indicator to fall below -10,000 for the 3rd consecutive week:

Heavy outflows in the past while the S&P was above its 200 dma were more bullish than random for stocks over the next month: