What I'm looking at - Building Permits, VIX Put/Call, long term breadth, high yield bonds, Value vs. Growth

Here's what I'm looking at:

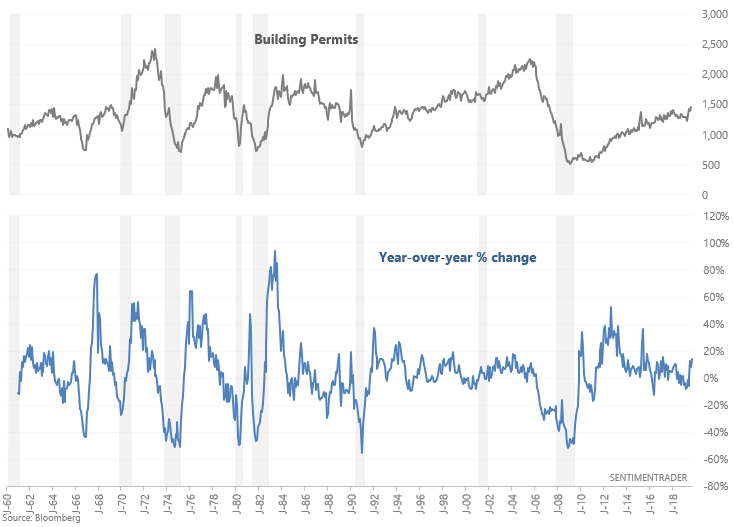

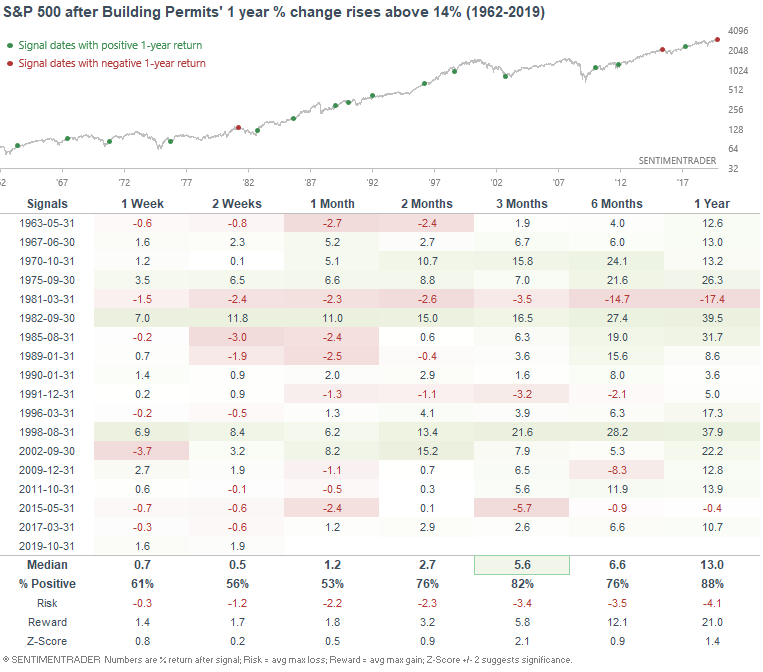

Building Permits

Building Permits made a new high for this economic expansion. Building Permits is one of 3 indicators that the Macro Index includes, and its year-over-year % change has risen to 14%:

This isn't how recessions start, and it isn't usually how bear markets start. The following table demonstrates every case in which the 1 year % change rose above 14%:

I wouldn't quite use this on a 3 month basis, but I would consider this to be bullish for stocks over a 6-12 month basis. Housing is a key leading sector of the economy.

VIX Put/Call

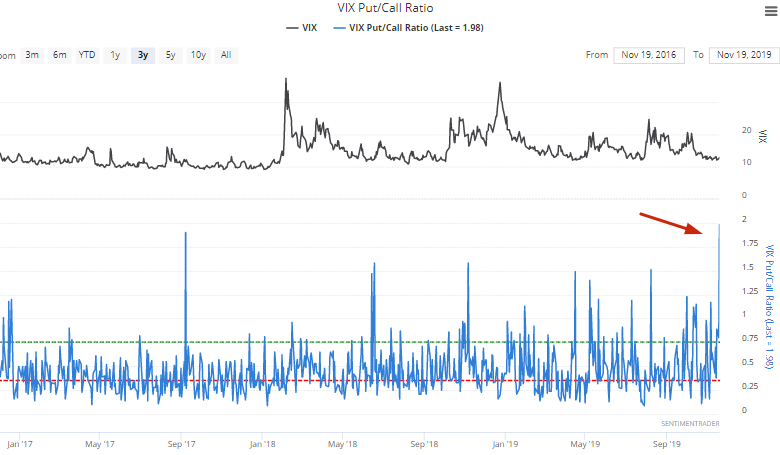

The VIX Put/Call ratio spiked on Tuesday to 1.98:

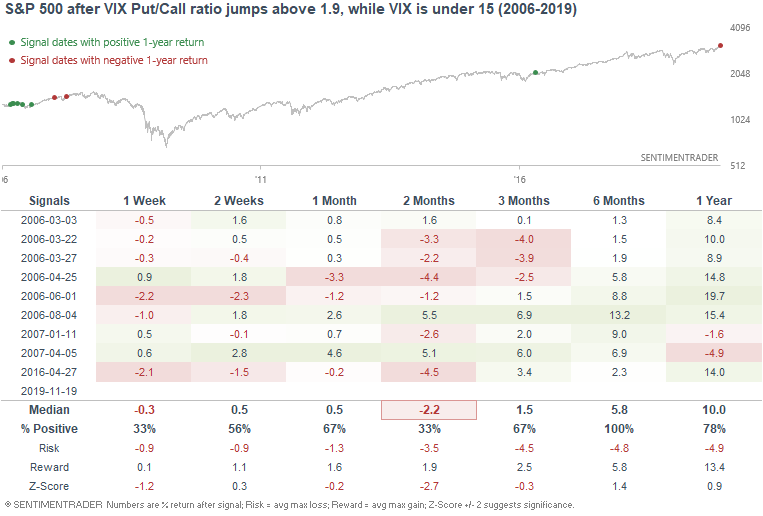

When VIX is low (e.g. under 15), this has typically been a bearish sign for the S&P 500 over the next 2 months (even when stocks are in a long term uptrend):

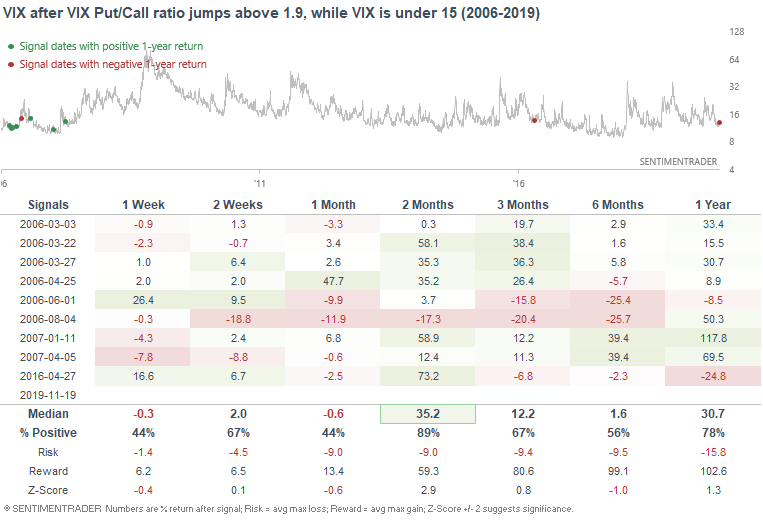

And it has typically been a bullish sign for VIX over the next 2 months:

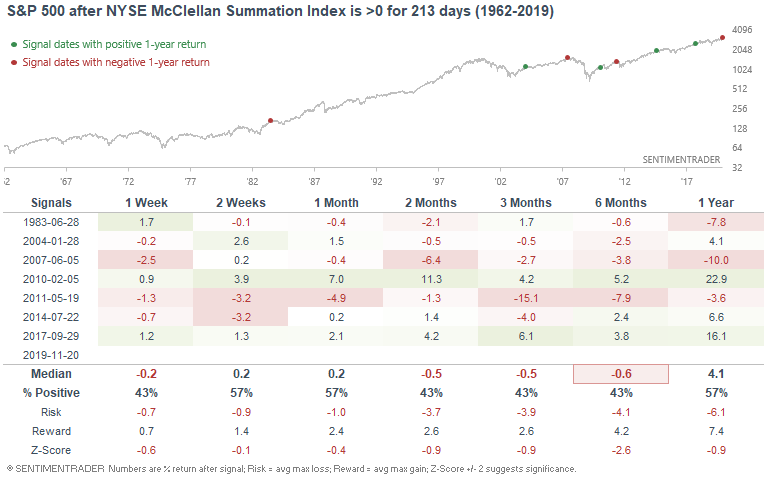

Long term breadth

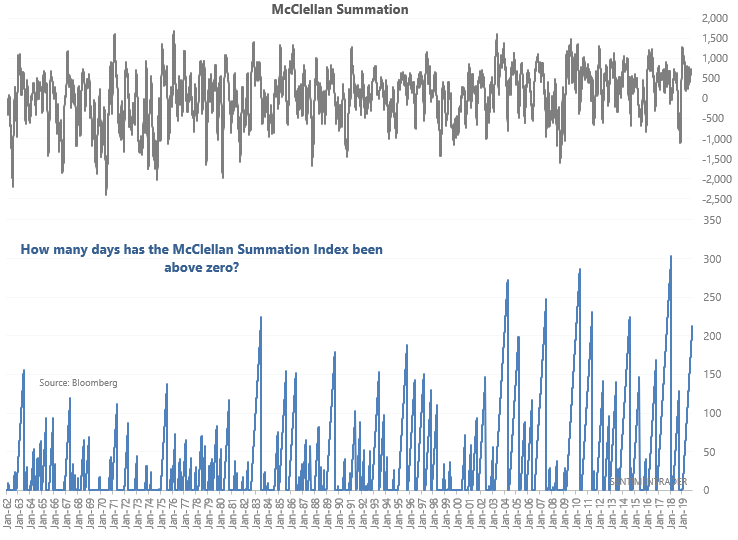

The stock market's rally has been extremely powerful this year, causing long term momentum (McClellan Summation) to consistently stay above zero. The last time such a streak existed was towards the end of 2017, just before stocks surged and then struggled over the next year:

When it reached this point, things were pretty overdone:

As you would expect, the stock market often struggled over the next few months. Strong rallies typically do not go on forever without taking a prolonged breather (volatility, corrections etc) along the way:

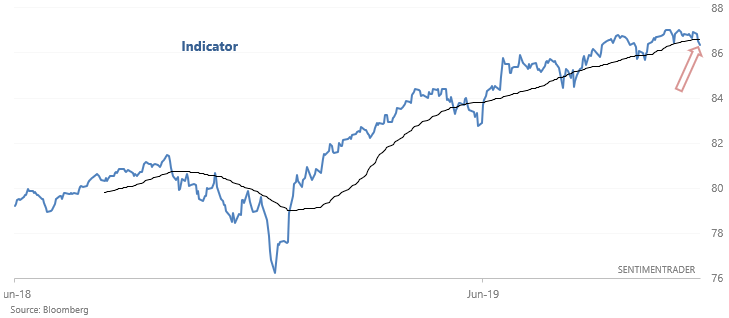

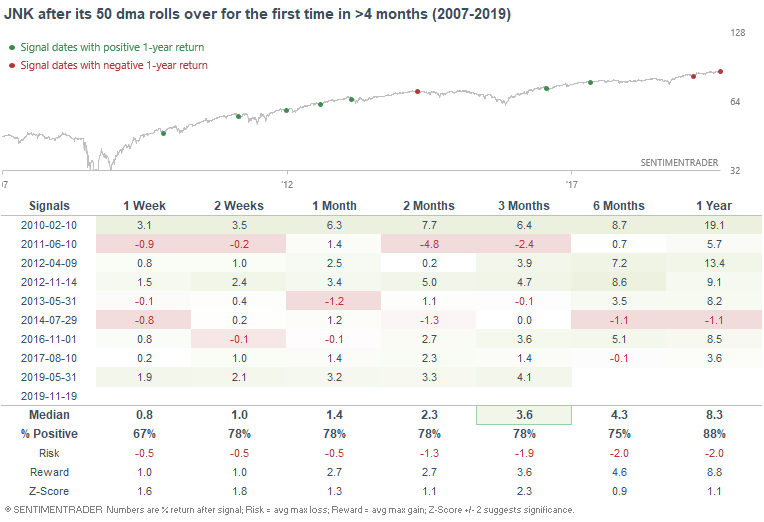

High yield bonds

While stocks have been rallying this year, high yield bonds (along with REITs and other interest rate sensitive asset classes) have been rallying even more persistently. JNK's 50 dma had been trending up the entire year, until now:

As is typical with momentum, the first change in the trend is usually followed by a continuation of the prior trend. So perhaps high yield bonds will pullback. But more often than not, JNK tends to rally higher over the next few months:

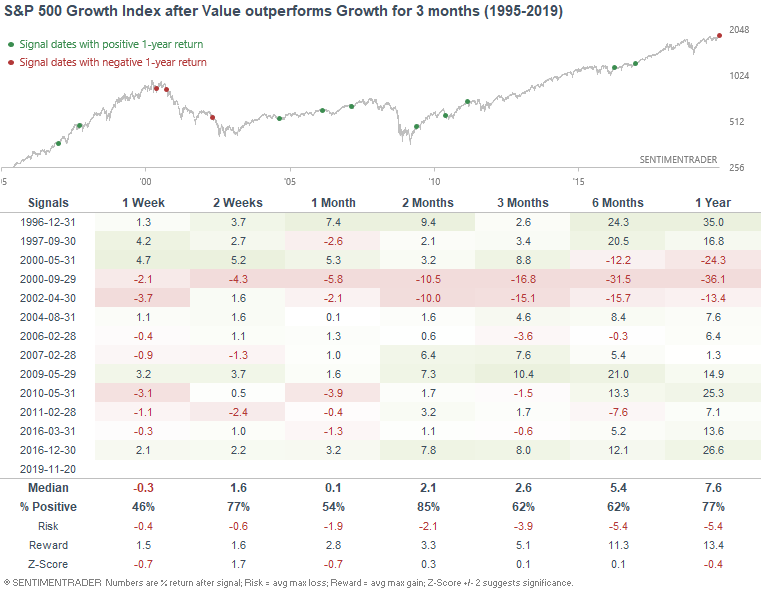

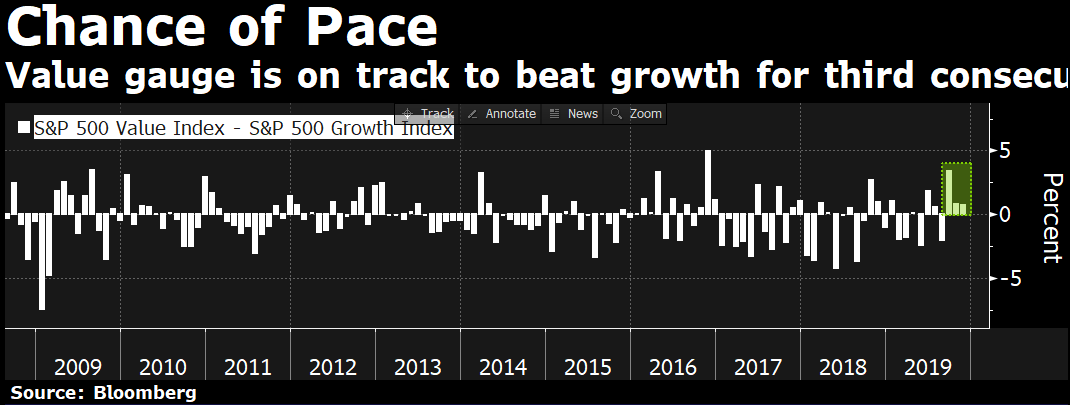

Value - Growth

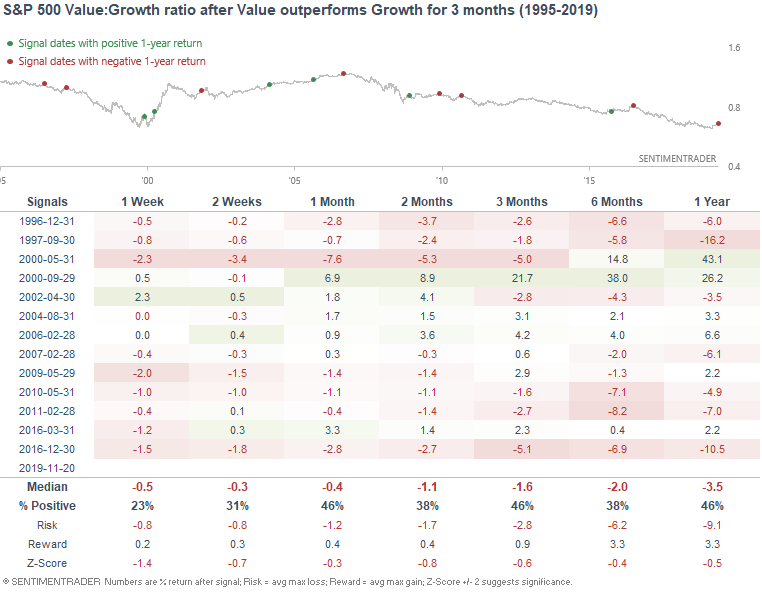

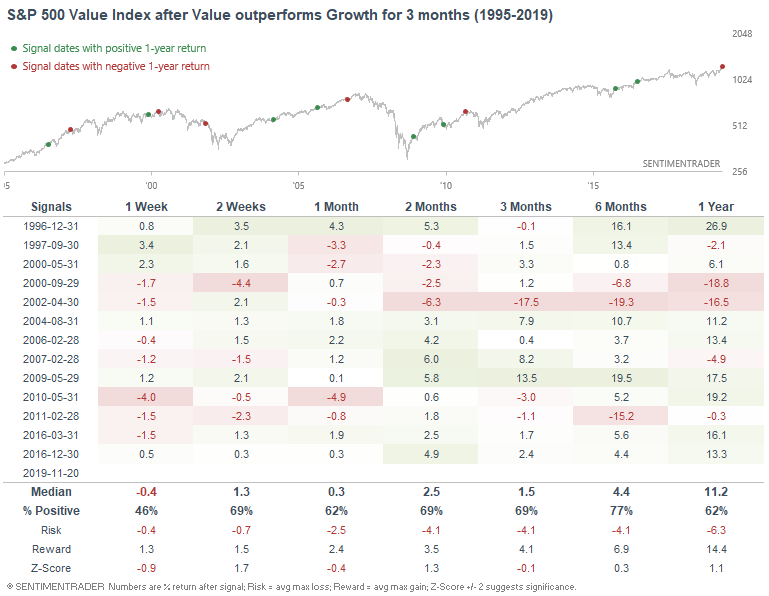

As Bloomberg TV noted, the S&P 500 Value Index is on the verge of outperforming the S&P 500 Growth Index for the 3rd month in a row:

Such outperformance is almost always followed by underperformance in Value in the short term (see 1-2 weeks):

*Keep in mind that this won't be triggered until November is over.

Here's what the S&P 500 Value Index did next:

Here's what the S&P 500 Growth Index did next: