What I'm looking at - bear market, profit warnings, VIX Put/Call, homebuilders, manufacturers' new orders

Here's what I'm looking at:

Bear market

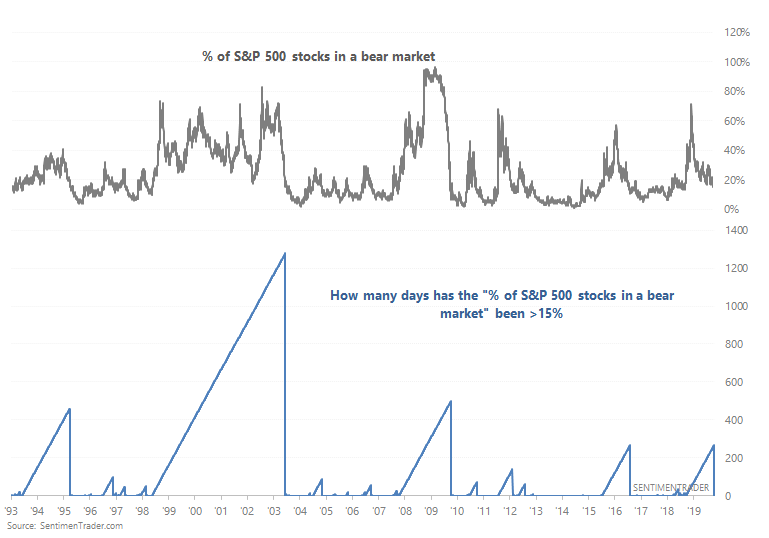

As the S&P 500 approaches all-time highs, the % of S&P stocks in a bear market (at least 20% below a 52 week high) has fallen to 15% for the first time since September 2018:

When this figure fell to 15% for the first time in more than 1 year....

... the S&P surged over the next 6-12 months.

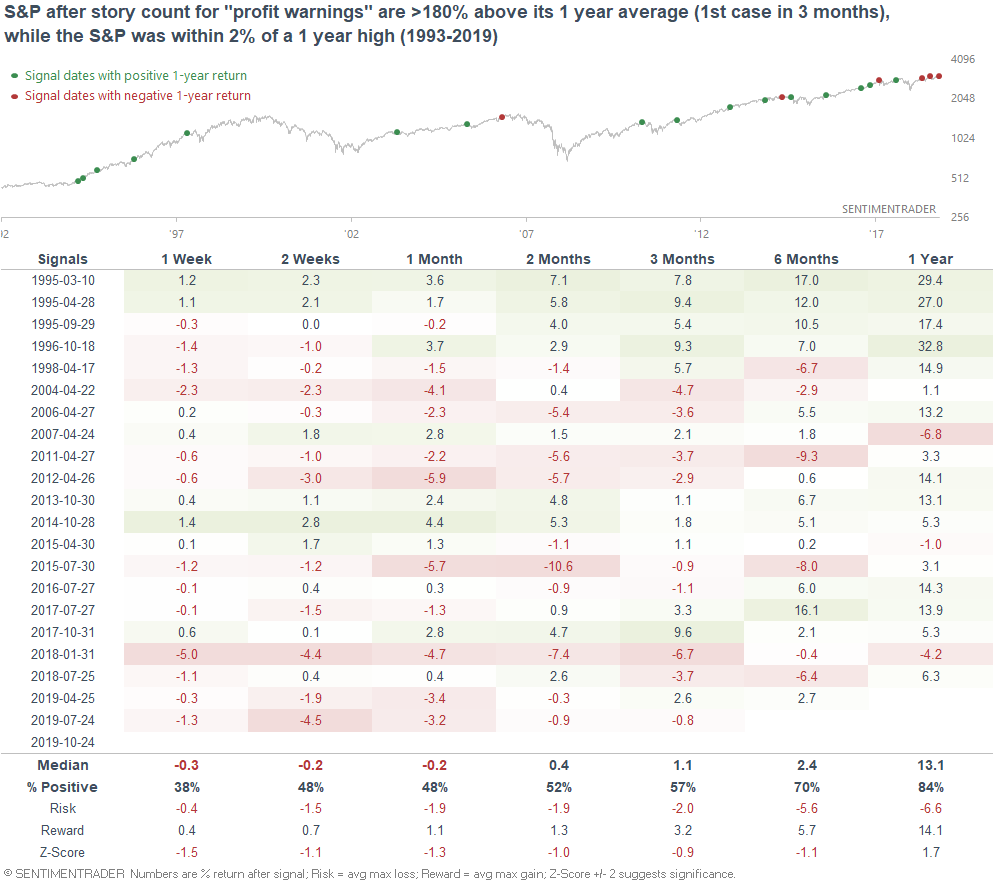

Profit warnings

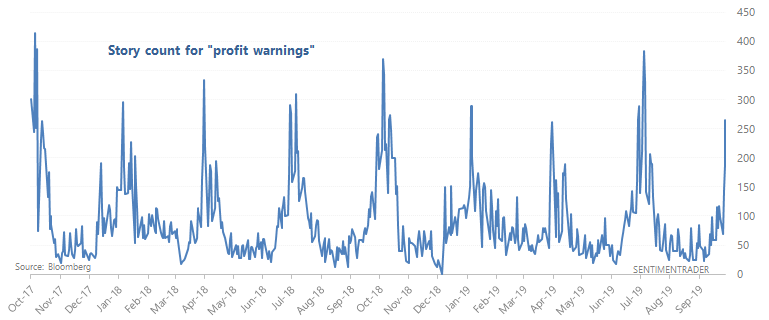

A quick scan of Bloomberg's "trending topics" demonstrates that traders are looking at profit warnings. And who can blame them, with a wide array of companies missing expectations during this earnings season?

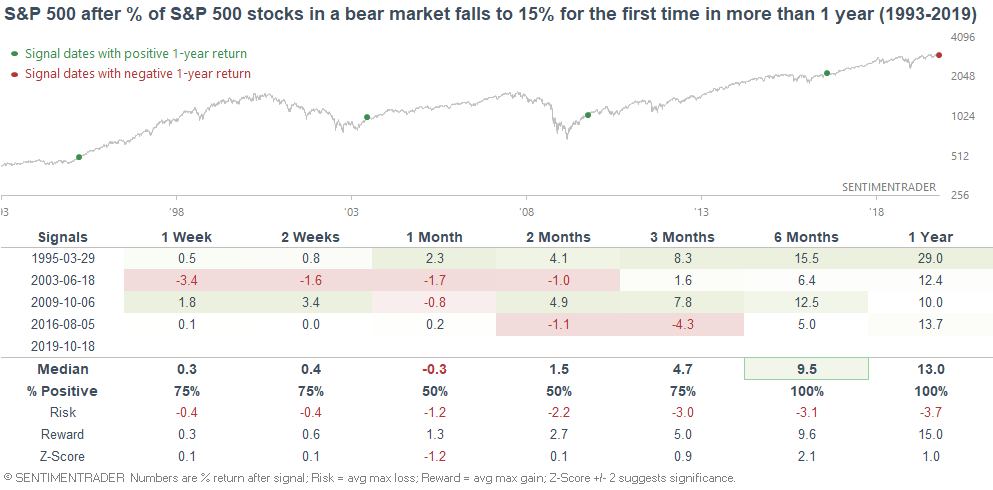

If we look at a story count for "profit warnings" we can see that the situation isn't all that dire. Profit warnings pop up every earnings season as companies play the earnings game (lower expectations, then beat expectations more than 50% of the time).

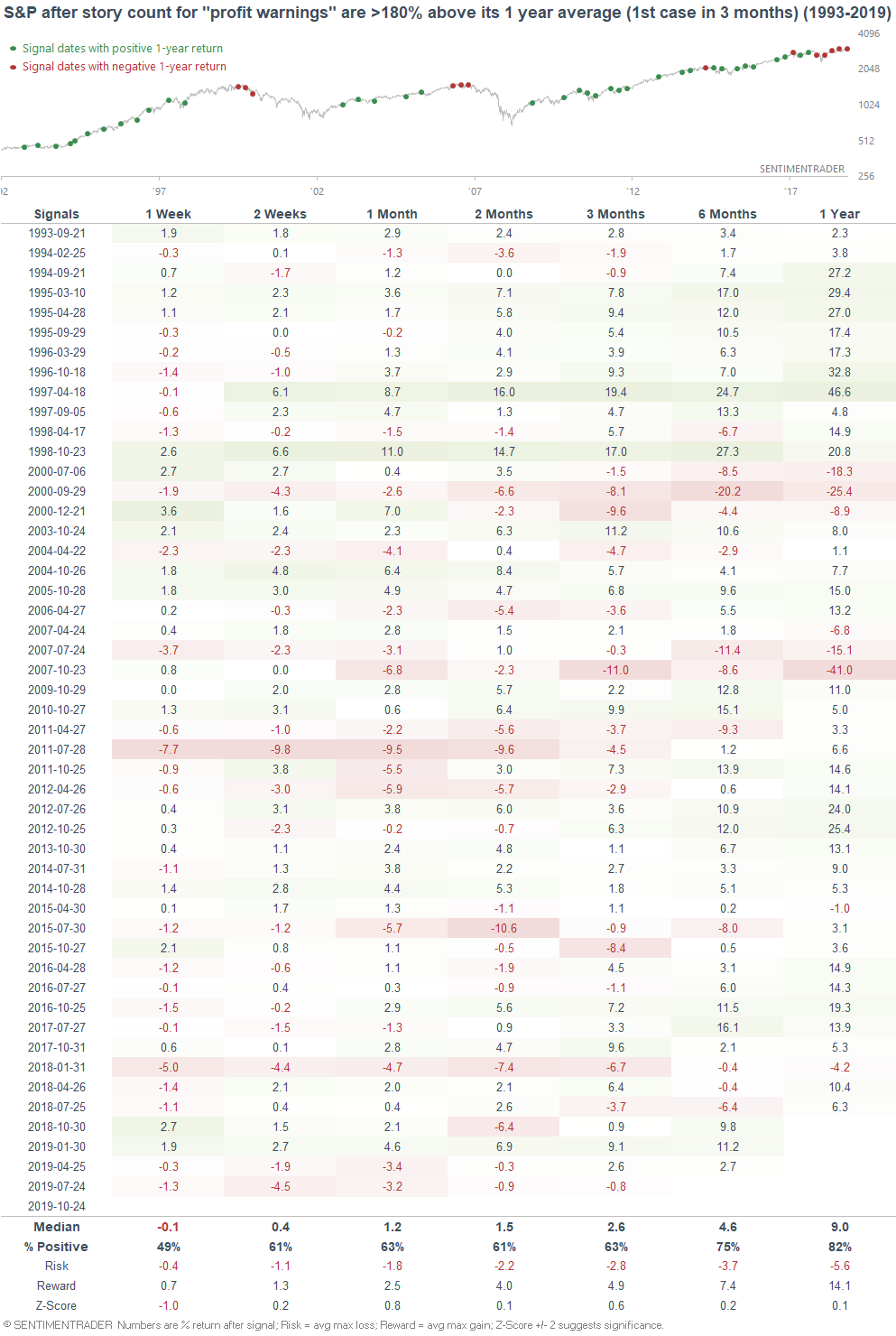

When the story count for "profit warnings" was more than 180% above its 1 year average, the S&P's forward returns weren't much different from random:

However, if we isolate for the cases that occurred while the S&P was within -2% of a 1 year high...

... the S&P's short term forward returns are more bearish.

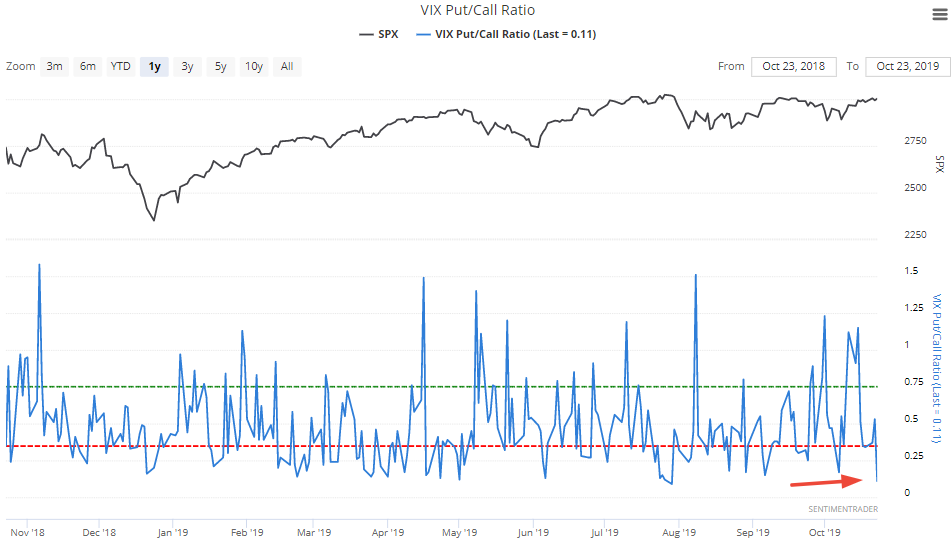

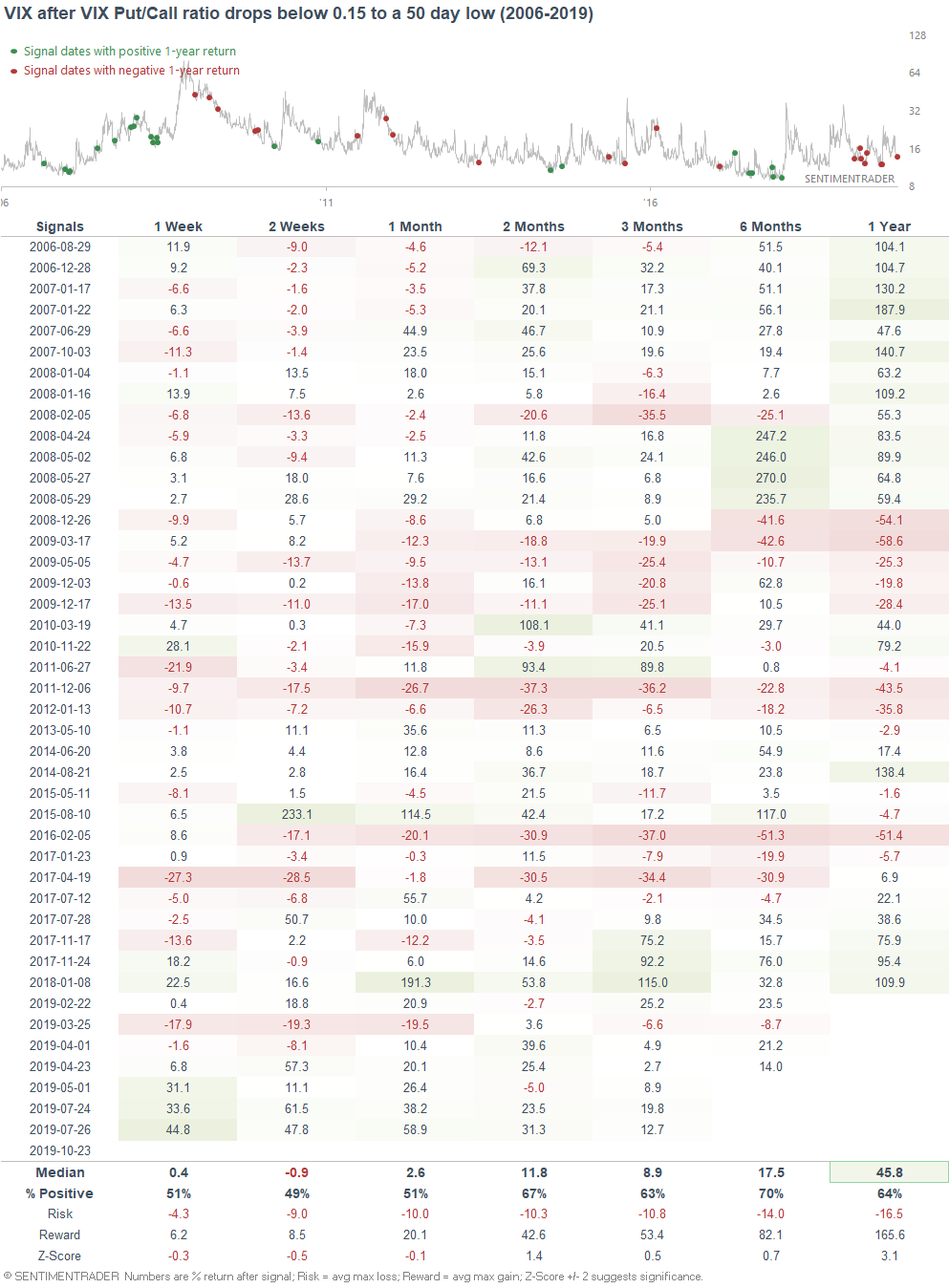

VIX Put/Call

With the stock market slowly grinding higher, the VIX Put/Call ratio has been trending lower. This is the lowest reading since late-July, just before stocks fell and VIX popped:

As is often the case, what's bullish for VIX isn't necessarily bearish for the S&P since VIX tends to be lower-bound. If we look at the cases in which VIX Put/Call fell below 0.15 to a 50 day low, it wasn't consistently bearish for the S&P 500. However, it was more bullish than random for VIX after 2+ months:

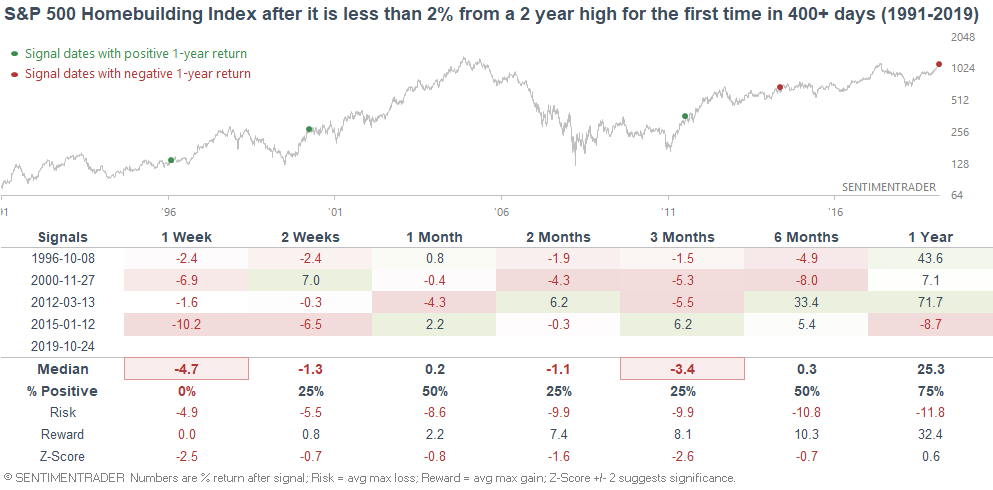

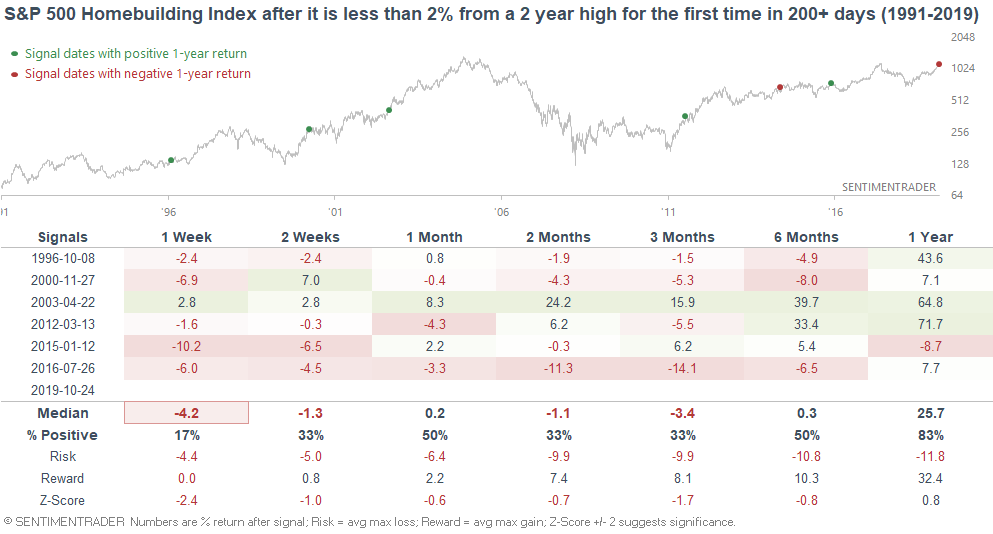

Homebuilders

As REITs continue to power higher, the S&P 500 Homebuilding Index is approaching its January 2018 high:

The S&P 500 Homebuilding Index is within -2% of a 2 year high for the first time in 400+ days (even including dividends, this index has not broken out yet). When the Homebuilding Index approached a multi-year high for the first time in 400+ days, it often faced weakness over the next few weeks and months. Breakouts were not that easy:

If we relax the study's parameters (from 400+ days to 200+ days) to increase the sample size, we get the sample results. The Homebuilding Index tends to face short term weakness:

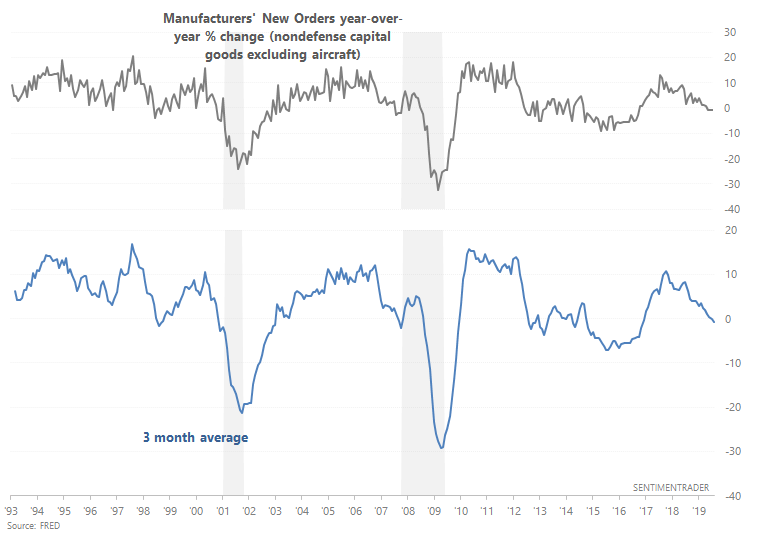

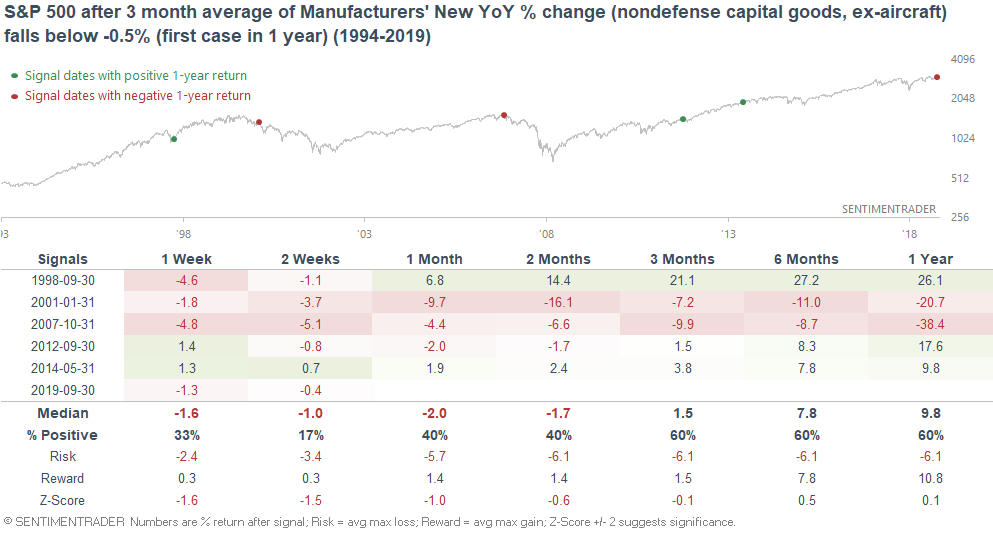

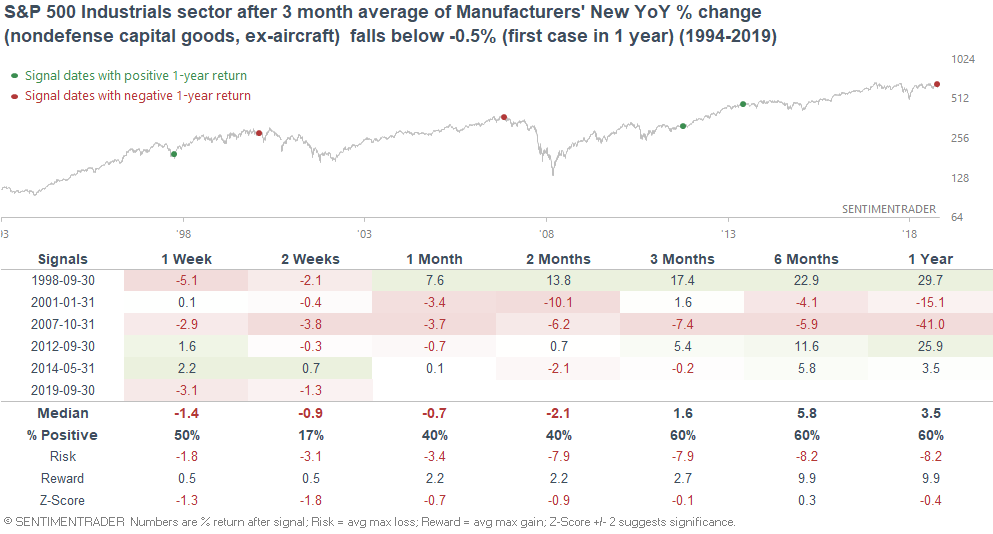

Manufacturers' New Orders

As David Rosenberg suggested, core capex is weak. The following is Manufacturers' New Orders year-over-year % change (nondefense capital goods excluding aircraft):

But if we look at the data, this wasn't consistently bearish for stocks. It did happen at the start of the 2000-2002 and 2007-2009 bear markets, but there were also other false bearish signals. Here's what the S&P did next:

Here's what the industrials sector did next:

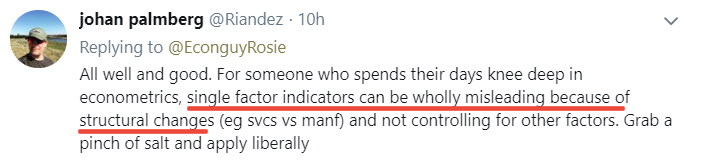

Looking closely at this indicator, we can see that it has spent much of this decade under 0%. I think Johan Palmberg has the best explanation for why this is:

Since there are thousands of economic indicators, we can always cherry-pick the sectors of the economy that best suit our bias. E.g. if I'm very bullish right now, I can focus on the labor market and housing. If I'm very bearish right now, I can focus on manufacturing and trade. As investors, we should try to look at the data holistically, combining the bullish and bearish data.