What happens when S&P tries to swallow a whale

An event that Elon Musk fans have been waiting for all year finally happened, with the announcement that Tesla would be added to the most important equity benchmark in the world. There are trillions invested based on the S&P 500 index, and inclusion brings a certain cachet.

What it doesn't usually bring is profit.

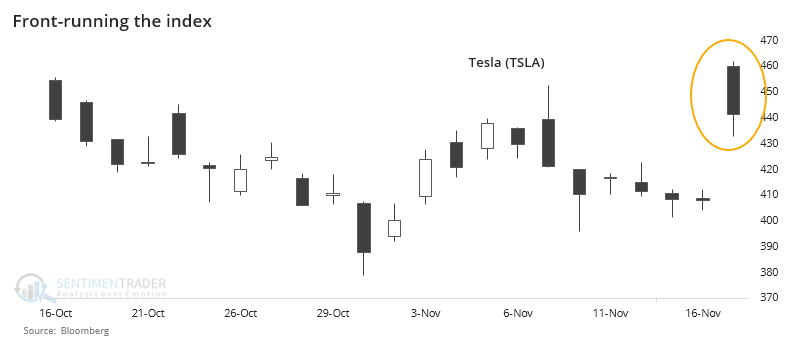

Even though being added to the index seemed widely expected, investors were disappointed the last time the S&P updated its index and Tesla wasn't included. Perhaps they were once bitten, twice shy. Regardless, the news was enough to trigger a pop at Tuesday's open which faded during the rest of the day.

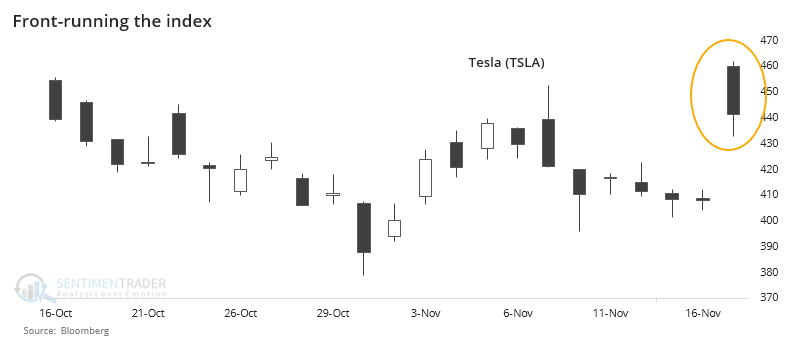

Going back to 1979, we looked for every time the Standard & Poor's committee added a new stock to the index of (approximately) 500 stocks in the S&P 500. We filtered it to only look at the stocks that had the largest market capitalizations at the time of the announcement. Tesla will be - by far - the largest stock the index tries to swallow at the moment of inclusion.

For the S&P, it preceded mostly below-average returns going forward. Over the next 6 months, it averaged a measly 0.8%, nearly 3 standard deviations below a random 6-month return over the past 25 years. There were no additions prior to 1994 that made the list of largest market cap stocks added to the index.

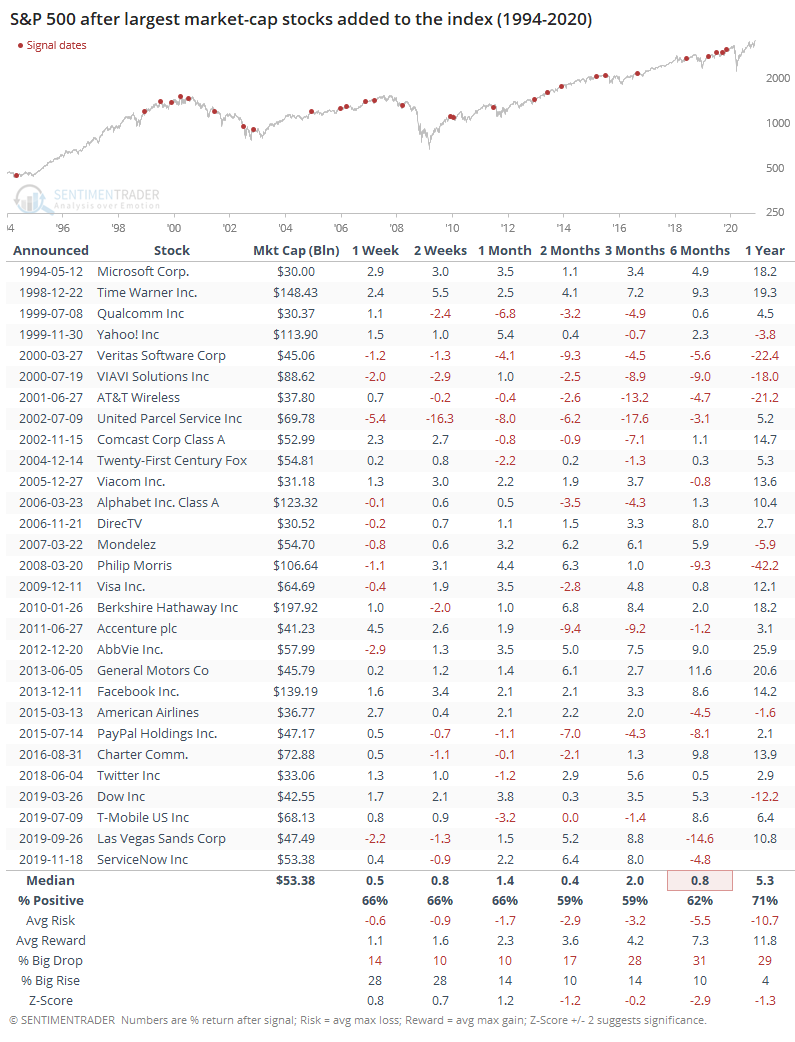

For the stocks themselves, forward returns from the date of the announcement were pretty good. Excluding the bubble additions in 1999-2000, the returns were even better, though there have been some big oopsies over the past 5 years.

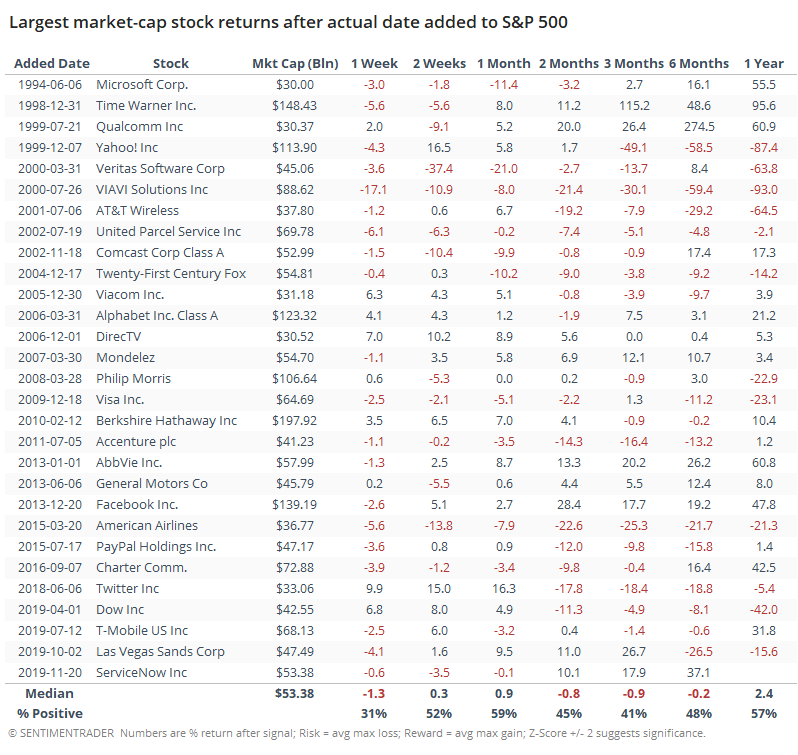

Where it gets interesting is that returns turn significantly south once the stock is actually added to the index, which on average has been around 7 trading days after the announcement date. By this time, investors have front-run the index in anticipation of all the passive buying that should flood into the stock.

Once the stock was added to the index, it had a strong tendency to see poor returns immediately and up to a week later. There were some rebounds after that, but by 3 months later, only 41% of them sported a price that was higher than the close on the date it was added to the index.

For Tesla bulls, it's a modest warning that much of the good news about being added to the most important index in the world may have already been priced in. It's even more of a challenge that the stock is so huge to begin with.