Wednesday Midday Color

Here's what's piquing my interest so far on this weak day.

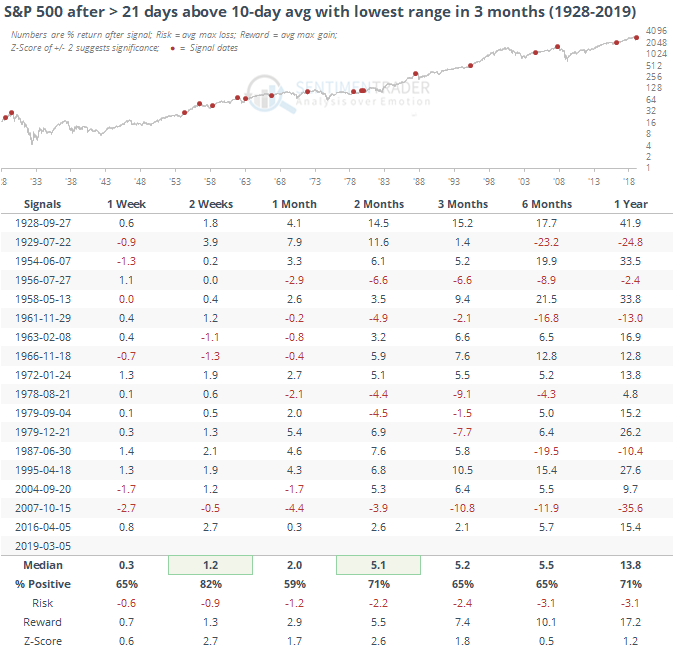

Ebbing Momentum

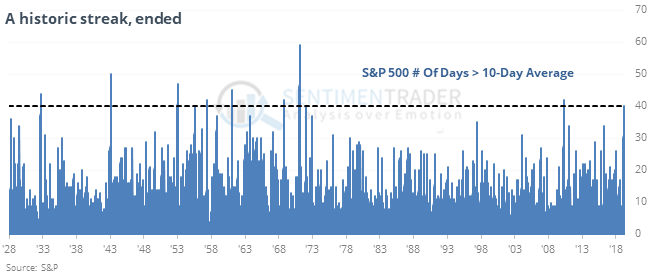

The S&P 500 has finally closed below its 10-day moving average for the first time in at least 40 sessions. That's one of its most persistent short-term trends since 1928.

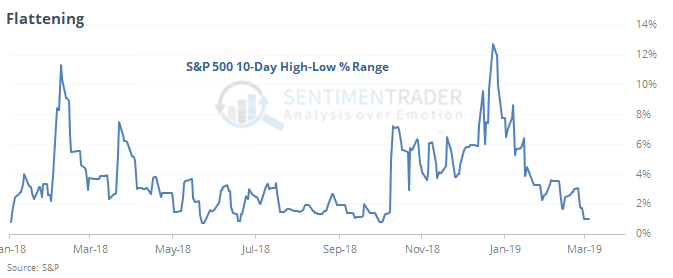

At the same time, it has flattened out. Over the past 10 days, the difference between its highest and lowest closes is barely 1%, the least amount of volatility in months.

It seems like this combination (low volatility with waning momentum) should be a bad sign, but historically it has not been.

Over the next two weeks, especially, the S&P did well, with only minor losses. This is surprising - personally, I thought it would be much more negative. Momentum does not die easily, though I'd be surprised if it manages to follow through on this this time as the negatives have built up. On the downside, several of the short-term rebounds ended up failing and leading to large medium- to long-term losses.

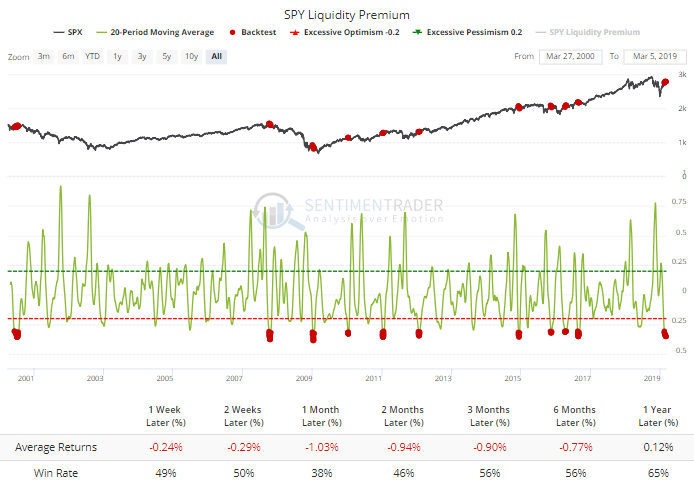

No Premium For Liquidity

Among those worries, traders have given up on the idea that they need the liquidity provided by major ETFs like SPY, as opposed to trading individual stocks. The SPY Liquidity Premium has fallen drastically, which has been a consistent sign of too much complacency.

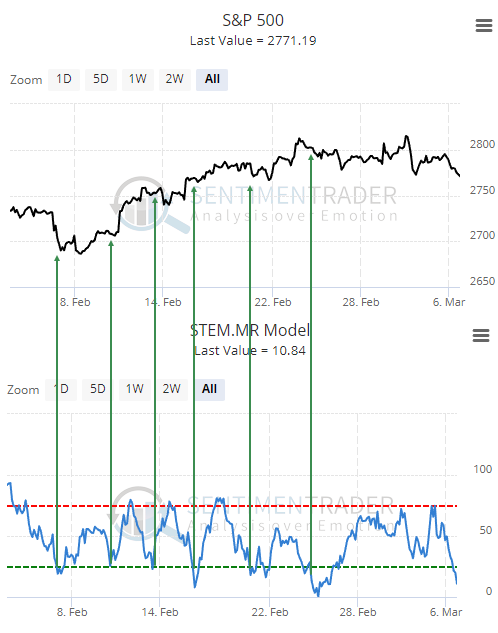

Oversold

In the very short-term, our shortest-term model has hit an intraday oversold reading. Over the past 2 weeks, this has led to limited downside as buyers stepped in almost immediately. But the last signal didn't, and stocks rolled over right after the model hit overbought. This is an additional sign of waning momentum.

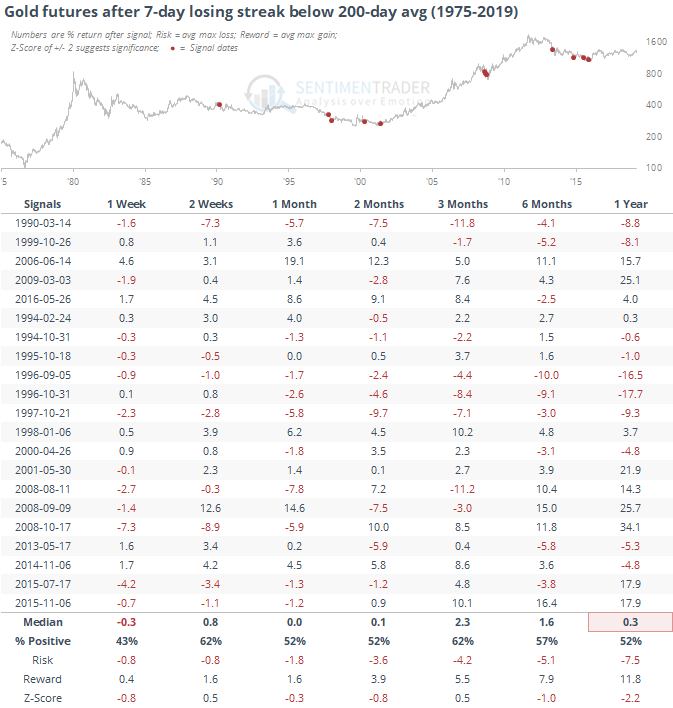

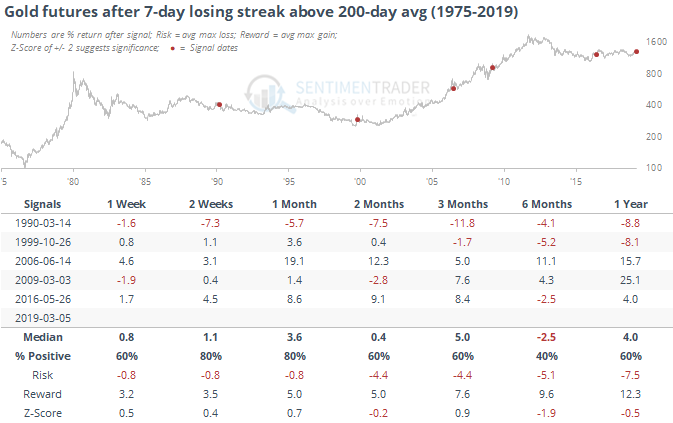

Gold

Gold futures declined for the 7th day in a row, and look to increase that streak Wednesday, but still remain above the 200-day average.

Returns were good except for 1990. They were a lot better than when gold suffered a 7-day losing streak and it was below its 200-day average.