Wednesday Midday Color

Here's what's piquing my interest so far ahead of the FOMC craziness.

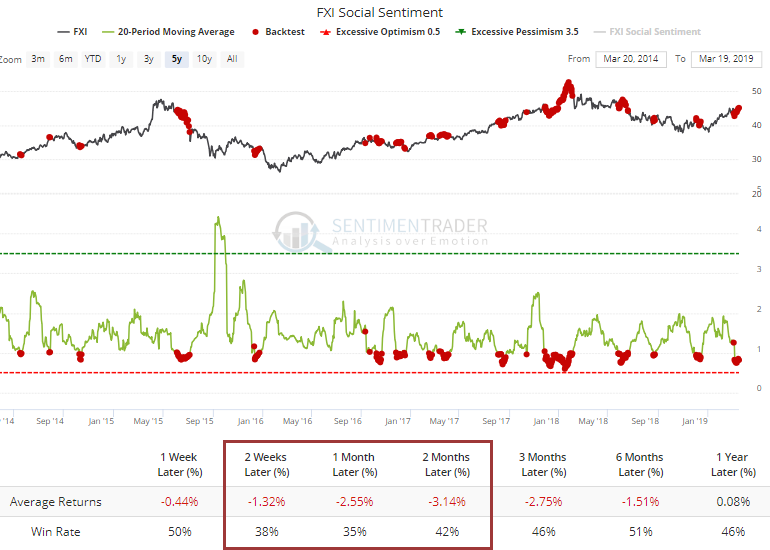

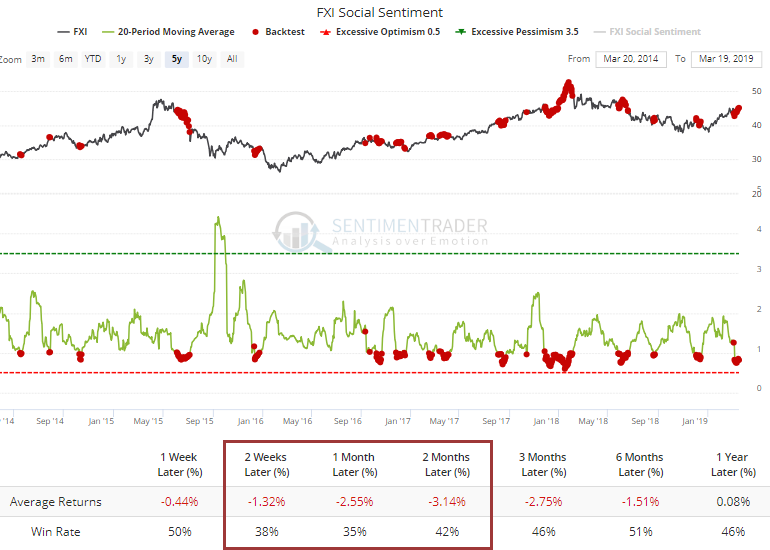

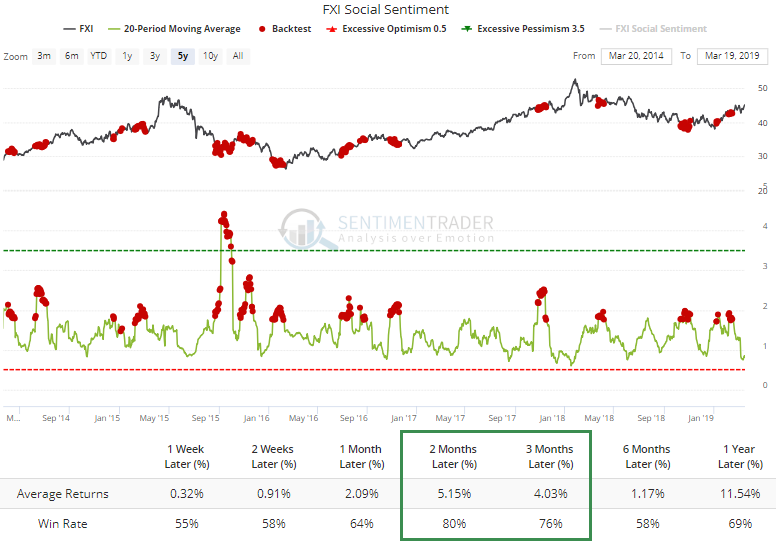

Tweeps Loving China

Social sentiment among Twitter users has become very optimistic over the past month. The 20-day average of Social Sentiment on FXI has dropped below 1, meaning that on an average day, there have been more optimistic Tweets about FXI than bearish ones. That hasn't been a good sign.

By contracts, when Twitter users were posting at least 75% more bearish messages than bullish ones, a sign of high pessimism, then FXI did quite well.

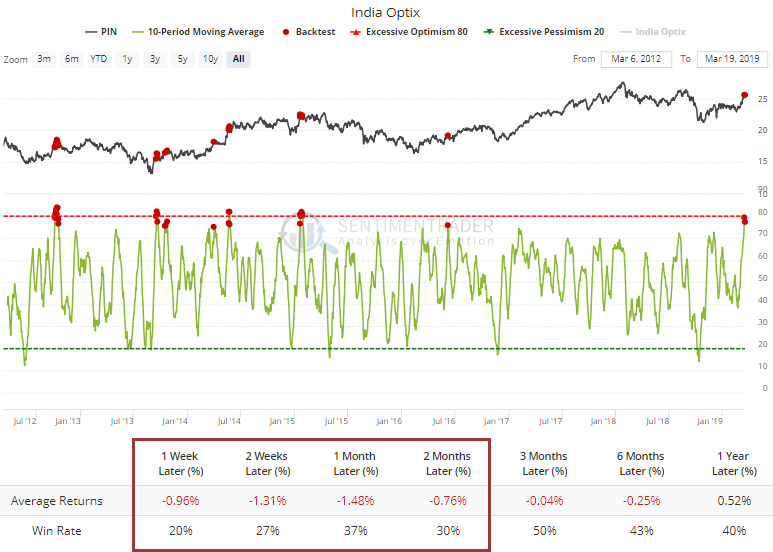

Sticking with Asian markets, optimism in funds like PIN has jumped over the past couple of weeks along with the outsized rally. PIN has struggled mightily after other times it got this high over a 2-week time frame.

Low Vol, Everywhere

We've touched on this several times over the past month or so, but volatility across assets has collapsed. Stocks, bonds, currencies, commodities, you name it.

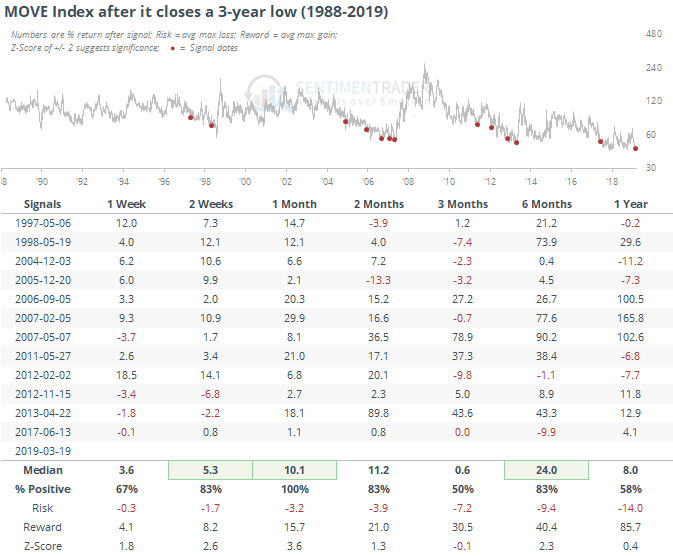

For bonds, the MOVE Index just dropped to a new multi-year low. That has led to a jump in bond volatility over the next month every time.

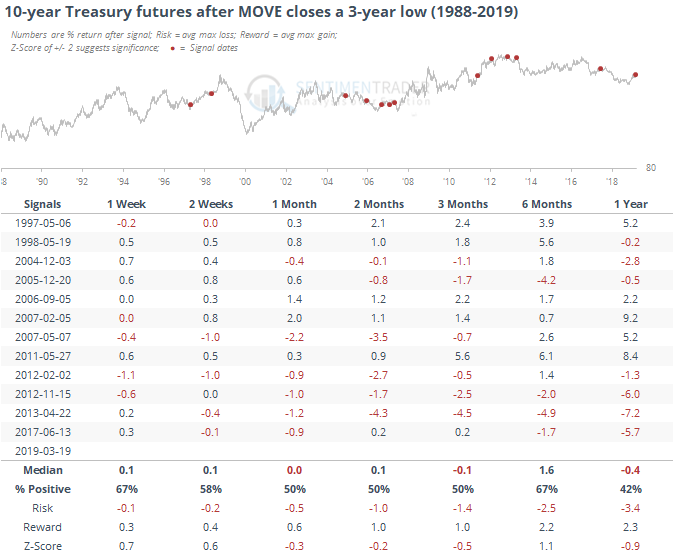

Returns on 10-year Treasury futures after other bouts of extremely low volatility were weaker than average, but pretty mixed.

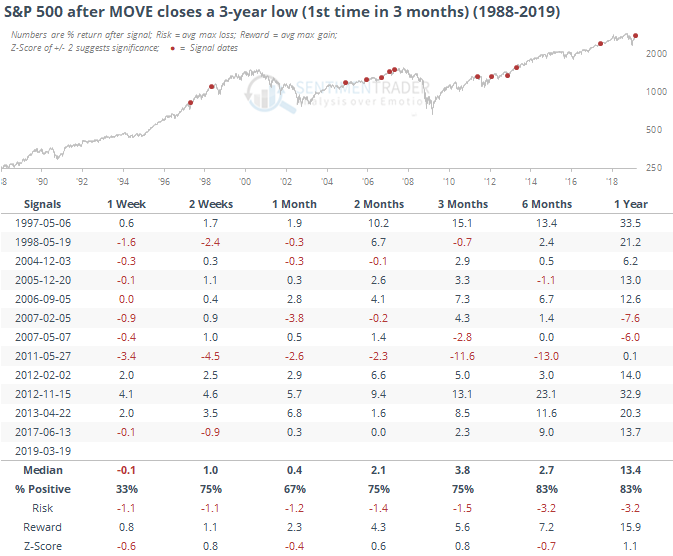

Mostly positive for stocks, for what it's worth.

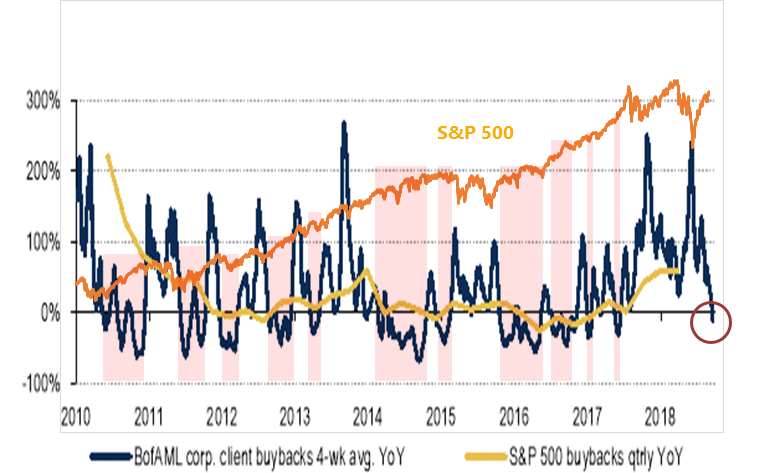

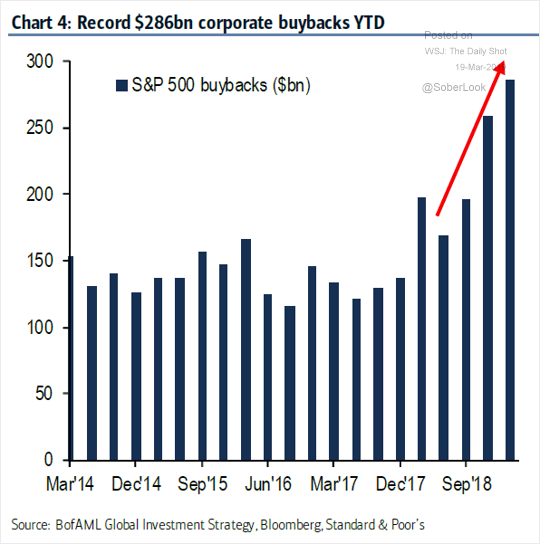

Buybacks

Ahead of every earnings season lately, traders become worried about corporate buybacks. They have become an increasingly large part of the support for stocks (via WSJ Daily Shot).

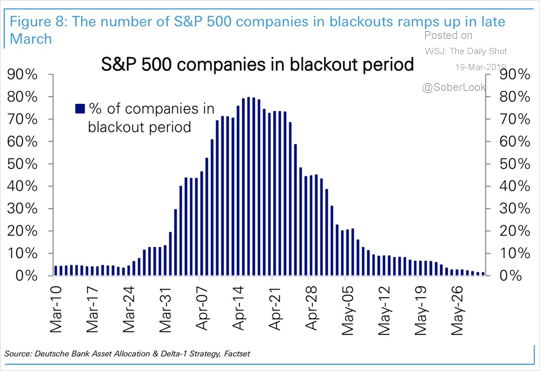

That causes anxiety as earnings season approaches since companies cannot buy back their own stock during "quiet periods" ahead of their earnings releases. That will become a factor in the coming weeks (via WSJ Daily Shot).

As noted by BofA, their clients are already starting to pull back on buybacks, with their 4-week average turning negative. If we superimpose the S&P 500 on the chart, we can see that when the trend in buybacks turns negative, the S&P has struggled some, but other times not so much. It was better as a buy signal (companies buying back a massive amount of stock) rather than a sell signal. It's perhaps a minor worry here, but has been too inconsistent to suggest it's an outright negative.