Wednesday Midday Color

Here's what's piquing my interest so far on this waiting-for-the-Fed day.

Mexican Momentum

In Friday's report, we saw that "The MSCI Mexico Index closed above its 200-days for the first time in six months on Friday. Other times it went this long before ending a downtrend, it added to gains over the next month 5 out of 6 times averaging 4.6% (the sole loser was -0.7%). Reward over the next month was three times larger than risk."

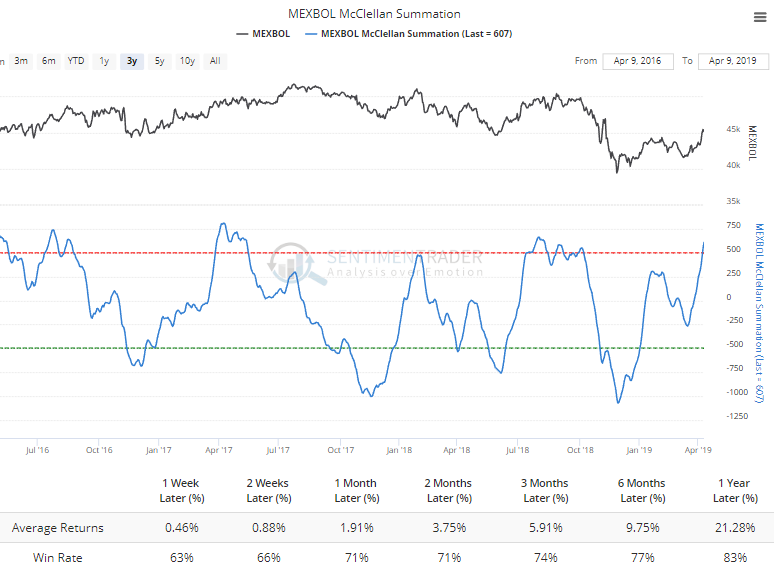

The Mexbol rally has continued with good, broad-based breadth. Its McClellan Summation Index just crossed above +500 for the first time in 6 months. Over the past 17 years, its forward return was good after the 1,388 days when the Summation Index was above this threshold.

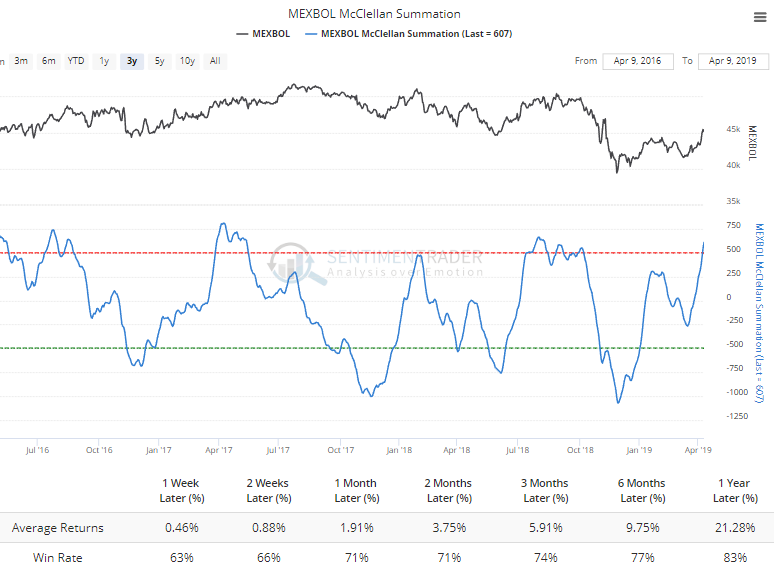

If we focus on those day when the Summation crossed 500 for the first time in at least 3 months, then there were some failures, but overall the returns were positive.

The only large medium-term failures were during the midst of the financial crisis.

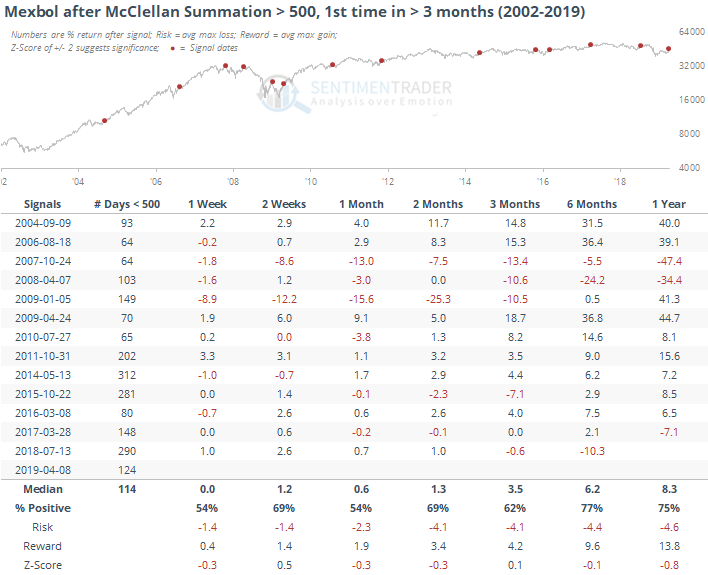

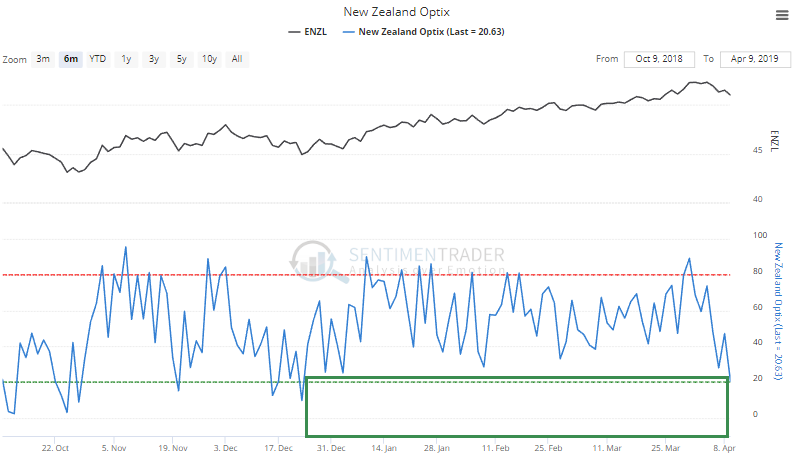

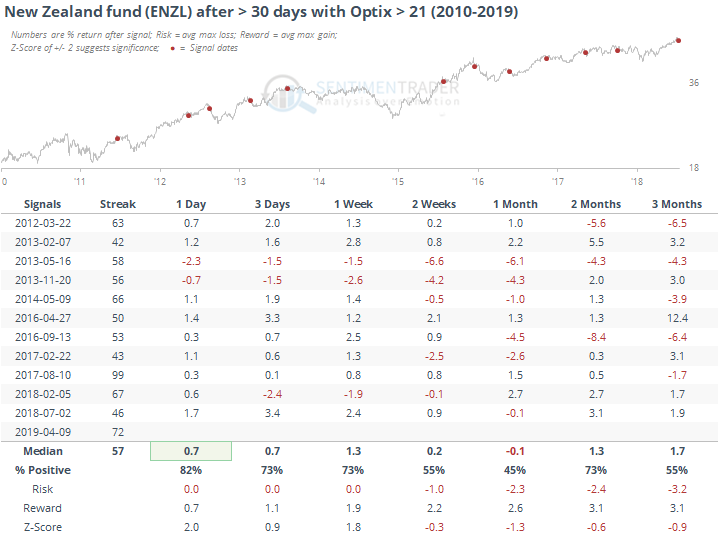

Among the country ETFs we follow, the ENZL fund of New Zealand stocks has been on quite a streak. It went more than 70 days without an Optimism Index below 21, which ended yesterday. Since the fund's 2010 inception, this ranks as one of the longest streaks.

The fund had a tendency to bounce back in the very short-term, but had some struggles medium-term.

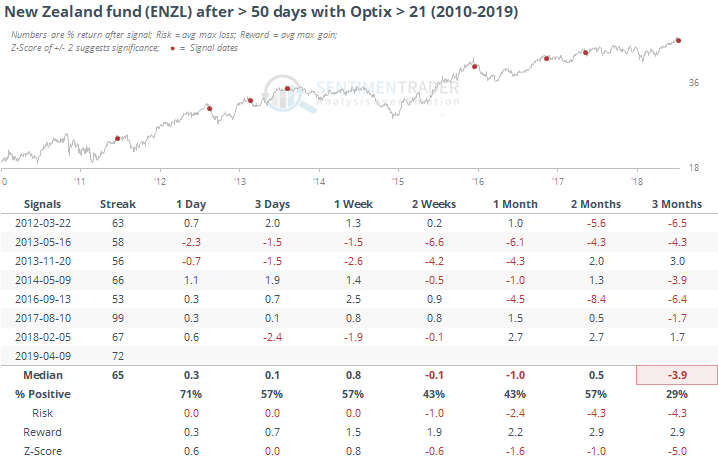

When the streak lasted longer than 50 days, it seems the ebbing optimism tended to last longer, with worse longer-term returns. It has a short history, though.

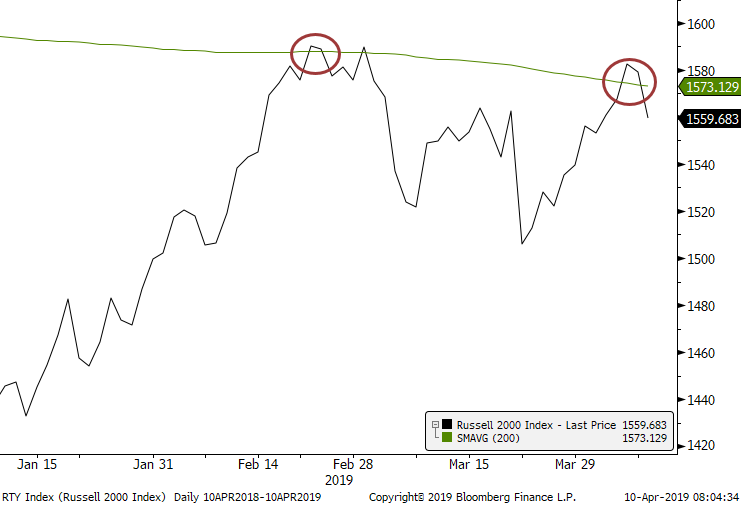

Failing Quickly

The Russell 2000 failed to hold above its 200-day average. The index has been weaker than most of its brethren and this is more evidence that not all stocks are being treated equally here.

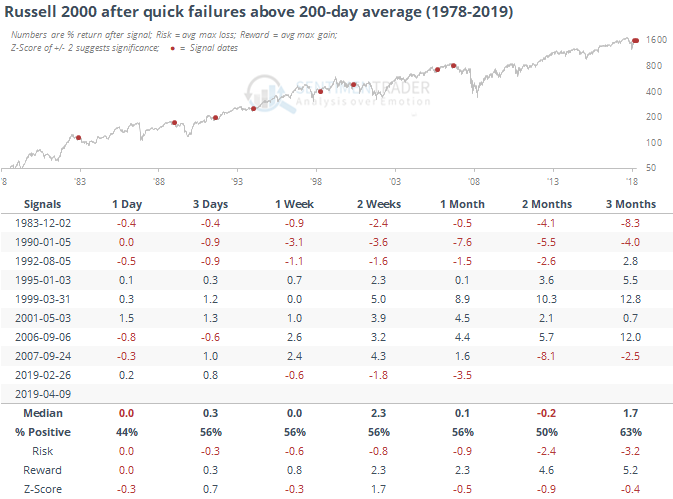

Historically, when the Russell was below its 200-day average for at least a month, then rose above it for less than a week before failing, it didn't tell us a whole lot.

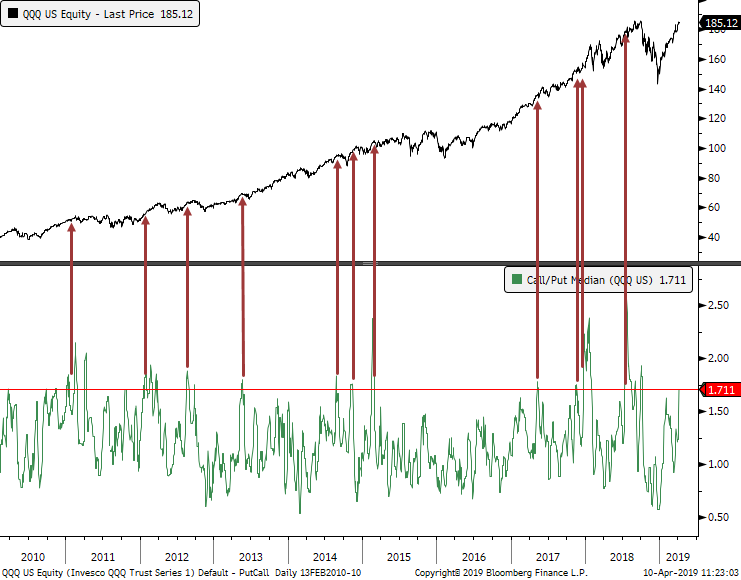

Tech Enthusiasm

Yesterday, we saw that big breakouts in the tech sector have typically led to impressive longer-term returns. Shorter-term, there are more minor warning signs popping up. Social sentiment is becoming quite bullish, and now options traders are paying up for the potential of further upside. This usually doesn't work well for them (from Erlanger Research).

Again, not foolproof by any means, but by the time enthusiasm has reached this stage, further short-term gains were usually given back at some point.