Wall Street Isn't Keeping Up

Fairly valued

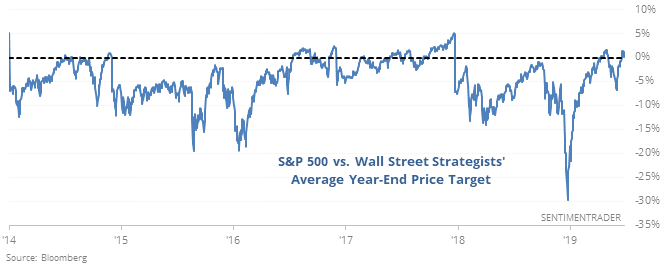

We’re approaching the halfway point of the year and the S&P 500 has already met Wall Street strategists’ estimate for where it would be at year-end, according to Bloomberg data.

When buyers have run ahead of already-rosy Wall Street predictions, stocks have tended to keep going for the rest of the year.

Worst of all was when the market was not buying Wall Street’s optimism whatsoever. In these years, the S&P really struggled to hold any gains over the medium-term, and strategists typically had to lower their price target to accommodate the market’s whims.

The U.S. is just the worst

Economic surprises in the U.S. have been bad for months. They’ve been so bad that they’re the worst in the world, with no other country or region suffering worse readings relative to economists’ expectations.

In terms of absolute returns, they weren’t bad for the S&P, but they were very good for world stocks, and best of all for world stocks relative to the U.S. These signals were also bad for the U.S. dollar.

Positive momentum

The McClellan Summation Index for emerging markets is above to climb above zero, showing that stocks’ momentum underlying the index is improving. The EEM fund has returned an annualized 19.8% when the Summation Index is above zero, and the Backtest Engine shows that when it crosses above zero, EEM was positive three months later 26 out of 36 times.

Fewer highs

The Nasdaq Composite is hanging within 2.5% of its high, but over the past 5 days the New High / New Low ratio has dropped below 40%. There have been 53 other days this happened since 1984, with the most consistent performance being two weeks later when the Nasdaq rose only 38% of the time. It was inconsistent after that.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.