Wall Street analysts turn positive after record downgrades

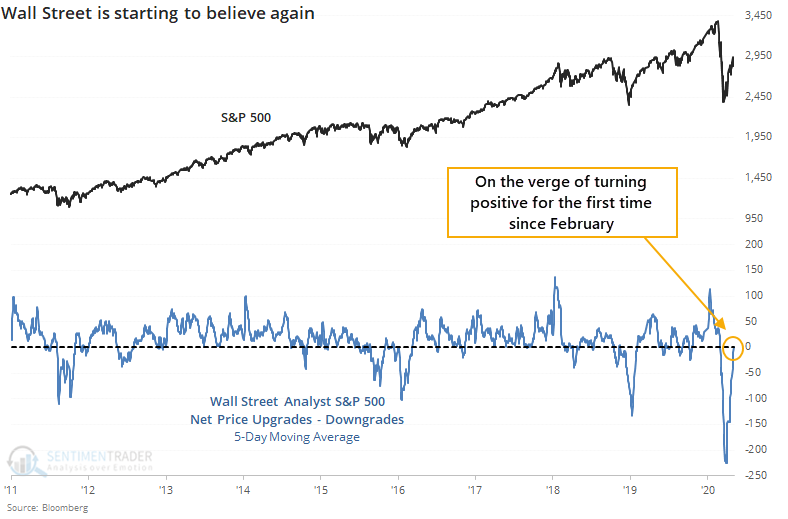

For the first time in almost two months, Wall Street is becoming a believer. During March, analysts were panicking, with a record number of price downgrades among S&P 500 stocks. That's a stark contrast to what they were doing in January.

Over the past week, they've been upgrading the price targets on more stocks than they've been downgrading, a recovery from what had been their most negative sentiment in a decade.

At extremes, analyst behavior has been a very good contrary indicator. When they rush to upgrade price targets or earnings estimates, then stocks tend to fall in the months ahead. When they're busy downgrading, then stocks usually rise.

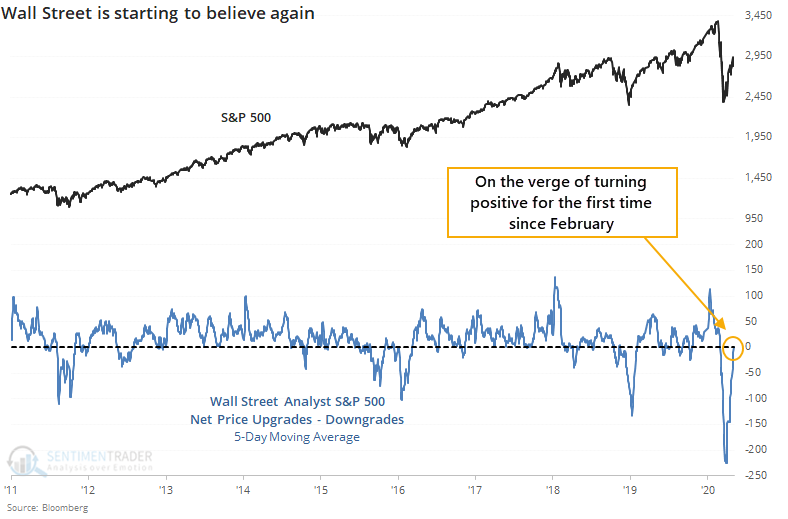

When they first turn positive after a prolonged period of pessimism, it has been less consistent as an indicator.

The past decade has been dominated by a bull market, so it's not a huge surprise that forward returns were mostly positive. The table doesn't quite tell the full story, though.

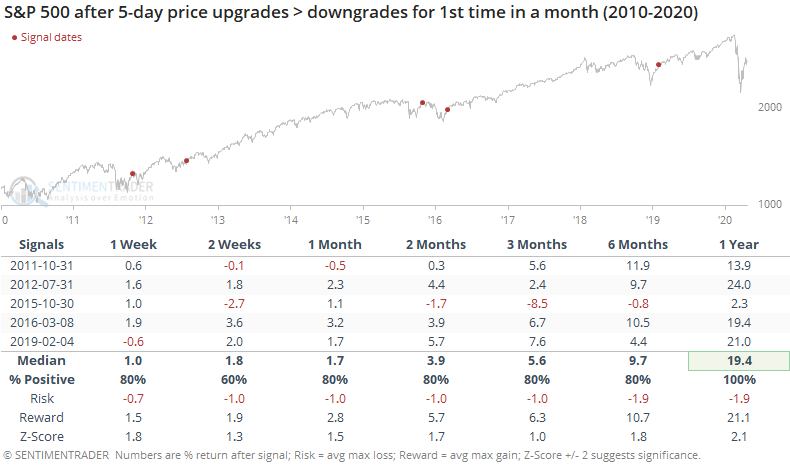

After each time that analyst sentiment recovered from a period of pessimism, stocks rose at some point, but each time, those gains also evaporated.

The time frames weren't consistent, and sometimes the interim gains were very impressive. It's a sign that while rising optimism is a good thing, we need to watch for a swing to the opposite extreme because net optimism from this group has not been a positive sign.