VIX term structure

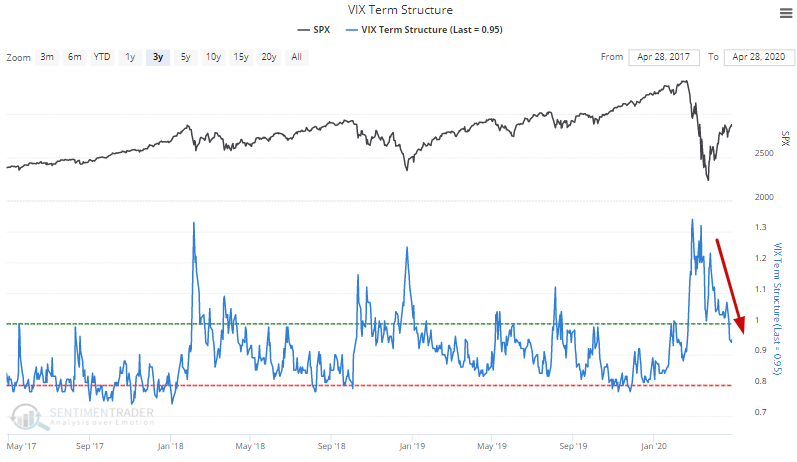

The stock market's volatility is starting to fall after months of large daily swings. VIX's term structure, which compares 1 month vs. 3 month VIX futures, is no longer inverted:

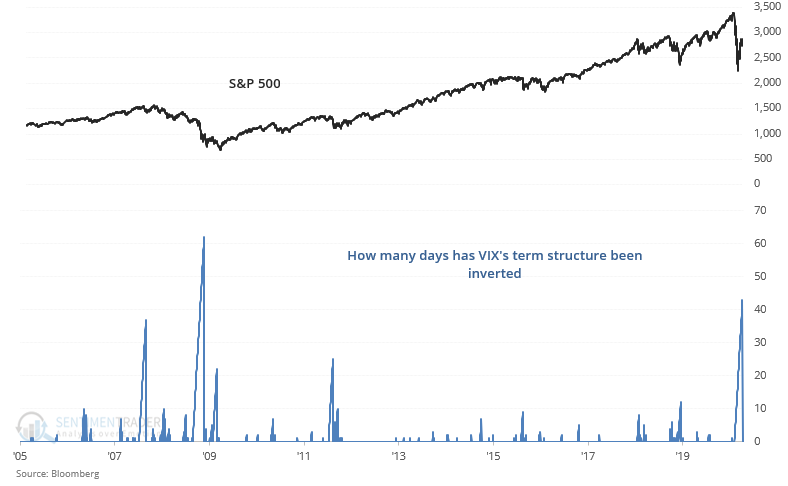

This ends a long streak during which VIX's term structure was inverted:

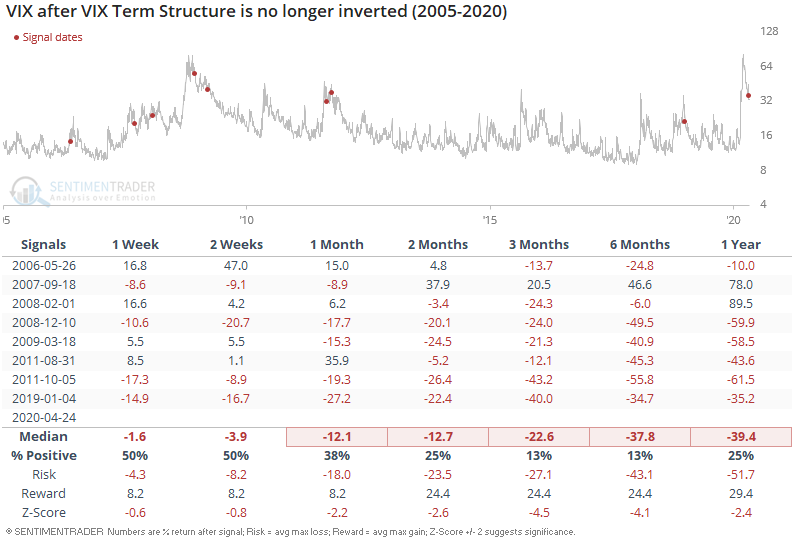

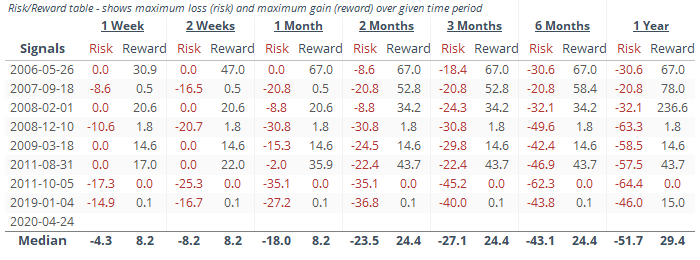

When this happened in the past, VIX usually fell even more over the next few months and year, even if VIX jumped in the short term:

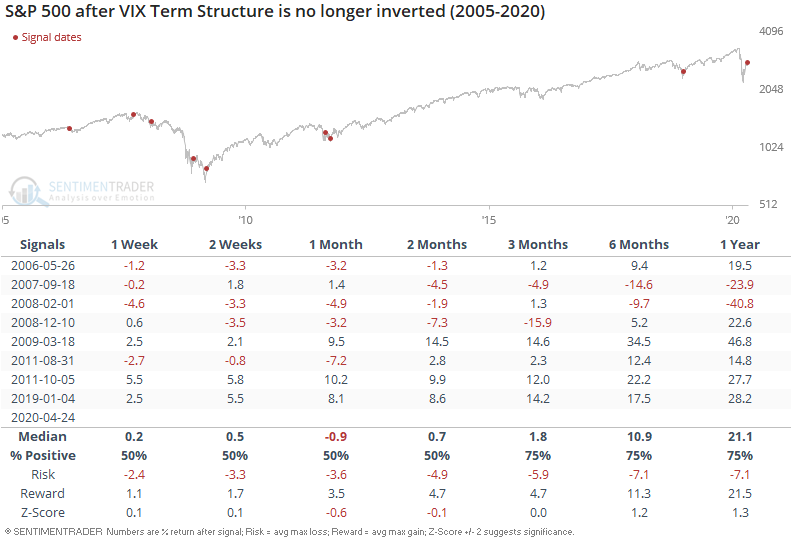

As for the S&P 500, this was bullish over the next 6-12 months but bearish during the 2007-2009 bear market: