VIX is coming down

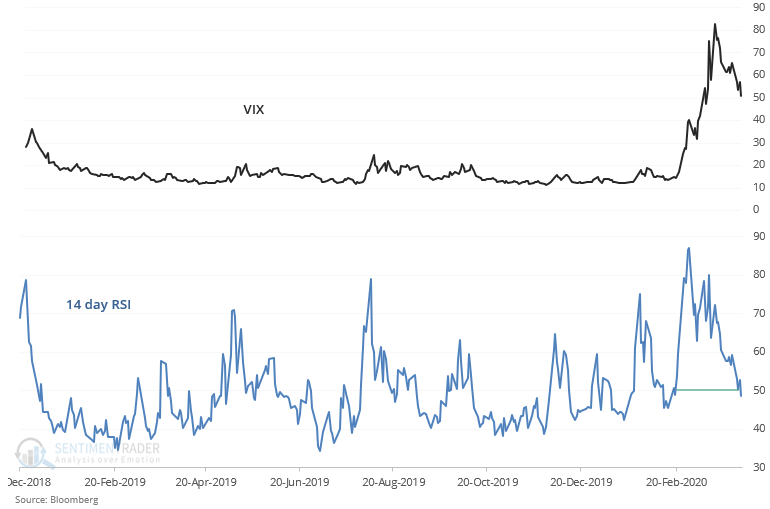

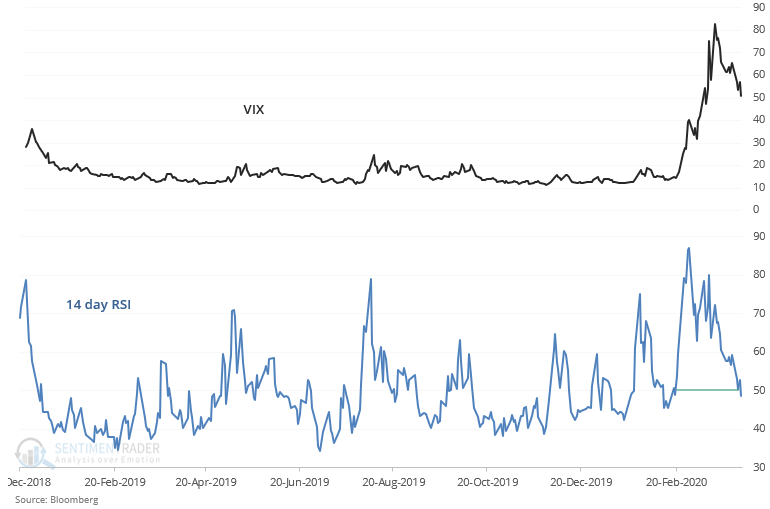

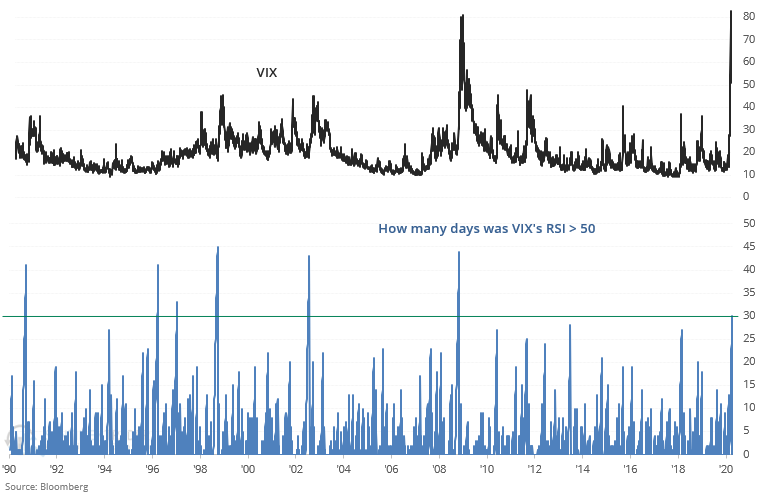

VIX's spike in March shattered all expectations, pushing its momentum to one of the highest readings ever. With stocks stabilizing over the past week and VIX coming down, VIX's 14 day RSI (momentum indicator) has crossed below 50 for the first time in 30 days:

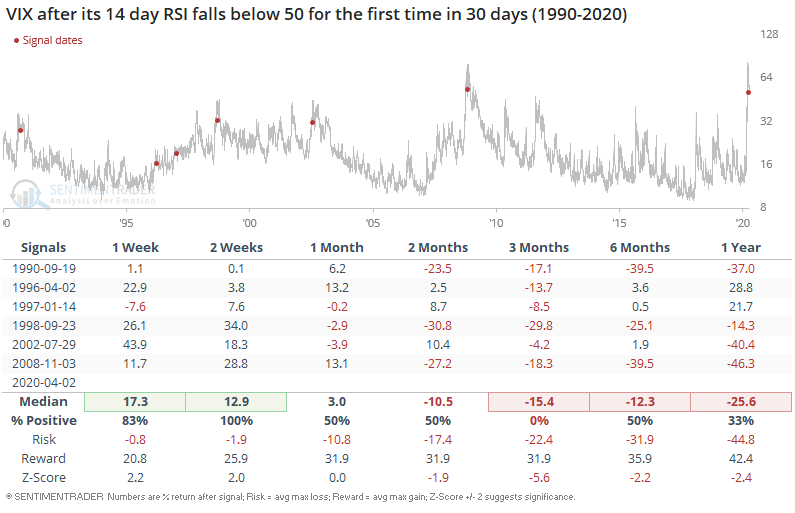

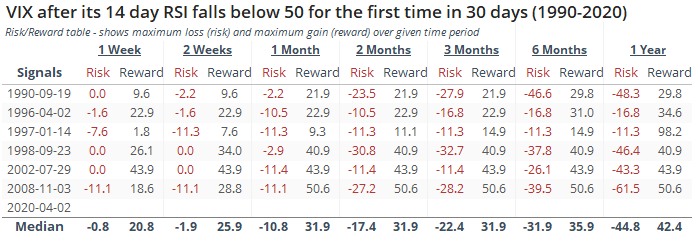

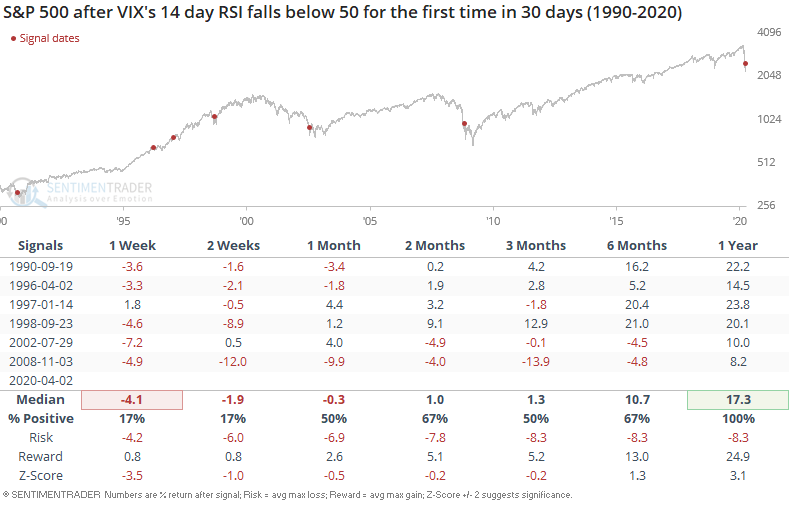

Many VIX spikes are followed by a secondary spike, with the 2nd high being lower than the first high. So when VIX's RSI fell below 50 for the first time in 30 days, this:

- Often happened during periods of major market turmoil, and...

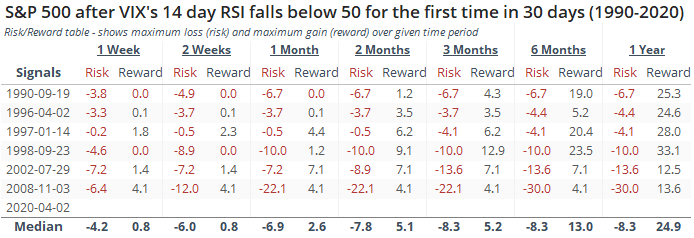

- The S&P always fell over the next few weeks, even though...

- The S&P usually rallied over the next year

Conversely, VIX usually spiked over the next 1-2 weeks, after which it faded.