Violent rotations into Value usually continue

Key points:

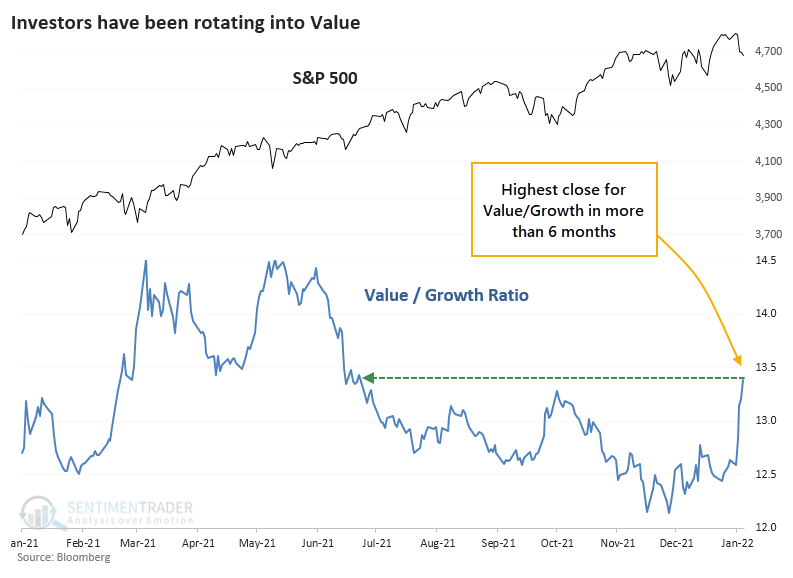

- The ratio of Value to Growth factors has cycled from a 1-year low to a 6-month high

- Similar reversals preceded more relative gains for Value over the next several months

- It was a mixed sign for the S&P 500

A violent shift to Value

One of the most vicious reversals of the new year has been the rotation out of Growth and into Value. After plunging to nearly a 20-year low late last year, the ratio between Value and Growth factors has soared. On Monday, it reached a 6-month high, surpassing its peak from October.

This is yet the latest temptation for Value investors. Previous rallies were nothing but siren songs, but hope springs eternal. At some point, valuations have to matter. Right?

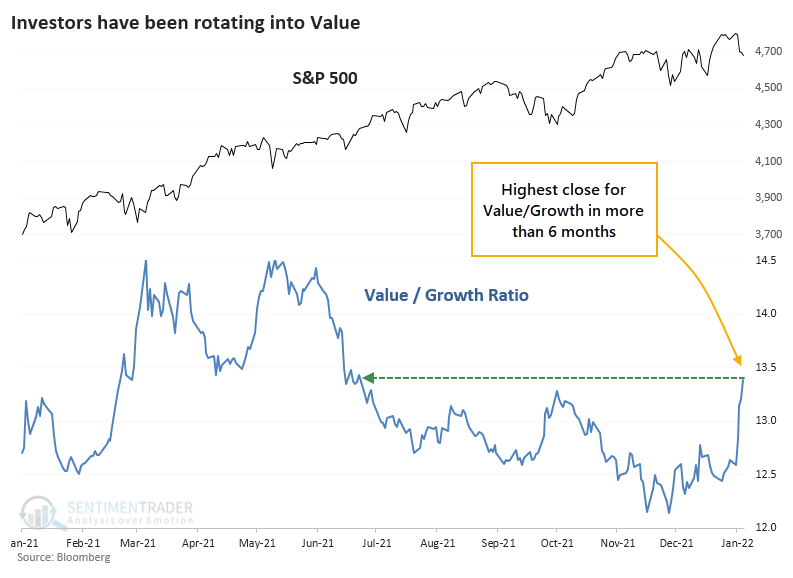

There may be a silver lining here for those who insist on actual profit-earning businesses that aren't absurdly speculative. After the Value/Growth ratio cycled from a 1-year low to a 6-month high within 3 months, Value continued to outperform in the months ahead. Value investors tend to have time frames that extend for years, not months, but the edge isn't significant after the first few months.

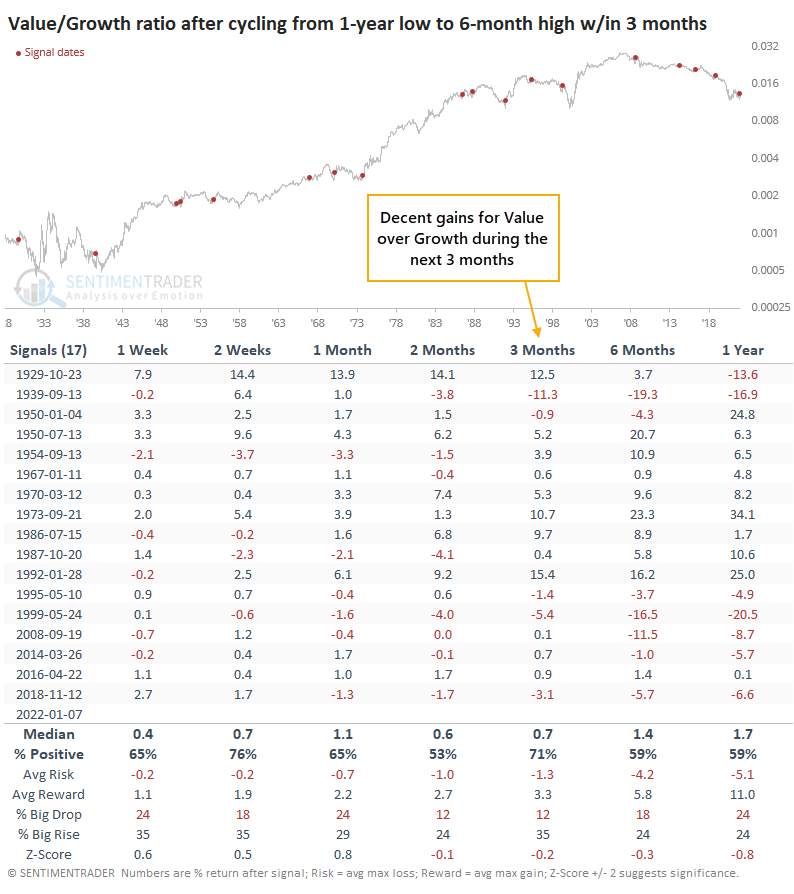

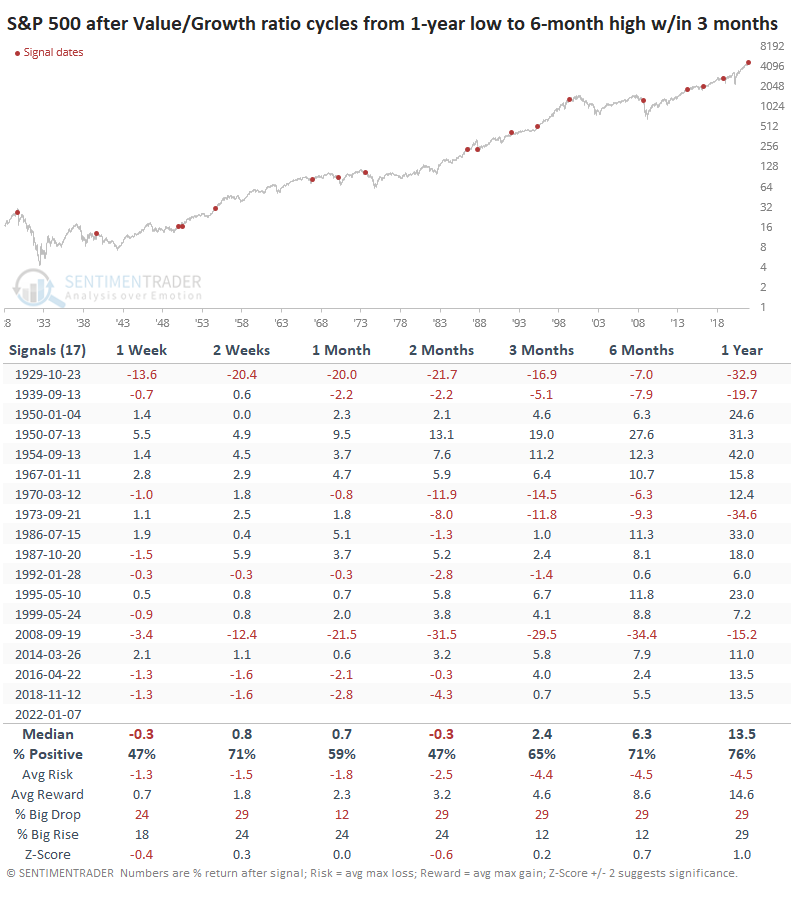

For the broader market, it was a mixed blessing. One might reasonably assume that a sudden shift toward Value would be a dire warning for the S&P 500, but that wasn't really the case. Over the next 2 months, it showed below-average returns, and up to 3 months later, the risk/reward was about even. But only 4 of the 17 signals preceded double-digit declines in the months ahead.

What the research tells us...

There has been a sudden and significant shift into Value shares in recent weeks at the expense of Growth stocks. Value investors have suffered false starts multiple times in recent years, leading to disappointment. One difference this time is the sheer violence of the move, and there is some historical support for the idea that it's finally time for Value to outperform. However, it's not a decisive edge and only extends for a few months.