Valuations: price to book

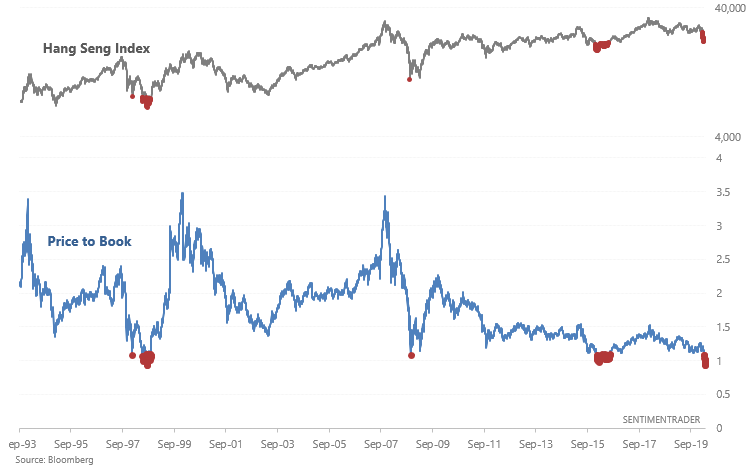

As Bloomberg noted over the past several days, price-to-book ratios are falling around the world. For example in the Asia Pacific region, markets such as Hong Kong are trading at below liquidation value! Let's look at valuations around the world via price/book ratios.

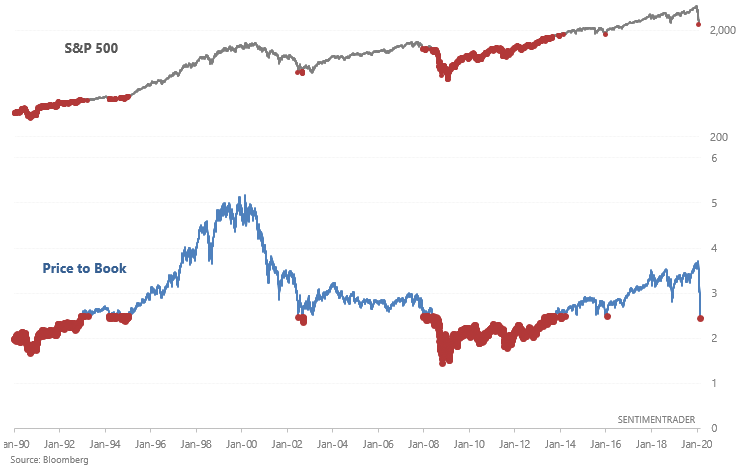

U.S.

The S&P 500's price/book ratio has fallen, which is normal given how much U.S. equities have fallen as a whole. However, this is not exactly "cheap" when looked at historically. Such low price/book ratios did not prevent the U.S. stock market from falling significantly more in 2008.

Valuations (via price/book ratios) are much lower in the rest of the world, which is to be expected since the U.S. rallied more than most other markets over the past 11 years.

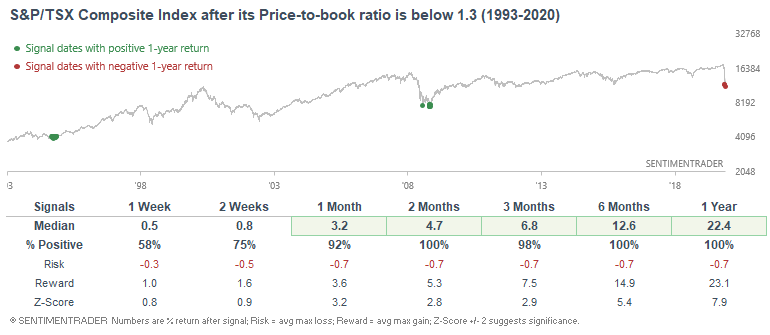

For example in Canada, price/book has fallen to a level that in the past consistently led to gains over the next year.

On the 52 days when price/book was this low, Canadian equities consistently rallied over the next few months and year:

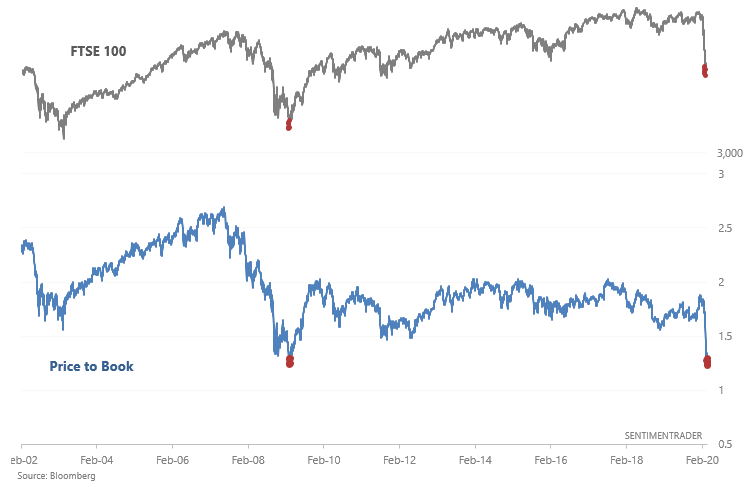

Similarly in the UK, price/book can only be compared to that of the 2009 bottom:

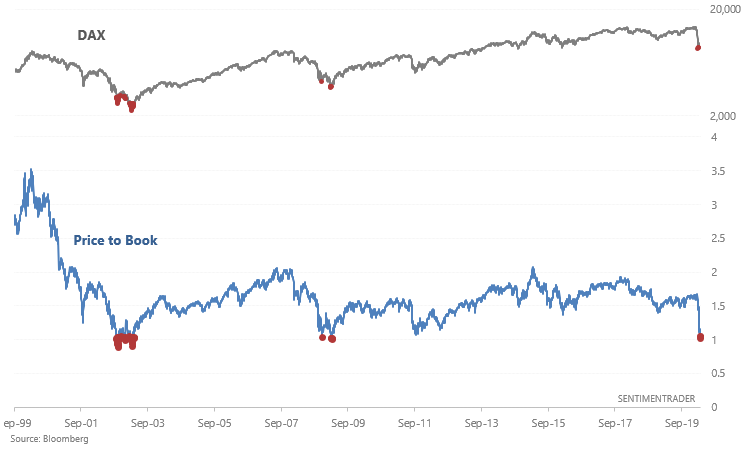

And for Germany, price/book can only be compared to major bottoms in the 2000-2002 and 2007-2009 bear markets:

The story is the same in HK. Price/book is so low (below liquidation value) that in the past, this always led to a rally over the next few months and year:

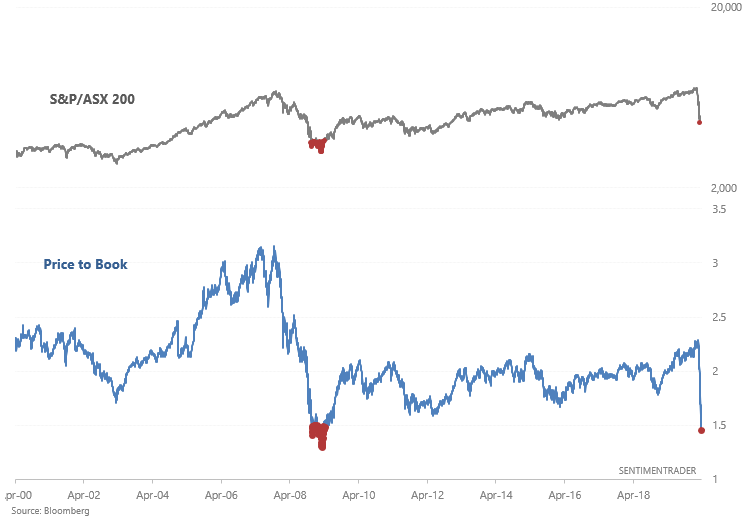

Same goes for Australia: