Utilities as a defensive sector choice

Key Points

- Investor angst is high - this often drives investors to more defensive sectors

- The little followed relationship between utility stocks and bond market sentiment recently flashed an important signal

- Corporate insider buying has been increasing of late in the utility sector

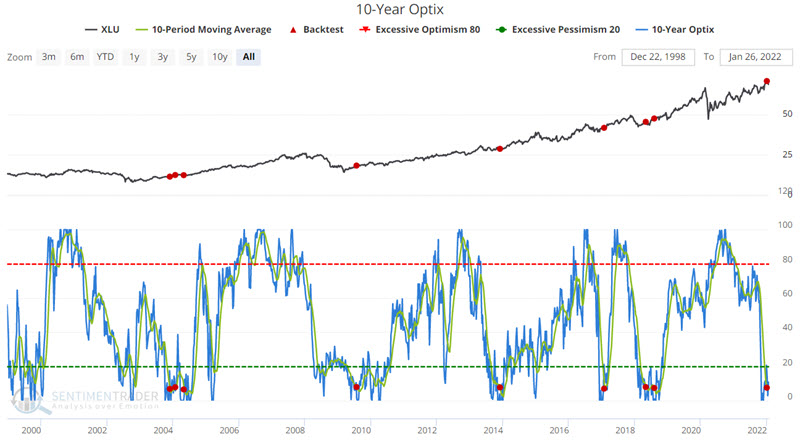

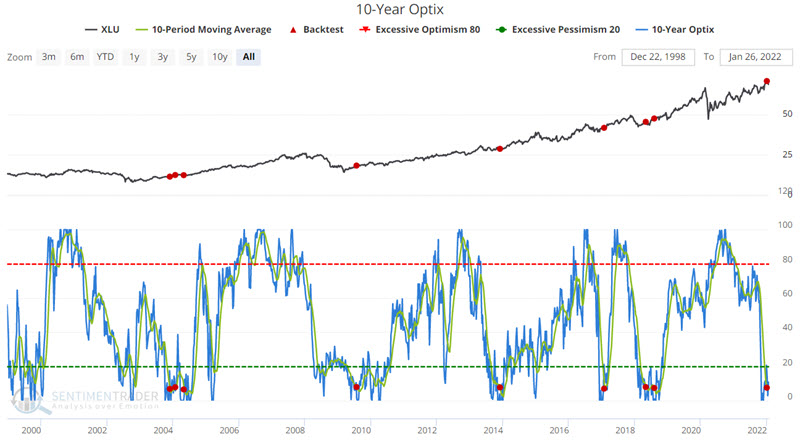

Ticker XLU versus bond sentiment

Ticker XLU (Utilities Select Sector SPDR Fund) serves as an investment proxy for the utility sector as a whole. With the possibility that the major stock market indexes may be dead money for a while, defensive sectors such as utilities may enjoy a stronger appeal, thanks to their below-average volatility and above-average dividend yield.

Few investors are aware of the relationship between the utility sector and bond investor sentiment. The chart below displays XLU and those times when the 10-day average for 10-year treasury Optix dropped below 8 for the first time in a month. You can run this test in the Backtest Engine.

The table below displays XLU performance following previous signals. Notice the tendency for weakness during the first two weeks after a signal, followed by an above average performance for two-month to one-year periods.

The two weeks after the 1/4/2022 signal witnessed significant weakness in the utility sector. If history proves an accurate guide, performance may steadily improve in the months ahead.

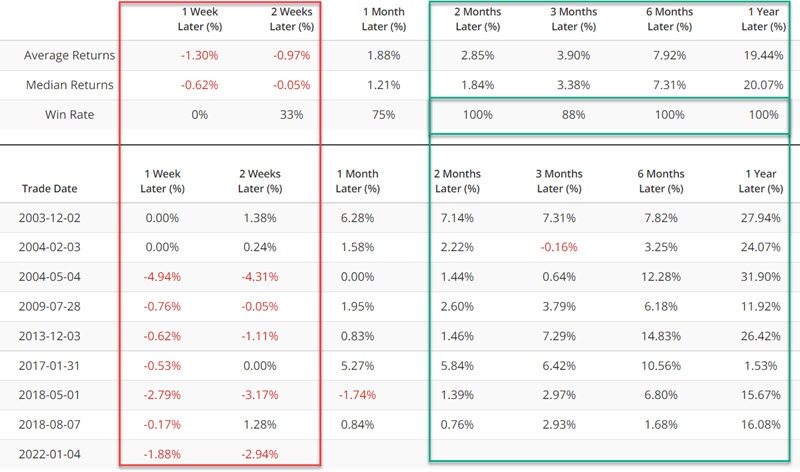

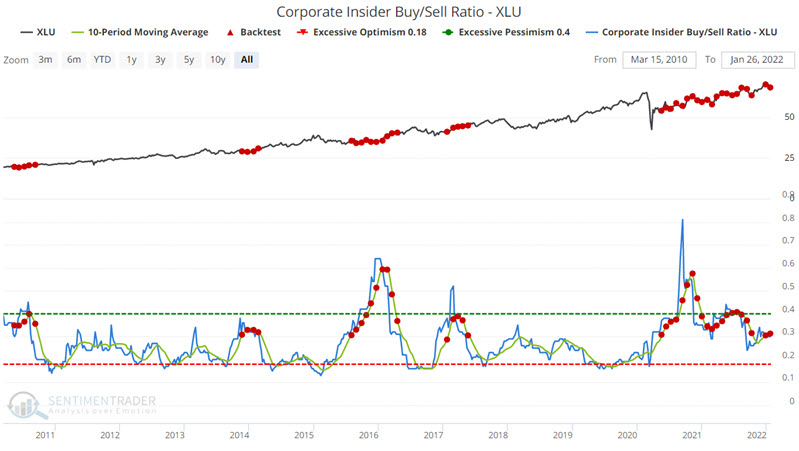

Corporate Insider Buy/Sell Ratio - XLU

Let's turn our attention to corporate insider buying. The chart below displays those times when the 10-period average of the insider buy/sell ratio among XLU component stocks stood above 0.3. You can run this test in the Backtest Engine.

The table below displays a summary of XLU performance following previous signals (including overlaps). The performance during the first two weeks is essentially a coin flip. Conversely, Win Rates for 2-months to 1-year is solid.

What the research tells us…

Utilities are generally viewed as stodgy, slow-moving, but higher-yielding investment vehicles. And as a result, many investors avoid them. But when market volatility and uncertainty heat up, utilities are often viewed differently. Given all of the concerns swirling around the stock market these days - when combined with typically reliable signals from both bond sentiment and corporate insiders - utilities may look even better in the months ahead on a relative basis.