USD bearish positioning

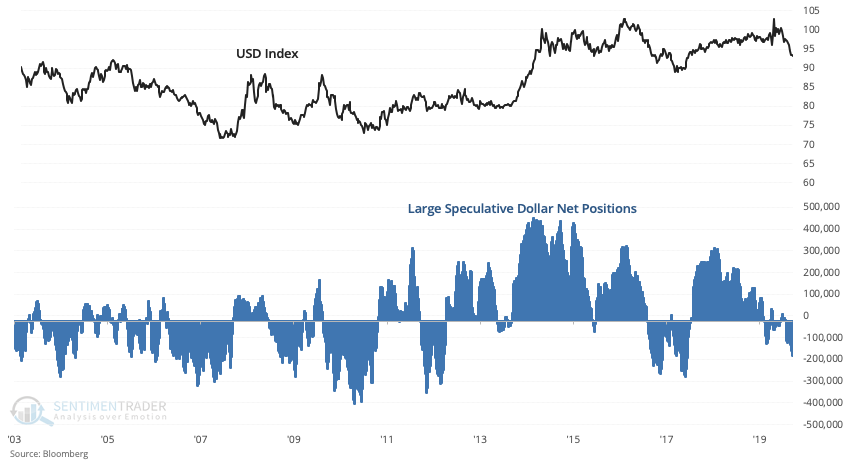

As Bloomberg noted, large speculators are quite bearish towards the Dollar. Their net positions has reached multi-year lows with the USD Index's poor performance in the recent times.

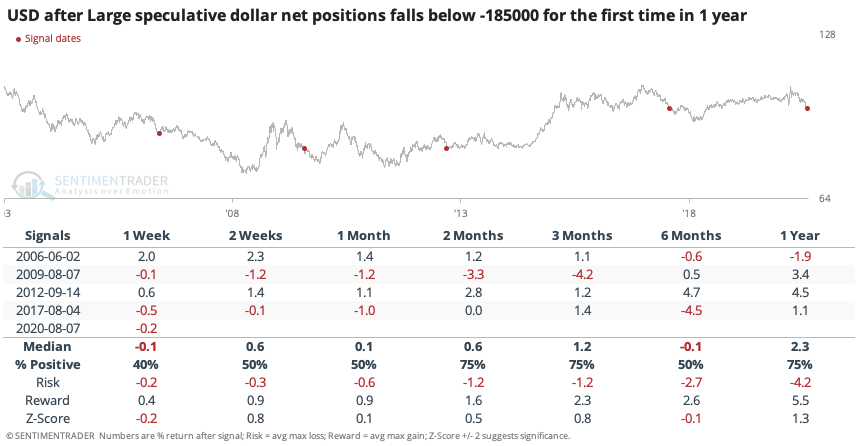

Historically when Large speculative dollar net positions fell below 185000 for the first time in a year, this was a mixed sign for the US Dollar Index but slightly bullish on the larger time frames.

The prior 3 historical cases could see the Dollar fall a little further before bottoming, but the bottom wasn't far off from a risk:reward perspective. The June 2006 historical case saw the Dollar trend sideways before several months before the USD bear market continued.