U.S.-Switzerland Trade Agreement

Based on News: U.S. and Switzerland working on a deal to slash 39% tariffs

Source Link: cnbc_top_news

Related Symbol: [franc (Swiss Franc), dollar (US Dollar), SMI (Swiss Market Index (SMI)), X (Us Steel Corp), EWL (Switzerland (EWL))]

Key Points

- U.S. and Switzerland negotiating a 39% tariff reduction, potentially boosting bilateral trade.

- Historical backtests show mixed performance: Swiss assets (SMI, EWL) generally positive, USD weakens, franc volatile.

- Risk of short-term volatility in franc and X, with SMI and EWL likely benefiting long-term.

Current Market Focus

The U.S. and Switzerland are currently negotiating a trade agreement aimed at reducing tariffs by 39%, as reported by CNBC on November 11, 2025. This move is driven by a mutual desire to enhance bilateral trade relations and reduce costs for businesses. Historical parallels, such as the U.S.-Canada Free Trade Agreement and the U.S.-Singapore FTA, suggest such agreements can lead to significant economic shifts, though outcomes vary. The immediate concern is how markets will react to the potential reduction in trade barriers.

The news has sparked mixed reactions in the markets, with initial sentiment leaning towards optimism for Swiss exporters and caution for U.S. manufacturers. The following analysis will explore how key assets-Swiss Franc (franc), U.S. Dollar (dollar), Swiss Market Index (SMI), U.S. Steel Corp (X), and Switzerland ETF (EWL)-have historically performed around similar trade liberalization events, using the provided backtest summaries to gauge potential impacts.

Historical Event References (Event & Date)

- FOREIGN TRADE BARRIERS Summary:The U.S.-Singapore Free Trade Agreement (FTA) entered into force in 2004, implementing phased tariff reductions that culminated in the complete removal of tariffs on all U.S. exports to Singapore. (Date: 2025-04-07 (Source: CNBC))

- Australia scraps 'nuisance' tariffs to remove red tape, lower living costs Summary:Most goods are now imported duty-free after successive trade agreements, reducing compliance costs for businesses. (Date: 2024-03-10 (Source: Reuters))

- Supply Chains Latest: Goodbye Nafta and Hello USMCA Summary:The USMCA replaced NAFTA, modernizing trade terms and reducing tariffs, effective July 2020 after three years of negotiations. (Date: 2020-07-01 (Source: Bloomberg))

- What's at Stake and at Risk in U.S.-Japan Trade Talks Summary:Japan will lower or abolish tariffs on $7.2 billion of U.S. farm products, including beef and pork, under the 2019 trade deal. (Date: 2019-08-26 (Source: Bloomberg))

- Colombia, Costa Rica to sign trade agreement Summary:The agreement eliminates import tariffs, impacting 80% of U.S. exports to Colombia. (Date: 2012-06-16 (Source: Reuters))

- FACTBOX: U.S. tariffs, sanctions abound in Muslim world Summary:The U.S.-Oman Free Trade Agreement, part of broader Middle East trade initiatives, removed tariffs on goods, enhancing trade relations. (Date: 2009-05-31 (Source: Reuters))

- FOREIGN TRADE BARRIERS Summary:The U.S.-Bahrain Free Trade Agreement (FTA) entered into force on August 1, 2006, eliminating tariffs on all consumer and industrial products. (Date: 2006-08-01 (Source: CNBC))

- Shufflin' Off To Buffalo Summary:Canada's recession after signing the 1988 U.S.-Canada Free Trade Agreement, which removed most tariffs between the two nations. (Date: 1991-04-07 (Source: Bloomberg))

- FOREIGN TRADE BARRIERS Summary:The U.S.-Israel Free Trade Agreement (FTA) entered into force on August 19, 1985, eliminating tariffs on most goods. (Date: 1985-08-19 (Source: CNBC))

Volatile short-term, positive long-term

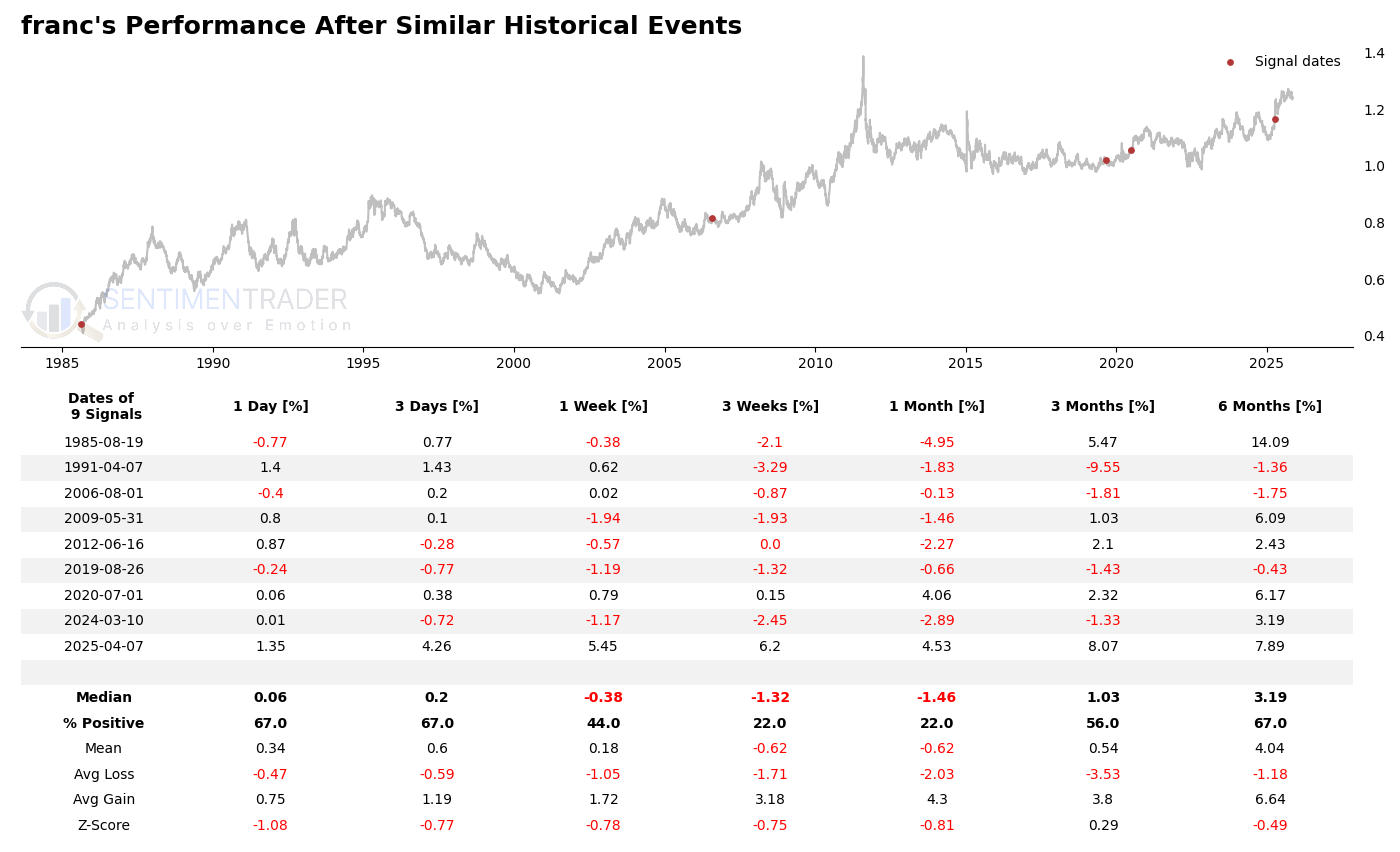

The Swiss Franc (franc) has historically shown mixed performance around trade liberalization events, with short-term volatility but generally positive long-term trends. The backtest summary indicates a tendency for initial fluctuations, followed by stabilization over longer holding periods. This aligns with the franc's role as a safe-haven currency, often reacting to trade news before settling into broader trends.

The backtest summary for the franc reveals a median 1-day return of 0.06%, with 67% of events showing positive performance. However, the Z-Score of -1.08 suggests weak statistical significance for short-term moves. Over 1 month, the median return drops to -1.46%, with only 22% of events positive, indicating potential short-term pressure. The 6-month horizon shows improvement, with a median return of 3.19% and 67% positive events, highlighting long-term resilience. Notably, the 2025-04-07 event saw a 1.35% 1-day gain and a 7.89% 6-month return, underscoring upside potential in favorable conditions.

Weakens post-trade deals

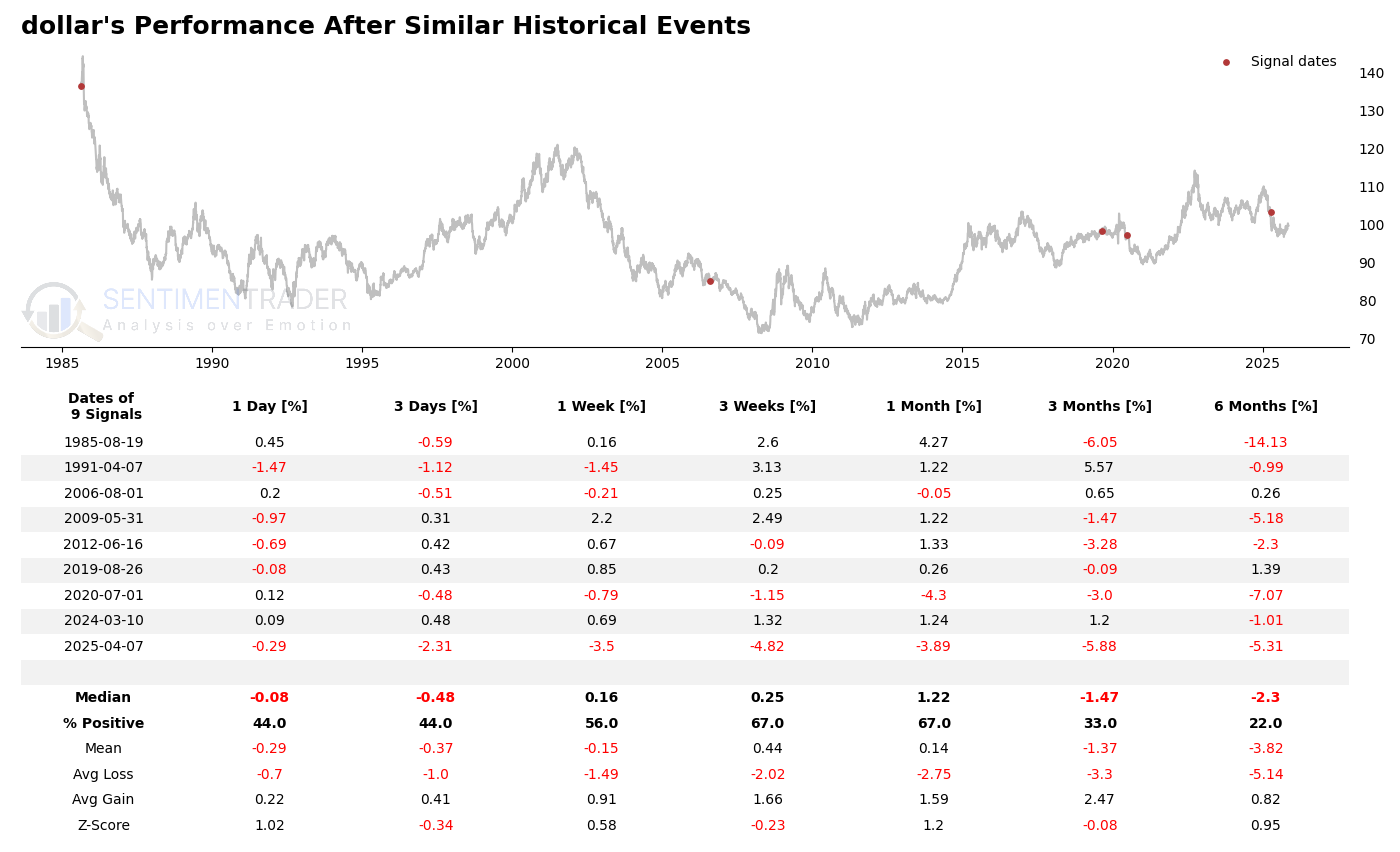

The U.S. Dollar (dollar) has historically underperformed following trade liberalization events, as seen in the backtest summary. This trend reflects the dollar's sensitivity to reduced trade barriers, which often diminish its relative strength. The data suggests a pattern of initial weakness, with some recovery over longer periods, though the overall bias remains negative.

The dollar's backtest summary shows a median 1-day return of -0.08%, with only 44% of events positive. The 1-month median return improves slightly to 1.22%, but the 6-month median remains negative at -2.3%, with just 22% positive events. The Z-Score of 1.02 for 1-day returns indicates some statistical significance for short-term declines. Extreme examples include the 1985-08-19 event, where the dollar gained 0.45% in 1 day but fell 14.13% over 6 months, illustrating long-term downside risks.

Strong long-term gains

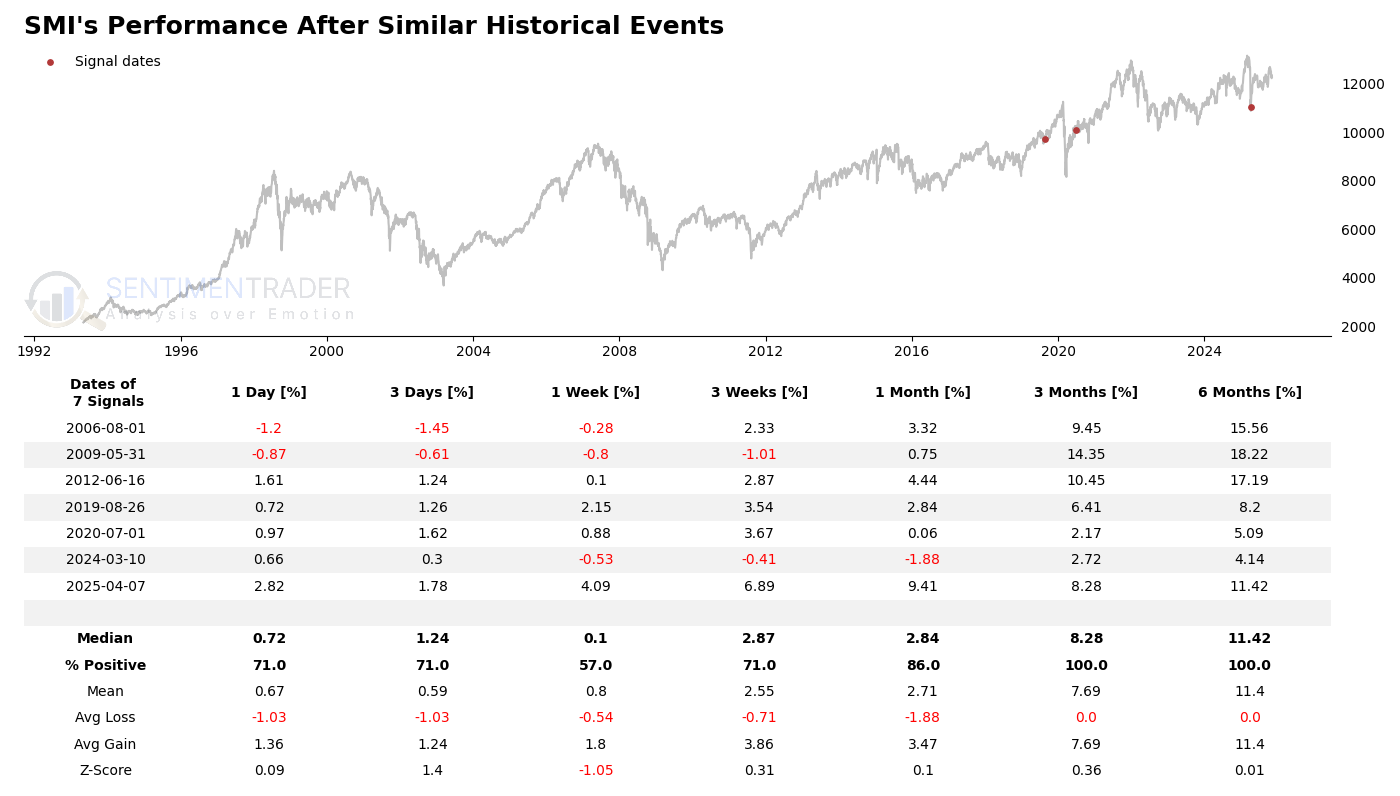

The Swiss Market Index (SMI) has consistently benefited from trade liberalization events, with historical backtests showing robust performance across all holding periods. The index's composition, heavily weighted towards export-oriented firms, positions it to capitalize on reduced trade barriers, as evidenced by the overwhelmingly positive returns in the summary data.

The SMI's backtest summary is notably bullish, with a median 1-day return of 0.72% and 71% positive events. Performance strengthens over time, with a 6-month median return of 11.42% and 100% positive events. The Z-Scores are modest, but the consistency of gains is striking. The 2025-04-07 event stands out, with a 2.82% 1-day gain and 11.42% 6-month return, reinforcing the index's long-term upside potential in trade deal scenarios.

High volatility, mixed outcomes

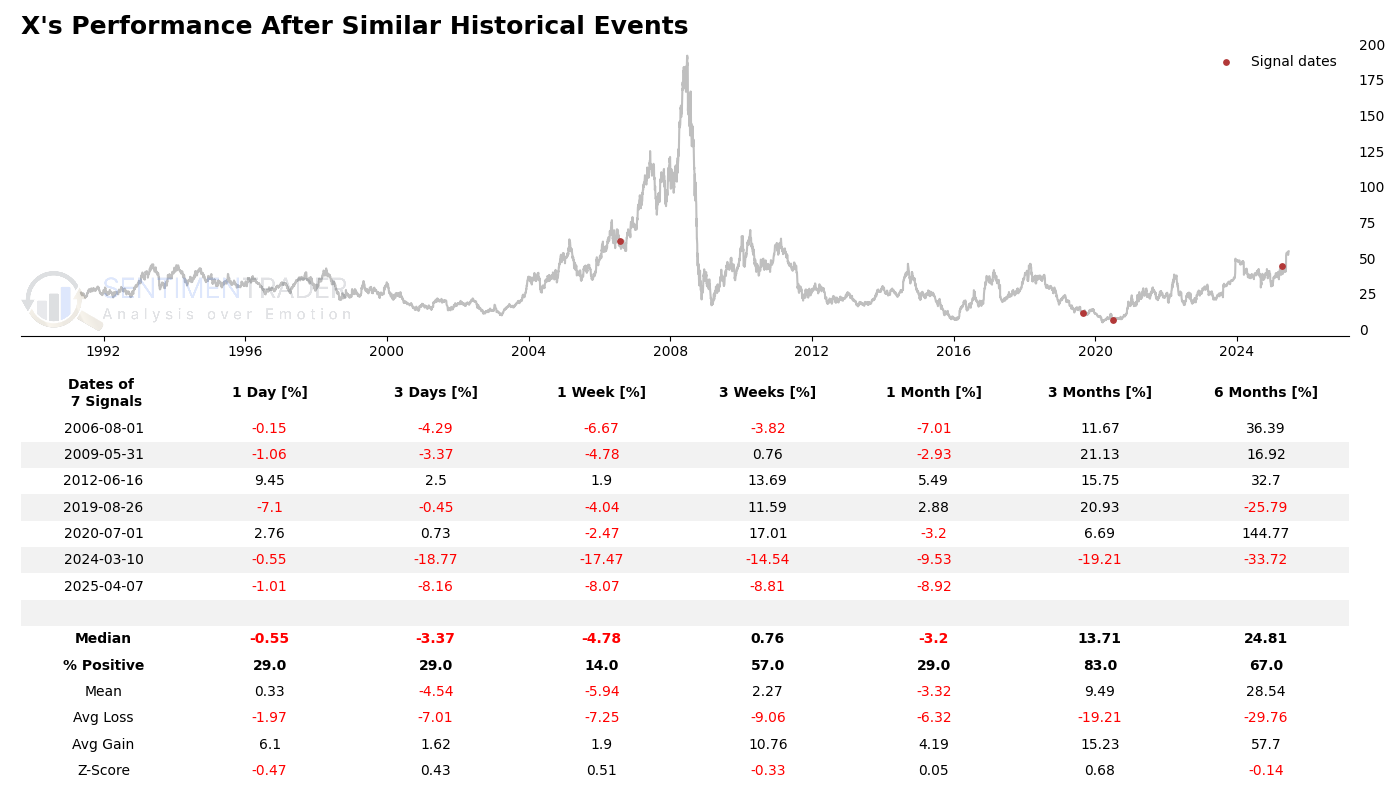

U.S. Steel Corp (X) has exhibited high volatility around trade liberalization events, with extreme swings in both directions. The backtest summary reflects this, showing significant gains in some instances and steep losses in others. This volatility underscores the company's sensitivity to trade policy changes, particularly in competitive industries like steel.

X's backtest summary reveals a median 1-day return of -0.55%, with only 29% of events positive. The 6-month median return improves to 24.81%, but the wide dispersion of outcomes (e.g., -33.72% in 2024-03-10 vs. +144.77% in 2020-07-01) highlights extreme volatility. The Z-Scores are neutral, suggesting no strong statistical trends, but the avg gain of 57.7% over 6 months vs. avg loss of -29.76% indicates asymmetric upside potential in favorable conditions.

Consistent long-term outperformer

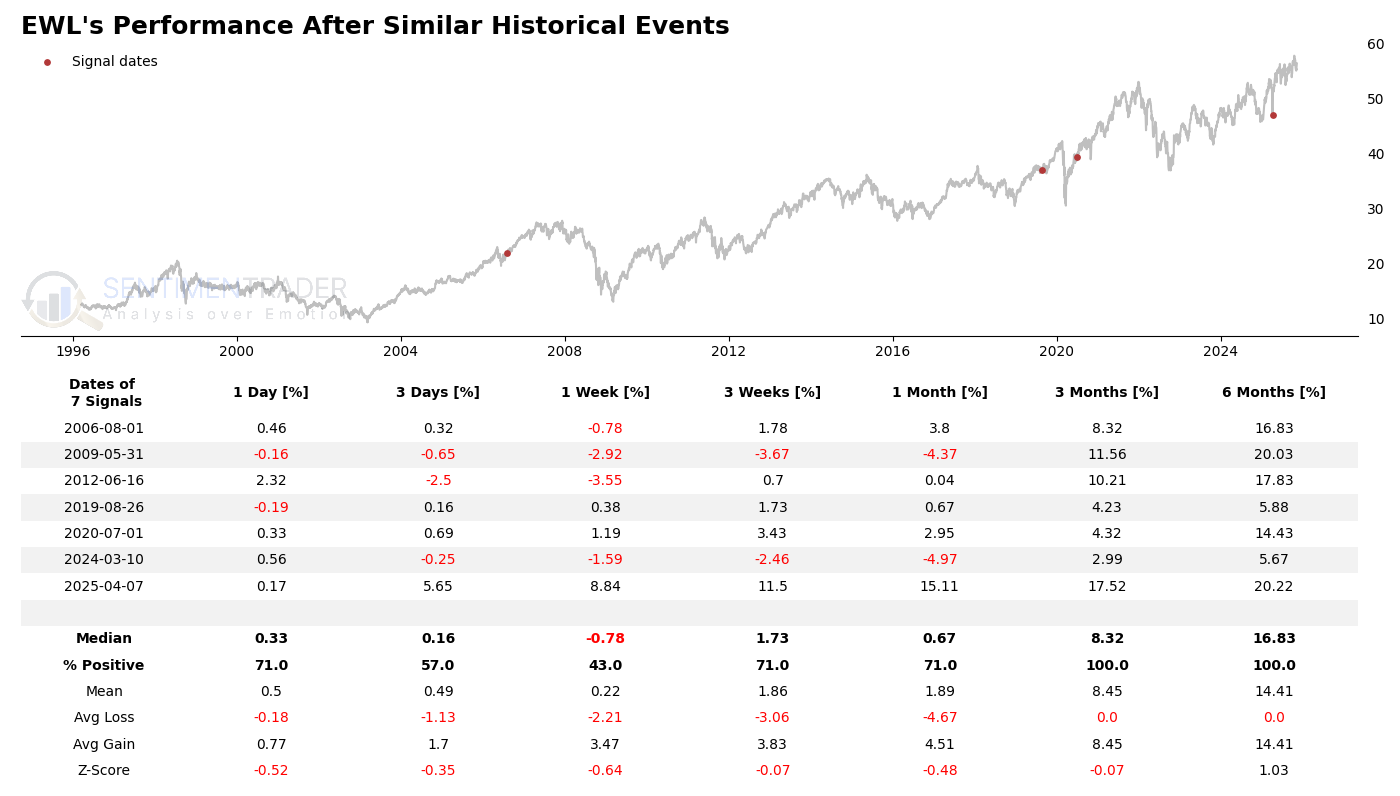

The Switzerland ETF (EWL) has historically delivered strong and consistent returns following trade liberalization events, as evidenced by the backtest summary. The ETF's broad exposure to Swiss equities positions it to benefit from improved trade access, with performance trending positively across all holding periods.

EWL's backtest summary shows a median 1-day return of 0.33%, with 71% of events positive. The 6-month median return jumps to 16.83%, with 100% positive events, underscoring its long-term strength. The Z-Score of 1.03 for 6-month returns indicates statistically significant outperformance. The 2025-04-07 event was particularly strong, with an 8.84% 1-week gain and 20.22% 6-month return, highlighting the ETF's potential in bullish trade scenarios.

What the research tells us...

The U.S.-Switzerland trade negotiations present a mixed outlook for the analyzed assets. Historical backtests suggest the Swiss Franc (franc) may face short-term volatility but stabilize long-term, while the U.S. Dollar (dollar) could weaken further. The Swiss Market Index (SMI) and Switzerland ETF (EWL) are poised for strong gains, with median 6-month returns of 11.42% and 16.83%, respectively. U.S. Steel Corp (X) remains a high-risk, high-reward play, given its extreme historical swings. Key risks include short-term market overreactions and geopolitical complexities. Investors should monitor the deal's specifics, with a focus on sectors most impacted by tariff reductions. The statistical consistency of SMI and EWL's outperformance makes them attractive for long-term positions.

Disclaimer

This report is generated automatically based on publicly available information, SentimenTrader's proprietary finance news filter tool and Backtest Engine, with AI assistance. It should be noted that the framework and narrative of this analysis were developed through an interactive dialogue process with an AI assistant, combining data-driven insights from SentimenTrader's tools. A record of this process may be found per requesting. It is intended for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. The accuracy and completeness of the information are not guaranteed.