US Dollar Suffers Major Loss

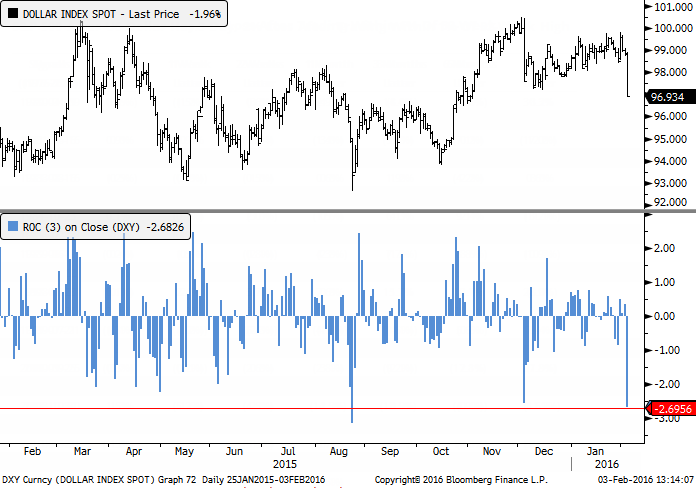

The US dollar is getting hammered so far today, with the Dollar Index dropping nearly -2%, among the largest one-day declines since 1975.

It is on track for more than a -2.5% loss over the past three sessions, which is of course also one of its largest losses in that time span. What's notable about the decline is that three days ago the Dollar Index was within spitting distance of a new high.

Sudden, severe price changes from a price extreme often signal a larger trend change, or at the very least a period of back-and-forth trading. Rarely do we see a market just turn right around and resume its previous trend.

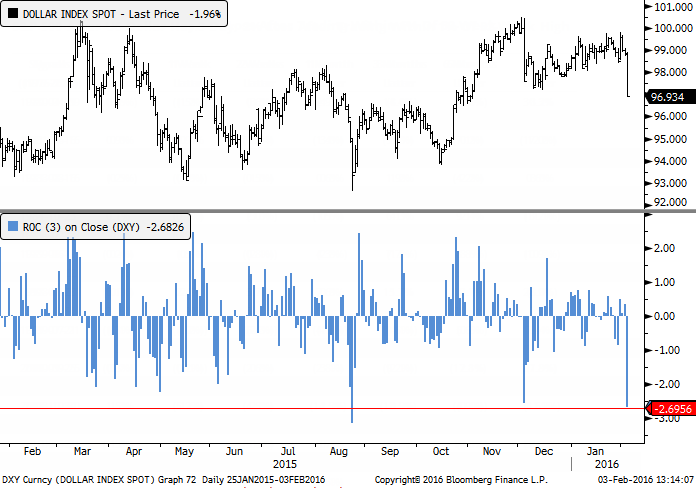

The table below shows every time since 1975 that the buck suffered a big 3-day drop from near a 52-week high along with its performance going forward.

Its worst performance was over the next month, losing more ground 12 out of 21 times and with a significantly negative average return. After 1986, every time it did happen to gain over the next month, it subsequently gave those gains back.

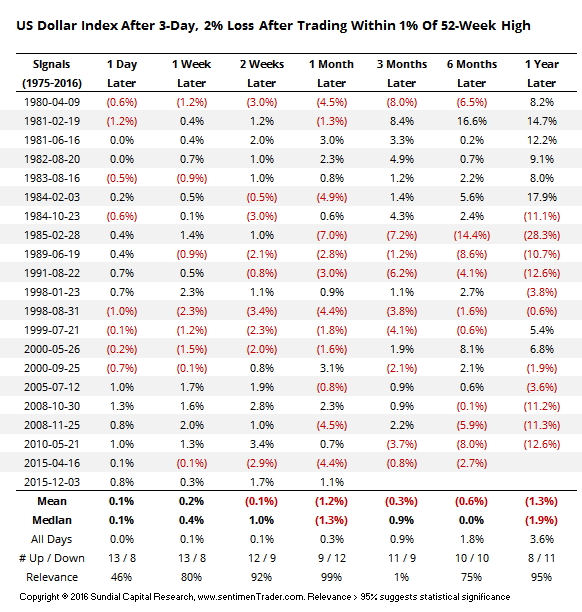

To see if there was any impact on stocks, here are the same dates, but with the performance of the S&P 500 going forward:

Not much there. Some weakness shorter-term (two weeks) but overall the returns were in line with random.

The sentiment figures for the dollar that we track on the site are showing optimism, but nothing like last spring when it was through the roof. Nothing much to conclude from that - sentiment is less of a help when not at an extreme, and not showing a clear trend.

Based solely on this price break, we'd consider the outlook to have a modest negative skew, especially over a multi-week time frame.