Two Indicators Flashing Favorable Signs for Stocks - Part I

This is Part I of a two-part series highlighting a pair of little-known indicators that recently flashed favorable signals for the stock market.

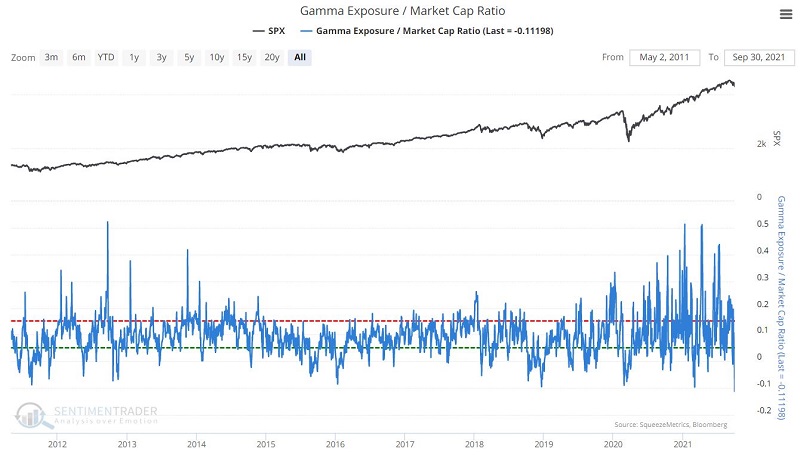

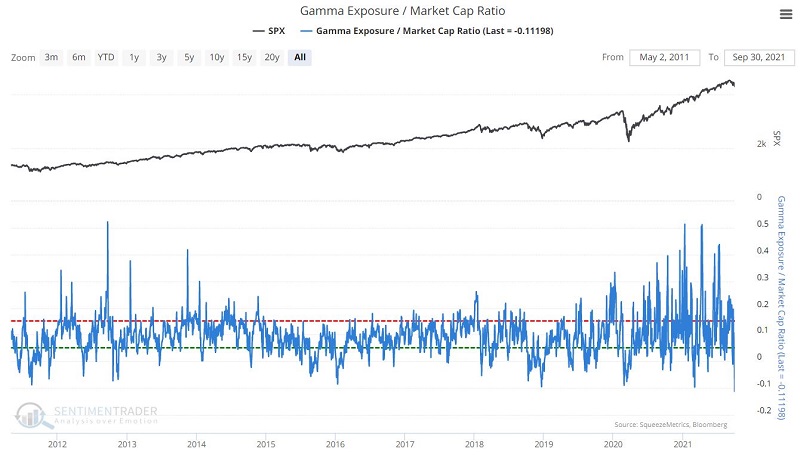

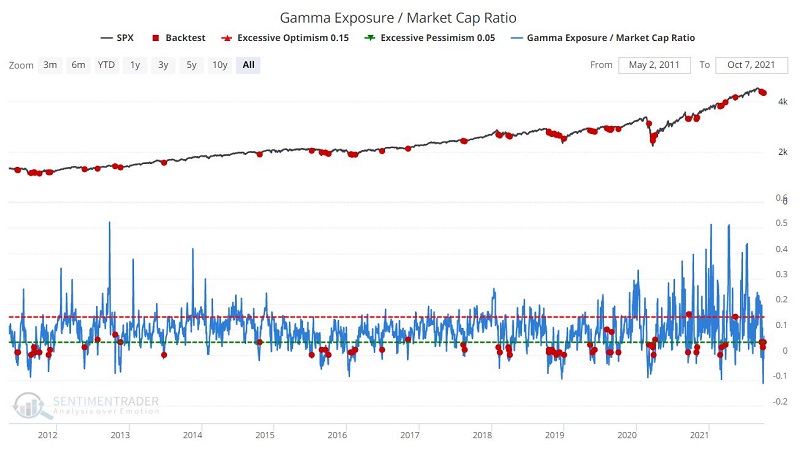

Indicator #1: Gamma Exposure / Market Cap Ratio

Gamma exposure refers to the sensitivity of existing options contracts to changes in the underlying price of the S&P 500 (see our Gamma Exposure chart for more details).

The chart below takes an extra step and shows Gamma Exposure relative to the market capitalization of U.S. stocks. The higher the level, the more potential selling pressure exists. This value is displayed in thousandths of a percent.

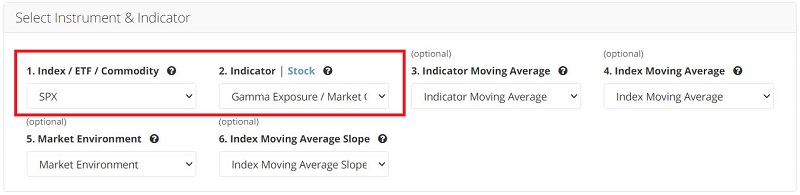

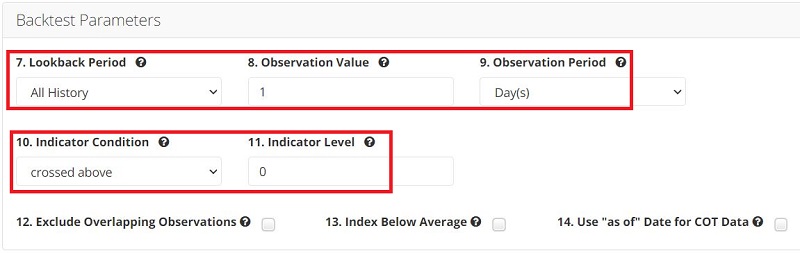

Let's highlight the performance for the S&P 500 Index following all days when:

- The value for this indicator first rises above 0

You can run this test by clicking here. The input screen appears below.

The output screen appears below.

Note that signals often tend to occur in "clusters."

The Summary screen appears below.

Note the high Win Rates - particularly for 1 Month and out - and the strong Median Returns for all timeframes.

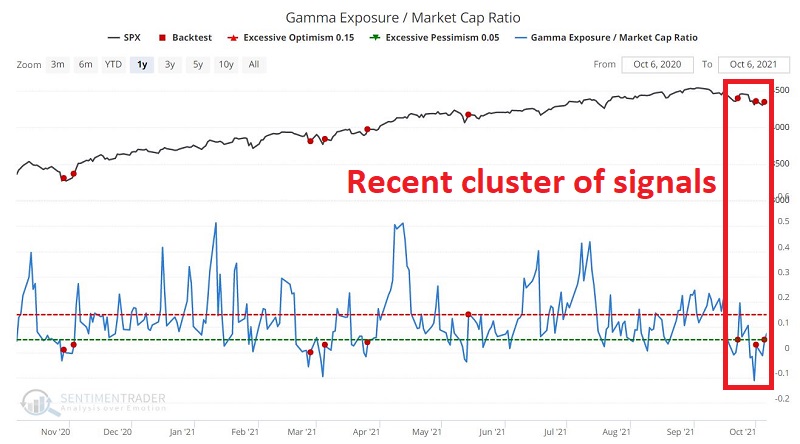

As we see in the screenshot below:

- The latest signals occurred on 9/22, 10/1, and 10.5

Like most indicators, this one is far from infallible. Still, the recent cluster of signals - and the high Win Rates dor 1-month to 1-year following precious signals - argues for the potential for renewed market strength as the 4th quarter progresses and possibly beyond.

Stay tuned for Part II.