Tuesday Midday Color - Overseas Carnage, Sweet Sugar

Here's what's piquing my interest so far this morning.

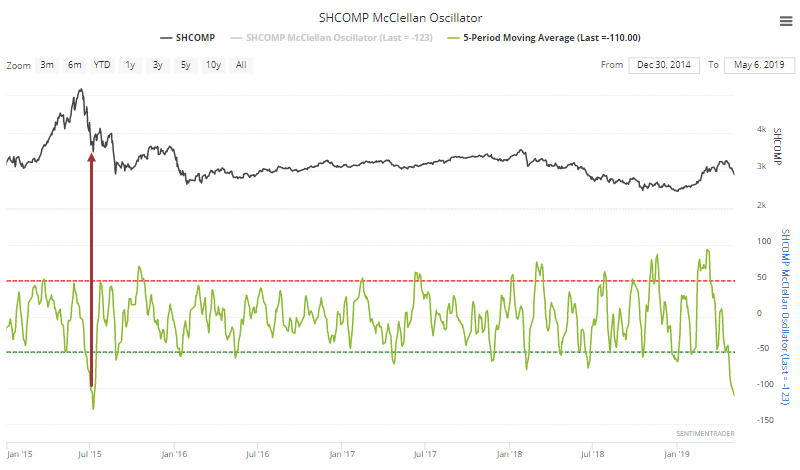

We saw last week that selling impulses similar to what triggered then have tended to occur near major peaks in the Shanghai Composite. While there are some long-term positives associated with the kind of momentum move that index enjoyed off its low, the sudden burst of concentrated selling is a shorter-term worry.

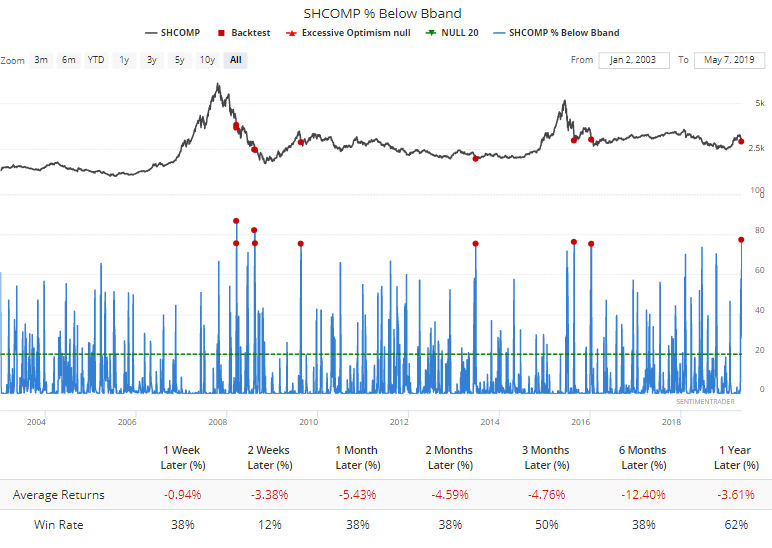

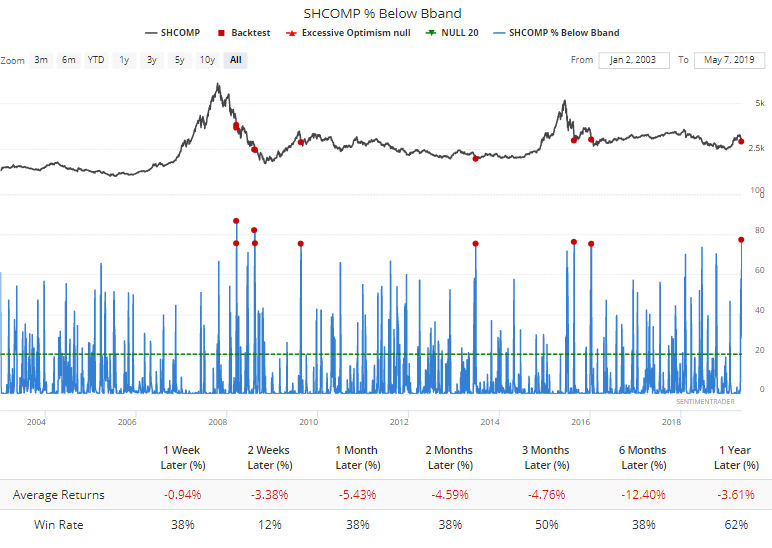

With the big decline to start the week, nearly 80% of stocks in that index dropped below their lower volatility bands. That screams like it should mean stocks are oversold and due to rebound, but in that market it hasn't usually worked out that way.

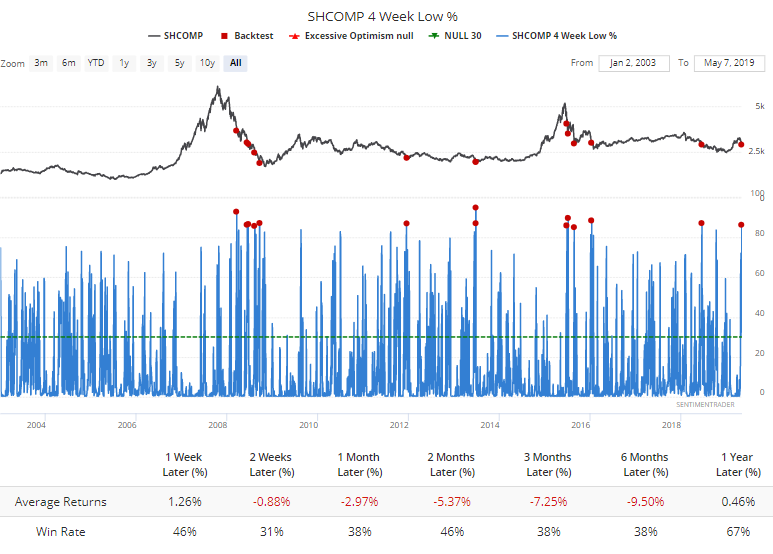

Same goes for times when more than 85% of the stocks hit a one-month low.

The 5-day average of the McClellan Oscillator for the Shanghai dropped below -100 for only the 2nd time in at least the past 17 years. That one immediately preceded a sharp snap-back, but it was only the first move in a major topping process.

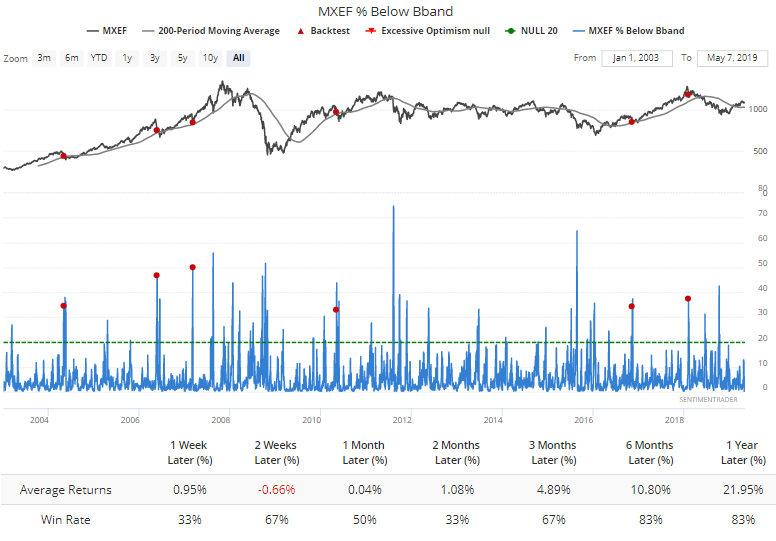

Due in part to the influence of weakness in Chinese shares, emerging market indexes also showed very weak breadth and selling impulses. Nearly a third of stocks dropped below their Bollinger Bands (the charts aren't displaying correctly due to differences in trading days because of exchange holidays overseas).

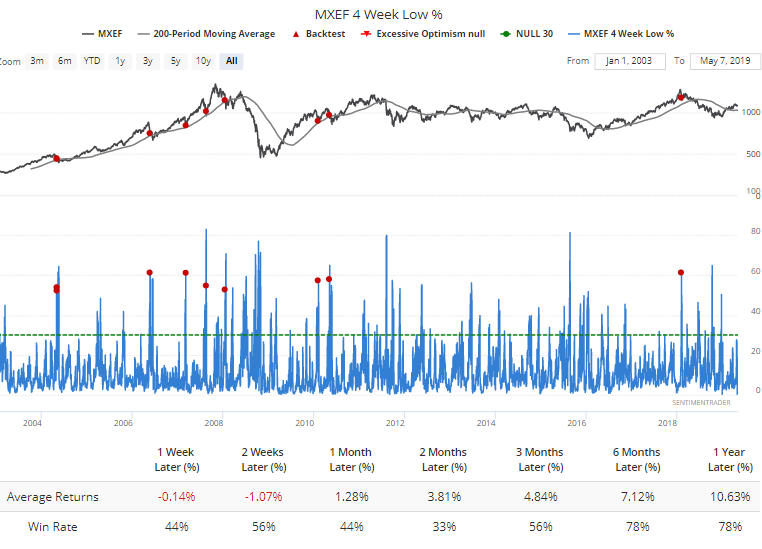

More than 50% of them hit new one-month lows.

In both studies, returns over the next couple of months were positive, but only a third of the signals showed positive returns. That means there were huge variations in those returns - the signals typically led to binary outcomes. Either emerging market stocks bottomed quickly and showed large gains over the medium-term, or these signals coincided with topping processes. The shorter-term reaction to these extremes should help give a clue as to which it is.

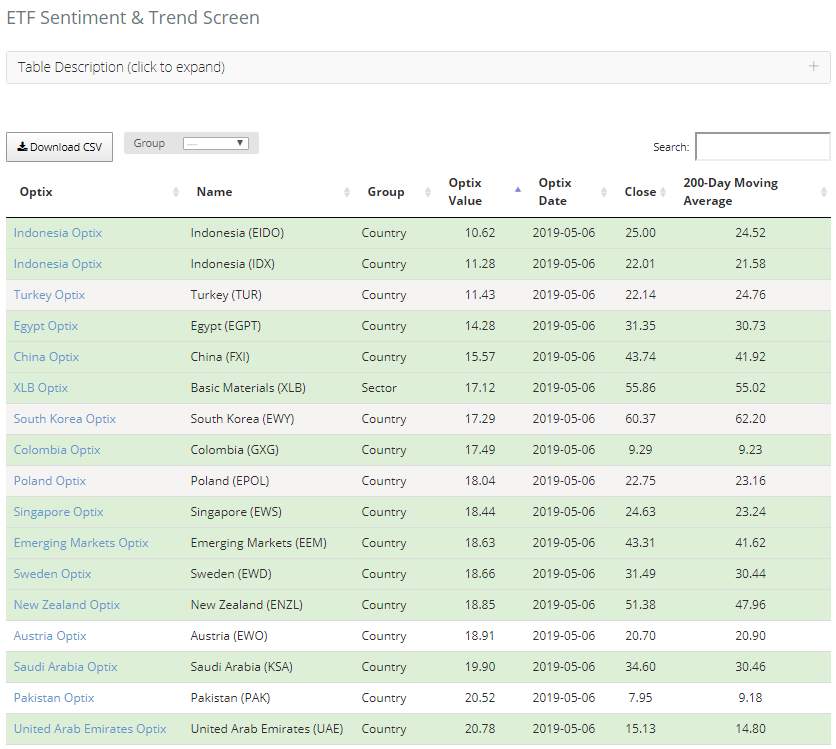

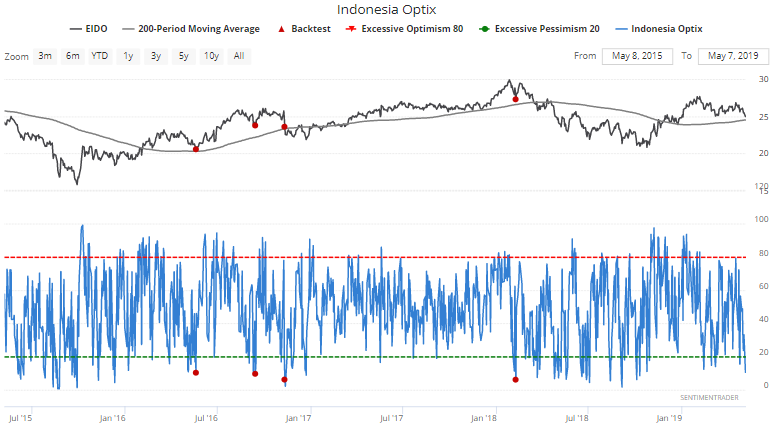

The overseas selling was enough to push many of the country ETFs into extreme pessimism while they're still trading above their 200-day averages (the ones highlighted in green).

Over the past few years, that's been a good sign for EIDO.

The Geo-Map gives a hint where the least optimism is right now (the darker the green color, the less the optimism). It's not just Indonesia, but focused in the Middle East and Asia.

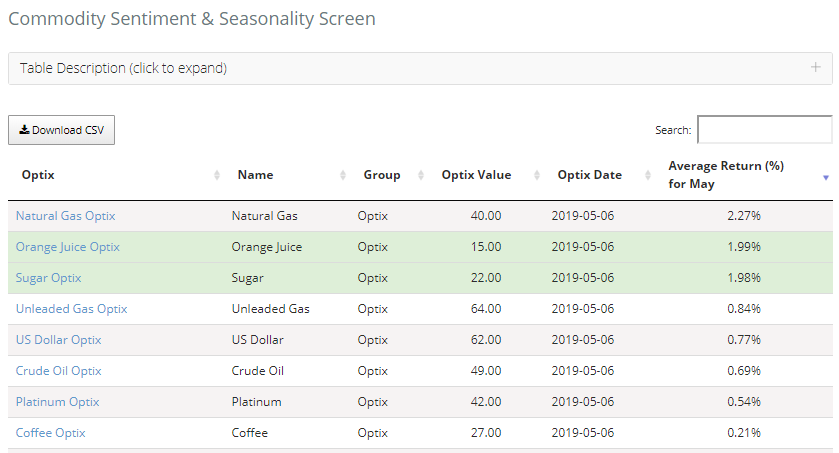

There is some pessimism in a few commodities that have good seasonality this time of year, too.

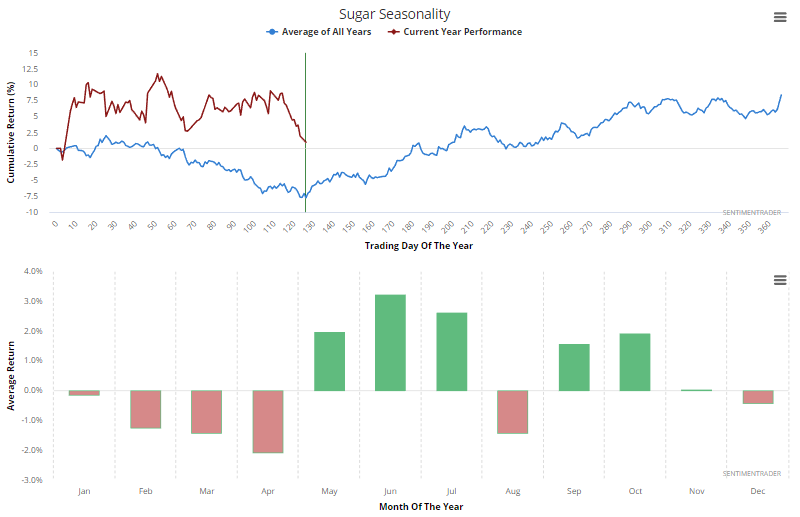

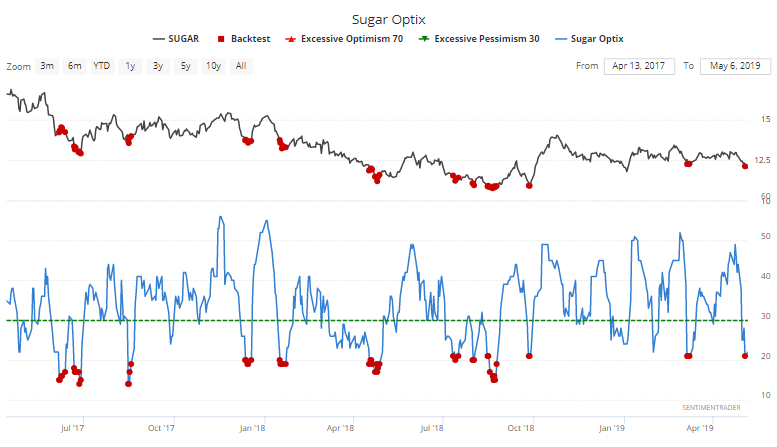

Most notable is sugar, where optimism is very low...

...just as it nears its seasonal sweet spot.