Trend analysis shows Discretionary stocks should rise

Key points:

- Trends and breadth in the Consumer Discretionary sector are improving

- Small-cap stocks are improving relative to others

- Global index trends remain unfavorable relative to the U.S.

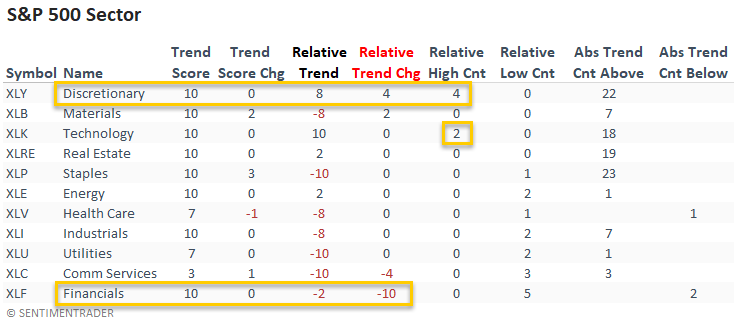

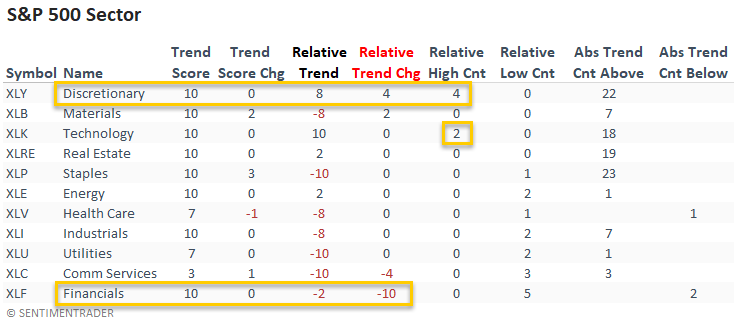

Trends show big improvements in Discretionary stocks as Financials lag

Momentum in the Consumer Discretionary sector continues as the group once again had the best relative trend score improvement versus last week. The sector registered a new relative high on 4 out of 5 days.

Technology maintained a perfect absolute and relative trend score profile and registered 2 new relative highs last week. I would keep an eye on the financials as its relative trend score decreased significantly, and it registered a new relative low on all 5 days. See this note for column definitions.

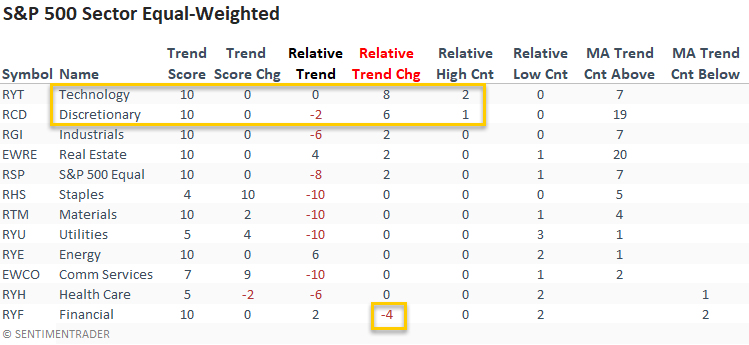

The equal-weighted data for the consumer discretionary and technology sectors confirmed the strength in the cap-weighted data with healthy relative trend score gains. So, it's not just TSLA, AMZN, and a handful of other mega-cap stocks driving the improvement.

Financials also confirmed the deterioration in the cap-weighted data.

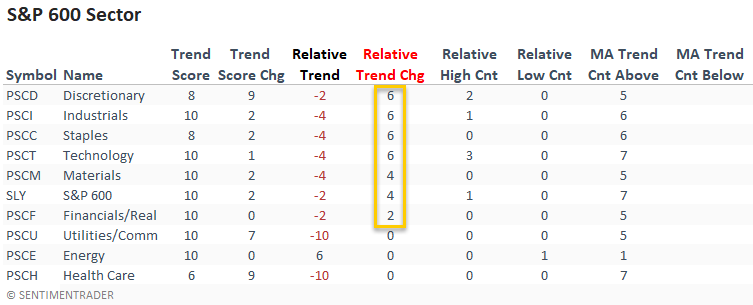

Several small-cap sectors improved on a relative basis, with consumer discretionary and technology confirming the trends in the large-cap data.

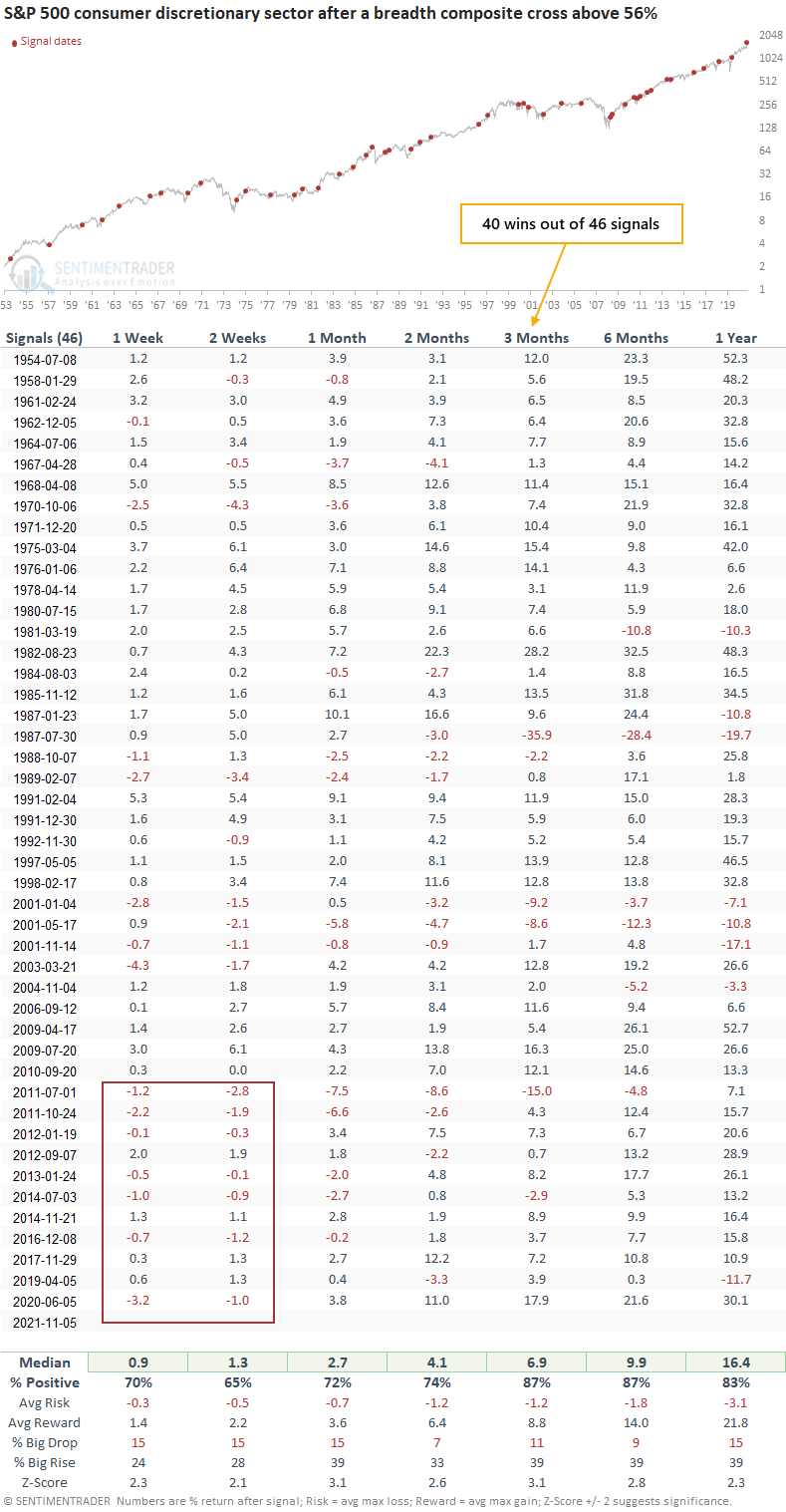

Discretionary stocks show a breadth thrust with an 87% win rate

Participation from constituents in the S&P 500 Consumer Discretionary sector is solid.

A breadth composite using a handful of measures just crossed above 56%, after having reset below 5%. The same signal triggered in June 2020, leading to a substantial rally.

This has triggered 46 other times since 1954. After the others, future returns and consistency in the sector were excellent across all time frames, but especially over the next 3 -months.

Over the past decade, shorter-term returns were inconsistent, so the sector could take a breather to digest the gains.

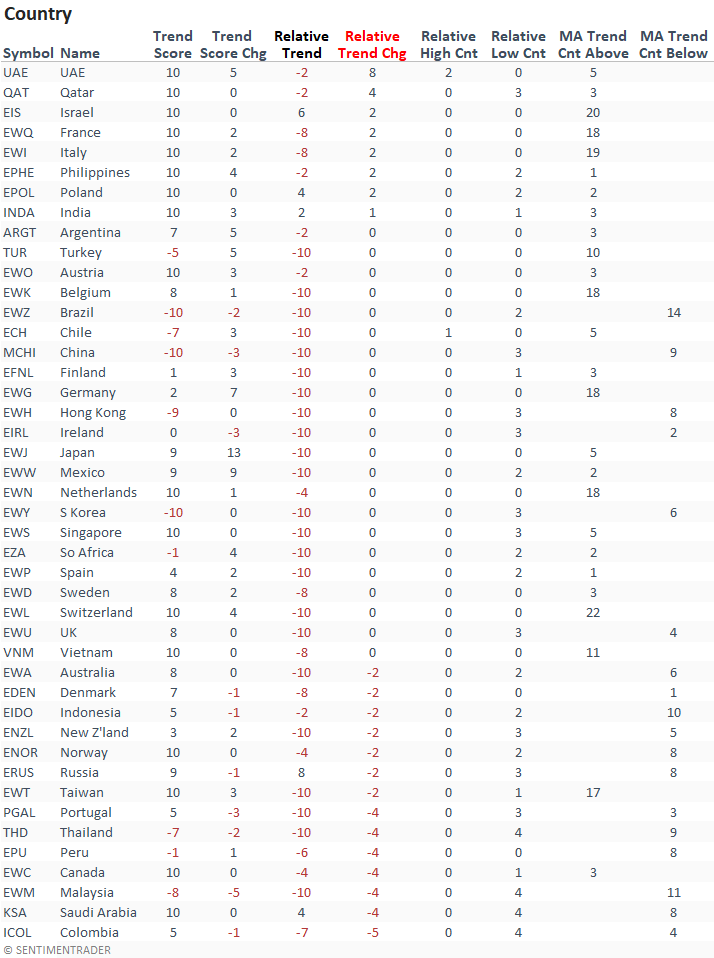

Overseas indexes continue to show poor relative trends

Last week, more countries showed a decrease in their trend scores. The United Arab Emirates ETF was the only country to register a positive trend score gain and record a relative high. Lows outpaced highs by a considerable number.

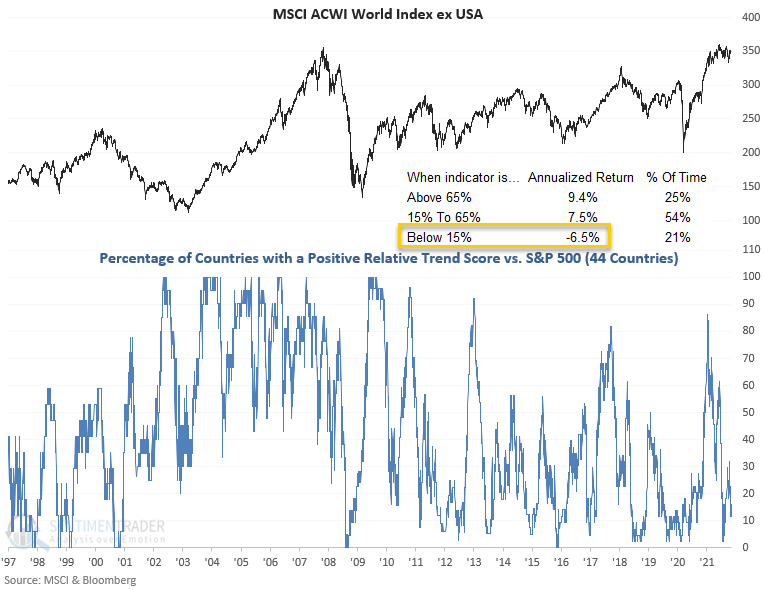

The percentage of countries with a positive relative trend score versus the S&P 500 declined last week. Europe and South America have zero countries with a positive relative trend score versus the S&P 500. And, the only Asia Pacific country with a positive score is India.

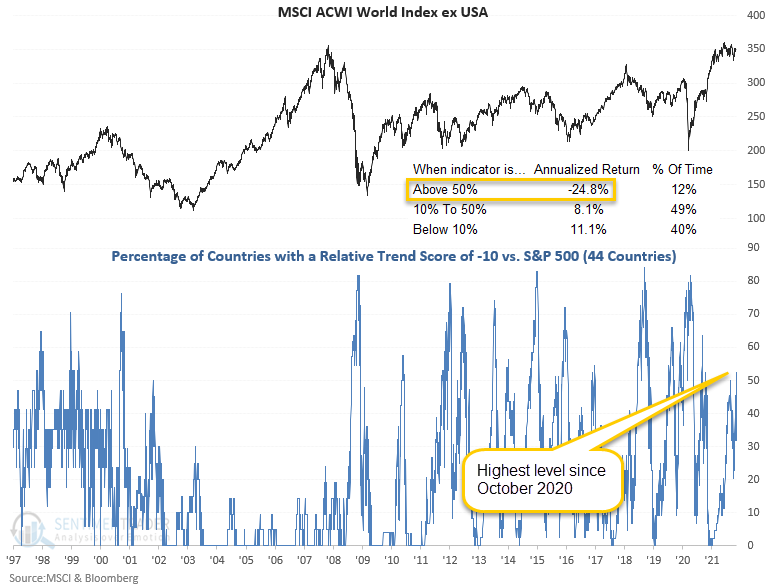

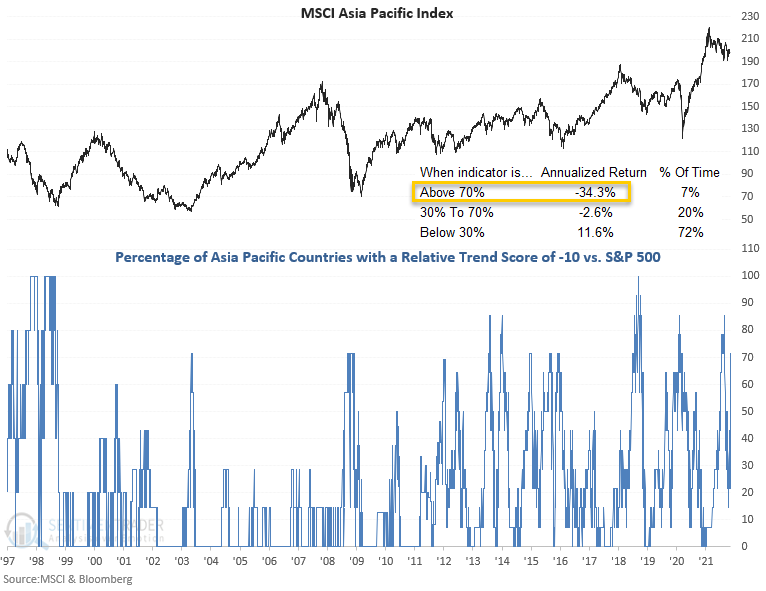

The percentage of countries with a relative trend score of -10 increased to the highest level since October 2020. Foward returns were poor when so many had such negative trends.

It was especially bad in the Asia Pacific region. The current level suggests negative returns for the MSCI Asia Pacific index. This is a must-watch indicator as the supply chain and shipping bottlenecks impact economies around the globe. This can also be a concern for domestic stocks as I showed in July.

What the research tells us...

An in-depth look at where investors are focusing in industries and sectors shows a big improvement in Consumer Discretionary stocks. So many of them regained their footing that it triggered a breadth thrust, showing consistent gains in the sector over the following 3 months.

Strength is mostly evident in the U.S., with overseas indexes still not improving much on an absolute or (especially) relative basis. When trends were lagging like this in the past, annualized returns in the MSCI indexes have been poor.