Time to Keep a Close Eye on Corporate Bonds

A lot of doubt and fear has crept into the bond market of late. This is not surprising given that interest rates are still near all-time lows, and inflation is relatively high and a cause of major concern for fixed-income investors.

Still, at least two factors are flashing signs of hope for investment-grade corporate bonds in the months ahead.

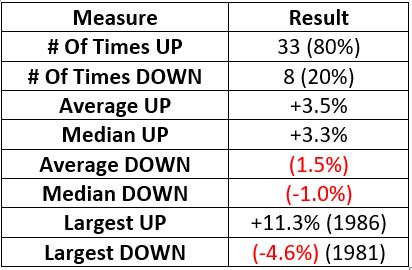

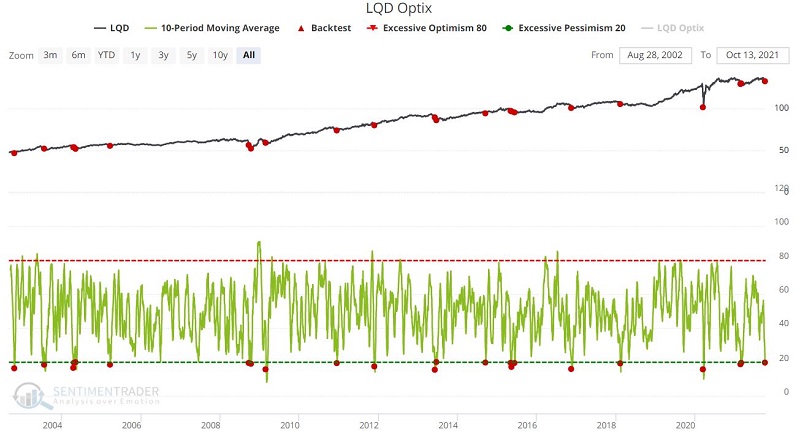

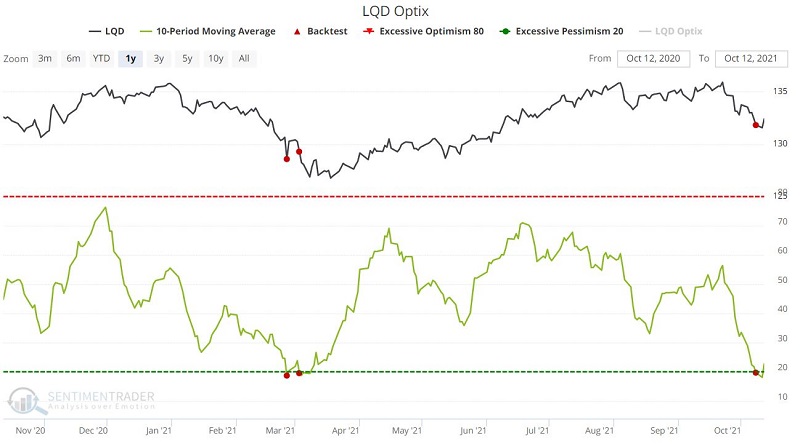

OPTIX

Jason recently pointed out the dearth of optimism in the corporate bond market. In this case, we can use this as a contrarian sign by using this test (which you can run by clicking here).

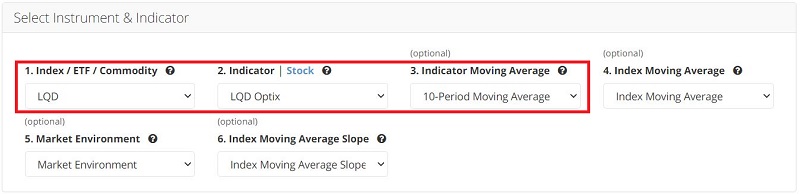

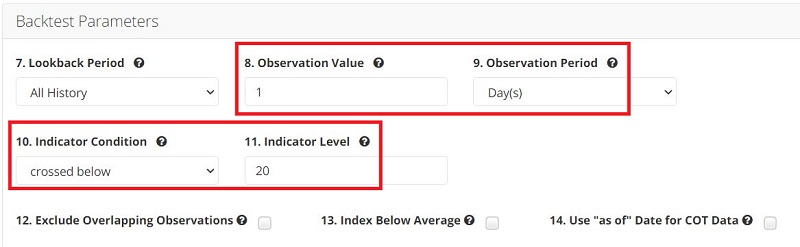

This test looks at investor sentiment for ticker LQD (iShares iBoxx $ Investment Grade Corporate Bond ETF) and identifies those times when:

- The 10-period moving average of LQD Optix

- Crosses below 20

The input screens appear below.

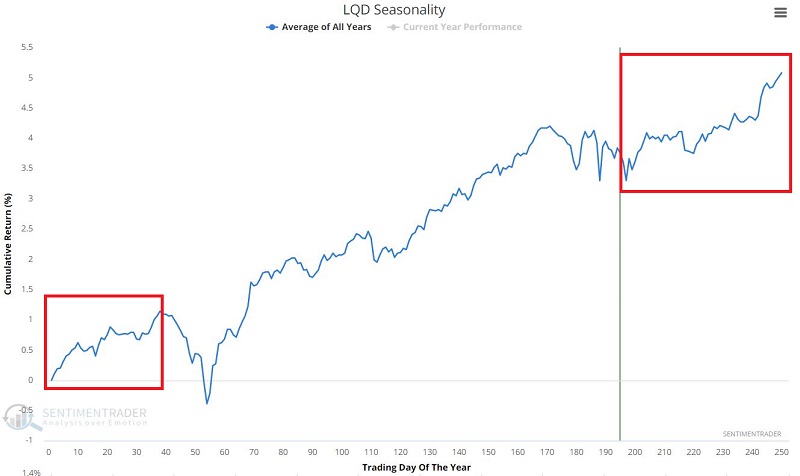

SEASONALITY

The chart below displays the Annual Seasonal Trend for ticker LQD.

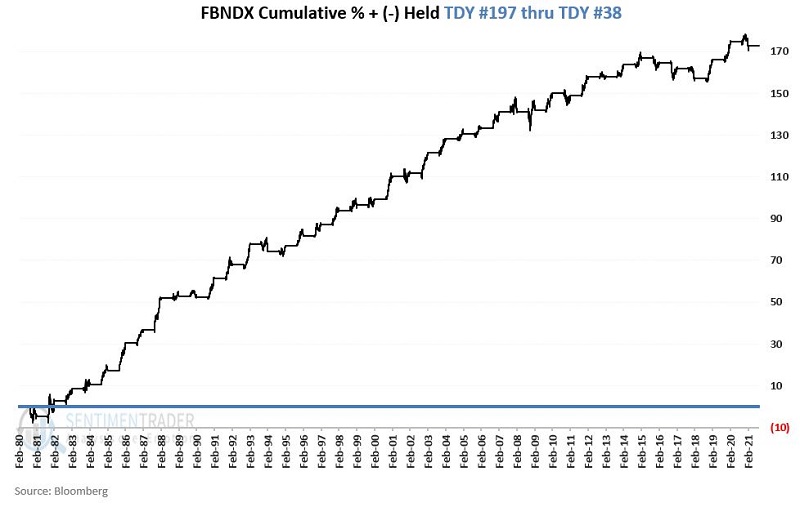

To test the performance of investment-grade bonds during this seasonal period, we will use daily total return data for ticker FBNDX (Fidelity Investment Grade Bond Fund), which has data back to 1980. The chart below displays the cumulative total return for FBNDX if held ONLY from TDY #197 through TDY #38 of the following year, every year since 1980.

SUMMARY

So, do the factors detailed above "guarantee" that investment-grade corporate bonds are sure to rally in the months ahead? Not at all. Bond price movements are primarily a function of interest rates.

3 things to note about interest rates:

- They have been in a downtrend for almost 40 years

- They are still near all-time lows

- They may ultimately get pushed higher as a function of inflation

In other words, bonds are not the "slam dunk" they were during the past several decades as interest rates steadily declined. Still, bearish sentiment and bullish seasonality are often a winning combination.