Thursday Color - Morning Gap, Sector Breadth, Gold Breakout

Here's what's piquing my interest as traders ramp up stocks prior to the open.

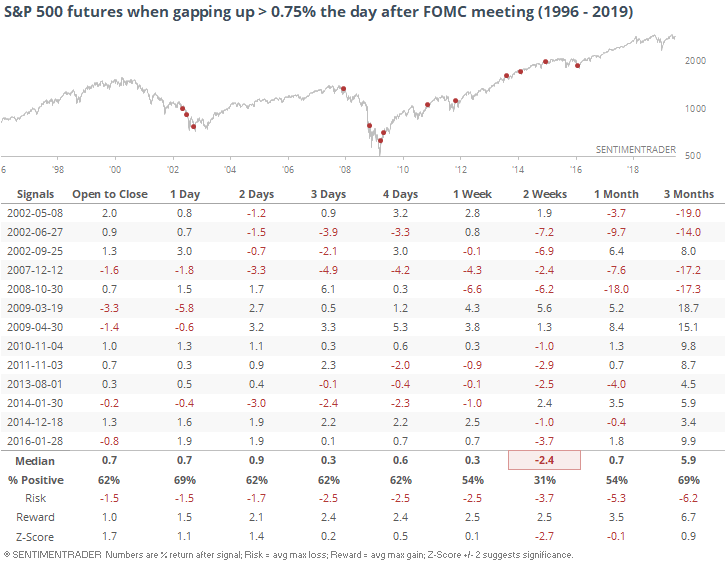

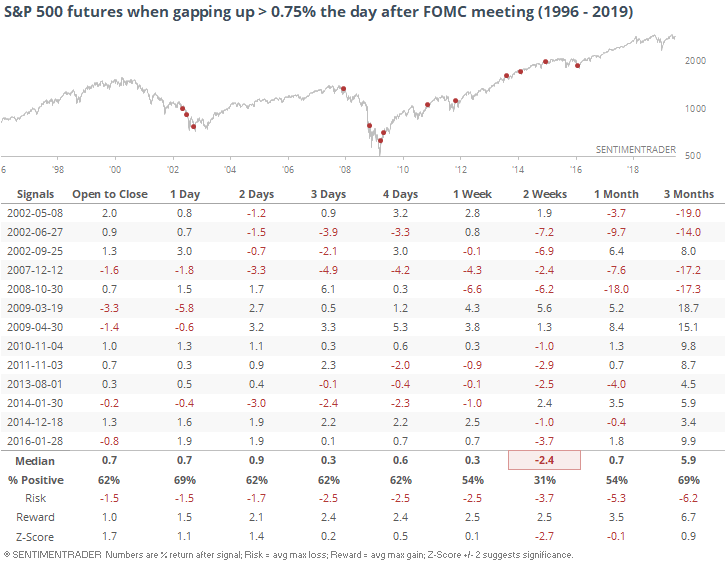

Post-Meeting Gap

In apparent reaction to yesterday's FOMC decision and statement, traders are bidding up the futures. This is quite a change from a few weeks ago when two out of every three days opened with a gap down.

There has been a modest tendency for these pre-market gains to stick over the next 2-3 days, not so much the next 2 weeks.

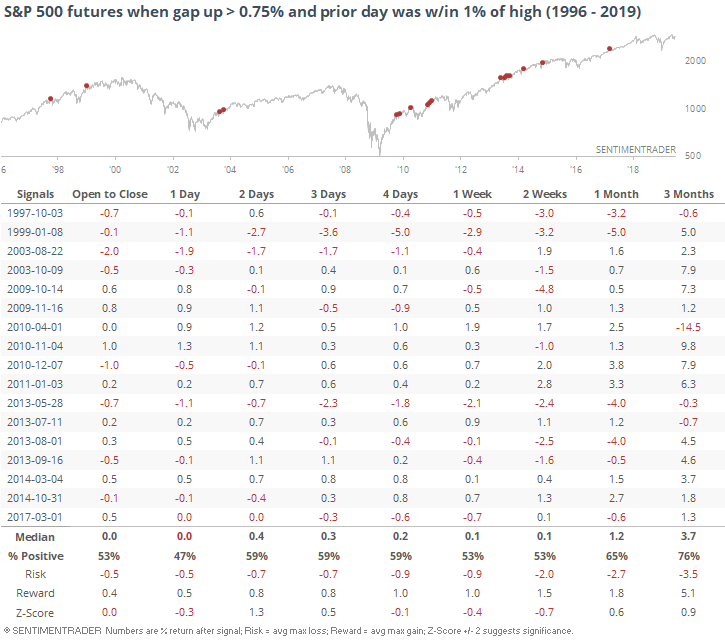

Some of the larger gains came when markets were stressed and traders reacted to a responsive Fed. This time it's triggering during a much more healthy market environment. It hasn't happened often.

After these gaps, the futures were down over the next two weeks every time but once, and that sole exception had seen weakness up to that time.

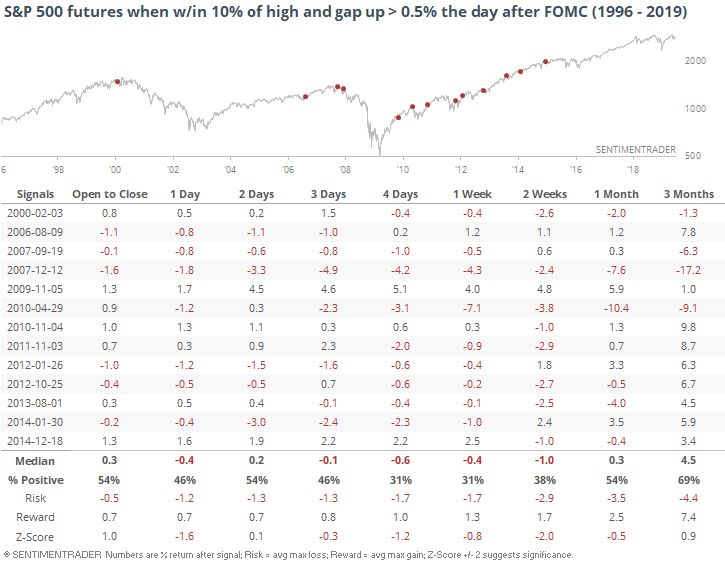

Even if we relax the parameters to a 0.5% opening gap (from 0.75%) to get a larger sample size, it's the same basic pattern - even a bit weaker in the very short-term.

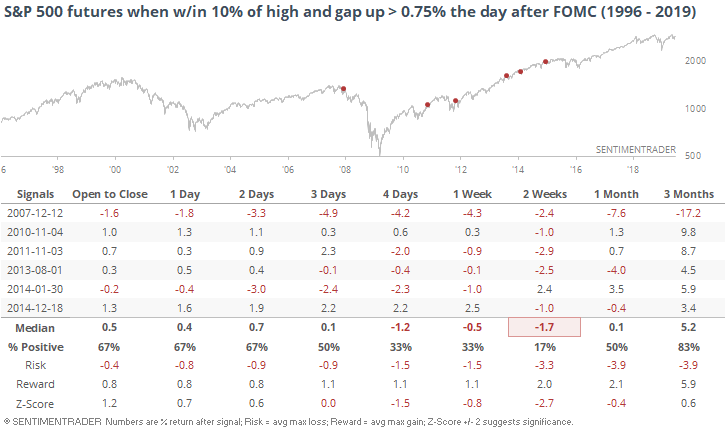

Let's forget about the FOMC. Maybe it's different because the futures will be at or near a new high with this morning's gap. If we look for any time they gapped up 0.75% or the morning after being within 0.75% of a new high the prior day, we get this:

These were mixed, without a clear edge either way, and slightly weak overall with the risk/reward ratio. Most of them did not coincide with a "blow-off" top, though. Out of the 17 signals, 4 showed only very minimal upside over the next couple of weeks with substantial downside. The rest were either more balanced or showed more reward than risk.

Breadth Review

If this morning's move sticks, we're likely going to see a big jump in the number of extremes in breadth figures. They started to pop a bit yesterday and will likely tip over today if buyers continue to push. That's usually a good longer-term sign but makes the shorter-term more difficult to chase.

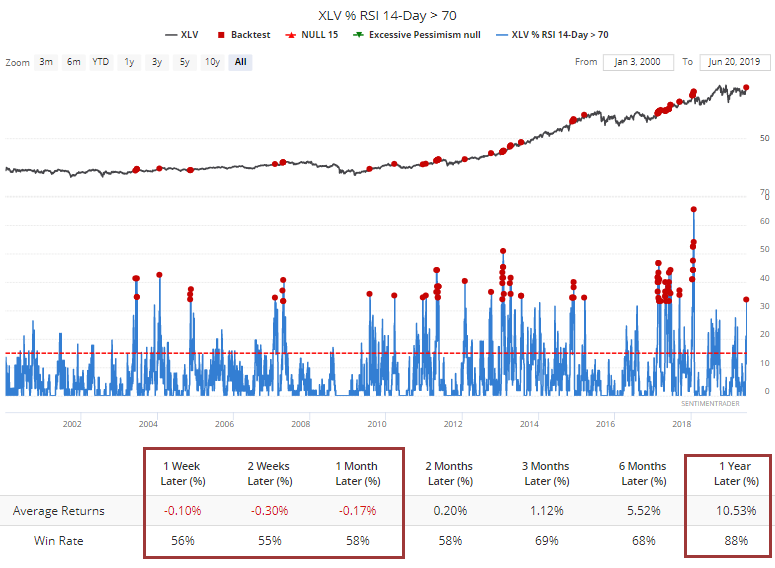

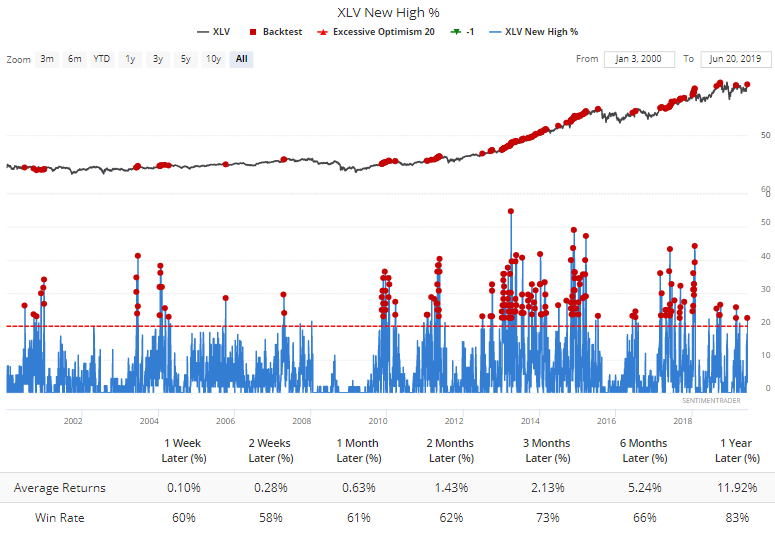

For health care stocks, more than a third of them are already overbought.

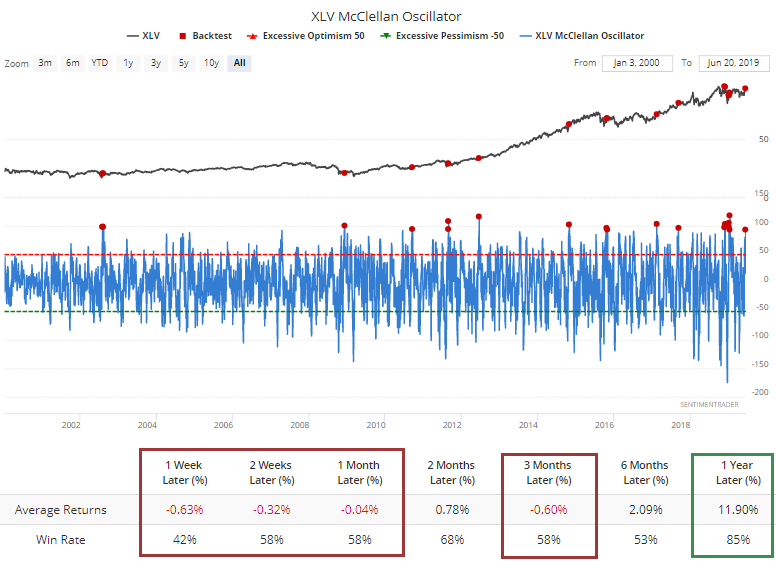

That pushed the McClellan Oscillator to a very high level for the sector.

And more than 20% of them hit a new 52-week high. Mostly a good sign, but fairly weak returns in the short- to medium-term. We should see this spike today if the move holds.

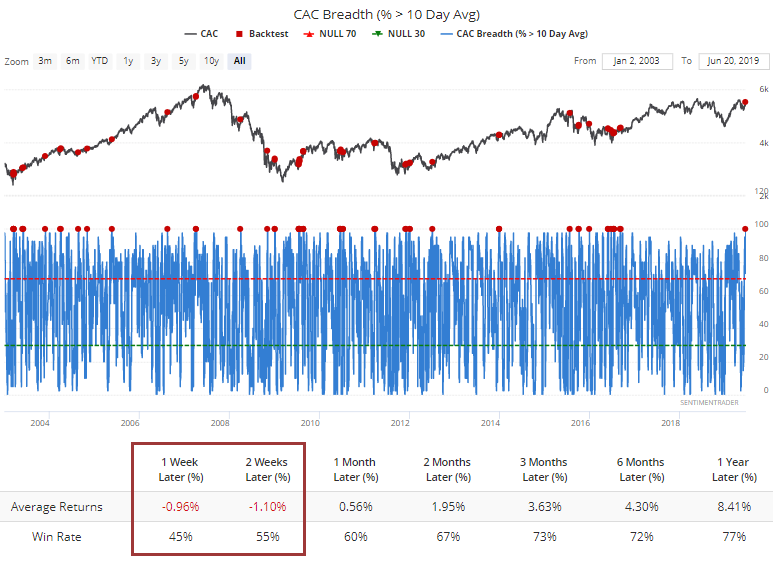

Overseas, every stock in the CAC 40 is trading above their 10-day moving average.

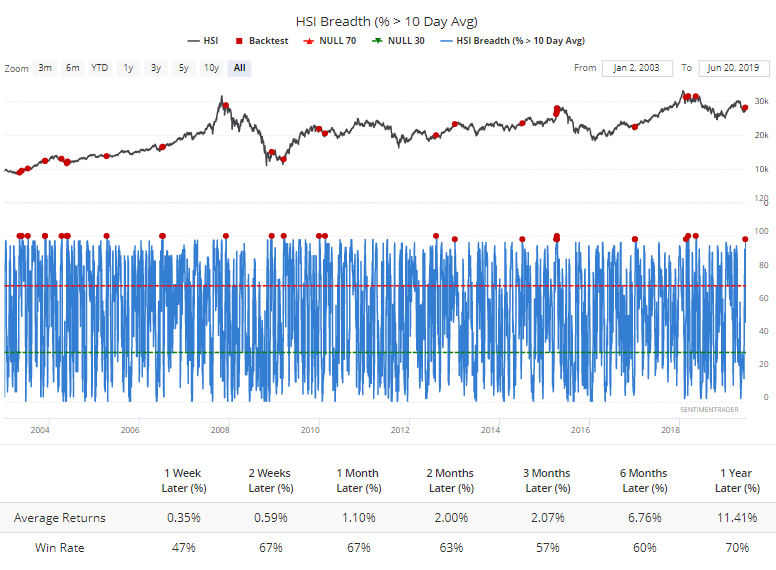

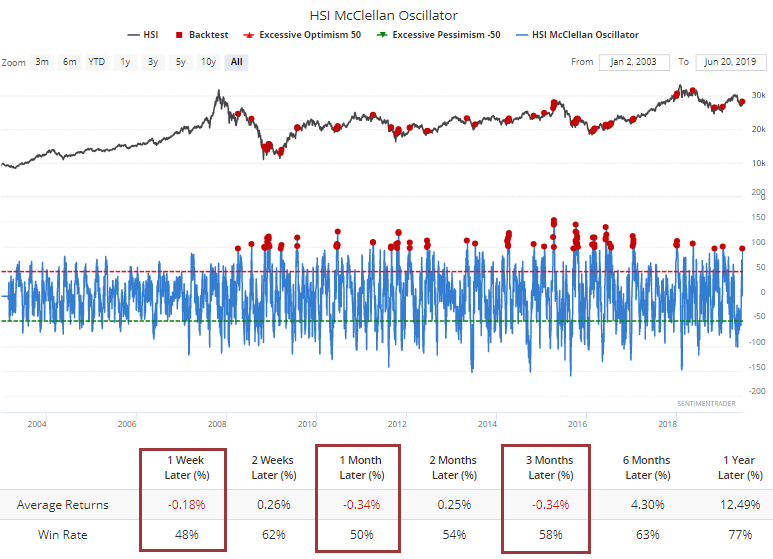

It's nearly the same within the Hang Seng.

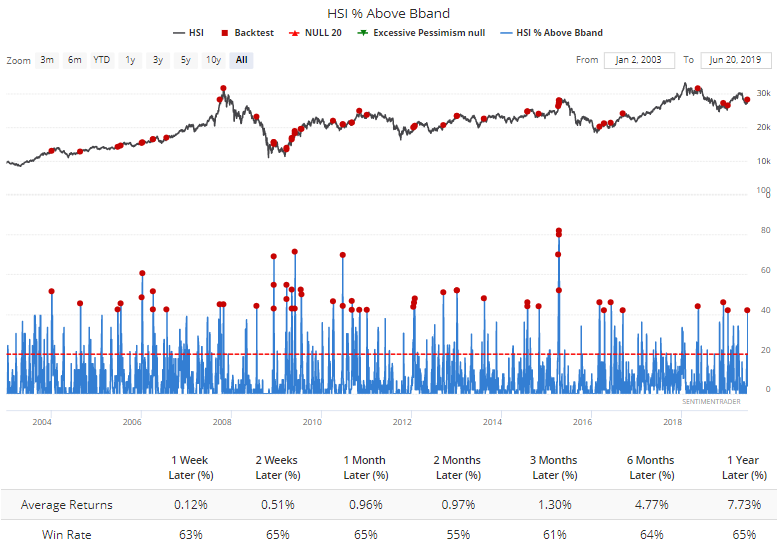

That's pushed more than 40% of them outside their volatility bands, which hasn't been as negative as it typically is for other indexes and sectors.

The Oscillator has surged, though, which has been something of a damper on returns.

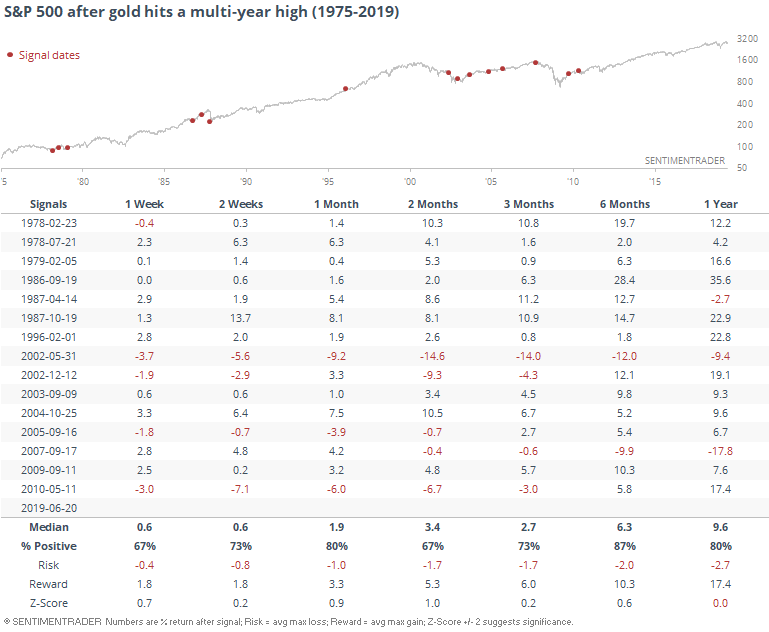

Gold's New High

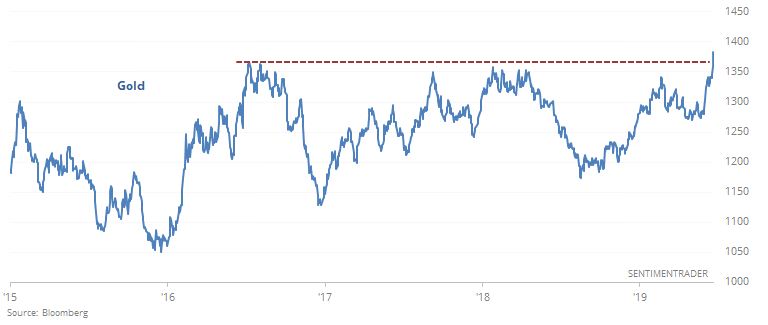

With a dropping dollar, gold bugs have been rushing in and pushed the metal to a multi-year high.

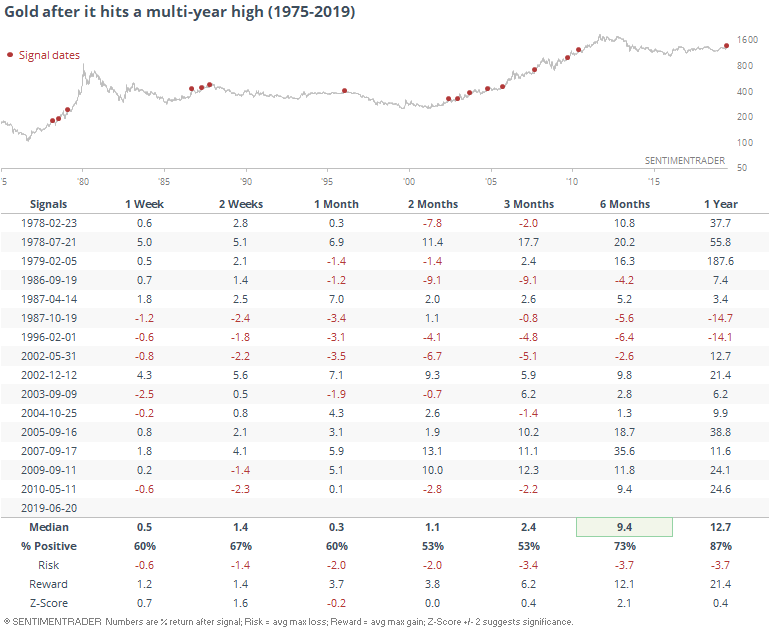

Breakouts always get people excited, especially in a sentiment-driven asset like gold. This is the first time in 2010 that it hit a multi-year high for the first time in months.

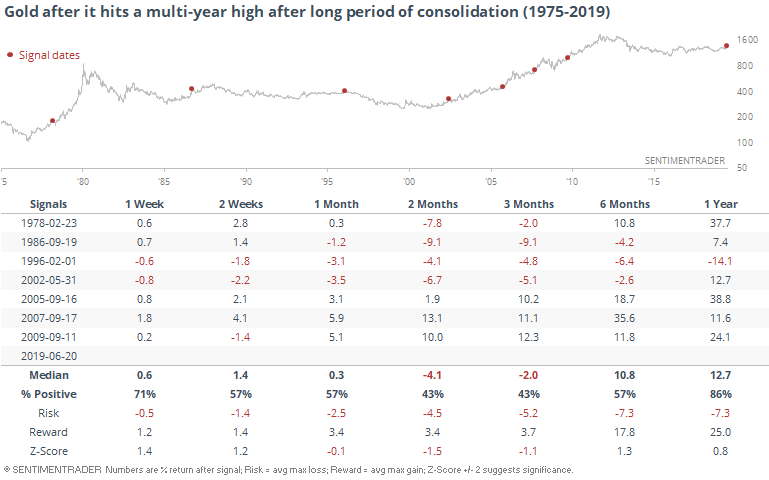

Its future returns were pretty good, especially over the next 6 months. But quite of a few of those good returns came in clusters. If we filter the table to only include the first real breakout after a long period of consolidation, they became less positive, at least prior to the 2000s when gold went on its monster run.

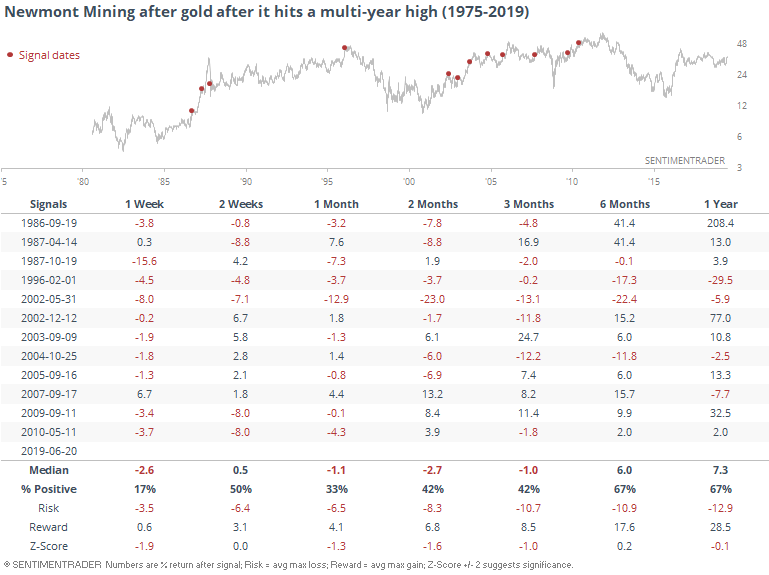

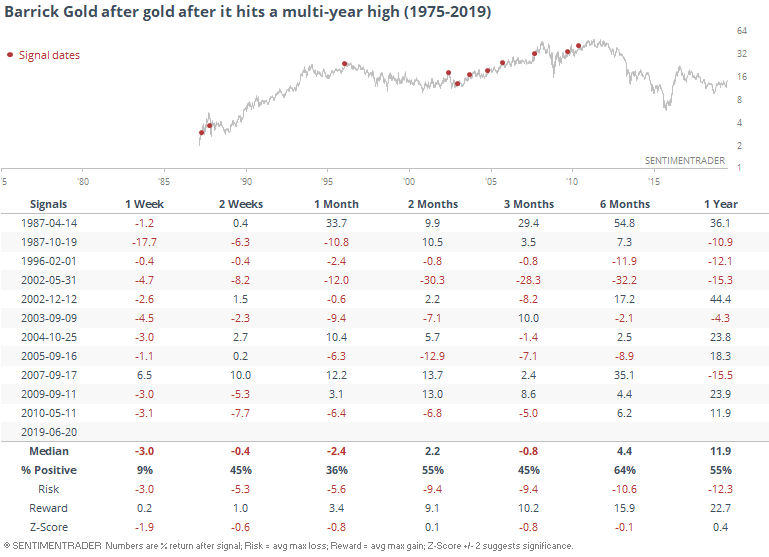

Looking at all the breakouts, old-time gold mining stocks didn't do quite as well as the metal itself.

For stocks in general, breakouts in gold were mostly a positive.