This signal suggests risk-on for stocks

Key points:

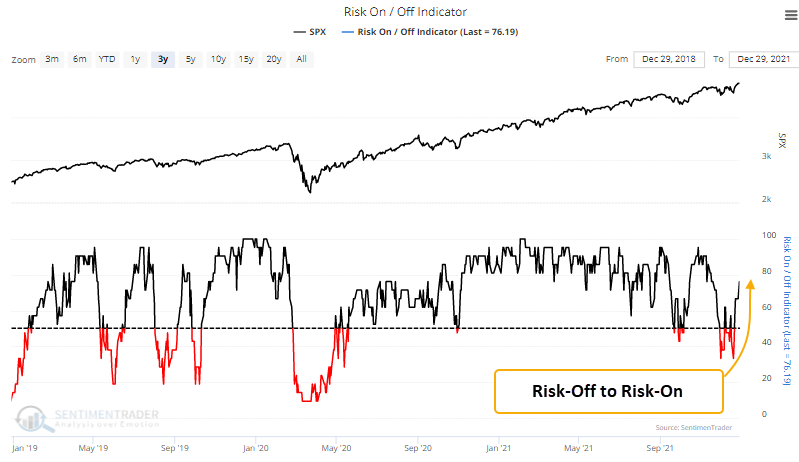

- The SentimenTrader risk-on/off indicator cycled from risk-off to risk-on

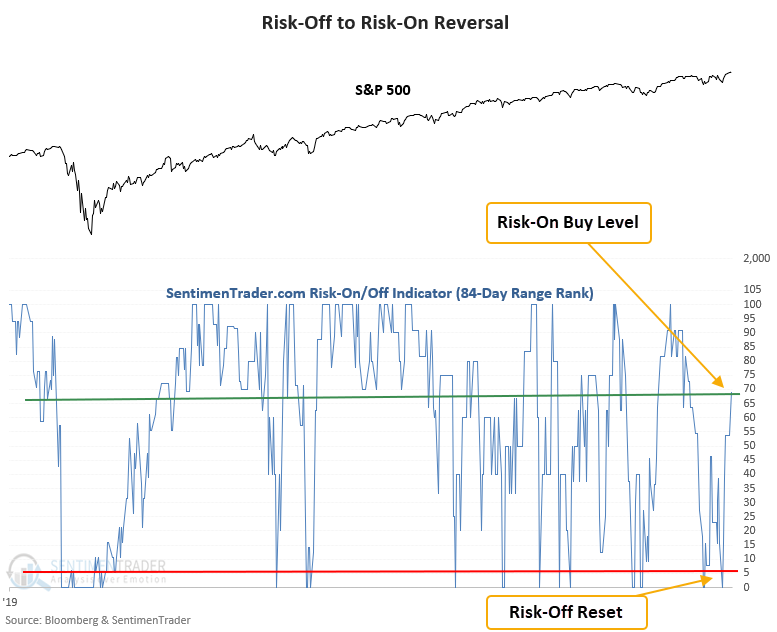

- A trading model based on the indicator registered a new buy signal

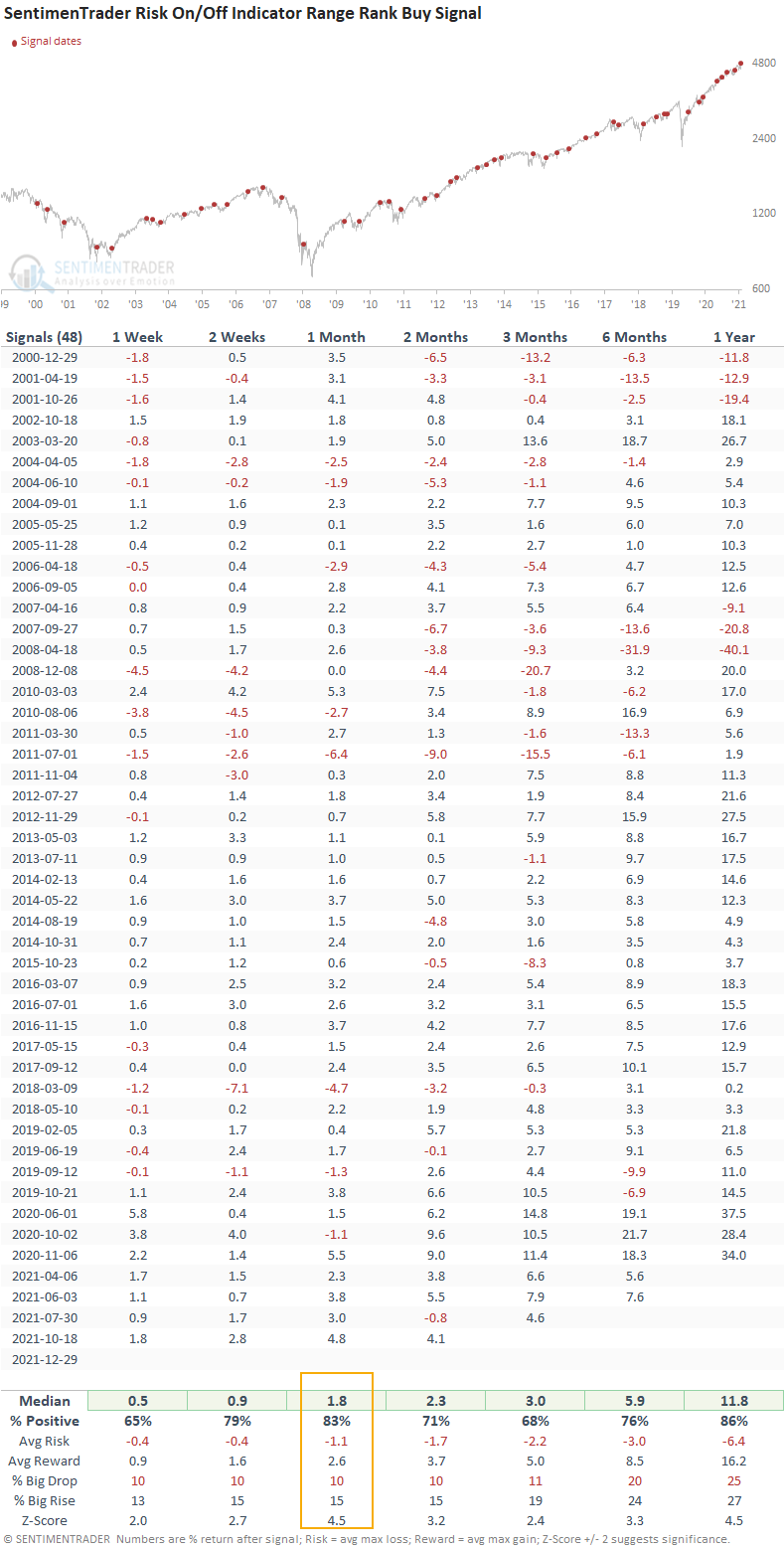

- The S&P 500 has rallied 83% of the time over the next 4 weeks after other signals

Composite models are more reliable than a single indicator

The SentimenTrader risk on/off indicator utilizes a weight-of-the-evidence approach by combining 21 diverse components into a single model to assess the current market environment. A level above 50% is considered risk-on.

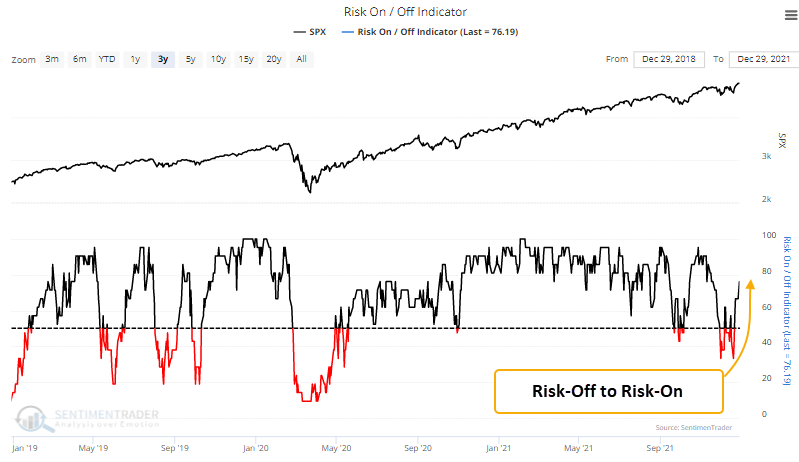

A trading model that identifies a reversal in the SentimenTrader risk-on/off indicator

The trading model applies a range rank to the indicator to identify a bearish to bullish reversal. This same signal triggered in October, leading to a substantial 1-month gain.

Similar reversals have preceded gains 83% of the time

This signal triggered 48 other times over the past 22 years. After the others, future returns, win rates, and risk/reward profiles were excellent across all time frames, especially the 4-week window. Since 2012, the 2-week time frame has registered 25 out of 27 winners.

What the research tells us...

When the trading model for the risk-on/off indicator reverses from a bearish to bullish condition, stocks are likely to trade higher. Similar setups to what we're seeing now have preceded rising prices for the S&P 500, with a 4-week win rate of 83%.