This price volatility signal suggests higher stock prices

Key points:

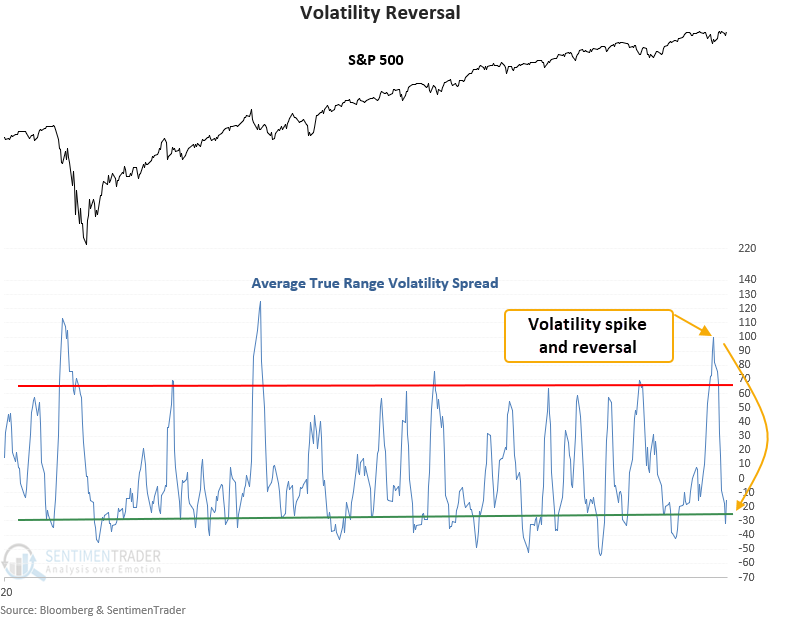

- Price volatility recently spiked higher and subsequently reversed lower

- A model based on the average true range indicator issued a buy signal

- The S&P 500 rallied 88% of the time over the next 2 months after other signals

A price volatility model for identifying mean reversion opportunities

The S&P 500 has now cycled from a period of elevated volatility to a period of relative calm. This type of behavior often signals higher prices as investors become more comfortable with new buys.

The average true range spread signal identifies when a stock, ETF, or commodity reverses from a period of high volatility to low volatility in a quick manner. This same signal triggered an alert on 10/22/21, which shows a gain of 3.86% through 12/15/21.

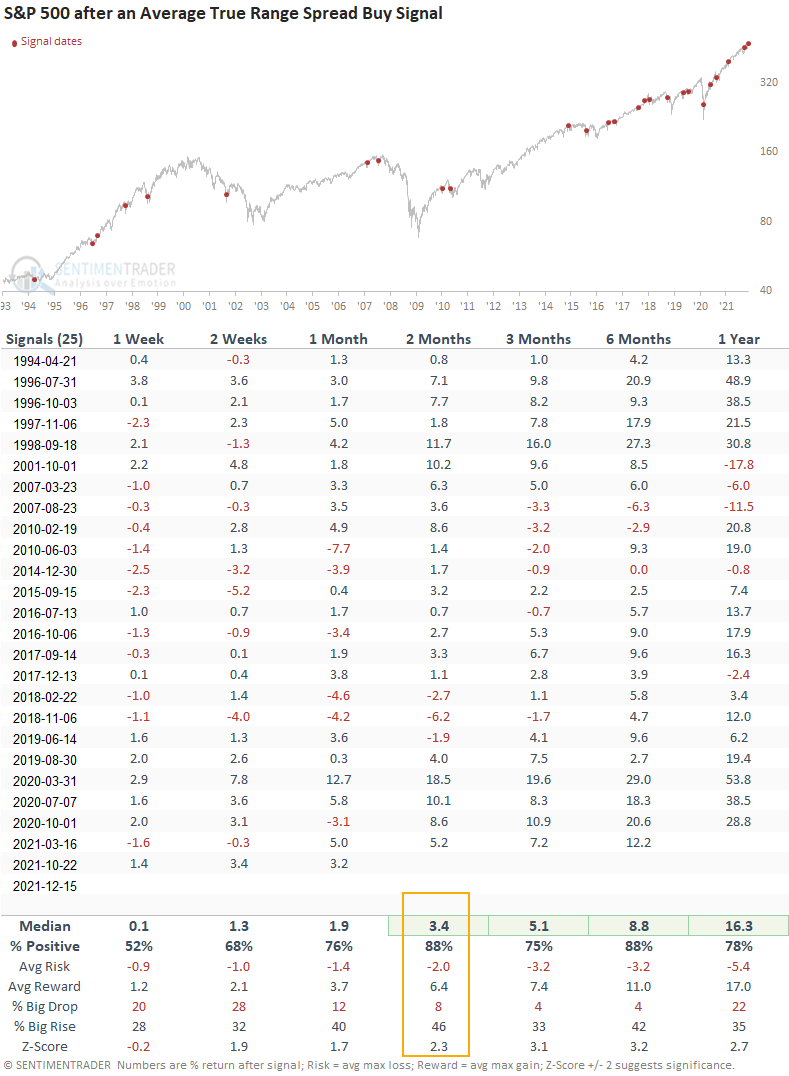

Similar signals preceded gains 88% of the time

This signal has triggered 25 other times over the past 28 years. After the others, future returns and win rates were excellent on medium and long-term time frames. Consistency was outstanding in the 2 and 6-month time frames, with 21 out of 24 winners. And, the 6-month time frame is currently riding a 13 signal win streak.

What the research tells us...

When the average true range spreads indicator cycles from high to low volatility, stocks tend to rise. Similar setups to what we're seeing now have preceded consistent gains on a medium and long-term basis with an 88% win rate 2 months later.