This Bollinger band signal suggests higher prices for Korean stocks

Key points:

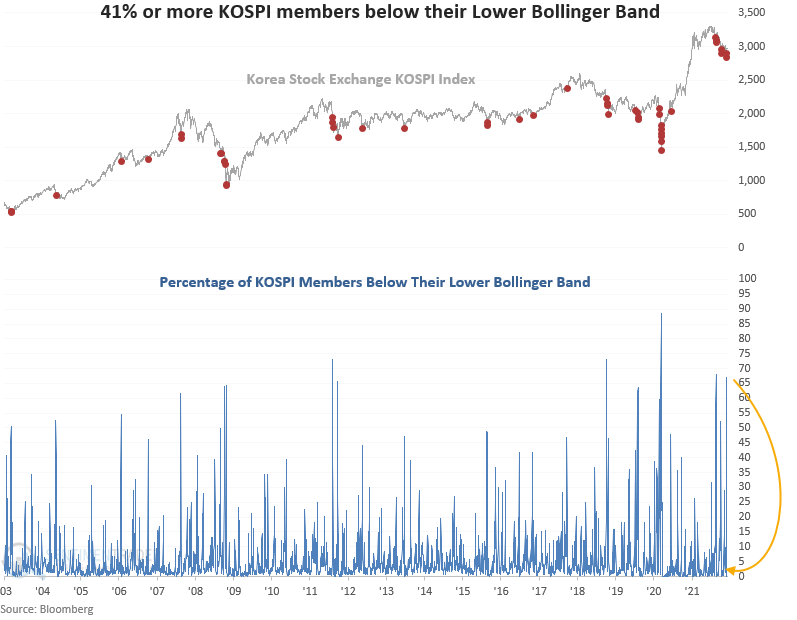

- The percentage of KOSPI index members below their lower Bollinger band surged above 67%

- Members have now reversed lower with fewer than 1% below their lower band

- The KOSPI rallied 89% of the time over the next 3 months after other signals

A breadth-based model for identifying oversold mean reversion opportunities

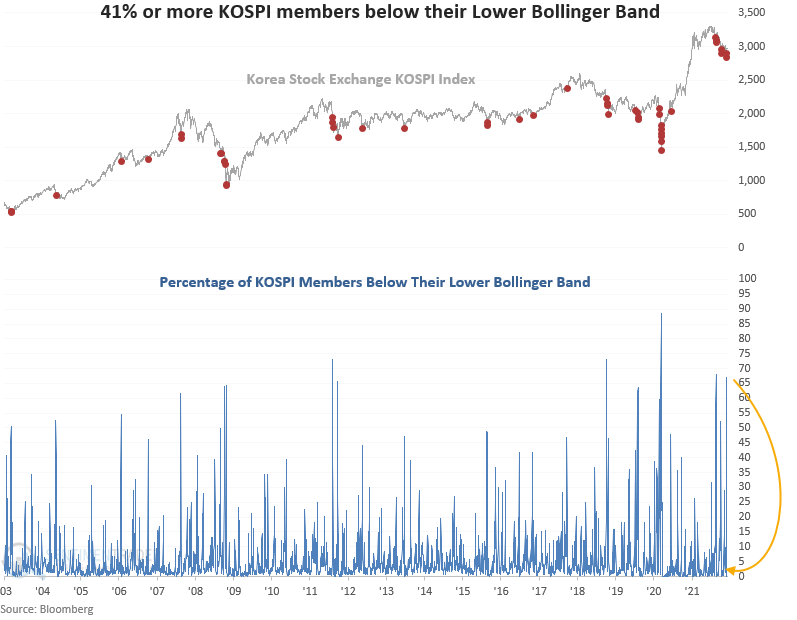

A new signal from a mean reversion model that utilizes the percentage of KOSPI index members below their lower Bollinger band registered an alert on Monday.

The Bollinger band signal identifies when the percentage of index members trading below their lower Bollinger band cycles from a high to a low level. At the same time, KOSPI momentum must be positive.

The percentage of KOSPI members below their lower Bollinger band recently increased to the 7th highest level in history.

Similar signals preceded consistent gains on a medium-term basis

This signal has triggered 19 other times over the past 18 years. After the others, future returns and win rates were good on medium-term time frames. Consistency was especially good in the 3-month time frame, with 17 out of 19 winners. The 1-week results suggest we should be mindful of a short-term pause.

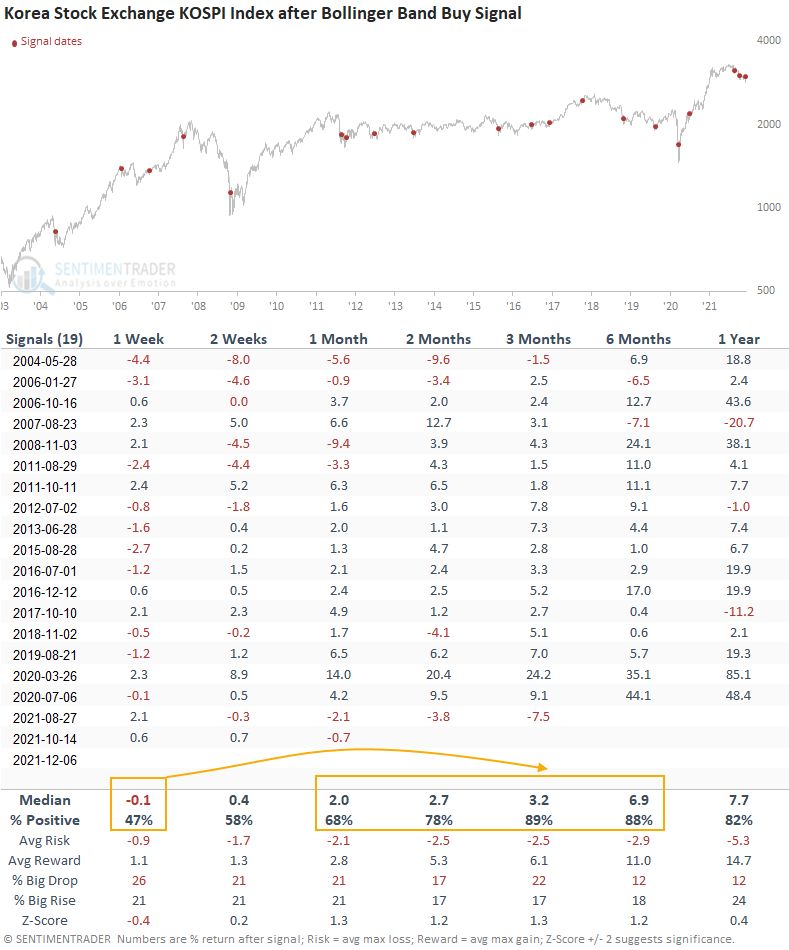

Returns for a USD-based South Korea ETF

The medium-term results and risk/reward profile look solid for the South Korea ETF (EWY). However, as was the case with the KOSPI results, one should be mindful of a potential pullback in the next week.

What the research tells us...

When the percentage of members below their lower Bollinger band cycles from a high to a low level, an oversold mean reversion opportunity looks favorable. Similar setups to what we're seeing now have preceded consistent gains on a medium-term basis with an 89% win rate 3 months later. Suppose we apply the signals to a USD-based ETF. In that case, we see solid gains and more favorable risk/reward profiles on a medium-term basis.