The worst economy since...

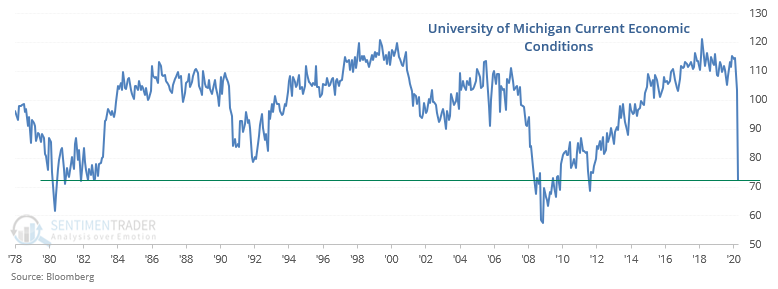

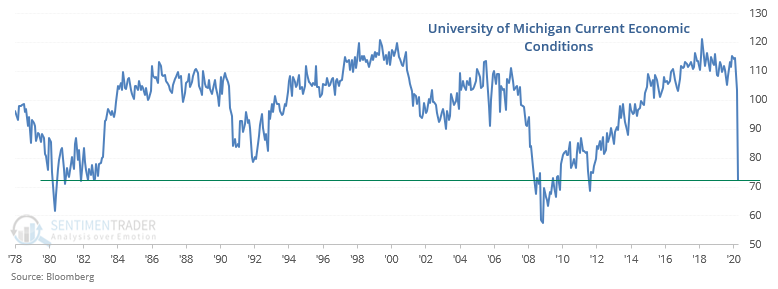

As expected, the coronavirus-driven recession has pushed many economic data series to the lowest level in years (if not decades). For example, the University of Michigan's Current Economic Conditions Index is at its lowest level since 2011:

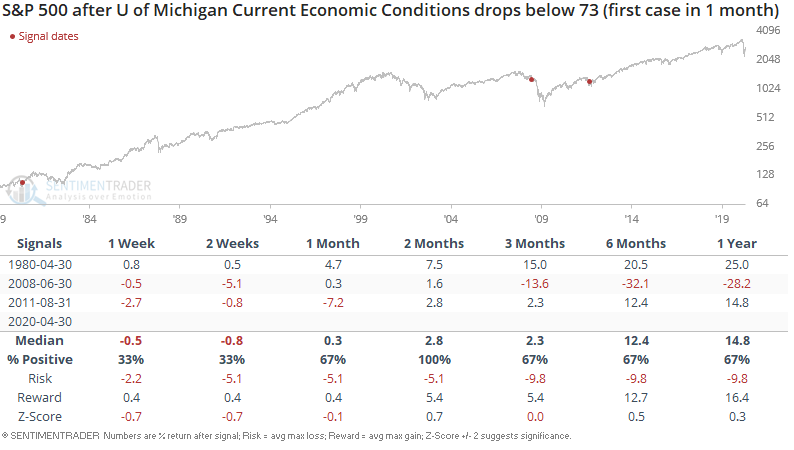

This wasn't consistently bullish or bearish for stocks going forward. While this was clearly a good bullish sign in April 1980 and August 2011, this was far too early in June 2008.

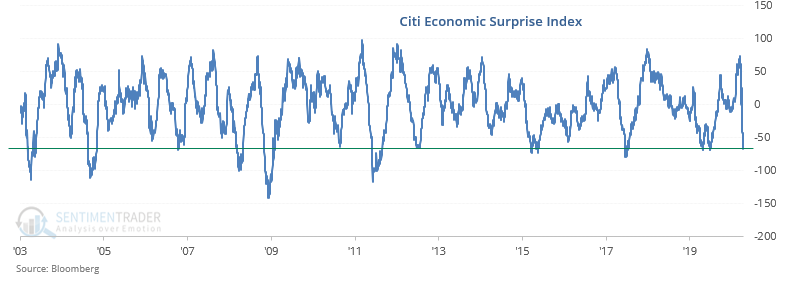

Meanwhile, a string of horrid economic reports has pushed the Citi Economic Surprise Index to extremely low levels:

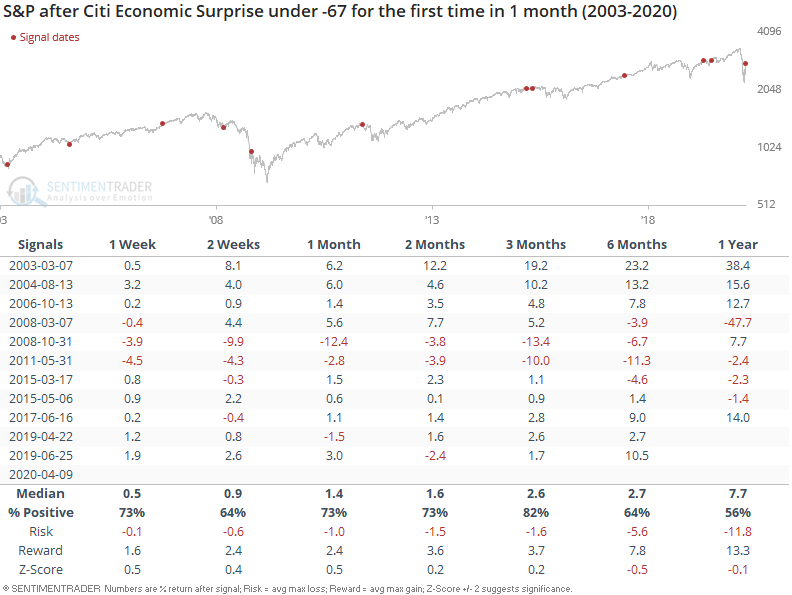

When this happened in the past, the S&P's returns over the next 3 months were usually bullish, with the exception of 2 big failures in 208 and 2011:

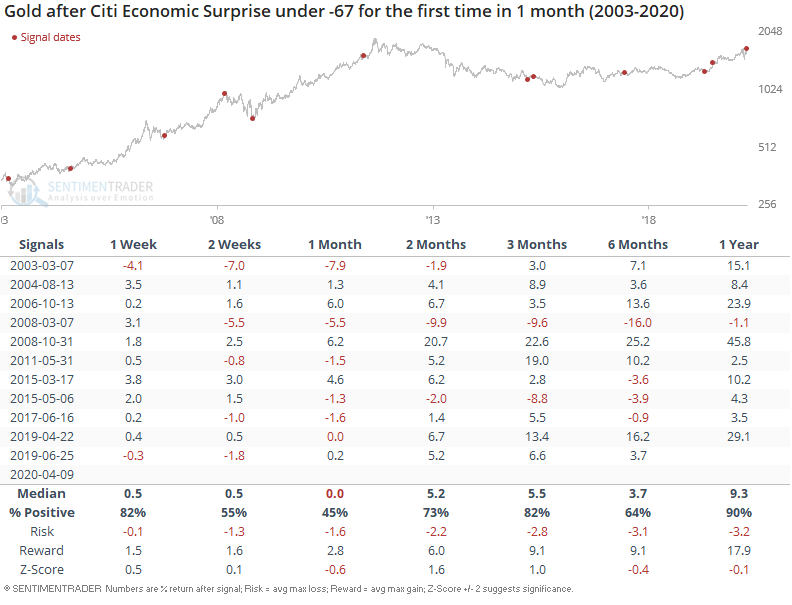

As for gold, this usually led to gains over the next year:

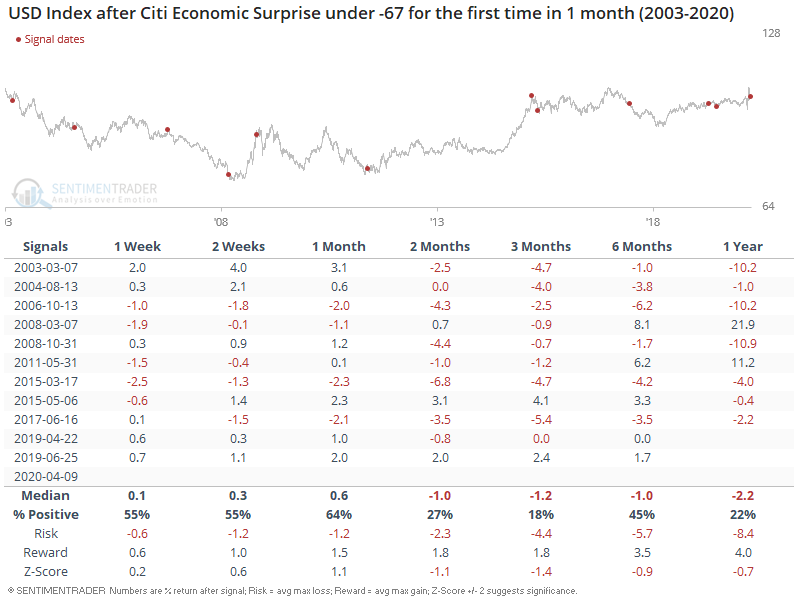

And as for the USD Index, this usually led to losses on all time frames after 1 month.

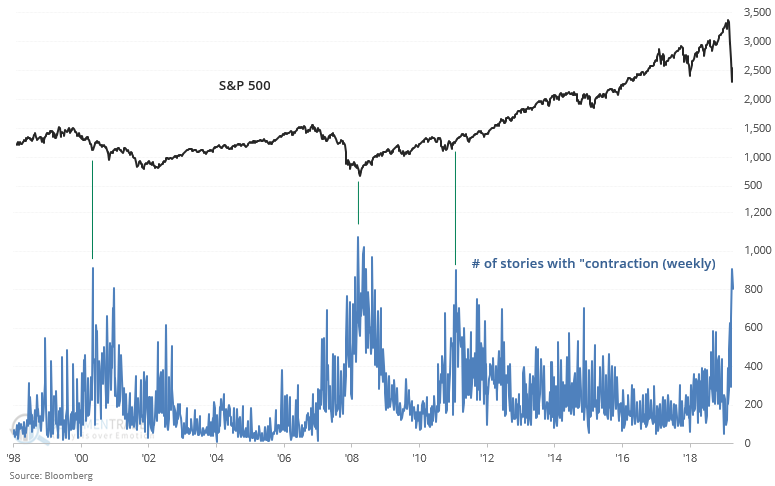

And finally, I noted a few days ago that the media is bombarding readers with bad news. I've seen forecasts saying that the economy will contract anywhere between -10% to -40%. Whether this is true or waits to be seen.

But when so many news articles were talking about "contraction" in the past, this usually led to at least a medium term rally in stocks. This happened in April 2001 as the recession was just getting under way, the bear market's bottom in 2009, and 2011 when fears of another recession spiked.

*Keep in mind that this indicator reached a peak in late-March 2020. The S&P has already rallied significantly since then.