The trend is your friend

Key points:

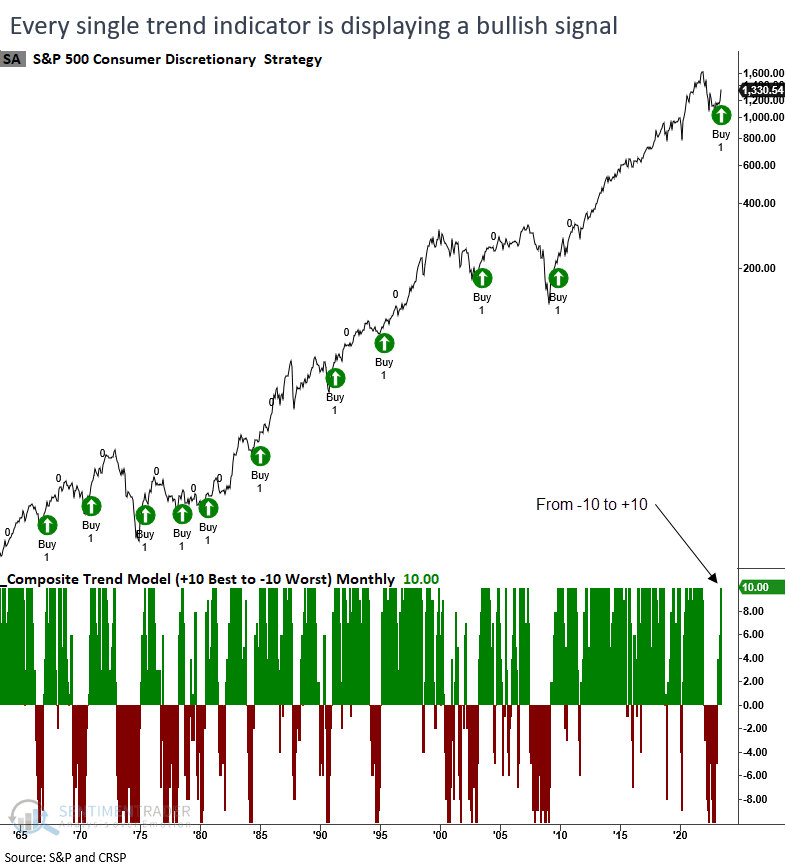

- A trend-following composite cycled from -10 to +10, triggering a bullish signal for the Discretionary sector

- The same composite applied to the Industrials sector also registered a trend change reversal signal

- Similar shifts in the trend-following composite led to above average returns for both sectors

Trend-following indicators are shifting to a bullish position

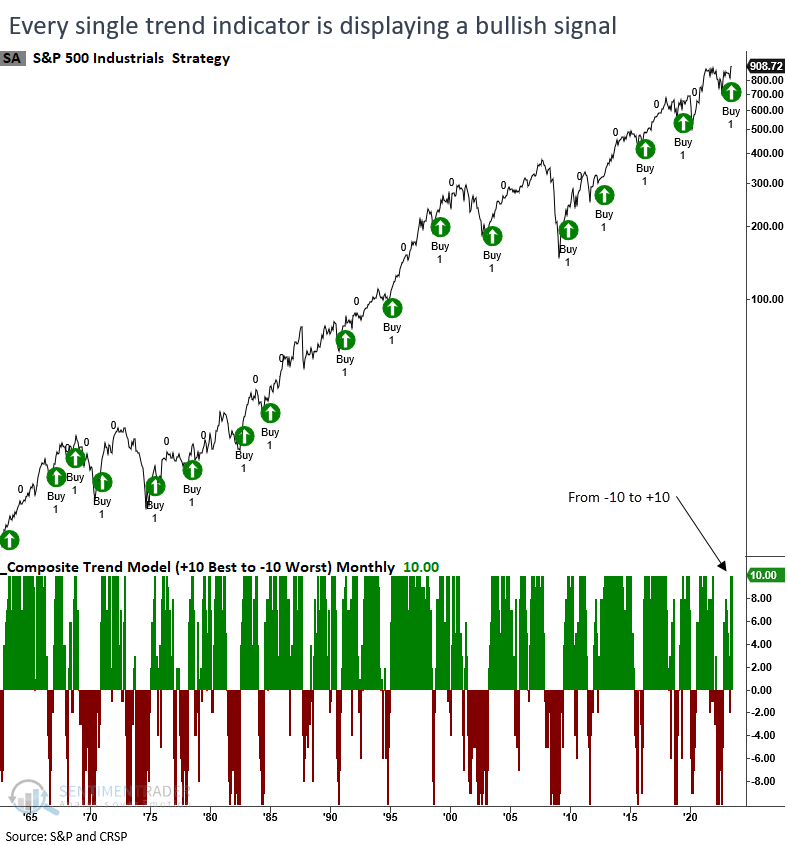

In a recent report, I highlighted a significant trend change reversal for the S&P 500, as indicated by a trend-following composite that ranges from a score of -10, worst, to +10, best. The system, a TCTM Composite Confirmation Model member, can be applied to any security to evaluate the strength or weakness of a trend based on ten indicators with varying durations.

With June coming to a close, the trend composite that assesses monthly data for the Consumer Discretionary and Industrials sectors completed a trend reversal signal when their respective scores cycled from -10 to +10, joining the bullish alert from S&P 500 that occurred in April.

With more and more indexes and sectors entering long-term uptrends, the weight of the evidence favors the bulls.

Composite construction

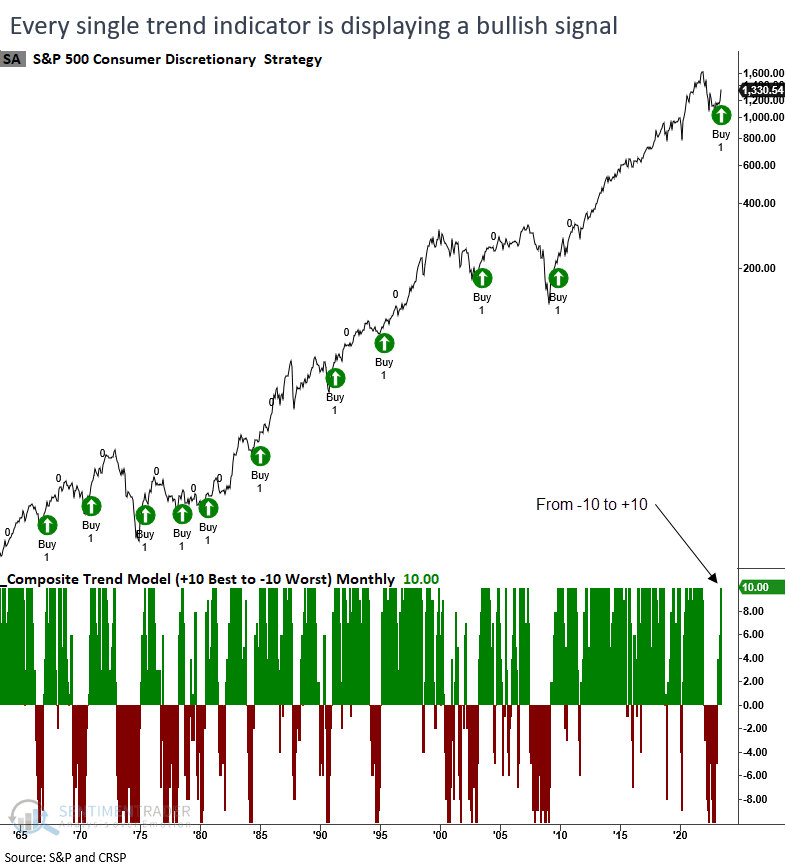

The composite assigns a score of +1 or -1 to each component in the model based on the following conditions.

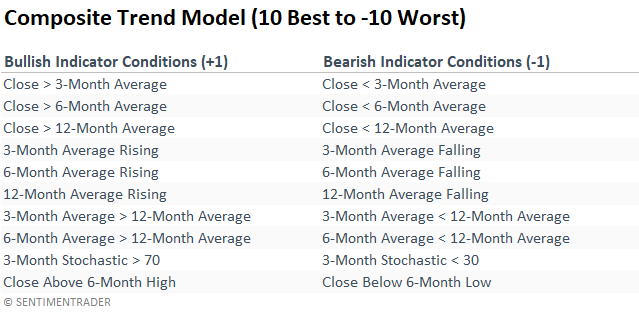

Similar composite signals preceded positive returns

When the trend-following composite cycles from -10 to +10, the Consumer Discretionary sector rallies consistently across all time frames. And despite employing monthly data, which is less timely, the results consistently outperform average historical returns over all horizons.

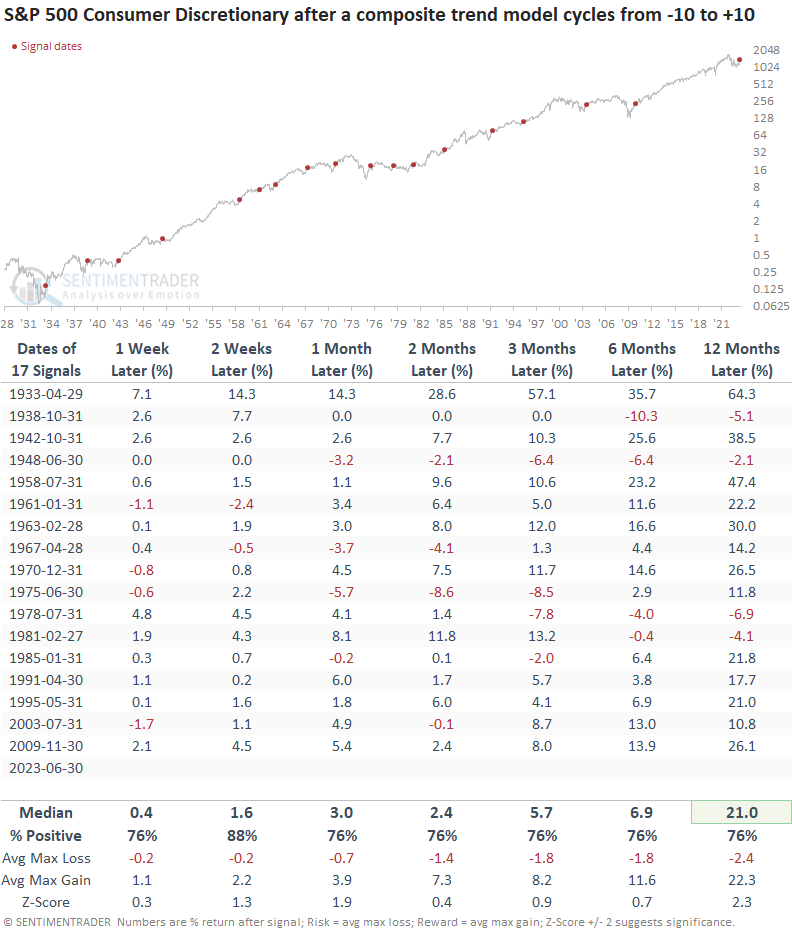

Another cyclical sector with all ten indicators in a bullish position

For only the 24th time since 1933, the Industrials sector composite trend model cycles from -10 to +10.

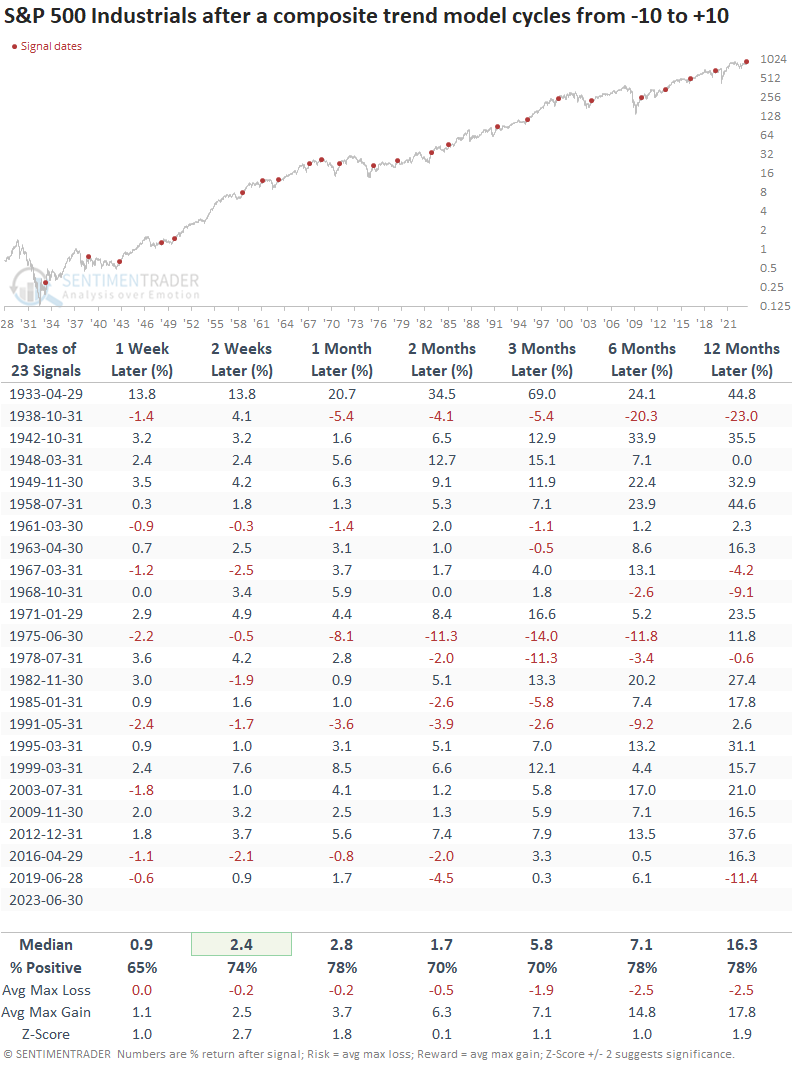

Comparable composite signals preceded positive returns

Like the Discretionary sector, the Industrials tend to trend upward across all time frames consistently. Although the sector outperformed historical averages in terms of returns, it experienced slightly more substantial drawdowns compared to the Discretionary group.

Other recent trend reversals

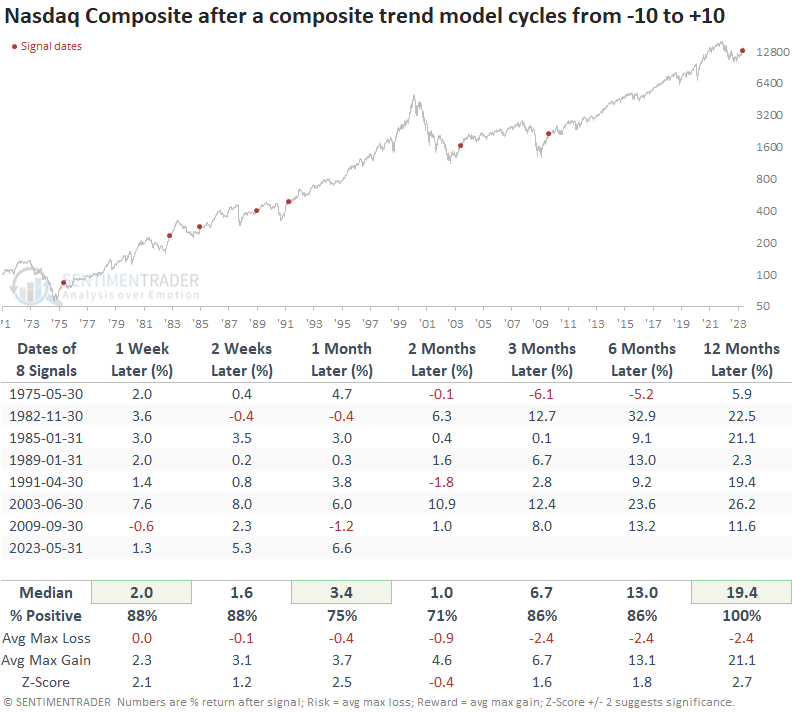

The Nasdaq Composite triggered its 9th composite reversal signal since 1975 at the end of May. Up to this point, that alert demonstrates the highest return after one month when evaluating results relative to historical outcomes. After similar precedents, the Nasdaq Composite was higher a year later every time.

What the research tells us...

The emerging uptrend for indexes and sectors continues to gather steam, with the Consumer Discretionary and Industrials sectors joining the S&P 500 on a long-term composite trend model buy signal. Similar precedents resulted in solid returns and an above-average outlook relative to history for both groups. Other trend change alerts in the last few months include the Nasdaq Composite, S&P 500 Technology, and Nasdaq 100.

Remember the following, "The trend is your friend until the end when it bends." - Ed Seykota