The transportation sector may be set to move

Key points:

- Several months ago, Optix on IYT reversed from a low level

- Historically this setup has been followed by several months of churning followed by a strong rally

- We have entered the period when transports could rally strongly

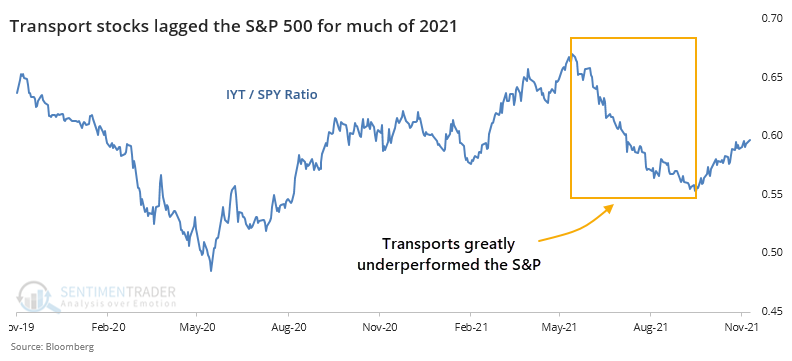

IYT underperforms, then reverses

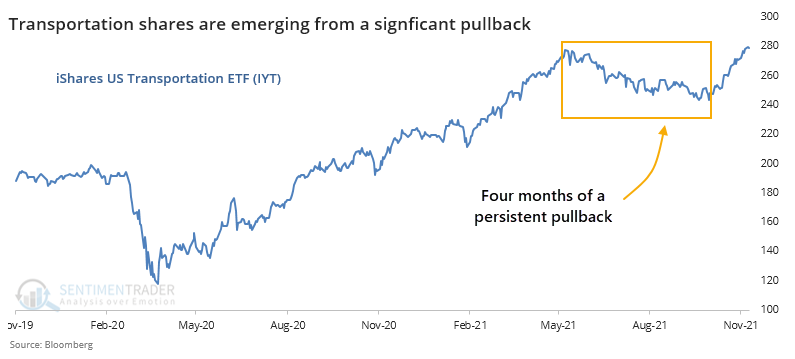

In mid-2021, the transportation sector experienced a significant pullback while the major market indexes made a series of new highs. The chart below shows how the iShares Transportation Average ETF (IYT) has finally rebounded after 4 months mired in a pullback.

The IYT fund greatly underperformed the broader market from spring through the fall. The ratio between IYT and SPY plunged from May through September.

The subsequent powerful reversal in IYT may have set the stage for an even further advance. Let's consider the history of this setup.

IYT Optix improvement led to an 86% win rate

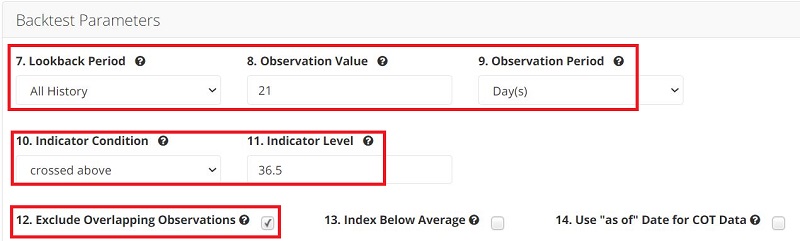

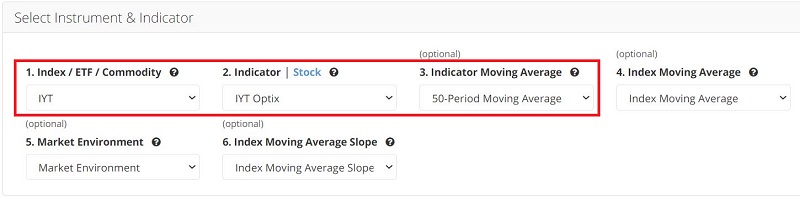

We will examine when the 50-day moving average for IYT Optix crosses above 36.5 for the first time in 21 days. You can run this test by clicking here. The input settings appear below.

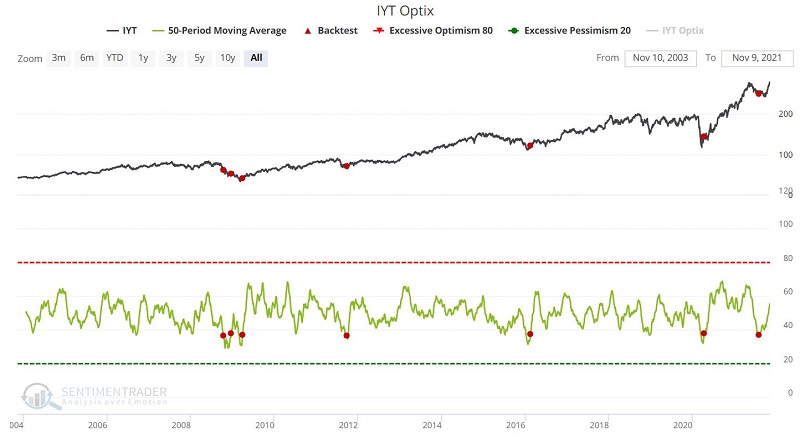

The chart below displays the output screen for the test above.

The returns following previous signals show that IYT rebounded over the next couple of weeks 86% of the time. Over the next year, it averaged a median return of more than 27%.

If we dig a little deeper, we find that the most reliable and powerful period for returns begins 3 months after a signal.

The table below displays the cumulative return for IYT during the 9-month period extending from 3 months after each signal through 12 months after each signal.

The sample size is relatively small, which is a concern. Nevertheless, the median return for the 9-month period starting 3 months after a signal is a robust +32.1%.

The favorable 9-month period following the most recent signal on August 5 began on November 5 and extends through August 5 of next year. Even though IYT has already rallied in recent weeks, this suggests there is more to go.

What the research shows…

A washout in sentiment for the transportation sector typically sets the stage for a powerful advance once the market has had some time to turn the tide. The IYT fund is facing a significant resistance level, but if it manages to break out again, history suggests it may be a move worth climbing aboard.