The surge in agricultural commodities suggests higher food prices

Key points:

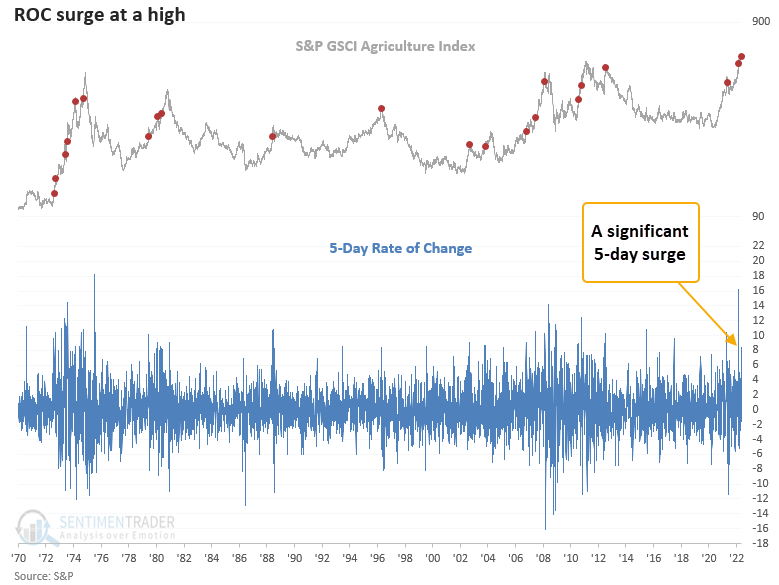

- An index of agricultural commodities surged 8% over the trailing 5-day period

- At the same time, the index closed at a 252-day high

- Similar conditions preceded rising food prices, especially on a 3 & 6-month basis

Agricultural commodities are surging again

The Dollar Index is surging as the Federal Reserve has increased the benchmark fed funds rate twice and intends to raise rates even further to tame inflation. Usually, that would be an unfriendly environment for commodities. However, they continue to defy the odds, and it looks like food prices could go higher despite the record run. On Tuesday, a basket of agricultural commodities surged 8% to a new all-time high.

Let's conduct a study to assess the outlook for agricultural commodities after the 5-day rate of change surges by 8% and the index registers a 252-day high.

Agricultural commodities tend to see a cluster of short-term surges during bullish trend environments.

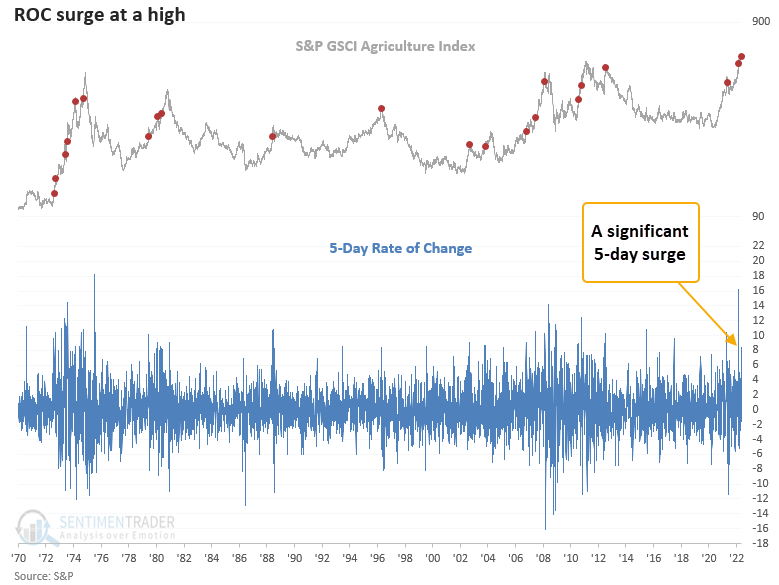

Similar momentum surges preceded positive returns

This study generated a signal 21 other times over the past 50 years. After the others, agricultural commodity returns were positive across all time frames except for the 1-week window. I suspect that was due to some digestion from the significant gains over the previous week. The 3 & 6-month time frames show solid returns, win rates, and z-scores, which means we may not get relief anytime soon for our grocery bill. 1996, 2002, and 2012 are the only instances where we saw an almost immediate price peak.

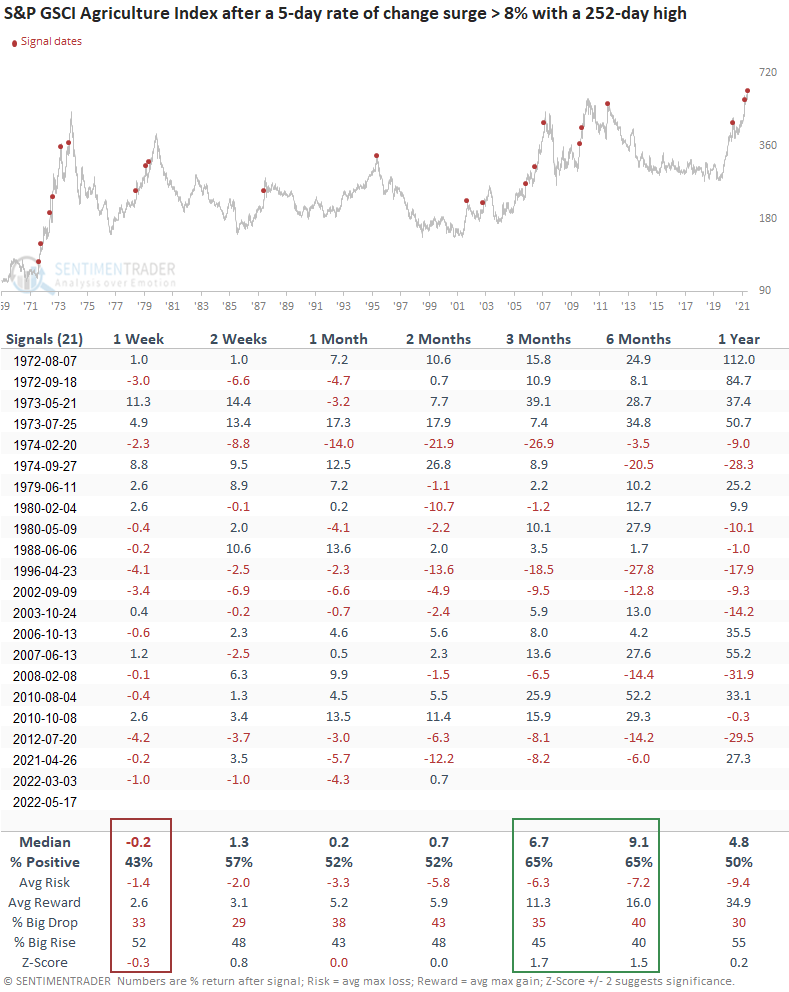

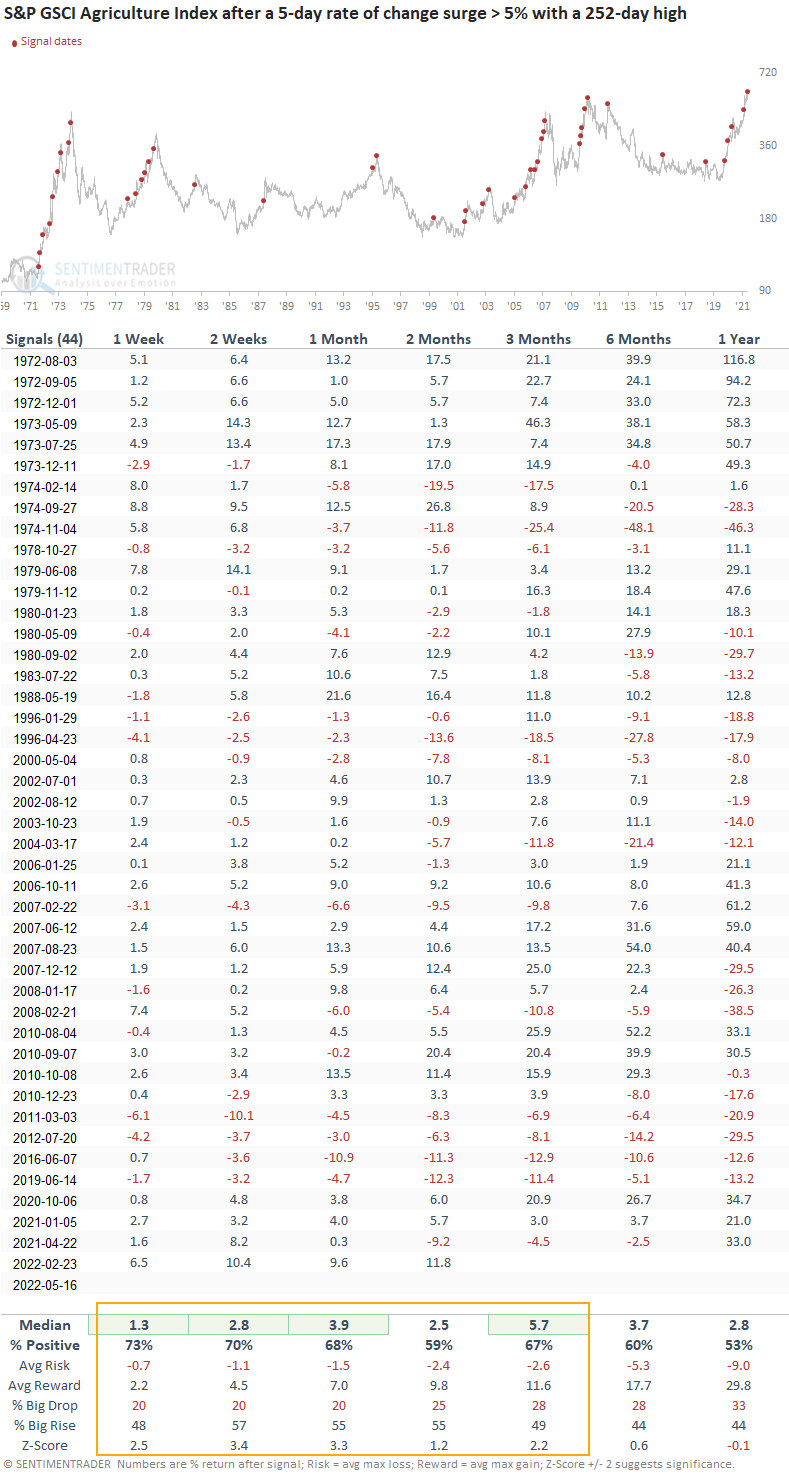

What happens if I relax the 5-day rate of change threshold from 8% to 5%

If I relax the rate of change threshold from 8% to 5% so we can assess a larger sample size, the study captures 44 signals over the last 50 years. The short and medium-term time frames look strong across all metrics. As we saw with the original research, instances in bullish trend environments tend to come in clusters. I count 5 signals since the pandemic low. As a comparison, the 1972-74 period contained 9 instances. The 6 and 12-months returns and win rates show some signs of fatigue. Eventually, the trend ends.

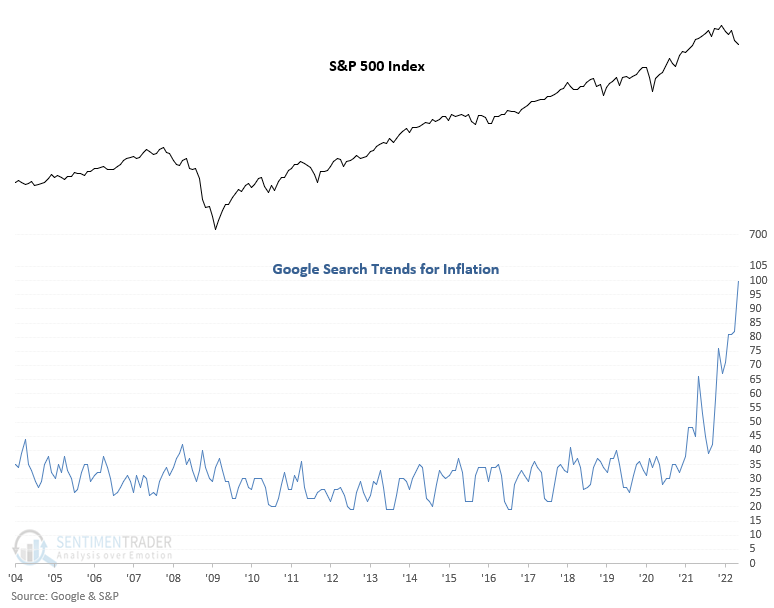

The impact of inflation is real and individuals are concerned

When I reviewed the company news function for Target (TGT) on my Bloomberg terminal this morning, the top-ranked story had the following headline. "Target plummets most since 1987 as inflation saps margins."

As has been the case all year, companies that thrive in an inflationary environment have performed the best. I don't see that changing anytime soon.

If I search for the word inflation using Google trends, I get the following chart.

What the research tells us...

When the 5-day rate of change for a basket of agricultural commodities surges by 8% and the index registers a 252-day high, the positive momentum typically leads to more positive momentum. Similar setups to what we're seeing now have preceded rising prices for agricultural commodities, especially on a 3 and 6-month basis. If I lower the threshold for the rate of change to 5%, the short and medium-term results look excellent.

While today's study provides a positive outlook for agricultural commodities, we need to remember that the Fed intends to crush inflation. I suspect the US will head toward a recession if they're successful. Commodities will most likely suffer in that environment.