The smart money hasn't done this since March

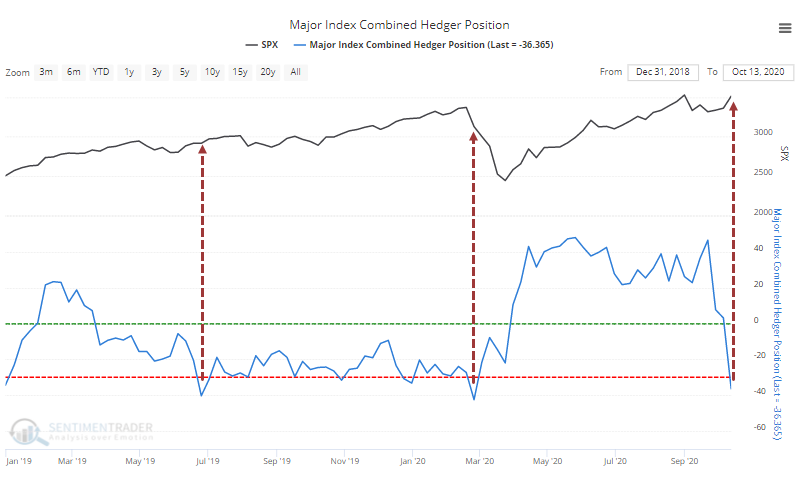

One of the inputs causing our sentiment models to become extremely positive in March, and then stay elevated into May, was the behavior of speculators in the major equity index futures contracts. They shorted heavily and remained short through much of this rally.

Commercial hedgers take the opposite sides of large and small speculators, so hedgers were curiously net long since March. Over the past decade, in particular, a large net long position by this "smart money" group has invariably been an excellent buy signal.

That changed in a drastic way in the past week. Thanks to a dramatic change in positioning in the Nasdaq 100, hedgers' positions cycled from a large net long position to a large net short one. Over the past couple of years, when their net short neared $40 billion, stocks struggled.

Historically, hedgers have established much larger shorts against stocks than they have now, so the absolute level of their exposure isn't too troubling. But when hedgers have been net long for at least 6 weeks and then flipped to a net short position, stocks have struggled over the short- to medium-term.

What else is happening

- Signals showing what happened when smart money hedgers flipped from net long to net short

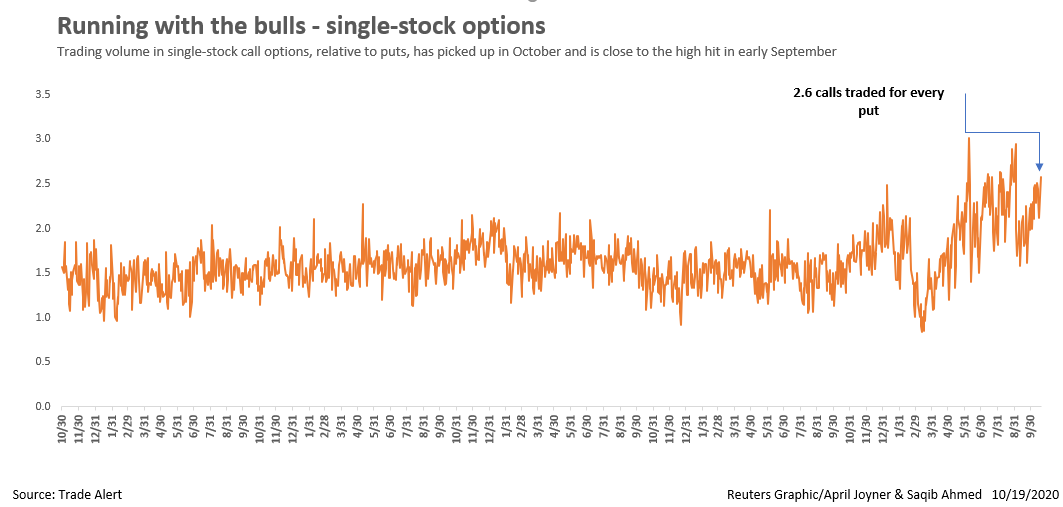

- Small options traders are becoming aggressive again

- One of our main models has hit a 6-month extreme

- Put options on the VIX are becoming more popular as its Term Structure starts to rise

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

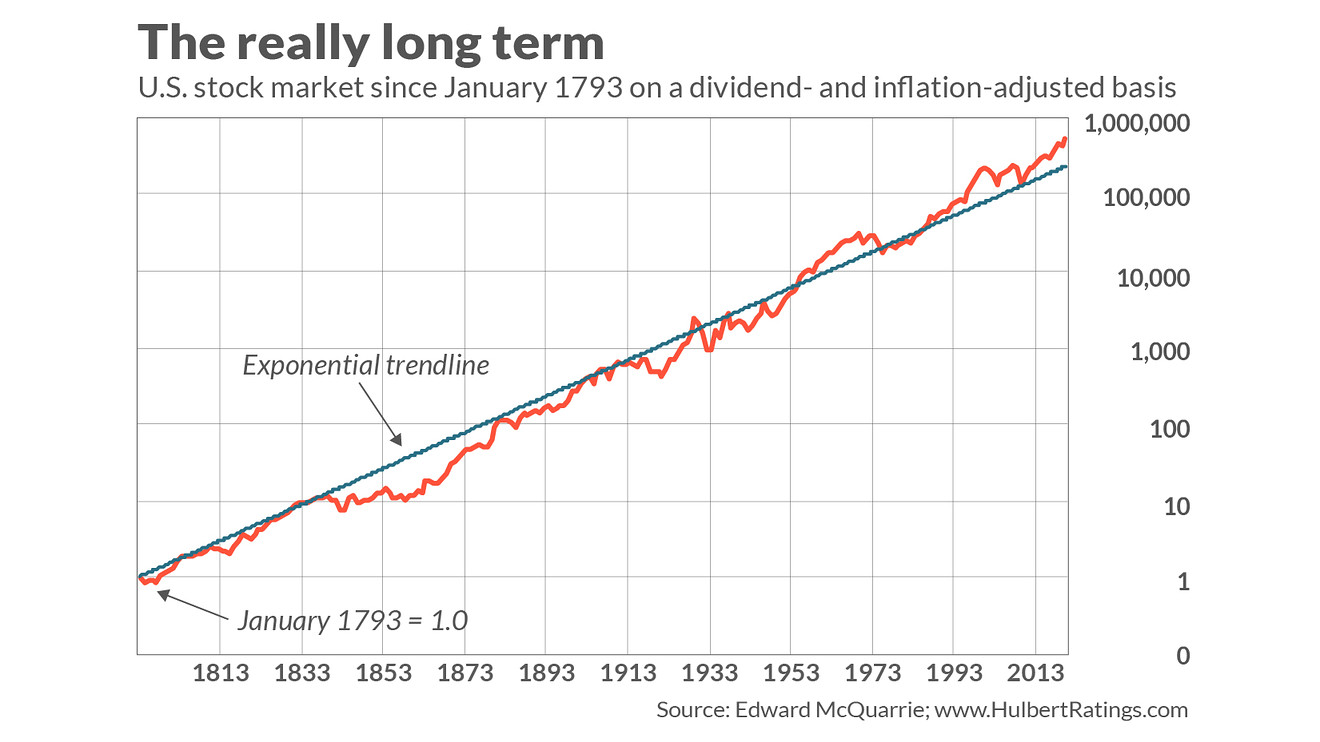

Optimistic buyers have pushed stocks too far above its 200+ year trend - MarketWatch

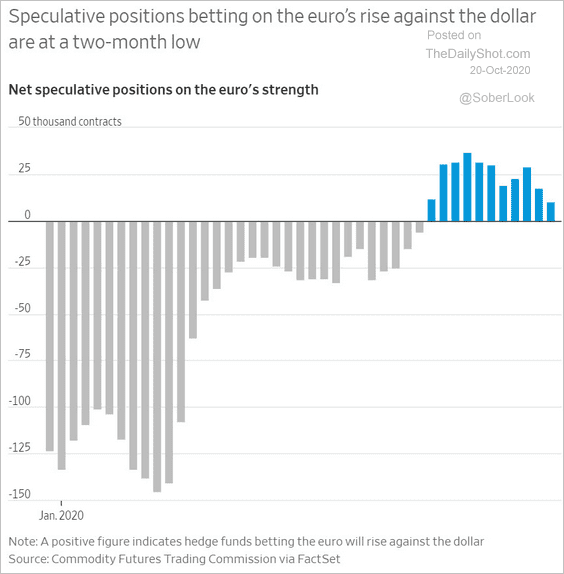

Speculators have started to ease off bets on a euro rally - WSJ

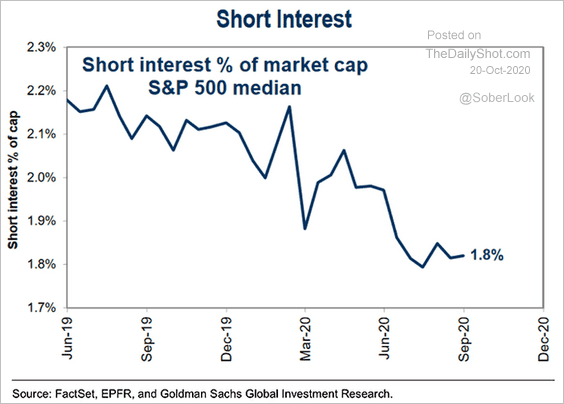

Short sellers have run for the hills - Daily Shot

Single-stock option volume remains historically high as retail traders buy "lottery tickets" - Reuters