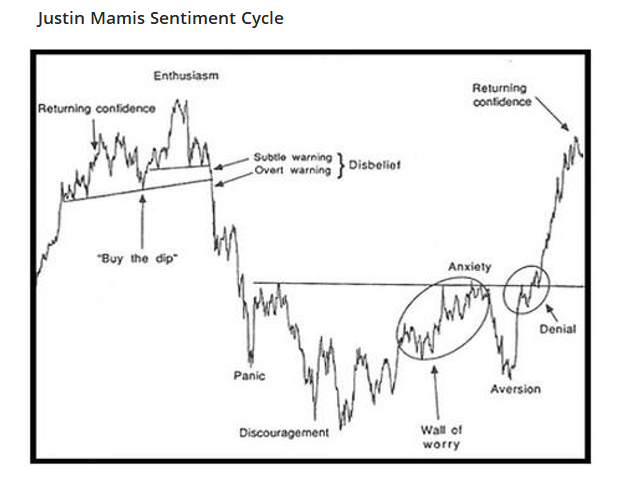

The Sentiment Cycle is showing Returning Confidence

Where are we in the typical Sentiment Cycle?

It's an important question, and one of the most-asked ones. The biggest problem with answering is that it's entirely subjective. Scroll through a recent poll by respected technician Helene Meisler and the responses are all over the place.

A popular heuristic is to use some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk.

There are essentially 4 major parts to the cycle. When we overlay that against the past 200 days, we can get a rough sense of where we might be now.

The trouble is that it's entirely subjective. To correct for that as much as we can, we took that period in history that Mr. Mamis used to create the Cycle and objectively compared it to our recent market, to see how much of a correlation we have to each part of the Cycle. It suggests Returning Confidence, but with caveats.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at the Sentiment Cycle and what kind of market behavior is typically seen

- Forward returns in the S&P 500 after every time we entered Returning Confidence

- News about job cuts continue to rise

- The Optimism Index on many overseas indexes has come down but is not yet extreme

- What happens when gold enjoys a streak like it has in recent months