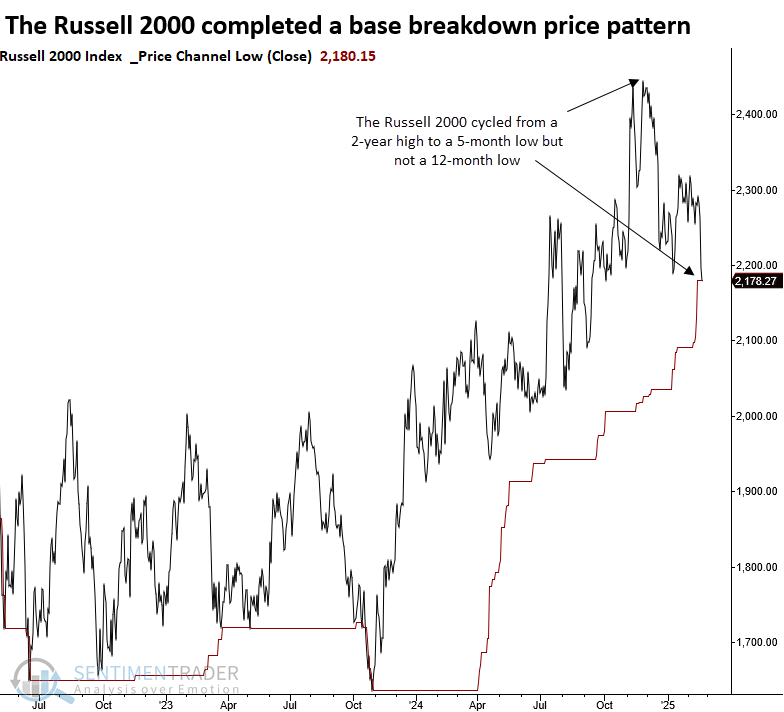

The Russell 2000 small-cap index formed a top pattern

Key points:

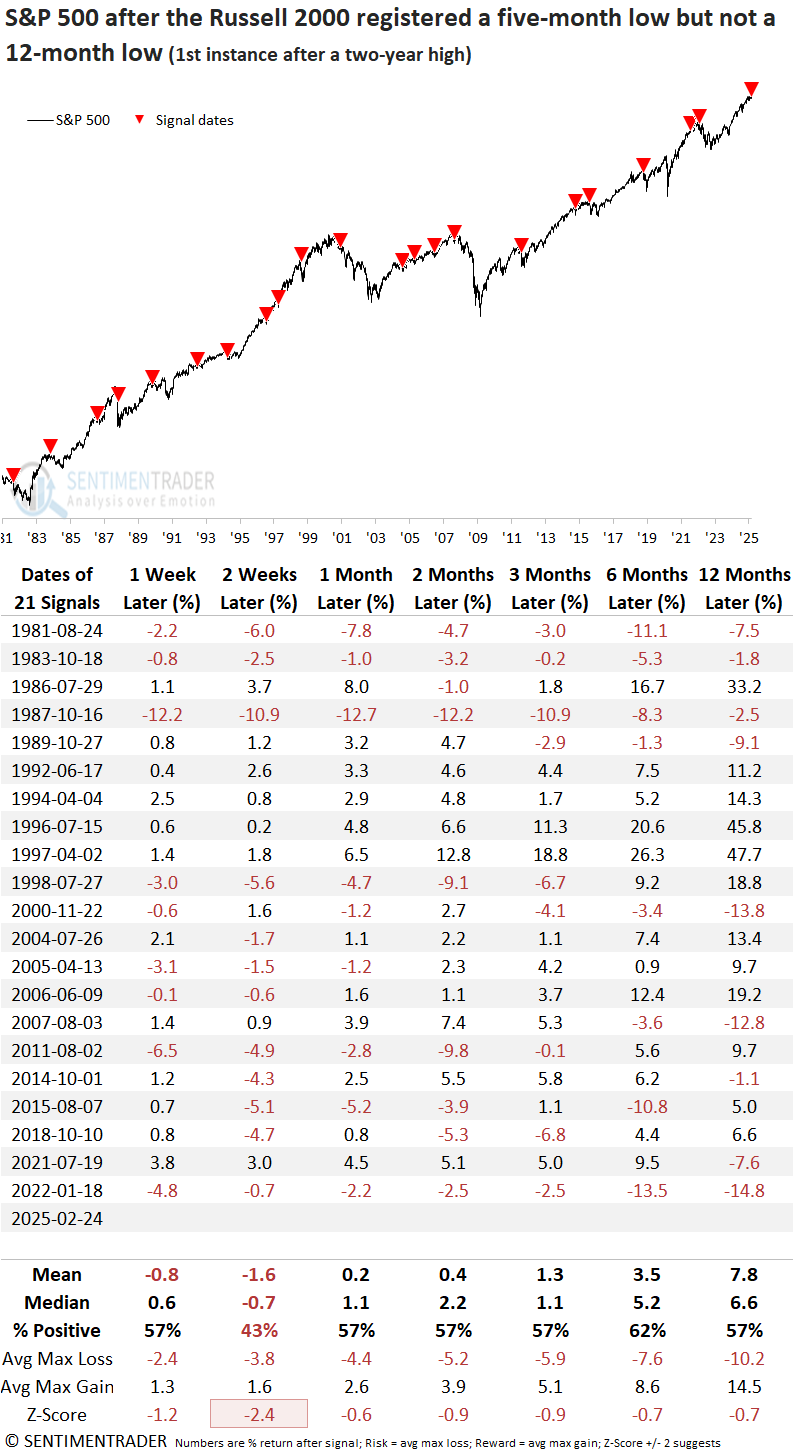

- After reaching a two-year high, the Russell 2000 closed at a five-month low but not a 12-month low

- Similar breakdowns led to near-term downside follow-through and muted long-term prospects

- The Russell's breakdown carried over to the S&P 500, which also showed near-term vulnerability

What are the economically sensitive small-cap stocks signaling?

After reaching a multi-year high, the Russell 2000's breakout proved short-lived as the index reversed lower, closing at a five-month low while avoiding a 12-month low. This price action aligns with a base breakdown pattern, which some technical analysts may interpret as a failed breakout.

While the initial decline in the small-cap index coincided with a sharp rise in the 10-year Treasury yield, it's notable that the latest downturn occurred as the 10-year benchmark fell-a scenario that would typically favor small caps unless the drop in yields signals economic weakness.

The previous instance occurred in January 2022, a less-than-ideal time to hold stocks across any market capitalization.

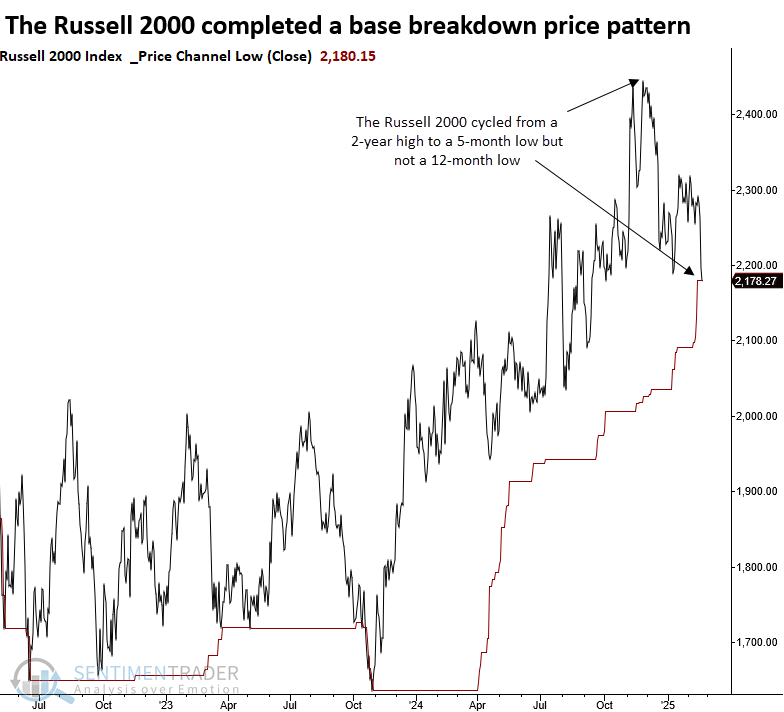

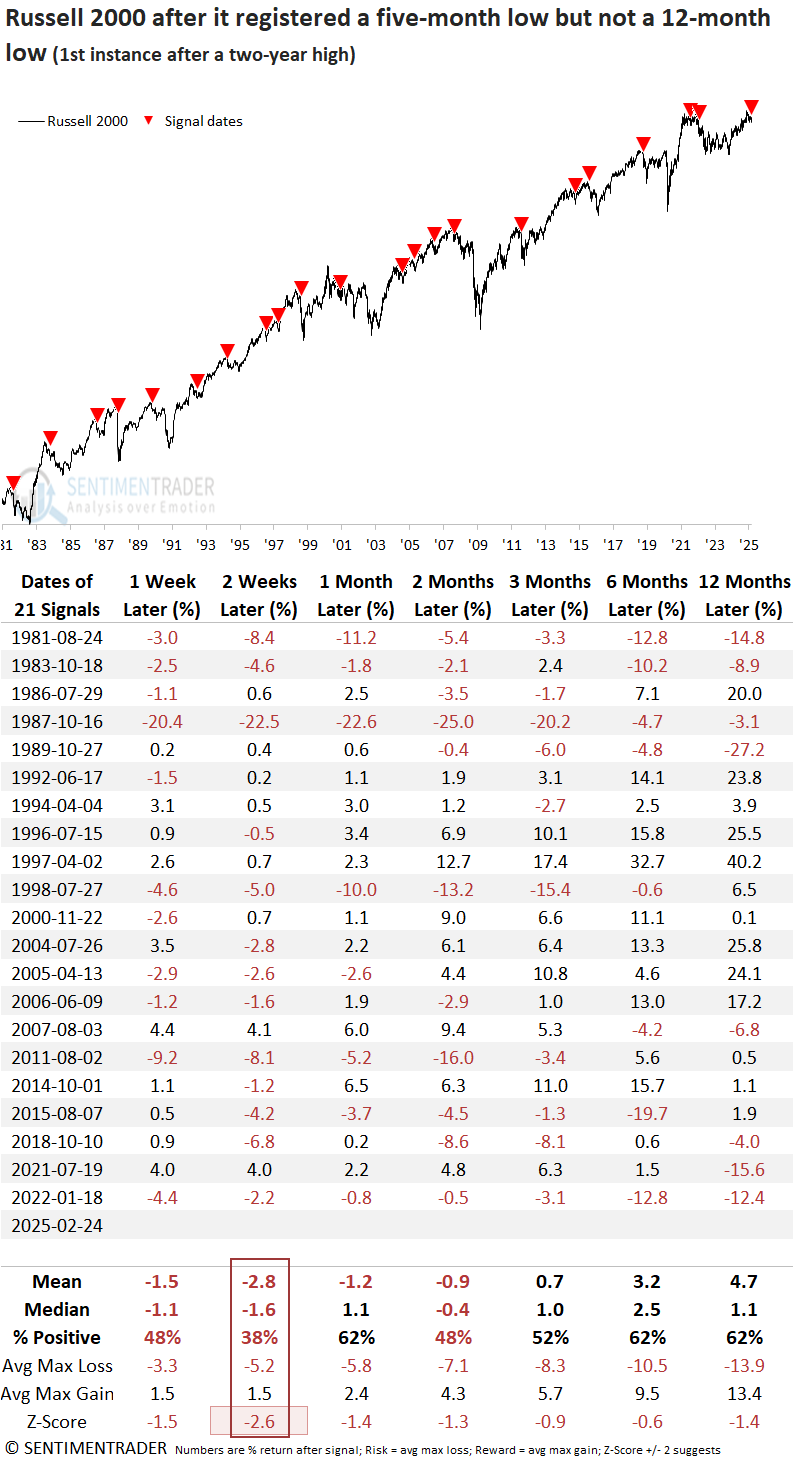

Similar breakdown patterns preceded negative returns in the near term

Whenever the Russell 2000 closed at a 5-month low, but not a 12-month low, and it was the first instance following a 2-year high, the small-cap index tended to see downside follow-through over the next few weeks. Although the outlook improved over medium and long-term horizons, it was uninspiring.

Risk exceeded reward across all time horizons except for the 12-month window, which only managed a slight positive skew.

Nearly half of the historical cases experienced a maximum loss exceeding 10% within the first six months, emphasizing the need for prudent risk management.

If the signals are applied to the S&P 500, it's clear that whatever affected small-cap stocks also created issues for large-caps, as the world's most benchmarked index struggled in initial weeks and posted rather uninspiring returns over a longer horizon.

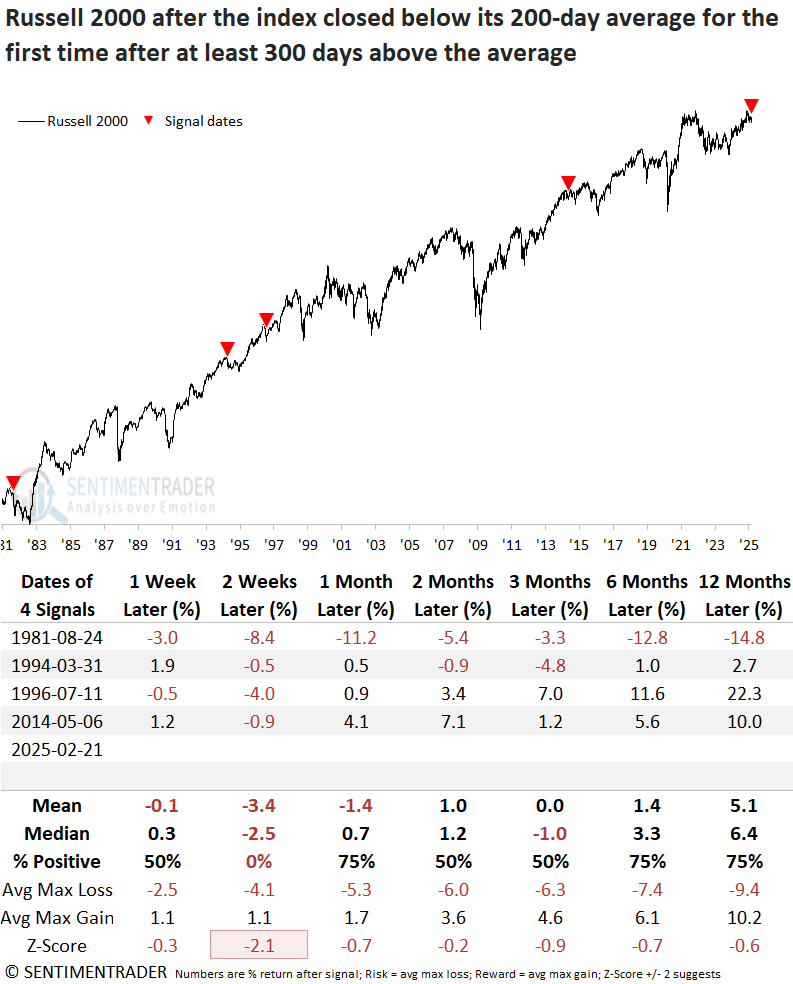

A long-term trend shift

Although the sample size is tiny, the Russell 2000's first close below its 200-day average, following a minimum 300-day streak above it, has historically signaled continued downward momentum over the subsequent two weeks, aligning with price pattern breakdown analysis.

What the research tells us...

The Russell 2000, a small-cap stock index, closed at its lowest point in five months, though it avoided recording a 12-month low. This price trend shift marks the first instance after a two-year high, completing a topping pattern. Similar breakdowns suggest continued downside momentum in the small-cap index over the near term. Furthermore, returns and consistency were subpar over longer time horizons. The adverse price action extended to the S&P 500, possibly hinting at a broader macroeconomic influence. Given small-caps' sensitivity to the business cycle, one might question what, if anything, this breakdown indicates.