The Risk-On/Off indicator shifts to risk-on status

Key points:

- The Sentimentrader Risk On/Off Indicator rose above 67%, shifting the composite to risk-on status

- Similar risk-on regimes significantly outperformed risk-off regimes

- Cyclical sectors outperformed the S&P 500, and defensive groups

A weight-of-the-evidence indicator shifts to a favorable condition for stocks

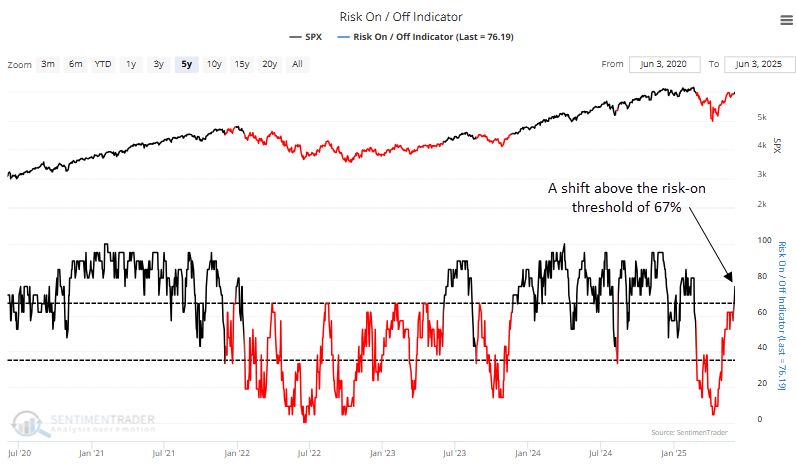

Since plunging to an extremely low reading of 4.76% on April 8th, coinciding with the bottom in major stock indexes, the SentimenTrader Risk-On/Off Indicator, a composite of 21 diverse sentiment and breadth-based measures, has steadily climbed, signaling a broad recovery in investor appetite for risk.

This persistent improvement reflects the strengthening of market internals and growing investor confidence, as indicated by sentiment-based indicators. On Monday, the composite climbed above the critical 67% threshold, marking a transition into a risk-on regime, historically associated with more favorable conditions for equity returns.

The timeliness of the most recent shift back to a risk-on status was less than ideal, primarily due to the lagging nature of slower-moving components that require time to recalibrate. This misalignment is not uncommon in V-shaped market recoveries, where the pace of rebound outstrips the ability of specific models to adjust quickly.

As shown in the table below, the Risk-On/Off indicator incorporates a wide range of sentiment and breadth-based measures designed to capture market behavior across various indexes, exchanges, and investor perspectives.

Gains were more pronounced in risk-on environments

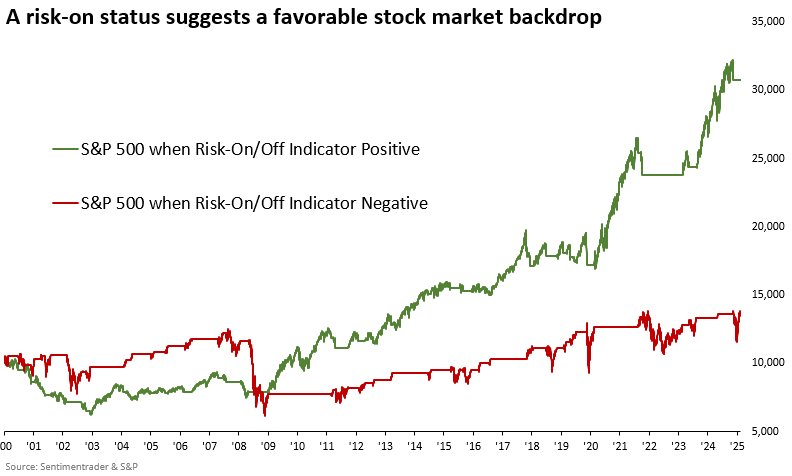

When examining a binary overlay model, such as the Risk-On/Off indicator, one way to gauge the strategy's validity is by assessing the performance of an initial capital outlay under the two market regimes. i.e., risk-on or risk-off.

A $10,000 investment in the S&P 500 grows to $30,743 when the Risk-On/Off indicator rises above 67% and stays above 35%. In contrast, if the indicator falls below 35% and remains under 67%, the investment increases to just $13,743.

Whenever the Risk-On/Off indicator cycled from below 35% to above 67%, signaling broad bullish alignment among components, the S&P 500 advanced 90% of the time over the following year with a median gain of 12%.

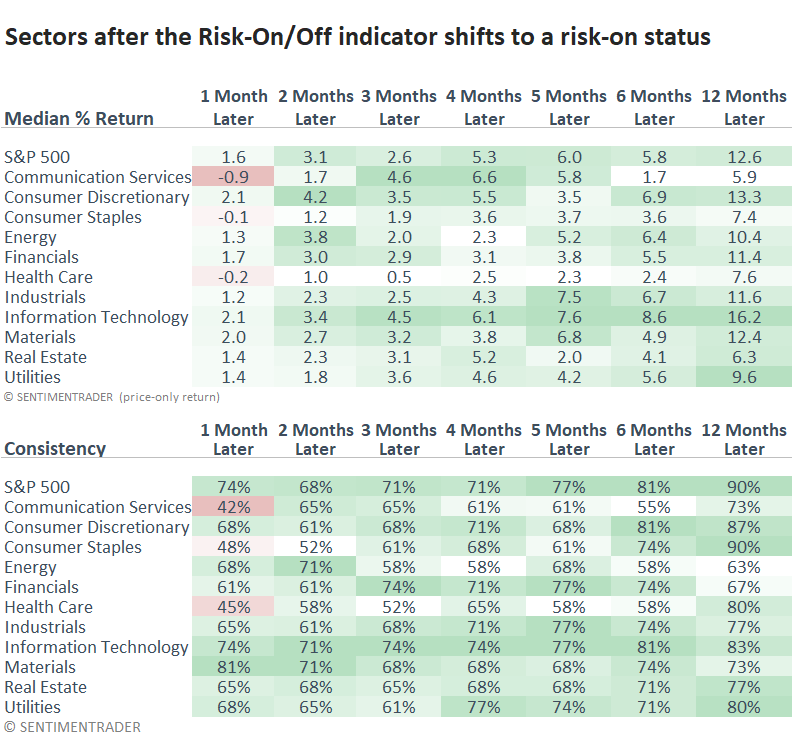

Cyclicals were the top-performing sectors, with technology emerging as the standout, outperforming the S&P 500 across all periods and achieving the highest one-year gain.

Cyclicals continue to display the highest relative ratio ranks

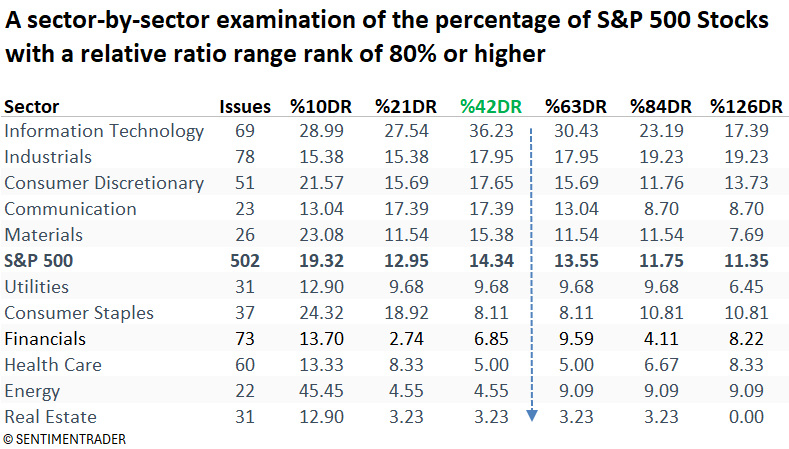

As always, it's critical to assess how historical tendencies align with current market conditions. Using our relative range rank data for S&P 500 stocks on the website's trend score page, I summarized which sectors had the highest proportion of stocks with a rank of 80% or higher across multiple durations.

The table below shows that offensive sectors, such as technology, industrials, communication services, and consumer discretionary, hold the largest share of stocks, with relative ratios hovering near the upper end of their ranges, indicating relative strength.

What does the weight of the evidence suggest?

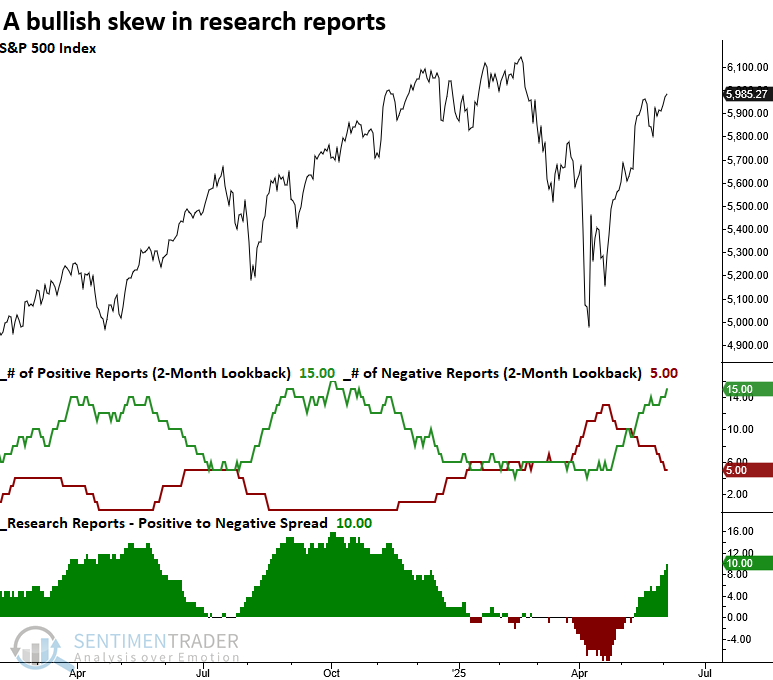

Risk-on signals continue to accumulate, with the number of positive research reports climbing to the highest level since October 2024. Consequently, investors should focus on allocating to leading sectors and stocks.

These rolling cumulative indicators compare a signal's returns and consistency to the study period results over one- to six-month horizons to determine whether a report is bullish or bearish. The indicators are exclusively based on S&P 500 signals.

What the research tells us...

The SentimenTrader Risk-On/Off indicators recently cycled from below 35% to above 67%, marking a transition into a risk-on phase for stock indexes. This shift reflects a broad improvement in market internals and investor sentiment, historically signaling a favorable environment for equities. Similar instances saw the S&P 500 rise over the following year 90% of the time, with gains often led by cyclical sectors and technology stocks in particular. This behavior underscores growing investor appetite for growth and economically sensitive areas of the market, reinforcing a constructive outlook for equities.