The Post-Election Year 'Dead Zone'

With August looming, it would seem to be a good time to highlight what I refer to as the Post-Election Year "Dead Zone." You've heard of the "Dog Days of Summer?" Well, welcome to them.

AUGUST THROUGH OCTOBER OF POST-ELECTION YEARS

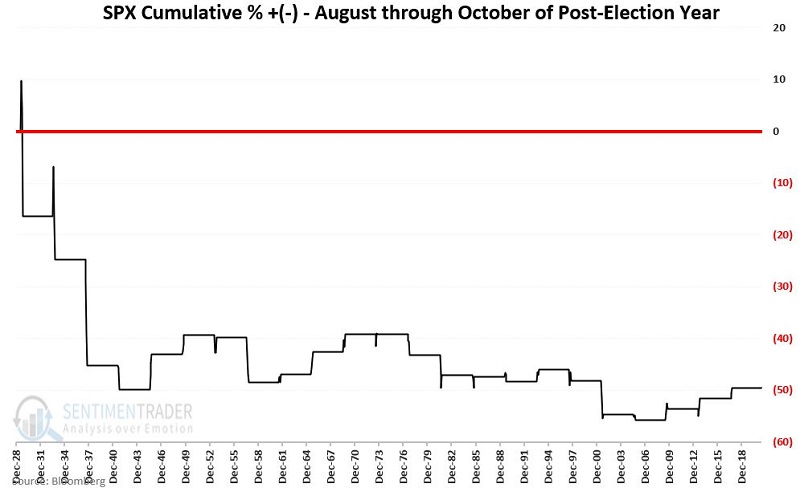

The chart below displays the cumulative % price change for the S&P 500 Index if held long ONLY during:

- August, September, and October

- Of each post-presidential election year starting in 1929

The net result is a cumulative decline of -49.5%. It should be noted that the bulk of this decline took place in 1929, 1933, 1937, and 1941 - a period which some might reasonably argue was far different from the environment today or even in the post-WWII era.

But before dismissing the "Dead Zone" theory, also note that since 1941:

- There have been 19 post-election years

- The cumulative gain for the S&P 500 Index during Aug-Oct of these 19 years is +0.73%

It doesn't get much more "dead" than that.

CYCLE-BY-CYCLE

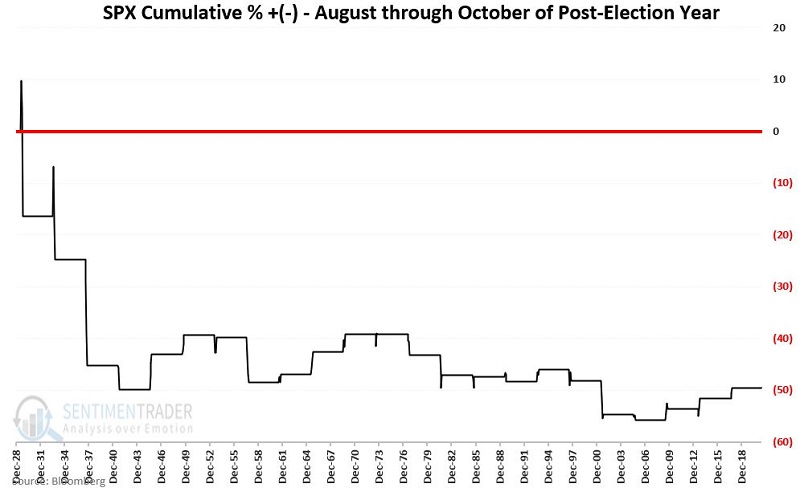

This 3-month period within each 4-year election cycle has shown:

- A gain 10 times

- A loss 13 times

- Average gain = +5.5%

- Average loss = (-8.6%)

- A gain exceeded 10% one time (+13.6% in 1945)

- A loss exceeded -10% four times (Worst was -27.2% in 1937)

The table below displays the cumulative 3-month price change for the S&P 500 during each election cycle.

One last thing to note is that the last 3 post-election years (2009, 2013, and 2017) have all seen the S&P 500 advance over +4%.

So does this mean:

- That the "curse" is broken?

- Or that the "law of averages" is about to assert itself?

Sorry folks, we will have to wait and see how the story unfolds. But at the very least, we enter August with an awareness that - IF the major stock market indexes in 2021 are EVER going to experience anything less than "Peaches and Cream," this time period is a likely candidate for when that could happen.