The next 100 days may hinge on Republicans' chances

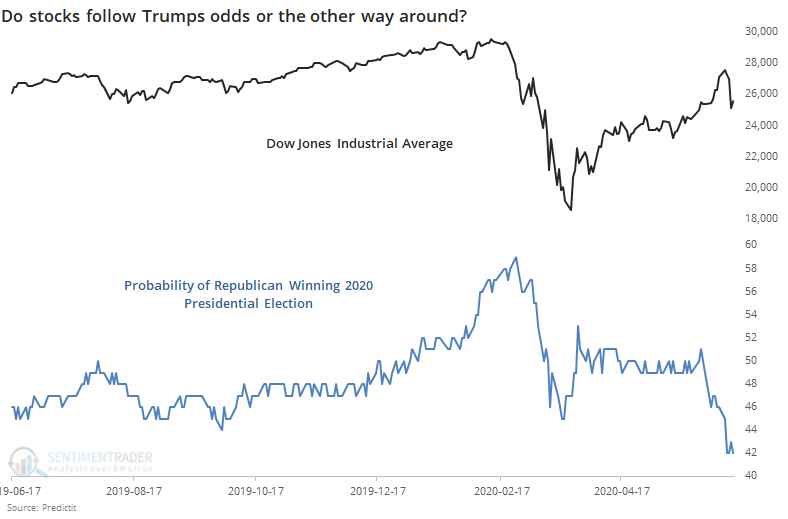

With a rise in social unrest, confusion over the pandemic response, and a highly volatile market, the probability of President Trump holding onto his office has dwindled.

Whatever one's political associations, there seems to be a clear correlation between re-election odds and the price path of the Dow Industrials.

Like any correlation, it's hard to know whether it's just happenstance, or even which one might be causing the other. Whatever the underlying cause and effect, there does seem to be a rise in anxiety among traders when approval numbers drop.

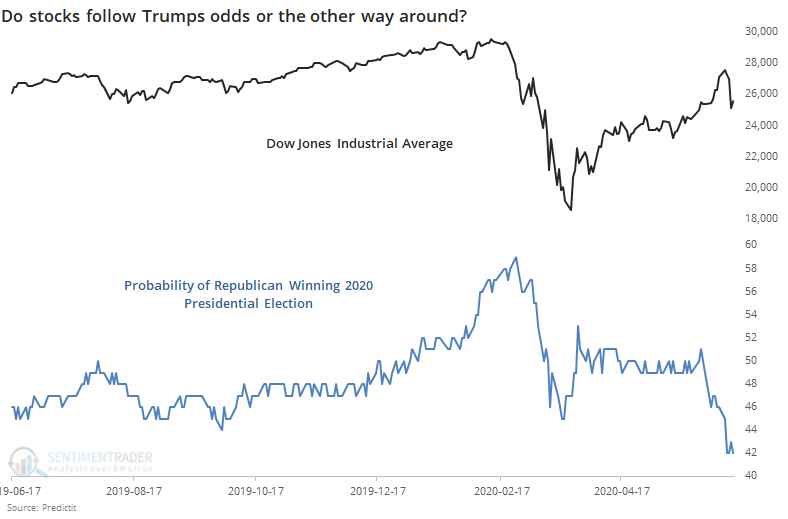

We're about 100 trading days from the election, so let's look at returns in the Dow Jones Industrial Average once we reach the 100-days-before-election mark, depending on whether an incumbent Republican wins (or loses to another Republican).

Over the next six months, roughly the time frame until the election, the Dow didn't suffer a single loss. In recent decades, its returns weren't great, but they were mostly positive or only slightly negative in the months leading up to the elections.

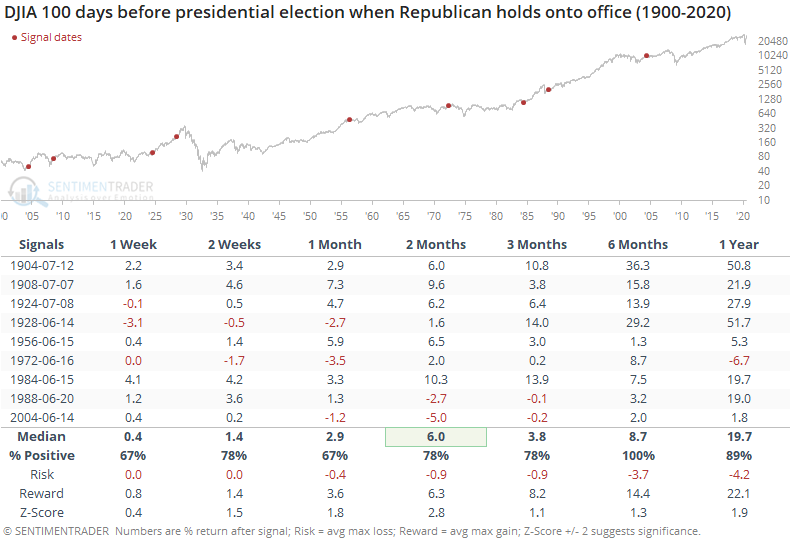

If a sitting Republican lost to a Democratic Party rival, then there was a starkly different tone.

During the summer months leading up to the election, the Dow often struggled. Over the next 1-2 months, roughly July-August, any upside was limited and the risk/reward was mostly "risk." While the Dow ended up doing very well in 1932, the others all saw negative returns over the next six months.

Based on these suggestions and the recent behavior of markets in correlation to President Trump's re-election chances, bulls should hope his probabilities improve.