The New Highs List for the S&P 500 Skews Toward Cyclical/Value Groups

New High Study

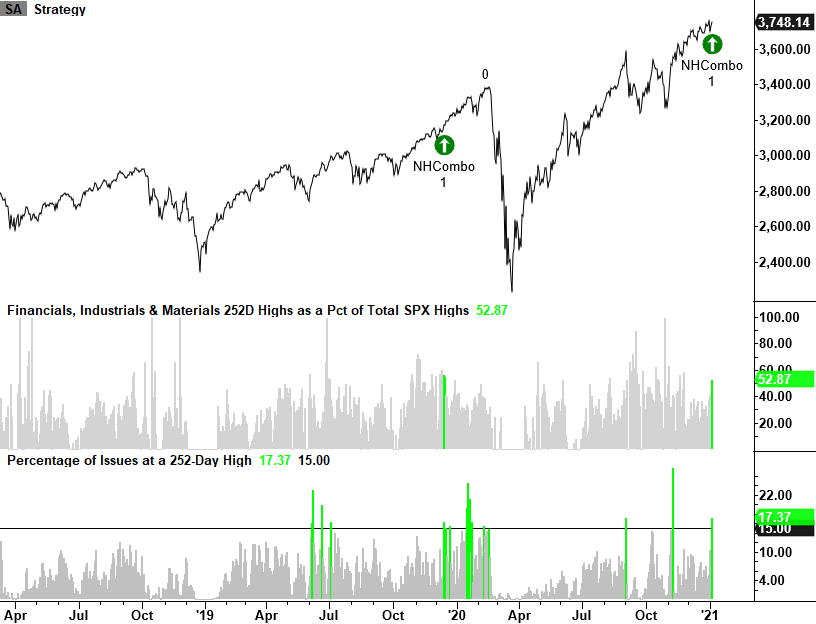

Financial, Industrial, and Material stocks accounted for 52.87% of the total new 252-day highs in the S&P 500 Index on 1/6/21. Simultaneously, the total number of S&P 500 issues registering a 252-Day high printed a level of 17.37%, according to my calculation.

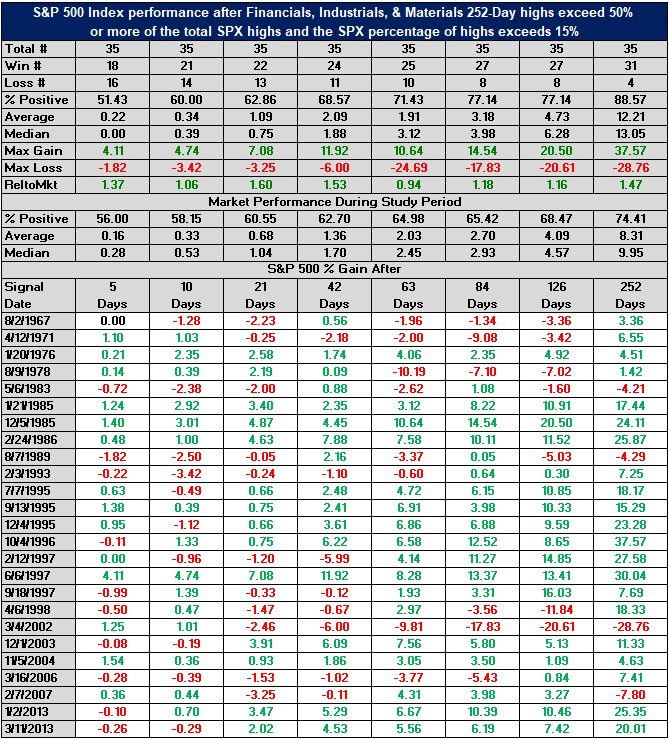

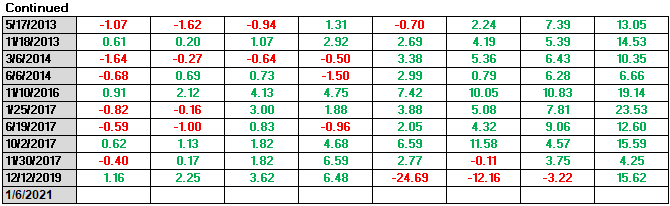

Let's conduct a study to see any impact the current scenario might have on the S&P 500 and the other associated groups. For the study, I will require the following conditions:

- Condition 1 = S&P 500 Financial, Industrial, and Material stocks >= 50% of Total S&P 500 Highs

- Condition 2 = Total S&P 500 Stocks registering a 252-Day >= 15%

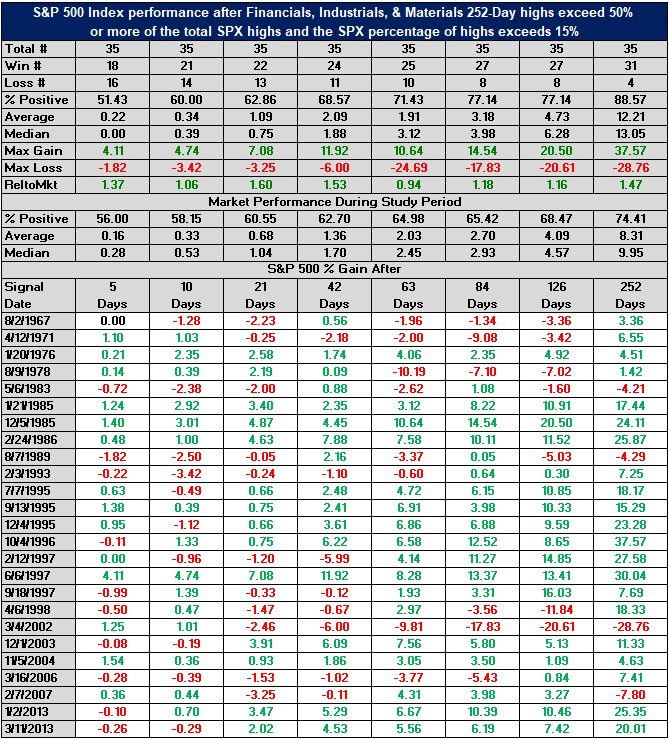

S&P 500 Performance Table

The short-term results appear to be roughly in line with historical averages and get slightly better through time.

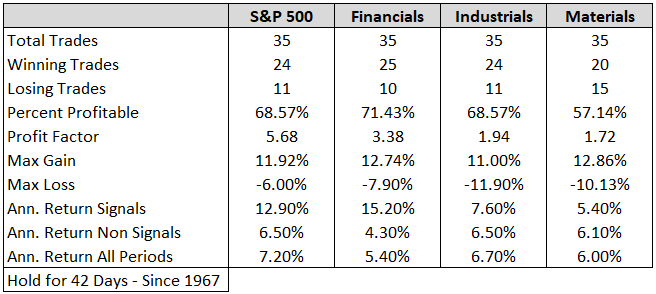

Sector Performance Table

Performance results favor Financials with an annualized return that exceeds all other groups in the study.

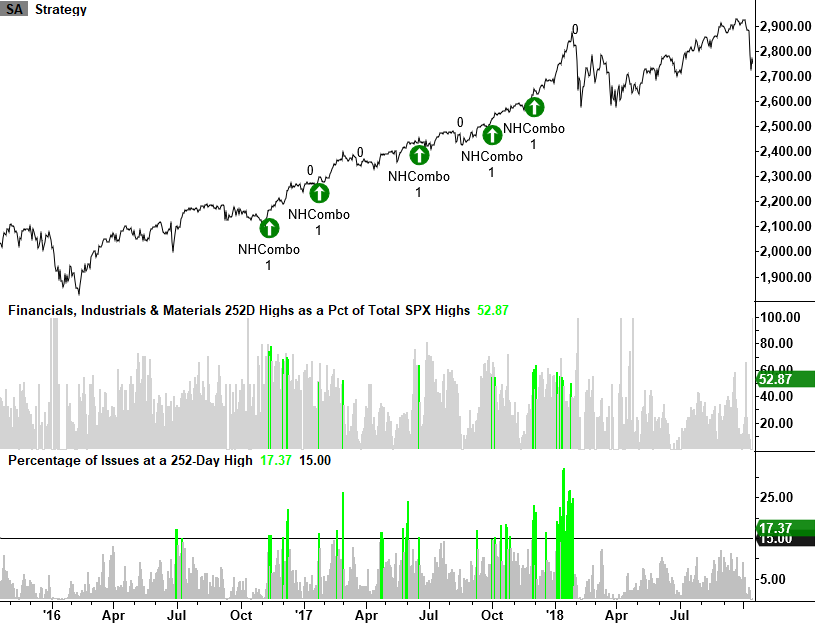

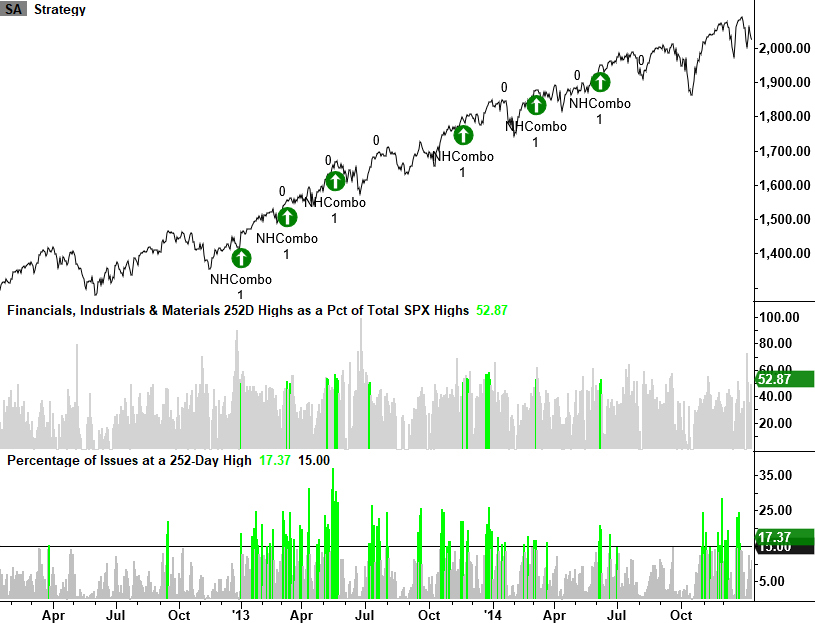

A Few Sample Charts