The Midcap Power Period

Key Points

- A specific nine trading day period near Thanksgiving has shown a tendency to be favorable for stocks

- The best performing index during this period is the S&P 400 Midcap Index

The Mid-cap power period

The period we will examine is the 9-trading day period that extends:

- From the close of the 7th to the last trading day of November

- Through the close on the 3rd trading day of December

In plain English, we are talking about being long the S&P 400 Index during the last six trading days of November plus the first three trading days of December.

For 2021, this period will extend from:

- The close on 11/19/2021

- Through the close on 12/3/2021

The history

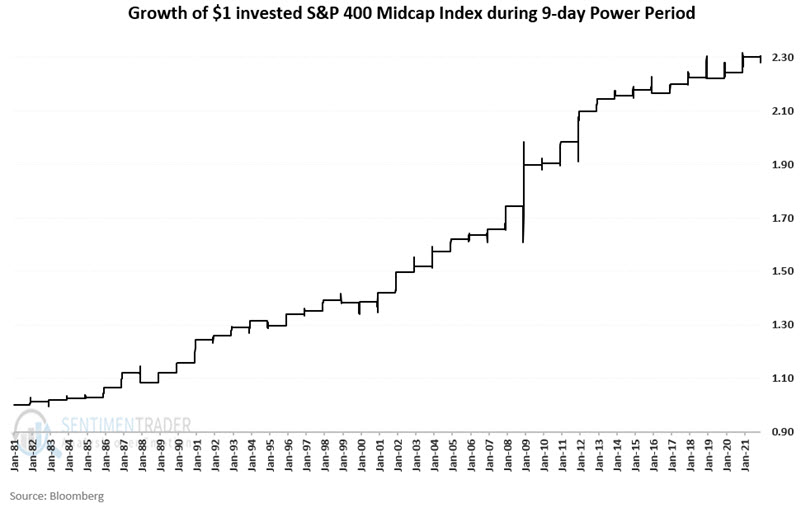

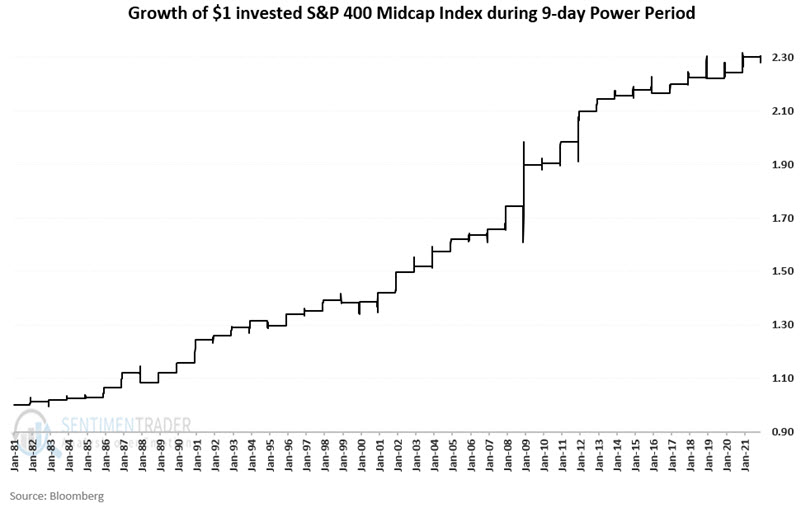

The chart below displays the cumulative growth of $1 invested in the S&P 400 Index (price-performance only) every year during the nine days described above since the index began in 1981.

The results

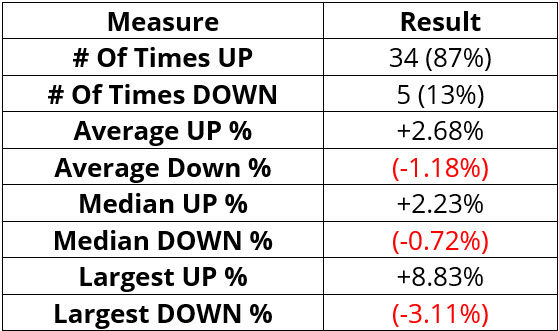

The table below displays the results of this test.

Traders can employ this strategy using ticker IJH (iShares Core S&P Mid-Cap ETF) or ticker MDY (SPDR S&P MIDCAP 400 ETF Trust) to track the S&P 400 Midcap Index.

What the research tells us…

- The "holiday effect" combined with the "month-end effect" has been a consistently powerful combination for the S&P 400 Midcap Index

- On a year-to-year basis, there is never a guarantee that this seasonal trend will see mid-cap stocks gain ground "this time around"

- But a 39-year history with 87% winning trades and a 3-1 median profit-to-loss ratio does appear to offer an "edge" that some short-term traders may find compelling