The first seasonal trend I ever learned

Key points

- Seasonal trends are best not used as a standalone indicator

- A reliable seasonal trend merely tells you "when to look where"

- One of the most ignored - and powerful - combinations is a bullish seasonal trend combined with bullish price action

- The first seasonal trend I ever read of - and dismissed and then re-embraced - remains in play

A little-known seasonal trend arguing for more

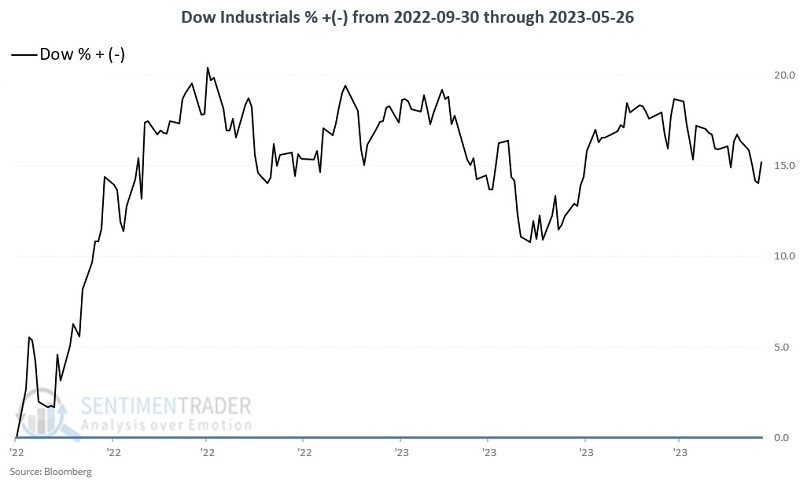

The rhetorical question is, "Can the rally that started in October 2022 continue through the end of 2025?" It sounds pretty ridiculous, I admit. And no, that is not a prediction.

Still, hear me out.

The truth is I don't remember where I first read about the seasonal trend I am about to discuss. Well, technically, I do. It was in the Des Plaines library in mid-1982, where I often spent my lunch hour digesting whatever stock market information I could find. But when I say I don't remember "where," I mean I don't remember the actual source I read about it from. That is probably partly because, at the time I read it, I thought it was the dumbest thing I'd ever read. But as a numbers geek - er, I mean, Student of the Market - I did what I always did a lot at the time - I jotted it down so I could come back later and see how it worked out.

It turns out, I'm glad I did.

The trend? (I hope you're sitting down):

- Every 20 years, the 39-month period that extends from September 30th of the Year ending in 2 (1902, 1922, 1942, etc.) through December 31st of the Year ending in 5 (1905, 1925, 1945, etc.) has been bullish for the stock market.

I know, I know. It's the dumbest thing you've ever read, right? I know because I had the exact same reaction. It's ridiculous. When I read it in mid-1982, inflation and interest rates were above 10%, the economy was mired in recession, the Dow Jones Industrial Average had spent the prior 16 years bouncing between 600 and 1,000 and seemed locked in a permanent trading range, and the leading pundits of the day were forecasting another Depression. A lot of people believed them.

The bottom line: No way was the stock market going anywhere. But, as I said, I wrote it down to review later. Then something surprising happened.

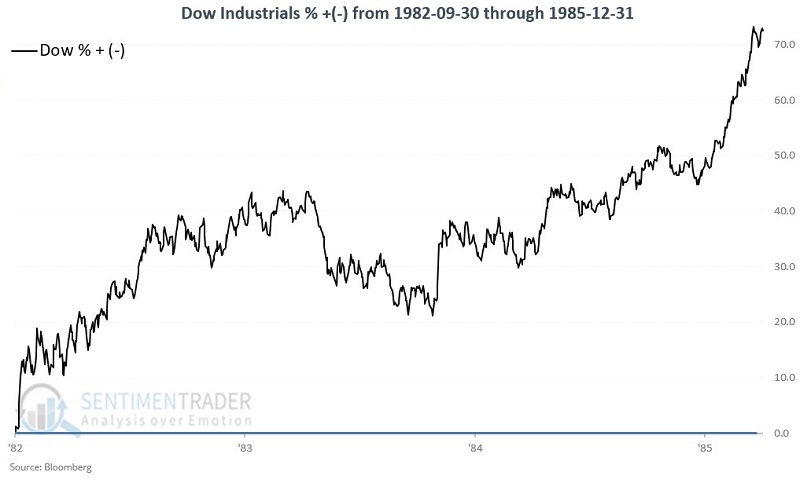

The surprise

In August 1982, the stock market shot higher. At the close on 1982-09-30, the Dow was 17% off its low at 869.25. According to conventional wisdom, there were another 100 points for it to run before it hit the "inevitable" top at 1,000. Instead, over the next seven months, the Dow advanced another 37%. To make a long story short, by 1985-12-31, the Dow closed at 1,546.48, or +72.6% higher than its September 1982 close. And coincidentally, a "seasonal analyst" was born.

The history

First, the obvious implication based on this trend is that the stock market will continue to be in a bull market through 2025-12-31. For the record, this article is not me making that prediction. At Sentimentrader, our job is not to tell people what to think or do, and our personal opinions are entirely irrelevant. Our job is simply to report as objectively as possible what we see. In this case, I am merely reporting the history. Truth be told, based on the current "state of affairs" in the market and economy, even I am not willing to follow this notion blindly and remain fully invested based solely on one seasonal trend.

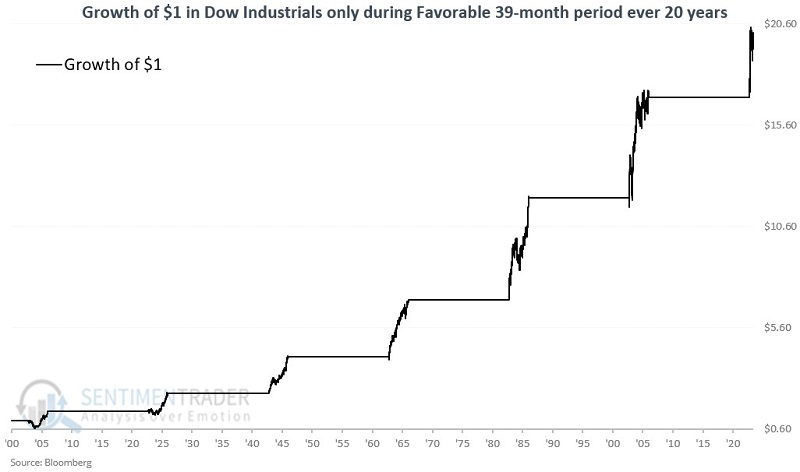

But I am willing to keep an open mind. Especially if the market is cooperating. The reason why I am willing to do so appears in the chart below displays an equity curve showing the growth of $1 invested in the Dow Jones Industrial Average only during the 39 months from the end of September of Year "2" through the end of Year "5" every 20 years starting in 1902, including the months since September 2022.

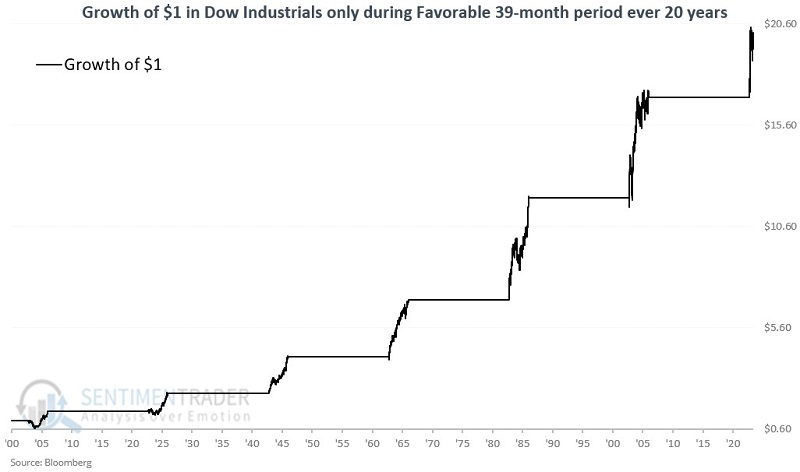

The chart below displays the same information on a logarithmic scale.

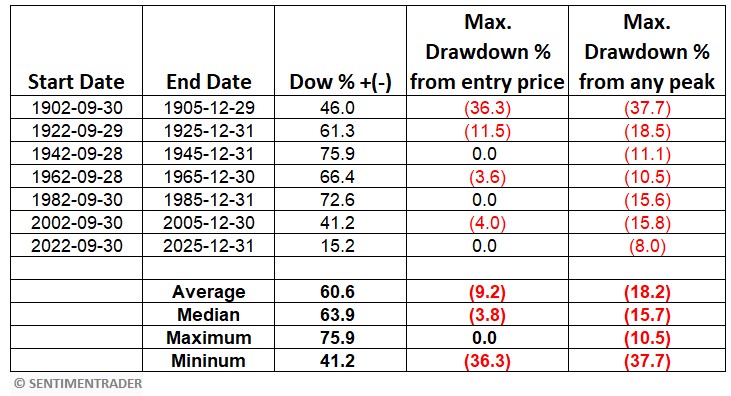

The table below summarizes the Dow's performance during this period, including results since the end of September 2022. The summary values at the bottom of the table do not include the latest period, which is only eight months old.

A closer look at history

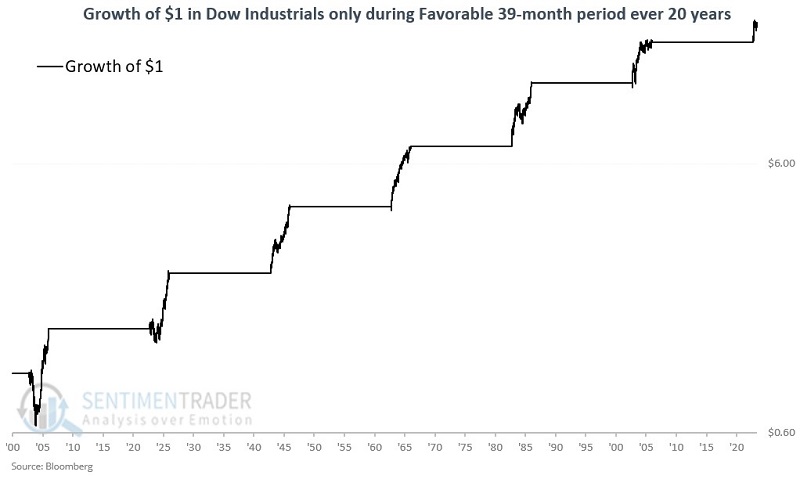

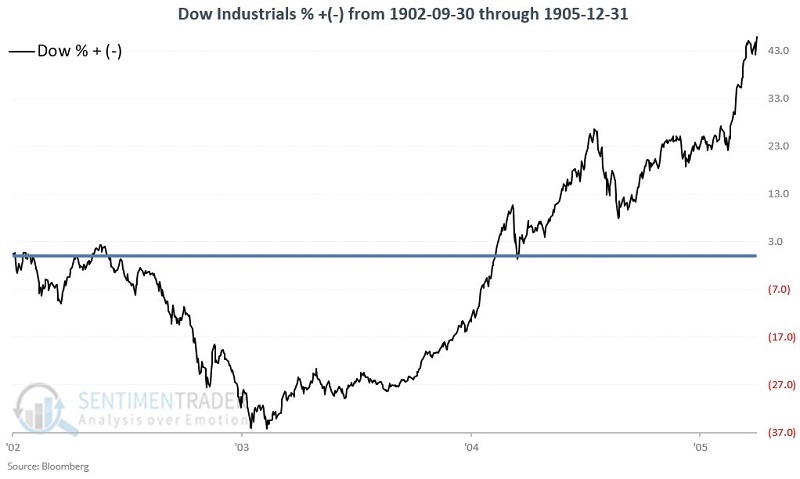

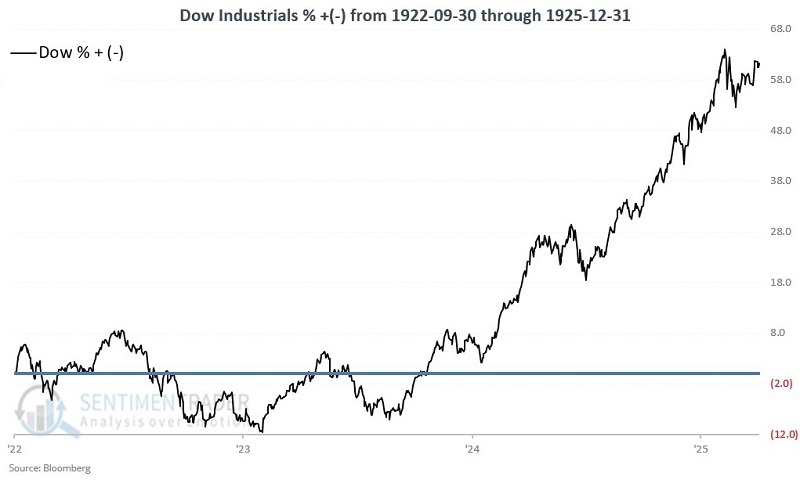

For illustrative purposes, the charts below display the growth of $1 invested in the Dow during each period listed in the table above.

What the research tells us…

Given the macroeconomic and geopolitical uncertainties swirling about the market at this exact moment, it is easy to dismiss all that appears above. On the other hand, I remember having that exact sentiment in mid-1982.

In my opinion, seasonal trends should rarely, if ever, be used as a standalone trading method. Particularly one that lasts for 39 months - a lot can happen in 39 months. But I have found that as a tool for telling you "Where to look" and "which way to lean," seasonal trends can be extremely useful. For the record, I am not "pounding the table" and insisting that the rally that began in October 2022 will continue to run.

I am also not saying that it won't.

The real lesson from the information above is this - as long as the major indexes are acting well, it may be best to ignore gloom and doom predictions and give the bullish case the benefit of the doubt.