The FAANMG rally

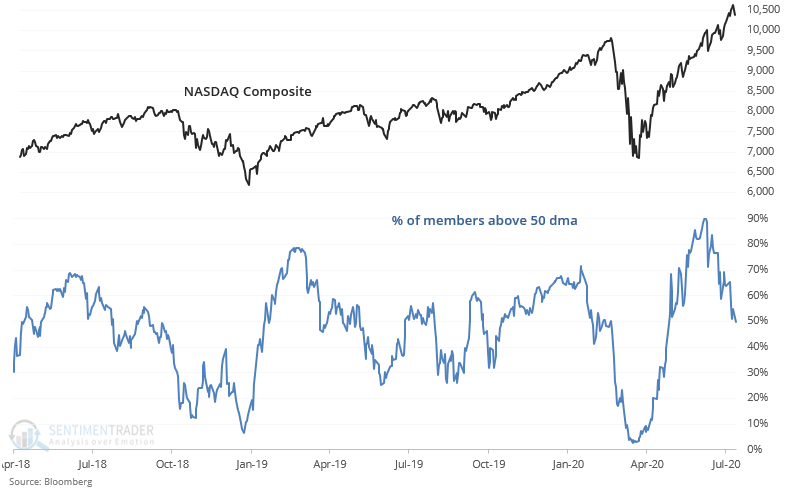

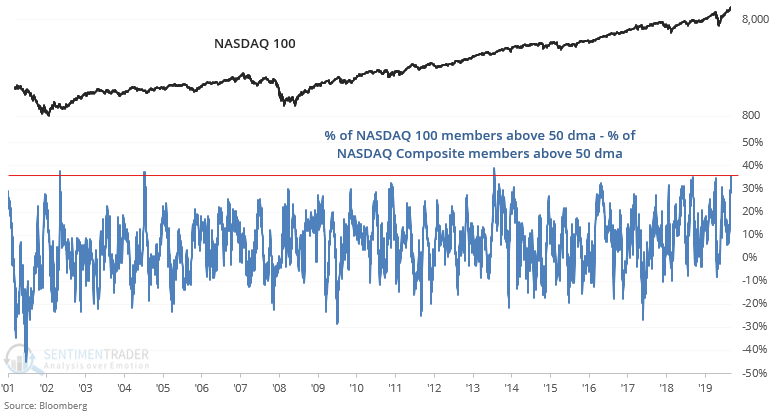

The U.S. stock market's rally over the last few weeks was led by tech stocks, and on the surface it looks like this rally could be running out of steam. As Liz Ann Sonders noted, the % of NASDAQ Composite members above their 50 dma fell below 50%, signalling a loss of these stocks' medium term moving averages.

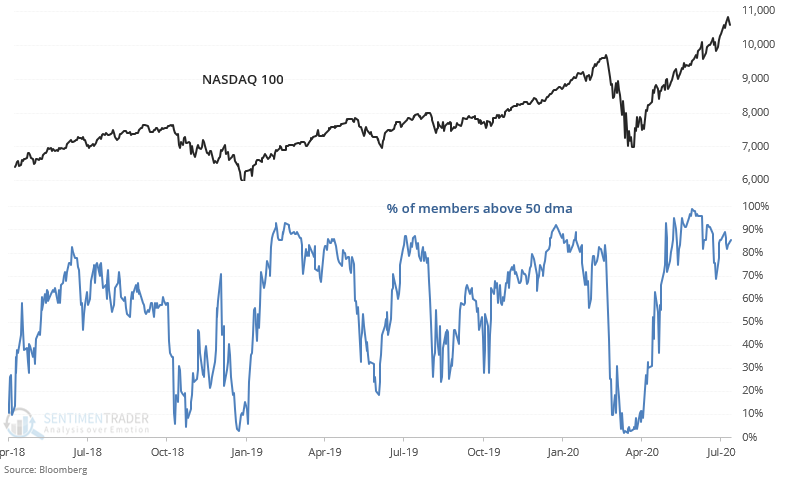

But a look at the NASDAQ 100 demonstrates that it's mostly smaller stocks that are slipping. More than 80% of the NASDAQ 100's members are still above their 50 dma:

This pushed the difference in % of NASDAQ 100 members above their 50 dma - the % of NASDAQ Composite members above their 50 dma to the highest level in years. Could this be a worrisome sign?

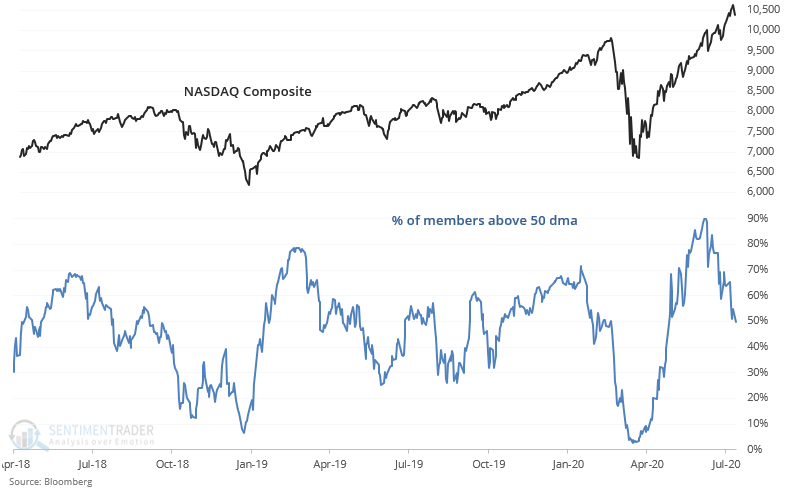

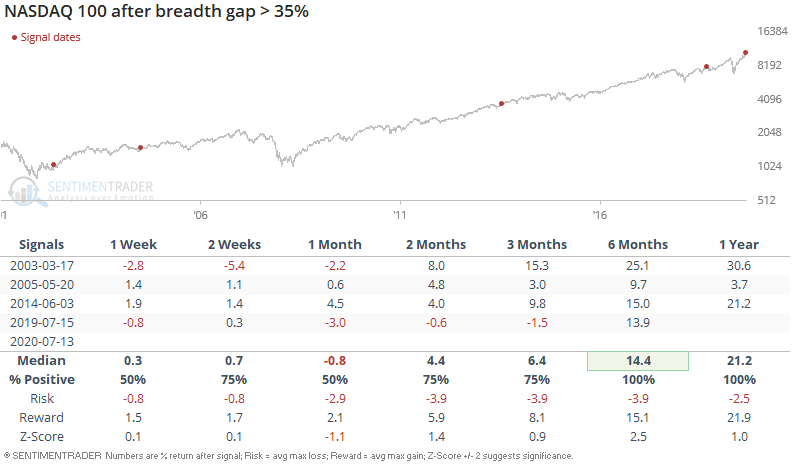

Such strong breadth divergences sometimes led to short term pullbacks, but long term this was bullish for the NASDAQ 100:

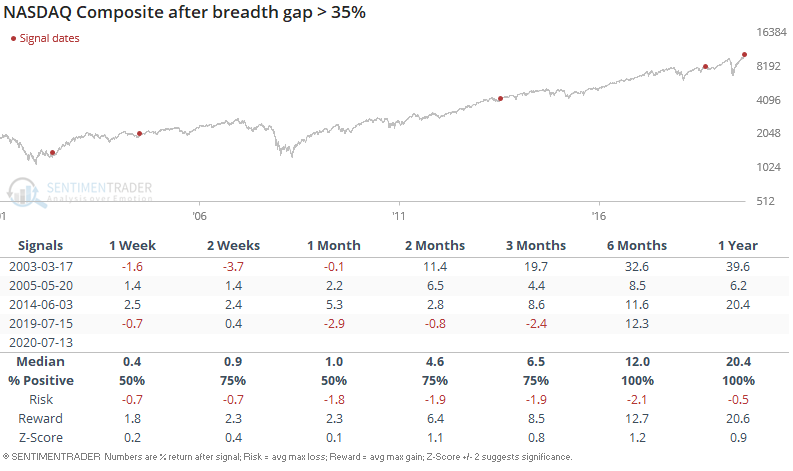

And it was also bullish for the NASDAQ Composite:

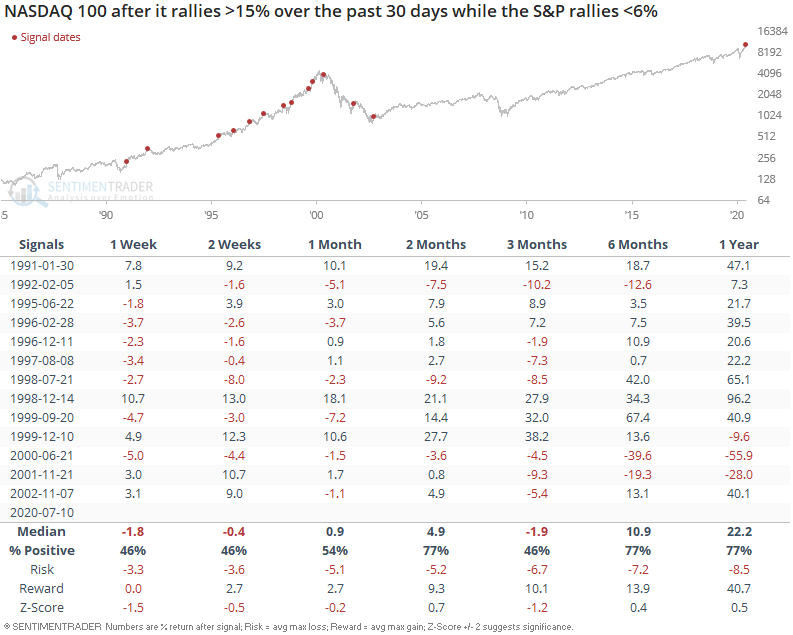

While tech speculators enjoyed strong gains over the past month, investors in a broad S&P 500 fund have had comparatively little to celebrate about. The NASDAQ surged while the S&P went nowhere.

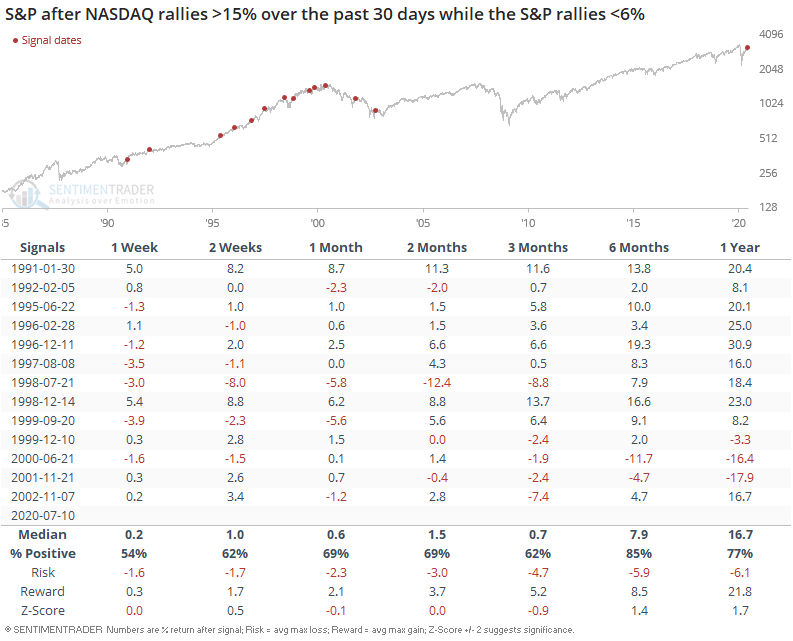

When the NASDAQ rallied >15% over the past 30 days while the S&P rallied <6%, it often led to a short term pullback in tech stocks over the next 2 weeks. Such a large gap in returns has not been seen since the dot-com boom and bust.

The S&P 500 fared comparatively better than the NASDAQ:

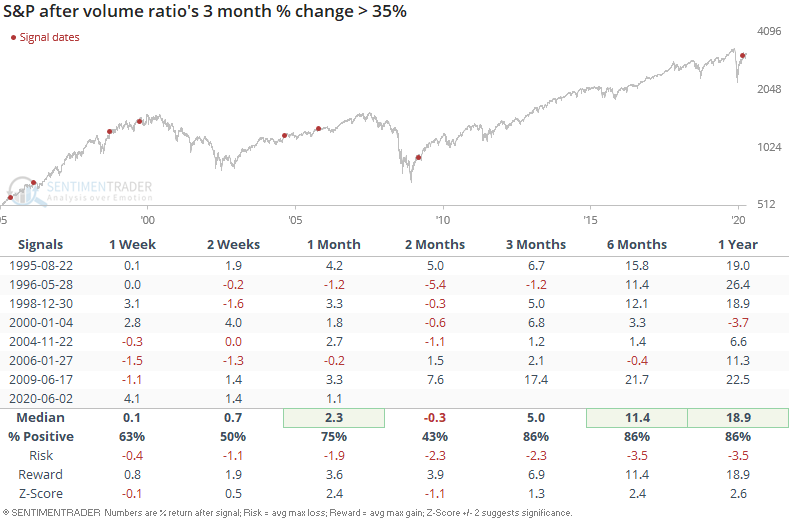

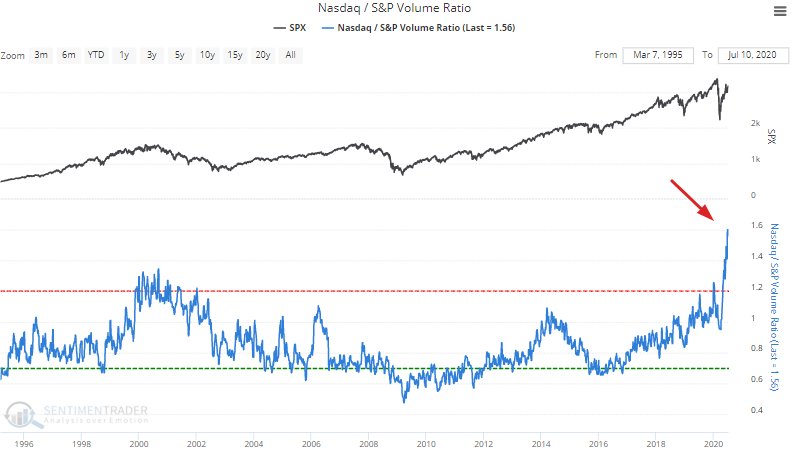

And lastly, the NASDAQ/S&P volume ratio is still near an all-time high:

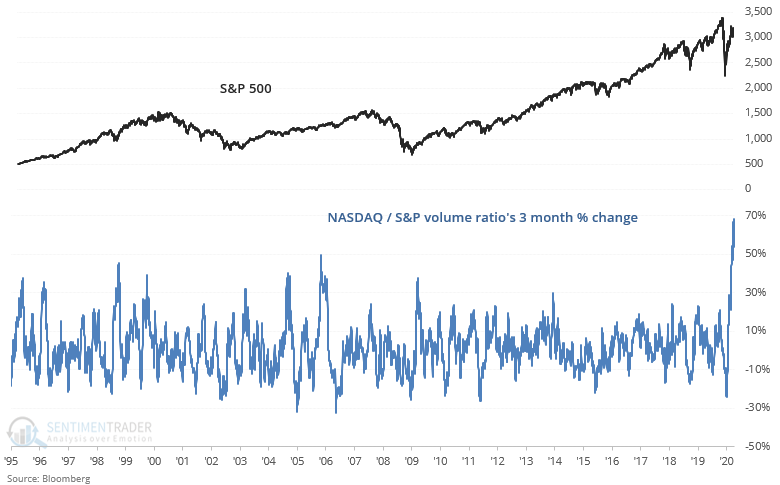

We can look at the ratio's 3 month rate-of-change instead of absolute figures. Such analysis leads to a similar conclusion: speculators have charged headlong into tech stocks over the past few months.

Such headlong charges into tech stocks could lead to short term pullbacks in the U.S. stock market, but on a 6-12 month forward basis this usually led to more gains.