The end of short-term selling for the world's most important index

Finally, a short-term break for stocks

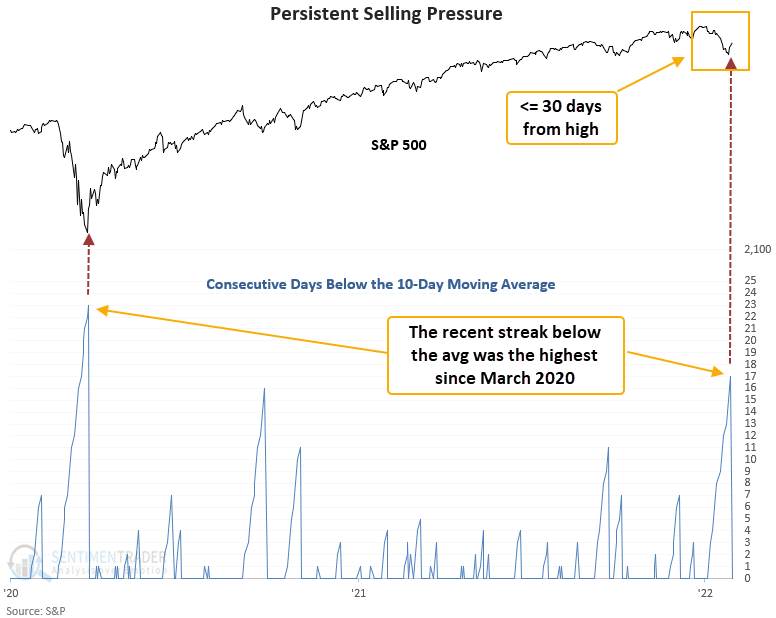

Buyers just couldn't catch a break. Finally, on Monday, the S&P 500 index closed above its 10-day average for the first time in 17 consecutive sessions.

Dean assessed the outlook for the S&P 500 when the index closes above its 10-day average after trading below the average for 17 consecutive days or more. He further filtered the signals to look for times when stocks were not too far removed from a new high at the time.

This signal triggered 20 other times over the past 84 years.

| Stat box The SPY S&P 500 ETF has suffered an average daily outflow of more than $2 billion per day over the past 10 days. According to our Backtest Engine, the only periods that compare are January 2008, February 2018, and February 2020. |

When inflation is higher than yields, watch out

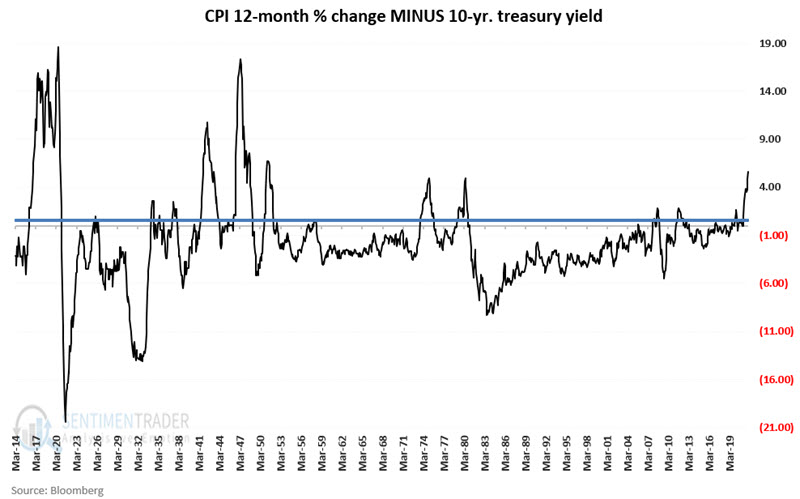

Jay looked at the rate of inflation versus what investors can earn on a 10-year Treasury note, and what that means for stocks.

By subtracting the current yield on 10-year treasuries from the 12-month % change in CPI, investors can get a handle on whether the environment is favorable for stocks.

The chart below displays value C above on a month-end basis since 1914. The dark blue horizontal line is drawn at the 0.60 level.

The growth of $1 invested in the Dow Jones Industrial Average ONLY during those months when the previous month's inflation is 0.6 points or higher than 10-year treasury yields was terrible. When the opposite condition was in effect, stocks performed very well.