The Big Money Is (Kind of) Bullish

According to some of the largest and most sophisticated investors in the world, stocks are a good place to be. But we may have to suffer some trouble first.

The latest issue of Barron's notes:

America's money managers are optimistic about the long-term outlook for the economy, the financial markets, and the recovery from the Covid pandemic. It's the short-term prognosis that concerns them.

Monetary and fiscal policies are in flux. Supply-chain bottlenecks and labor shortages are igniting inflation and threatening corporate profit margins, and the economic recovery from 2020's recession-so robust until now-is decelerating. Add pricey stock valuations and rising bond yields, and the immediate future suddenly looks more challenging than the recent past.

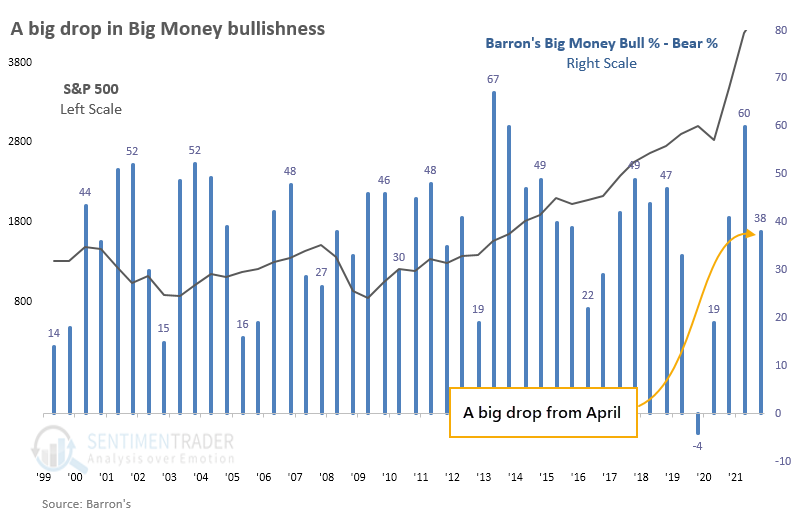

A BIG DROP IN OPTIMISM

In the survey that went out about a month ago, more managers became concerned about stocks. The Bull Ratio fell from 60% in the April survey to 38% now.

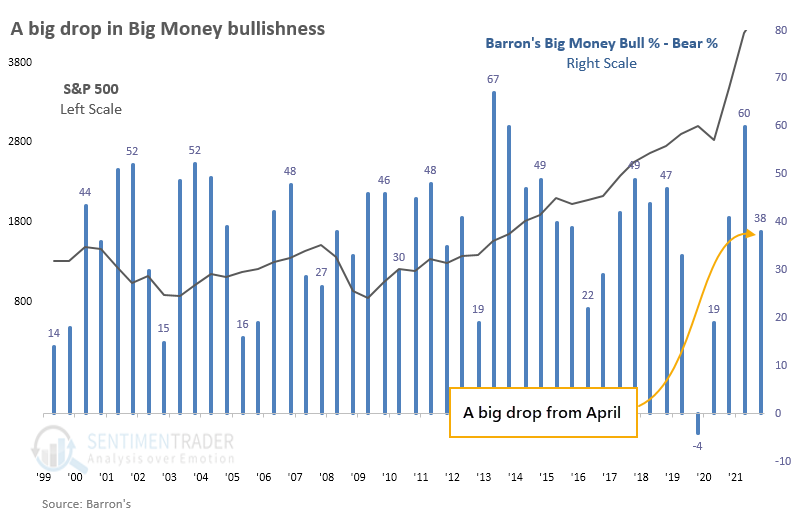

The scatter plot below shows returns in the S&P 500 from one survey to the next vs. the Big Money Bull Ratio. The trendline slopes up and to the right, suggesting that the more bullish the Big Money is, the better the S&P's future returns were. A true contrary indicator would show a trendline that slopes down and to the right. There is a lot of variability among the data points, though.

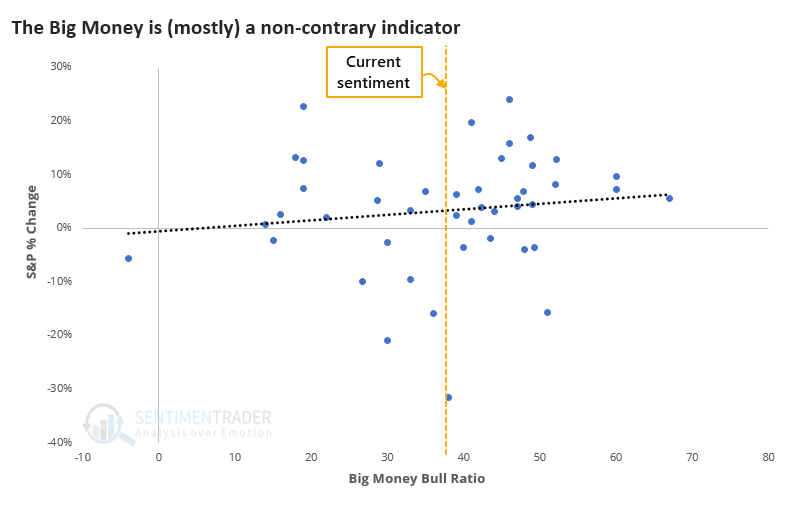

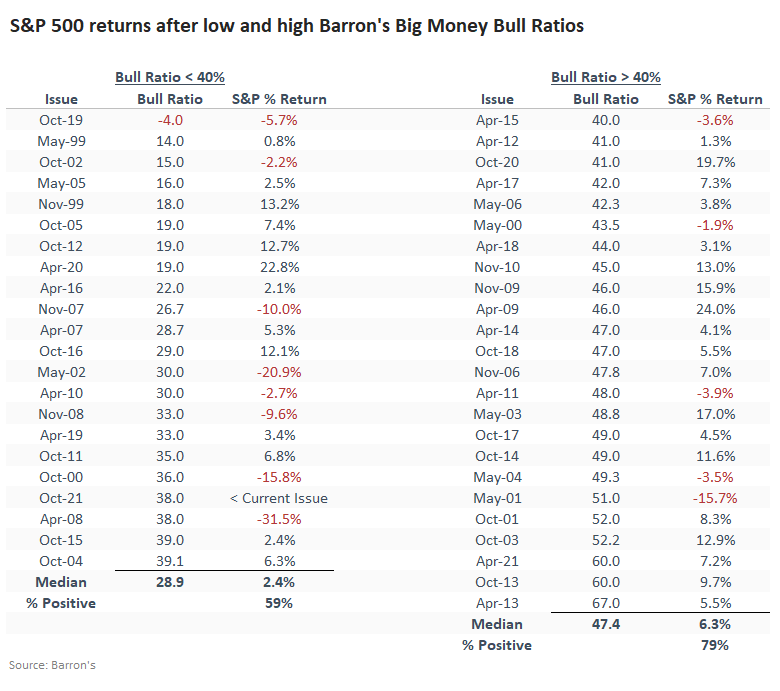

When we look at each issue and the Big Money Bull Ratio versus the S&P 500's returns until the next survey (about six months), we can see this more specifically.

When the Bull Ratio was below 40%, as it is now, the S&P returned a median 2.4% until the next survey. It sported a positive return 59% of the time. But when the Bull Ratio was above 40%, then the S&P returned a much healthier 6.3% over the next (approximately) six months, and was positive after 79% of the surveys.

So, it was a better sign for stocks when managers were more bullish as opposed to less bullish.

OTHER MONEY MANAGERS ARE ALSO MODESTLY OPTIMISTIC

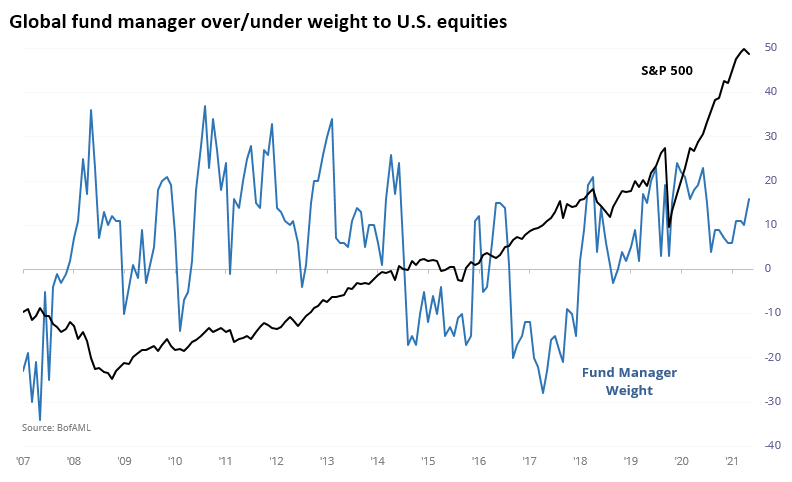

Another "smart money" survey, from Bank of America Merrill Lynch, shows that fund managers are a net 16% overweight U.S. stocks, a middling amount relative to their history.

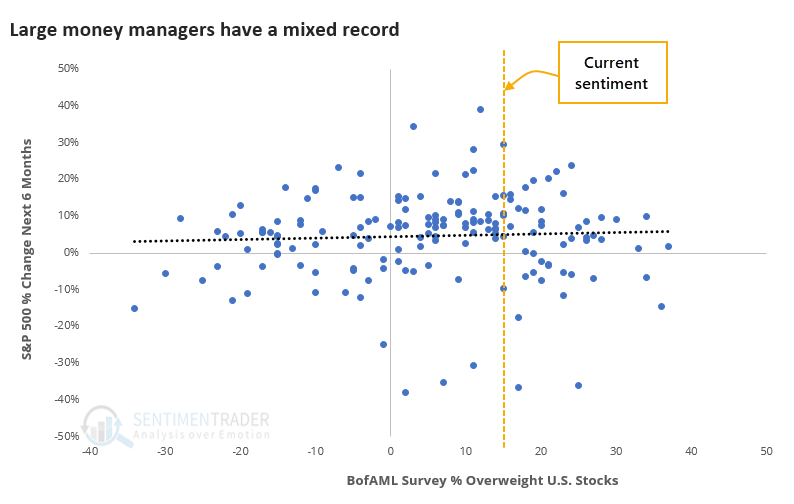

These folks have an even more mixed record at being over/underweight stocks at the right times. The regression line is about flat, suggesting there is very little relationship between how bullish the managers are positioned and the S&P 500's return over the next six months.

When these managers were modestly overweight, like between 10% - 20%, then the S&P did tend to rise, with a positive return 79% of the time. That's just slightly better than any random 6-month stretch over the study period, so it doesn't tell us much. Except maybe don't read too much into any headlines about how the managers might be positioned at the moment.

We've looked at these surveys every which way over the past 20 years, with the conclusion that they're mostly just interesting. They generate headlines because everyone wants to believe that large money managers have a crystal ball, and they don't.

These are some very smart and savvy folks but they suffer from groupthink like all of us. When they become extremely bullish or bearish, there may be a very slight contrary nature to their behavior, but overall it's better to be bullish when they are. The two surveys are giving off slightly different vibes, with the overall takeaway being a wash. It's not enough for us to be concerned about the prospects for stocks, and also not enough to generate a lot of excitement. Maybe a very slight edge to the "stocks should go up" crowd.