The April Barometer (Part 1)

Well, if the fact that the stock market seems to be levitating and refuses to go down is driving you crazy, you are probably NOT going to like what follows. As it turns out, the stock market's performance during April - and for the first months of the year as a whole - can at times offer useful clues regarding the performance of the stock market during the remainder of the year.

This is Part I.

THE TEST AND THE BENCHMARK

- Our test will identify those times when the S&P 500 Index gained 5% or more (using price only data) during April as a whole

- We will then look at the performance for the S&P 500 Index during the remainder of the year (May through December)

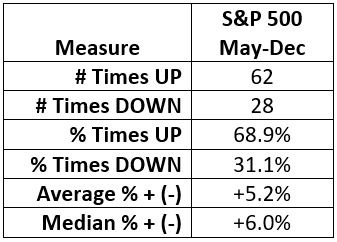

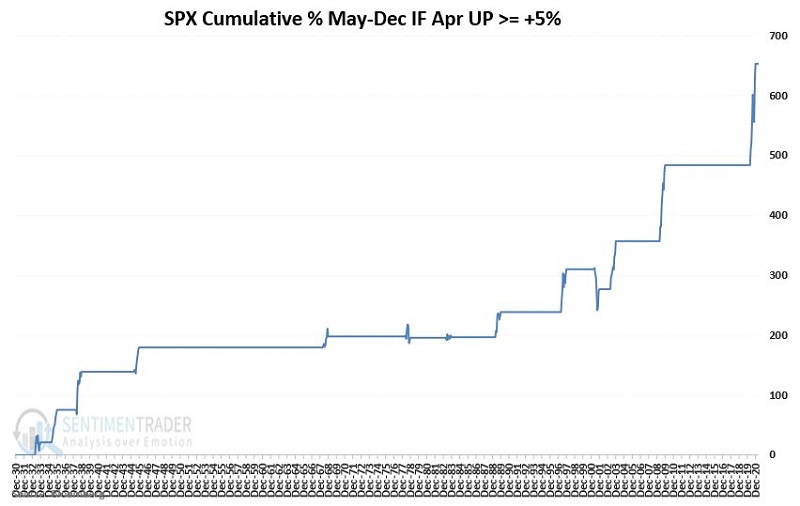

- As a benchmark, let's first let's look at how the S&P 500 typically performs from May through December

THE MONTH OF APRIL UP +5% OR MORE

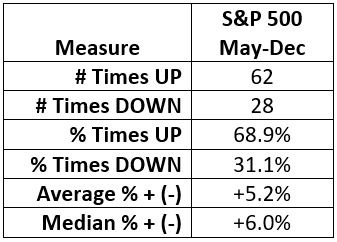

The table below displays only those years since 1931 when the S&P 500 showed a price gain of +5% or more during April.

In sum:

- Up 11 times (85% of the time)

- Down 2 times (14% of the time)

- Average May-Dec gain = +21.8%

- Average May-Dec loss = (-4.4%)

- Median May-Dec gain = +21.3%

- Median May-Dec loss = (-4.4%)

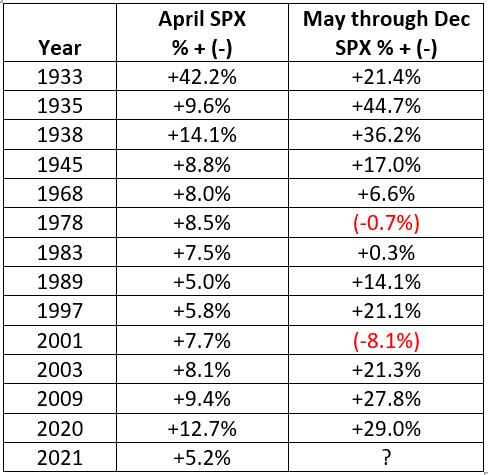

The chart below displays the cumulative price gain for the S&P 500 Index held ONLY during May through December of the years listed in the table above to provide a sense of consistency.

SUMMARY

So, does the S&P 500 Index rising +5.2% during April 2021 ensure that the rest of 2021 is "smooth sailing" for stocks? Not at all. The chart below displays the performance of the S&P 500 during 2001. Note that after a +7.7% gain in April, the S&P 500:

- Suffered a -22.7% drawdown into the September low

- Closed the May-Dec period down -8.1%

So, remember this:

- A strong performance during April lends bullish weight to the overall weight of the evidence

- But there are never (even in this current runaway bull market) any "sure things" in the market