Thanksgiving Selling; Heavy Pessimism; Monday Gaps

There certainly wasn't much of the typical pre-holiday buoyancy in markets last week. Bucking the traditionally positive, low-volatility holiday trading, markets got hit hard, particularly the stock market.

That left the S&P 500 at a 6-month low the day after Thanksgiving, which has never happened before, at least since 1950. It's never even been at a 3-month low the day after that holiday. It has sunk to a 1-month low only a few times, and for what it's worth, it rebounded strongly afterward each time.

As we start the new week, futures are indicating a hefty rebound from last week's losses. The concern is that this is not something we often see during bull markets.

This is true, but it doesn't mean that just because we're seeing high volatility that we're in a bear market. It just means that during bear markets, volatility tends to be high. Maybe that's a difference without a distinction.

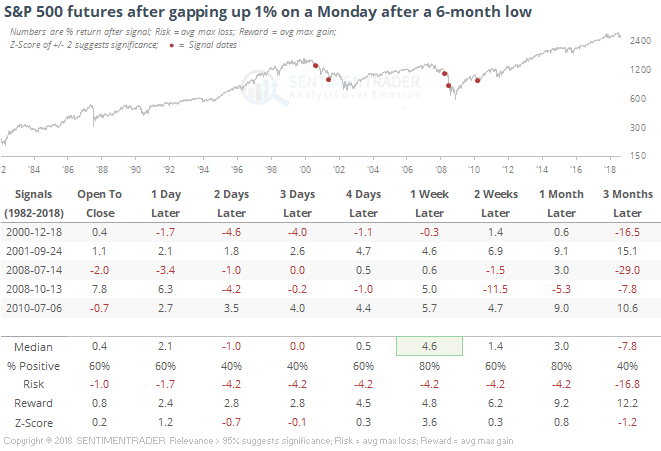

Either way, the S&P futures were looking at an open more than 1% above Friday's closing prices. This would be one of the strongest-ever openings to start a week following what had been a 6-month low on Friday.

After similar Monday morning gaps, buyers tended to persist into the close, but the sample size is awfully small. And there was a big loser in there, too. Over the next 2-3 days, the enthusiasm petered out, but a week later, there was only one minor loss.

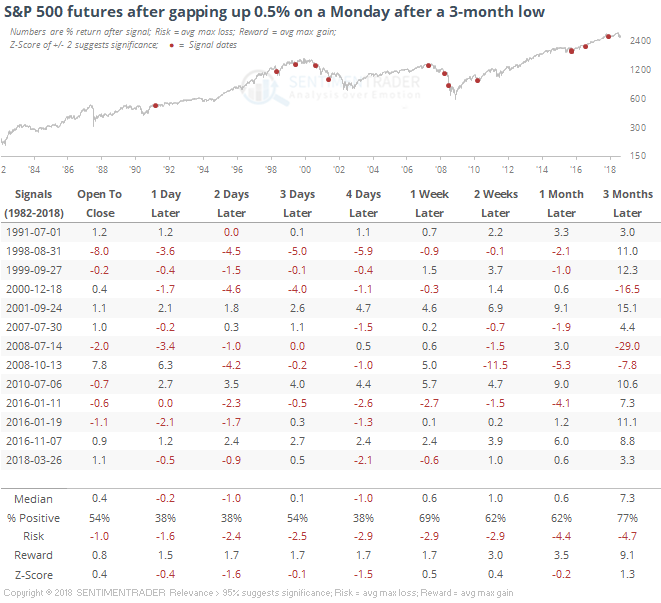

If we loosen the parameters to get a larger sample, that general bias is still prevalent.

When the futures gap up 0.5% or more on a Monday following a 3-month low, we tended to see weakness from the open through the next 1-2 days, but gains about 2/3 of the time over the next week. Not really a strong edge.

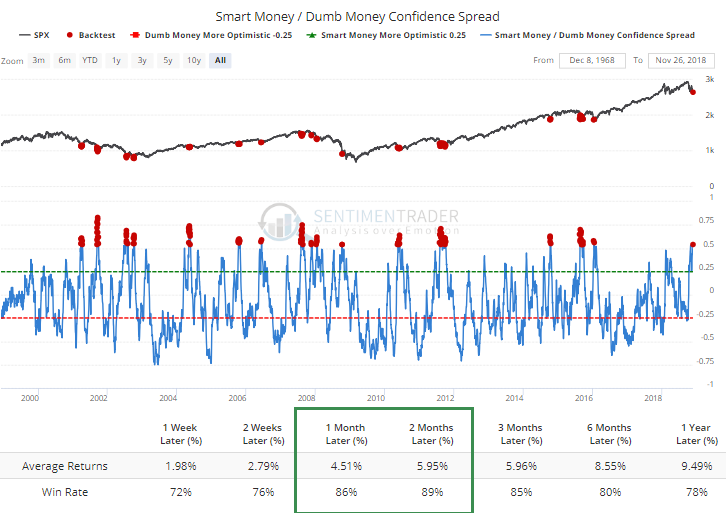

The decline last week was enough to push some of our indicators into an extreme position again. The spread between Smart Money and Dumb Money Confidence moved to 54%, which has preceded consistently strong returns over the next 1-2 months, even including bear market environments.

Seasonally we're in a very strong period, especially when there has been some weakness, as we saw above. Sentiment is also showing signs of extreme pessimism, which is another tailwind. The big gap on a Monday is often the kind of behavior we see during bear markets, but that's not necessarily a negative, especially over the next week or so.