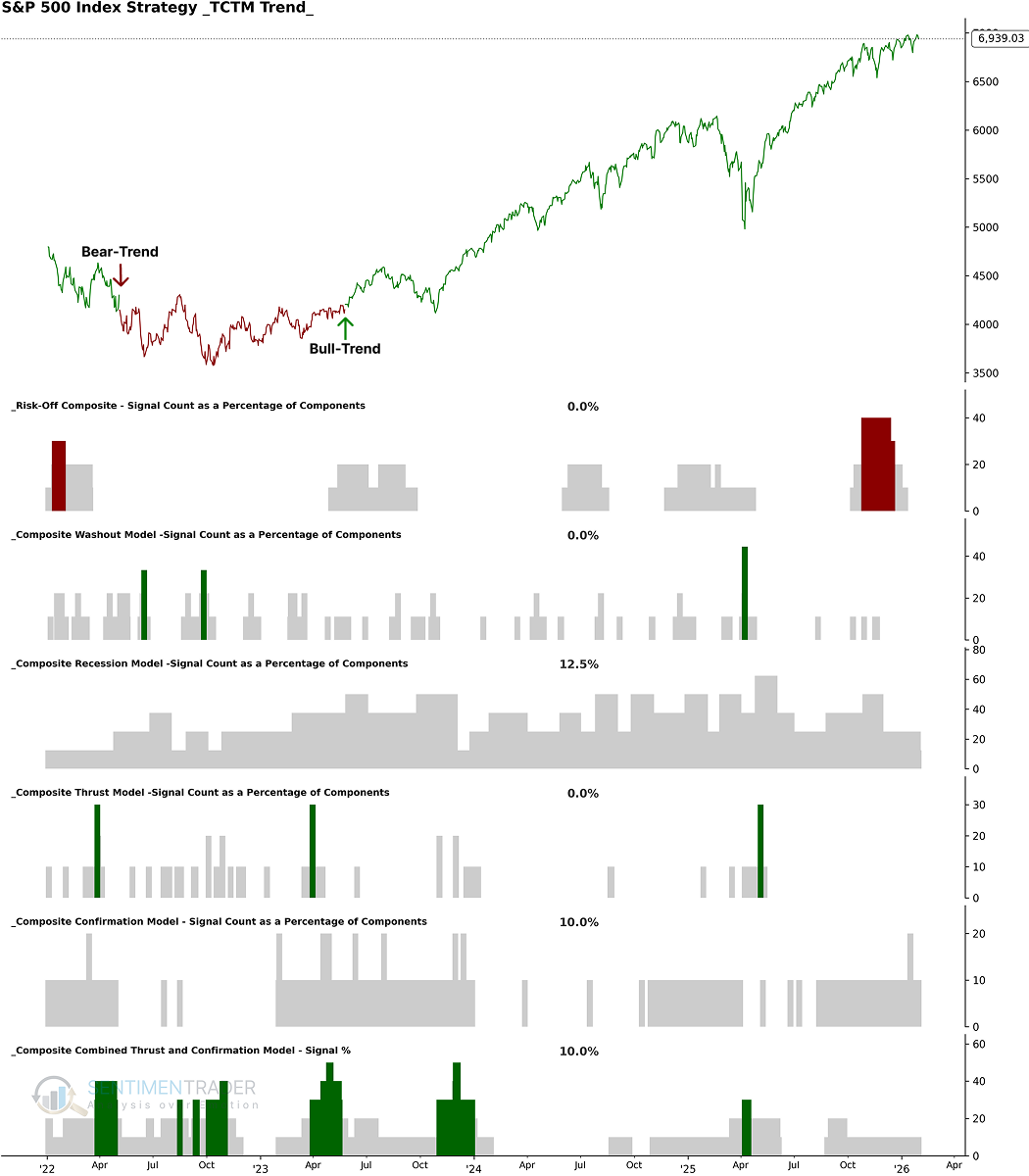

TCTM and Component Updates

Developed by Dean Christians, the Tactical Composite Trend Model (TCTM) is the culmination of decades of professional trading and financial market research. The model aims to give traders and investors key signals around identifiable market turning points.

The TCTM utilizes an extensive database that covers every bull and bear market since 1927, one of the most robust databases in the market research business. It uses a weight-of-the-evidence approach to identify the major market trend. This composite model features seven critical, time-tested components that alert investors to money-making opportunities or threats. For more information, refer to this Knowledge Base article.

Updates occur monthly or when a new signal emerges. Data as of 2026-01-30.

| MODEL | Signal Count % | STATUS | Last Signal Date |

| Tactical Composite Trend Model | Positive as of 2023-05-26 | ||

| Long-Term Trend Model | Positive as of 2023-05-26 | 2023-05-26 | |

| Composite Risk Warning Model | 0 | Neutral | 2025-11-17 to 2025-11-21 |

| Composite Recession Model | 12 | Neutral | 2020-04-30 to 2020-05-28 |

| Composite Washout Model | 0 | Neutral | 2025-04-08 |

| Composite Thrust Model | 0 | Neutral | 2025-05-05 |

| Composite Confirmation Model | 10 | Neutral | 2021-02-02 |

| Composite Combined Thrust and Confirmation | 10 | Neutral | 2025-04-08 |

Tactical Composite Trend Model - Positive

The Long-Term Trend Model component for the Tactical Composite Trend Model (TCTM) turned positive on May 26, 2023.

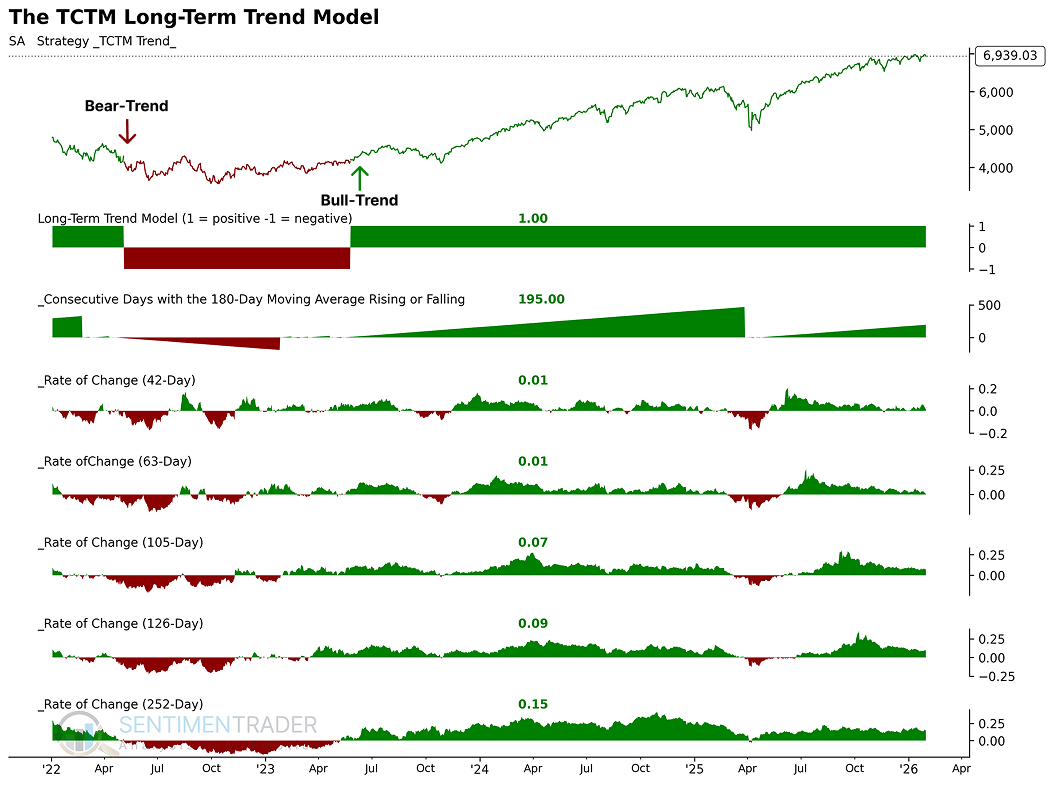

1. Long-Term Trend Model - Positive

The long-term trend model turned positive on May 26, 2023. For related backtest, click here.

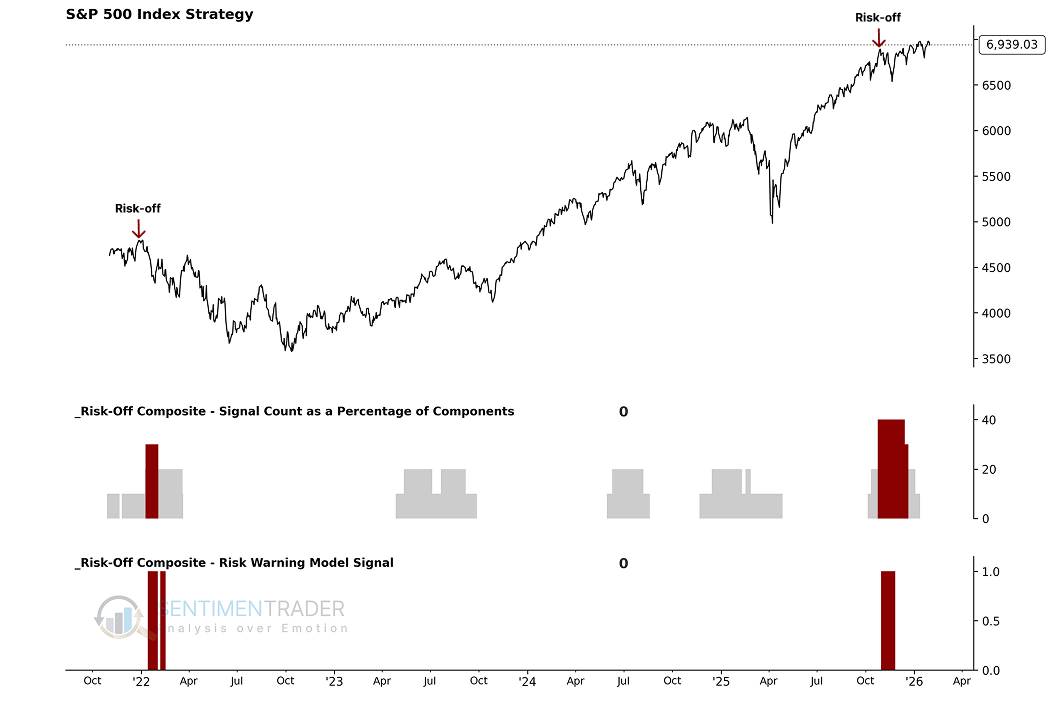

2. Composite Risk Warning Model - Neutral

The Composite Risk Warning Model's signal count value is 0%. The Risk Warning Model Signal is 0. For related backtest, click here.

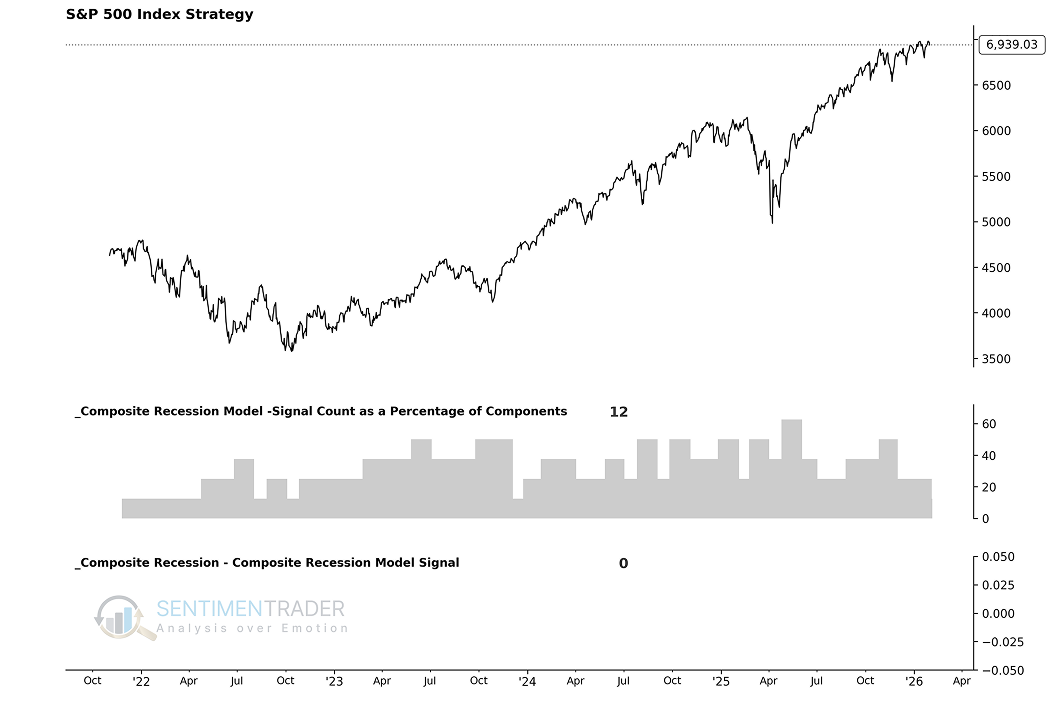

3. Composite Recession Model - Neutral

The Composite Recession model signal count value is 12%. The Composite Recession Model Signal is 0. For related backtest, click here.

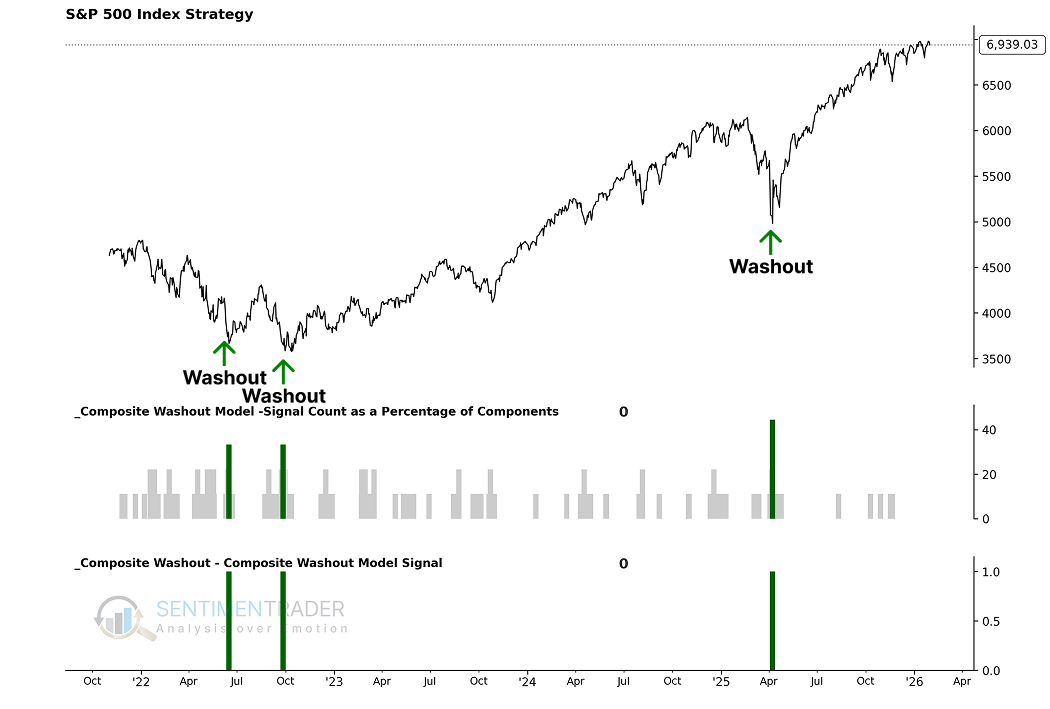

4. Composite Washout Model - Neutral

The Composite Washout Model's signal count value is 0%. The Composite Washout Model Signal is 0. For related backtest, click here.

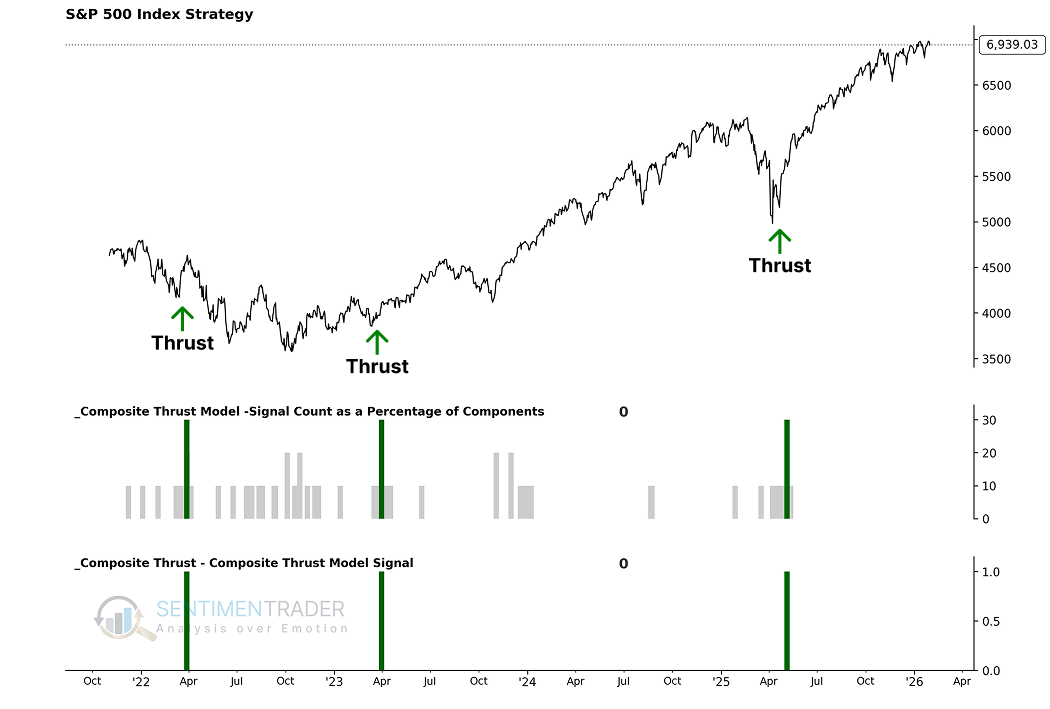

5. Composite Thrust Model - Neutral

The Composite Thrust Model's signal count value is 0%. The Composite Thrust Model Signal is 0. For related backtest, click here.

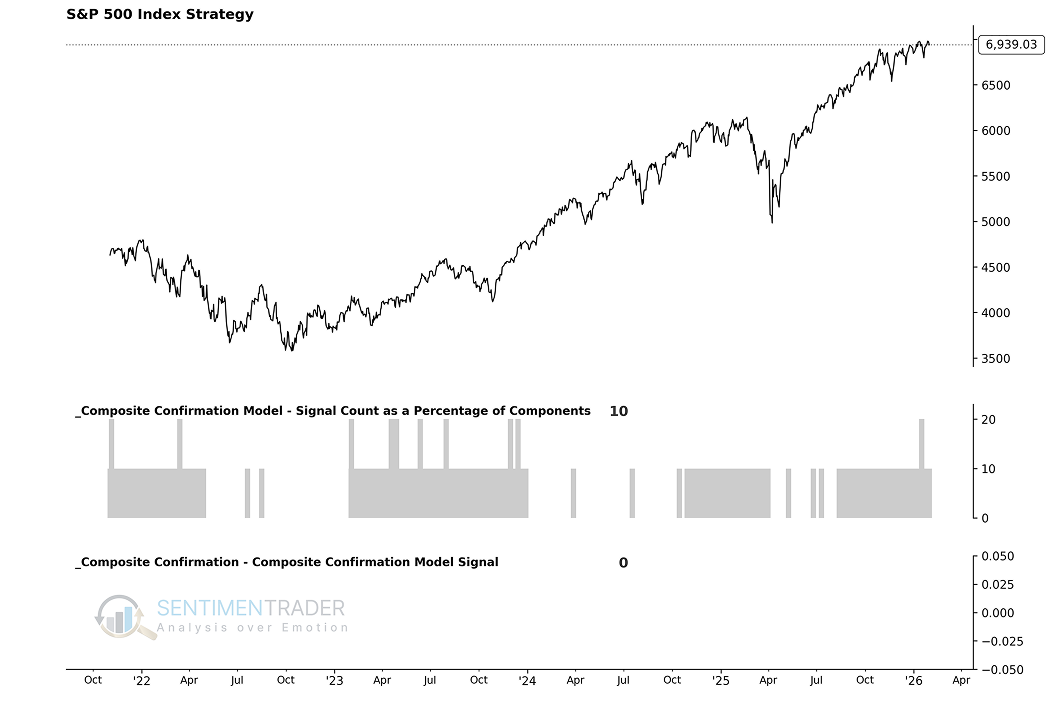

6. Composite Confirmation Model - Neutral

The Composite Confirmation Model's signal count value is 10%. The Composite Confirmation Model Signal is 0. For related backtest, click here.

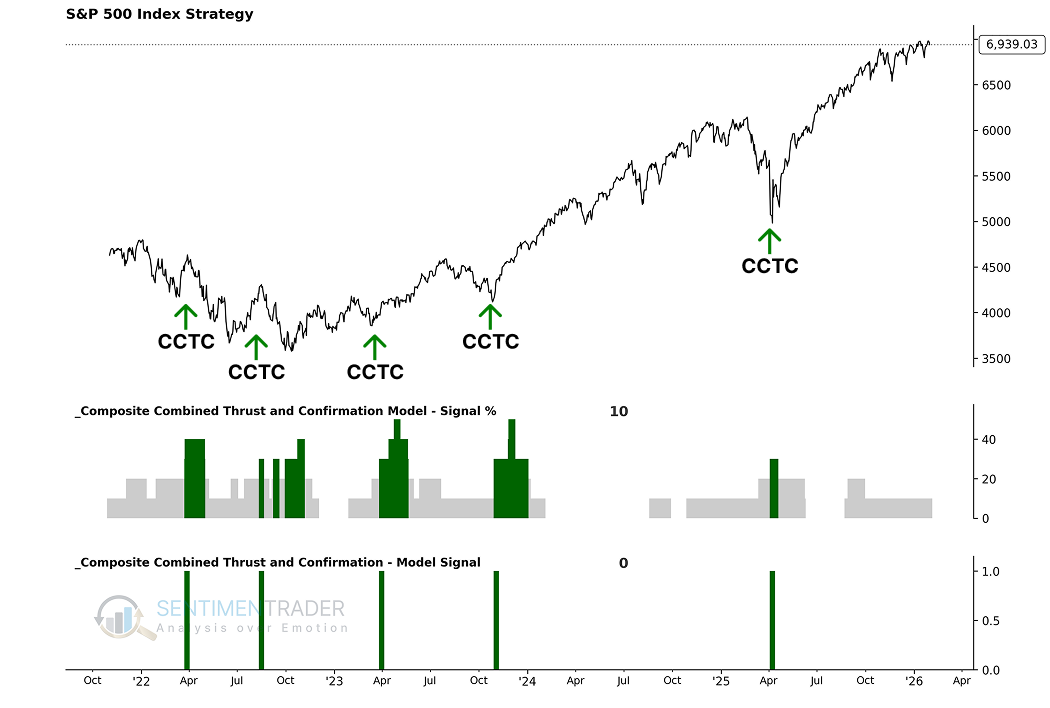

7. Composite Combined Thrust and Confirmation - Neutral

The Composite Combined Thrust & Confirmation Model's signal count value is 10%. The Composite Combined Thrust & Confirmation Model Signal is 0. For related backtest, click here.

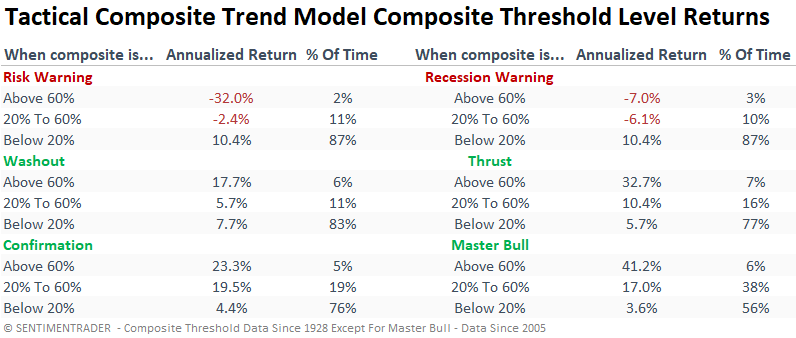

Historical Performance

The TCTM is not a pure black-box model. Its purpose is to enhance and complement your investment process.

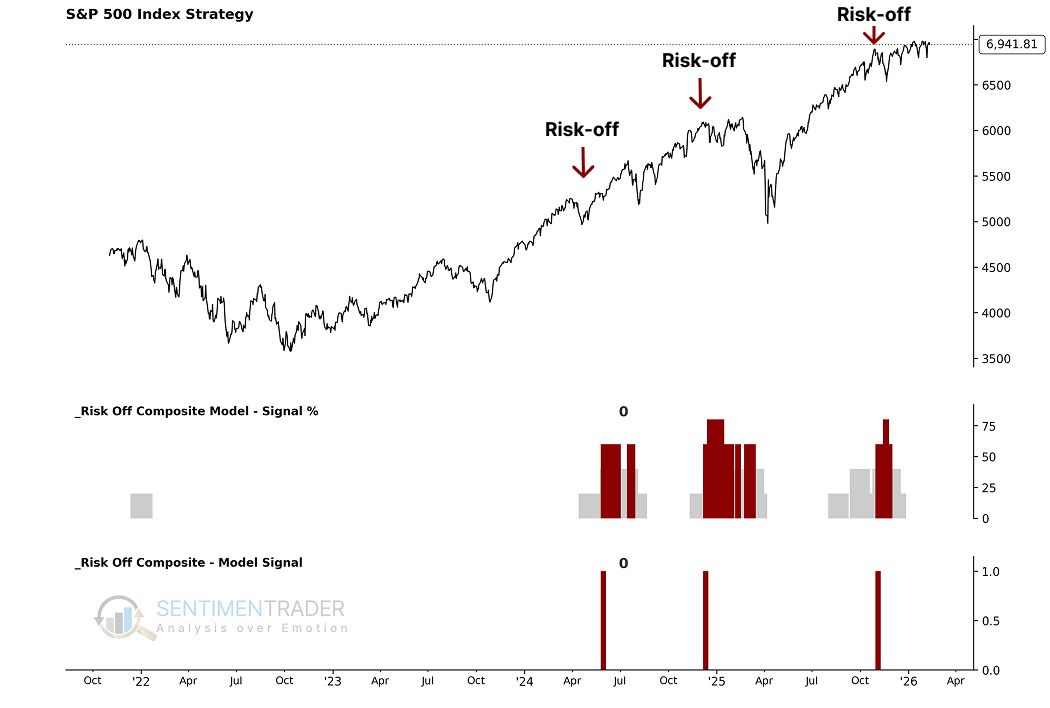

Risk-Off Composite Model

The Risk-Off Composite Model's signal count value is 0%. The Risk-Off Composite Model Signal is 0. For the related backtest, click here.

The Risk-Off Composite Model is not a member of the TCTM. I use it as a secondary input to assess risks around potential market peaks.