Strong rally and strong momentum

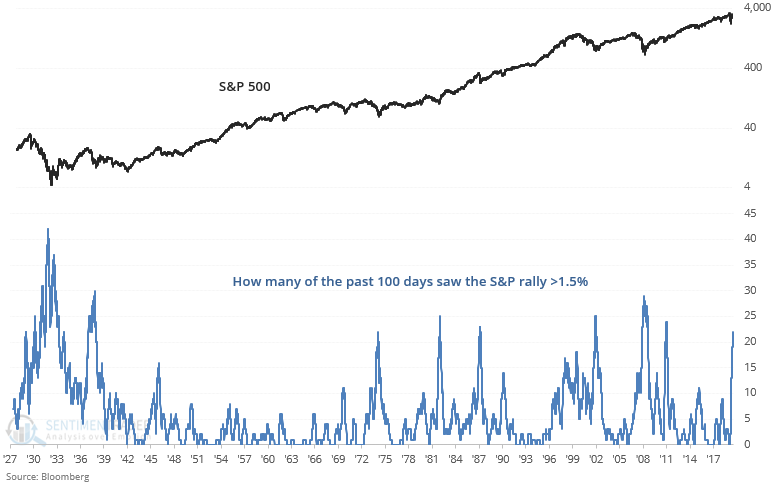

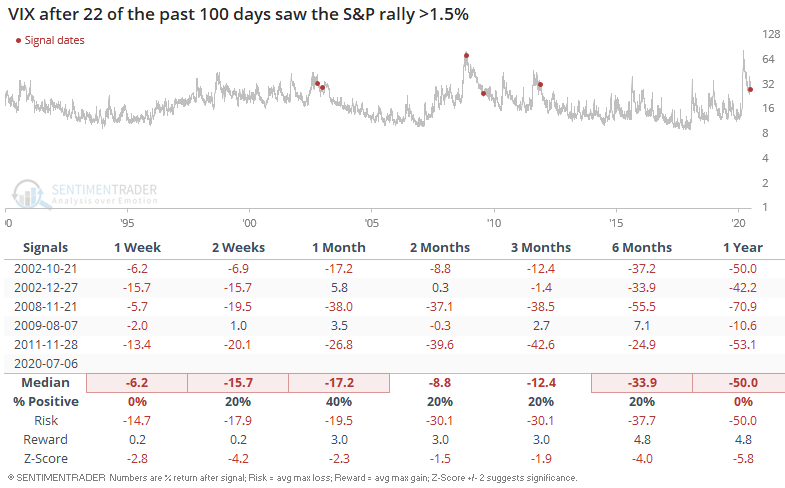

Global equity markets are rallying relentlessly, with tech still leading the way in the U.S.. Yesterday saw the S&P 500 surge another 1.5%, making this the 22 day in which the S&P rallied more than 1.5% over the past 100 days:

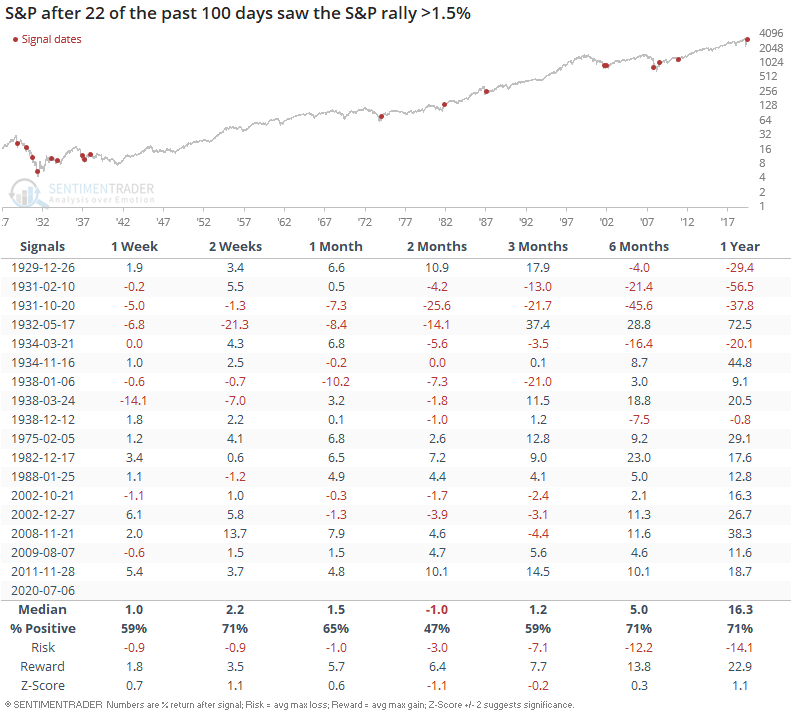

Such powerful rallies are quite common during/near periods of market turmoil. Bear markets have the largest 1 day gains, and post-bear market rallies also have large 1 day gains. Here's what happened next to the S&P when so many large daily gains were clustered together in the past:

Outside of the Great Depression, historical cases of strong momentum usually led to more gains for U.S. stocks in the next 1-4 weeks and more gains over the next 6-12 months. As one would expect, historical cases were mostly bearish for VIX:

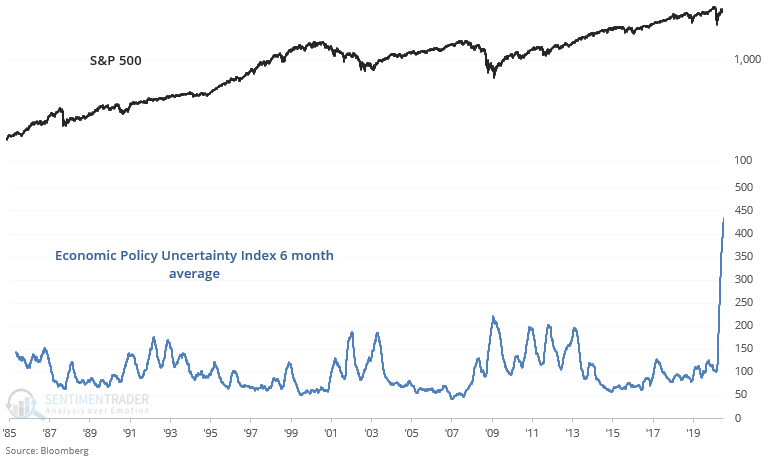

Keep in mind that all of this has occurred during a period of prolonged economic policy uncertainty. The U.S. Economic Policy Uncertainty Index's 6 month average has soared to an all-time high: