Stocks have been trapped between time frames

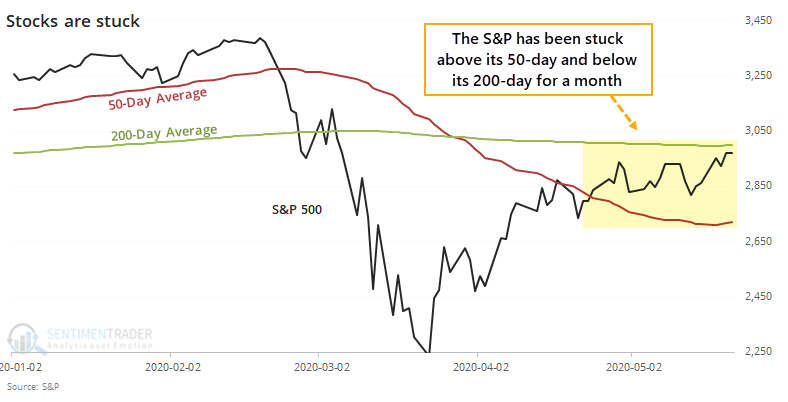

We're stuck in post-panic churn, and the most benchmarked index in the world can't seem to get over the hump.

On Thursday, we saw that the S&P 500 hasn't been able to mount its 200-day average despite approaching it 3 weeks ago. And yet, it's still been able to hold above its rising 50-day average, which caused some to question which time frame will win out. Is it more likely for stocks to fail and fall below the 50-day average, or succeed and break out above the 200-day?

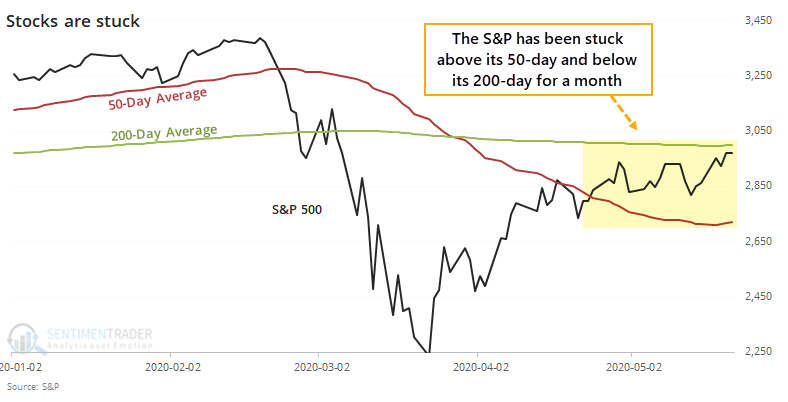

Now that its streak of being stuck has reached 20 days, it's one of the longer battles between time frames since 1928.

There have been 29 streaks that reached 20 days. Of those, 21 saw the streak end when the S&P fell below its 50-day average. Only 8 ended by the S&P rising above its 200-day average. So we could make the suggestion that there's about a 72% probability the index will break down.

It probably doesn't matter.

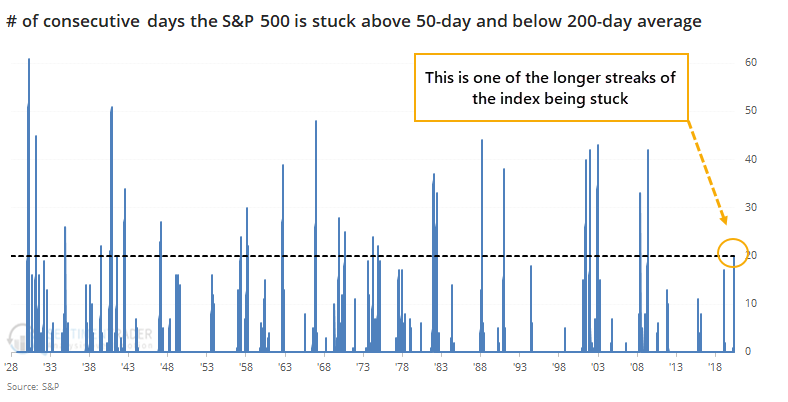

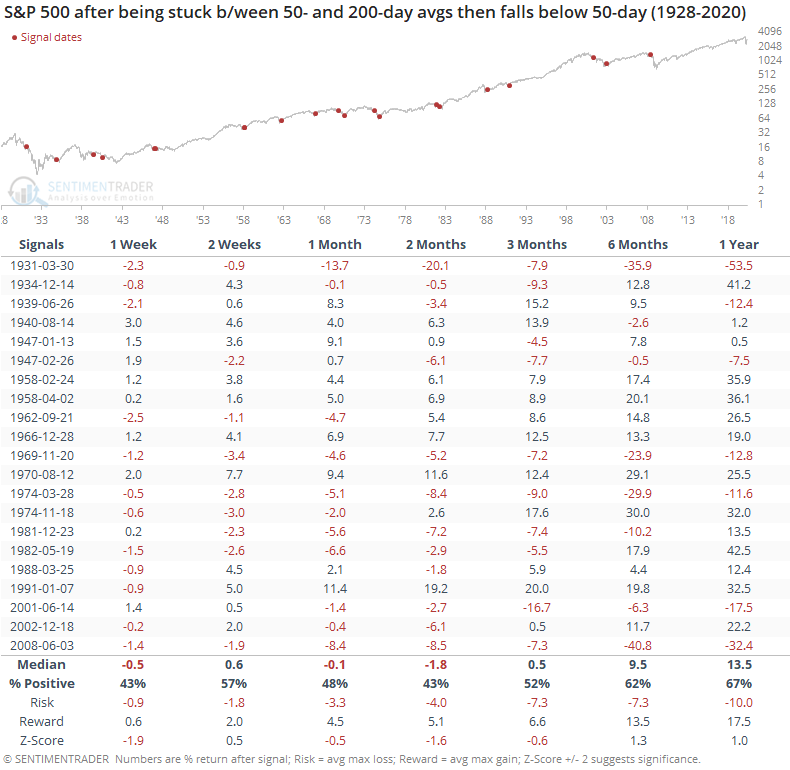

Below, we can see every time the S&P was stuck above its 50-day and below its 200-day for 20 consecutive sessions.

Like we saw on Thursday, when the index gets stuck below its long-term average, it has tended to resolve lower in the weeks ahead. Because of that, as noted above, there is a higher likelihood it will end the streak by falling below its 50-day average.

Here is how it performed after doing so:

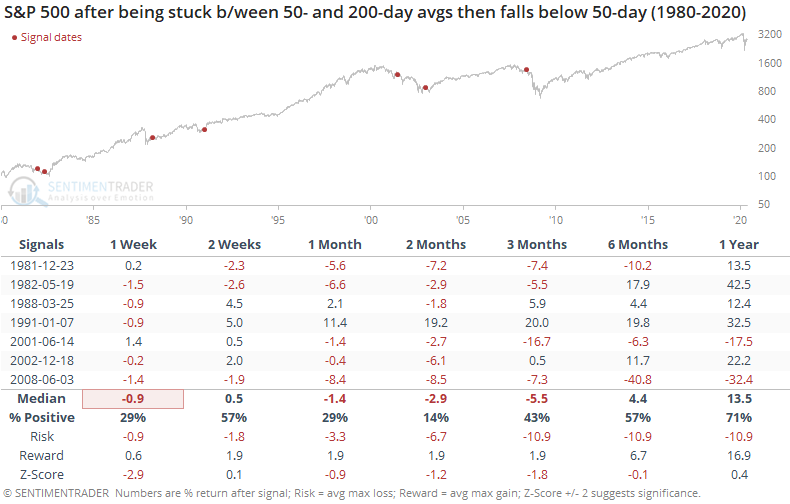

Again, the returns were poor, especially over the next two months. It has been an extremely bad sign over the past 40 years. Only one of the failures managed to quickly right itself and head higher, which ended up being a great sign for the longer-term.

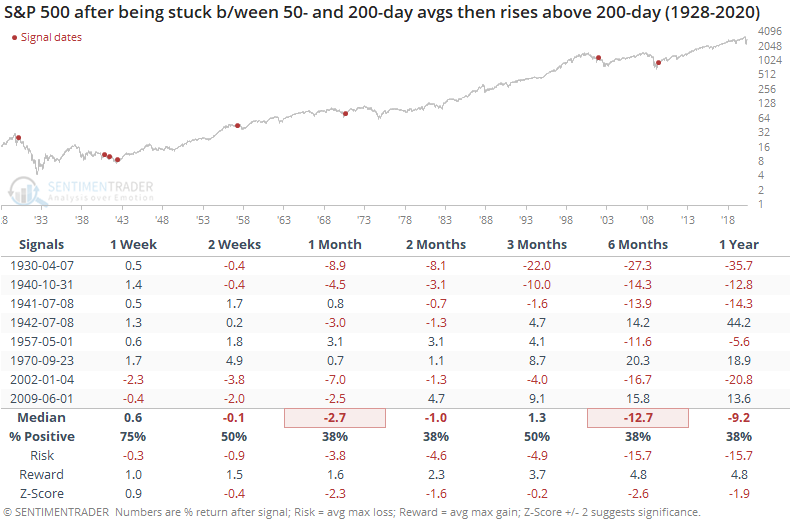

So what about if the index breakouts out to the upside instead? Well, that wasn't great, either.

It's kind of a no-win situation. If the S&P broke down below its 50-day, then returns were bad (and terrible in recent decades). If it broke out to the upside, then returns were limited across almost all time frames, with really only one exception in 1970. All of the others either saw losses in the month(s) ahead or failed rallies.

The trouble is basically that buyers haven't shown enough oomph to make any progress lately. When that happens during downtrending markets like we've been in, with a protracted stretch near but below the 200-day average, it has indicated larger problems and that has almost always meant further weakness ahead.