Stock indexes are plummeting ahead of the FOMC meeting

Key points:

- The S&P 500 is down 8.31% from its 252-day high as of the close on 1/21/22

- The FOMC concludes a two-day meeting on Wednesday

- Large-cap stocks show weak near term results after similar patterns

Does the Fed matter in the short-term when stocks are in free-fall

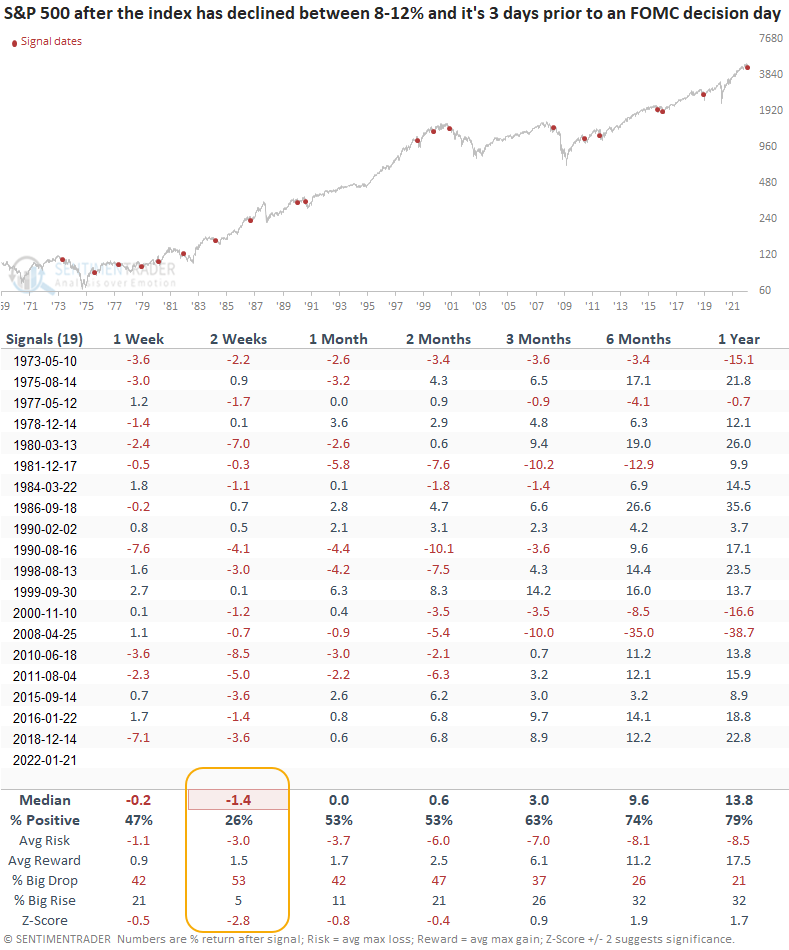

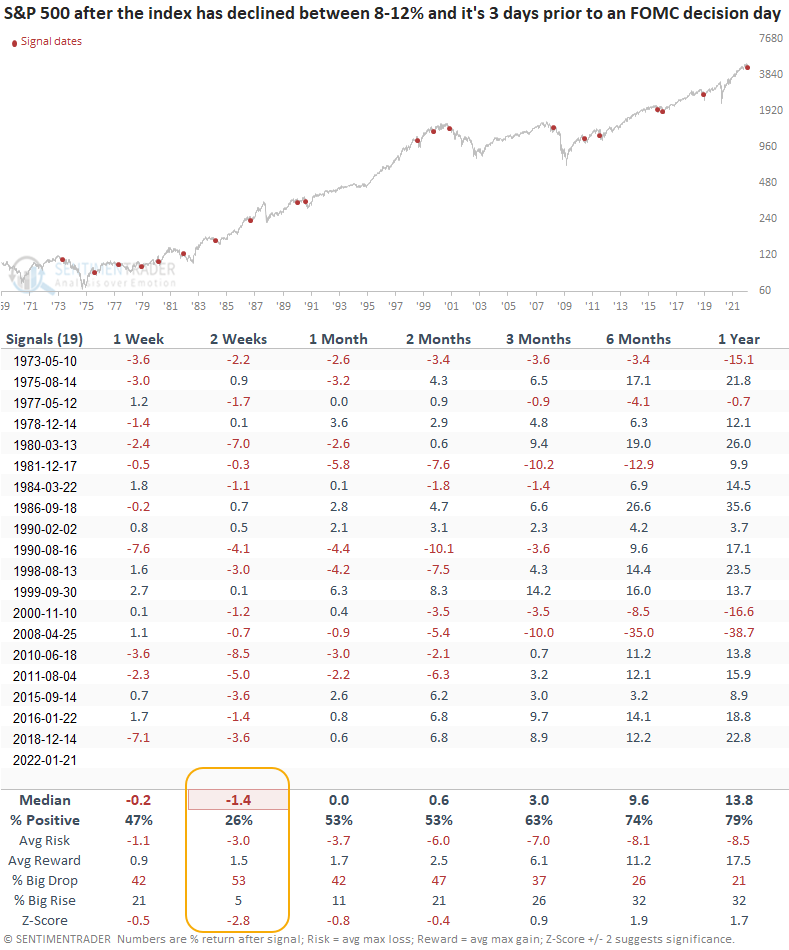

Domestic stock indexes are in free fall as the FOMC will conclude a two-day meeting on Wednesday. Let's assess the outlook for the S&P 500 when the index is down between 8 and 12% from a 252-day high, and the Federal Reserve concludes a meeting 3 days later. I included a reset condition that required the index to close within 3% of its high to screen out duplicates.

Similar signals preceded weak returns in the near term

This signal triggered 19 other times over the past 49 years. After the others, future returns and win rates were weak in the near term, especially the 2-week window. The 1 and 2-week time frames show that the S&P 500 closed lower at some point in 17 out of 19 instances. And, the 2-week window is currently on a 7 signal losing streak.

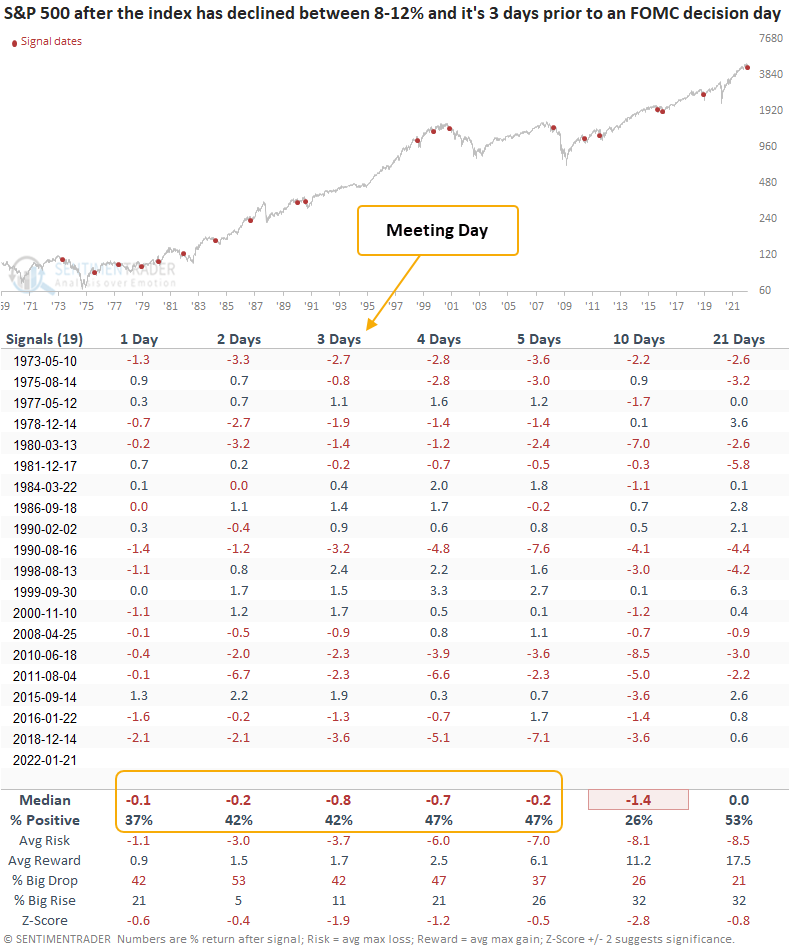

Ultra short term results suggest no relief pre or post-meeting

The ultra-short-term table shows weak results on both sides of the FOMC decision day. If we see a big rally after the FOMC meeting, I suspect it means traders misread the Fed and Jerome Powell has a less hawkish tone at the press conference.

What the research tells us...

When stock indexes are in free-fall before the conclusion of an FOMC meeting, history suggests the Fed can do very little to assuage market participants' fears in the near term. Similar setups to what we're seeing now have preceded weak returns and win rates for the S&P 500 in the near term, especially the 2-week time frame